Credit Repair Success Stories: Transforming Financial Futures

Everyone loves a success story, especially when it involves turning financial troubles around. Credit repair success stories inspire and motivate those facing similar challenges.

Imagine feeling the weight of debt slowly lifting off your shoulders. People across the country have successfully navigated their credit repair journey, finding financial freedom. These stories are not just about numbers; they are about real people overcoming obstacles. They highlight the tools and strategies that made a difference, such as SoloSuit, an automated software designed to assist in debt disputes. SoloSuit helps individuals respond to debt lawsuits and settle debts, offering comprehensive assistance in all 50 states. With professional reviews and a focus on out-of-court settlements, SoloSuit has supported thousands in their journey to financial stability. Ready to be inspired? Read on to discover the incredible stories of credit repair triumphs. Learn more about SoloSuit here.

Introduction To Credit Repair Success Stories

Credit repair success stories inspire hope and motivation. They showcase real-life transformations, where individuals reclaim control over their financial lives. These stories highlight the impact of effective credit repair and the potential for a brighter financial future.

Understanding The Importance Of Credit Repair

Credit repair is crucial for maintaining financial health. Poor credit can affect loan approvals, interest rates, and even job opportunities. Repairing credit involves identifying errors on credit reports, disputing inaccuracies, and improving credit habits.

Let’s break down why credit repair is so important:

- Loan Approvals: Better credit increases chances of loan approvals.

- Lower Interest Rates: Good credit can lead to lower interest rates on loans and credit cards.

- Employment Opportunities: Some employers check credit reports during hiring processes.

How Credit Repair Can Transform Financial Futures

Effective credit repair can transform your financial future. Improved credit scores open doors to better financial opportunities. Individuals can qualify for home loans, car loans, and lower insurance premiums. Credit repair also reduces financial stress, allowing individuals to focus on other life goals.

Consider the benefits of a successful credit repair journey:

- Home Ownership: Qualify for mortgage loans with favorable terms.

- Auto Loans: Get car loans with lower interest rates.

- Lower Insurance Premiums: Save money on various insurance policies.

SoloSuit offers tools for debt disputes, enhancing credit repair efforts. Their automated software helps users respond to debt lawsuits and settle debts outside of court. SoloSuit’s services are available in all 50 states, providing comprehensive assistance.

SoloSuit features include:

| Feature | Description |

|---|---|

| Reply to a Debt Lawsuit | Helps compile a response within 14-30 days of receiving a complaint. |

| Settle a Debt | Assists in arranging a settlement with the collector outside of court. |

| Professional Review | An attorney reviews the response before filing. |

By using tools like SoloSuit, individuals can navigate debt disputes more effectively. This can significantly improve their credit scores and financial stability.

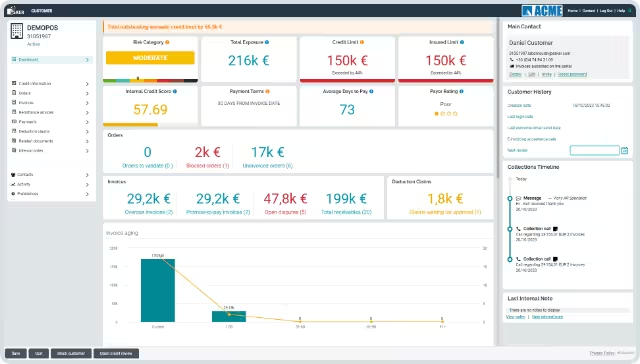

Key Features Of Effective Credit Repair Programs

Effective credit repair programs can transform your financial future. They offer personalized plans, access to professional counselors, dispute resolution services, and credit monitoring. Understanding these key features will help you choose the right program for your needs.

Personalized Credit Repair Plans

Each person’s credit situation is unique. Effective programs provide personalized credit repair plans. These plans address individual credit issues and set realistic goals. This tailored approach increases the chances of success.

Access To Professional Credit Counselors

Having access to professional credit counselors is crucial. Counselors offer expert advice and guidance. They help you understand your credit report and develop strategies to improve your credit score.

Dispute Resolution Services

Errors on your credit report can harm your credit score. Effective programs include dispute resolution services. These services help you identify and dispute inaccuracies. Correcting these errors can significantly improve your credit score.

Credit Monitoring And Alerts

Monitoring your credit is essential for maintaining a good score. Credit repair programs often offer credit monitoring and alerts. These tools keep you informed of changes to your credit report. Staying informed helps you address issues quickly.

In summary, personalized plans, professional counselors, dispute resolution, and credit monitoring are key features of effective credit repair programs. These elements work together to help you improve and maintain your credit score.

| Feature | Benefit |

|---|---|

| Personalized Credit Repair Plans | Addresses individual credit issues and sets realistic goals |

| Access to Professional Credit Counselors | Provides expert advice and guidance |

| Dispute Resolution Services | Helps identify and correct inaccuracies |

| Credit Monitoring and Alerts | Keeps you informed of changes to your credit report |

Real-world Success Stories

Experiencing financial difficulties can be overwhelming. Yet, countless individuals have turned their situations around with determination and the right resources. Here, we share some inspiring real-world success stories of people who have improved their credit scores and lives.

Case Study 1: From Poor Credit To Homeownership

Jane, a single mother, faced numerous financial challenges. Her credit score was in the low 500s, making it difficult to secure loans. She needed a stable home for her children, so she decided to take control of her finances.

Jane used SoloSuit to address her debt issues. By responding to debt lawsuits and negotiating settlements, she significantly reduced her debt. Over time, Jane’s credit score improved steadily.

Within two years, Jane’s credit score was in the high 600s. She was finally able to qualify for a mortgage and purchase a home. Her story shows that with determination and the right tools, achieving financial goals is possible.

Case Study 2: Overcoming Bankruptcy And Rebuilding Credit

John faced bankruptcy after losing his job. His credit score plummeted to below 400, making it difficult to recover. He was determined to rebuild his credit and started using Solo to manage his debts.

John began by responding to debt lawsuits with the help of SoloSuit. He settled several debts out of court, reducing his total debt amount. This proactive approach helped him improve his credit score.

In just three years, John’s credit score rose to the mid-600s. He secured a stable job and managed to get approved for a car loan with favorable terms. John’s journey demonstrates that overcoming bankruptcy and rebuilding credit is achievable with persistence.

Case Study 3: Improving Credit Scores For Better Loan Terms

Emily had a decent job but struggled with high-interest debts. Her credit score was in the low 600s, limiting her options for better loan terms. She decided to use Solo to address her debt issues.

By responding to debt lawsuits and negotiating settlements, Emily reduced her overall debt. With a professional review of her responses, she ensured accuracy and effectiveness in her approach.

Over 18 months, Emily’s credit score improved to the high 700s. She was able to refinance her loans at lower interest rates, saving a significant amount of money. Emily’s experience highlights the importance of improving credit scores for better financial opportunities.

Pricing And Affordability Of Credit Repair Services

Understanding the costs associated with credit repair services is crucial for anyone seeking to improve their credit score. The affordability of these services can vary widely, and knowing what to expect can help you make informed decisions.

Breakdown Of Typical Credit Repair Costs

Credit repair services often come with various fees. Here is a breakdown of typical costs:

| Service Type | Cost Range |

|---|---|

| Initial Setup Fee | $19 – $149 |

| Monthly Fees | $50 – $130 |

| Pay-Per-Deletion | $25 – $100 per item |

These costs can add up quickly, so it’s important to assess your budget before committing to a service.

Comparing Diy Credit Repair Vs. Professional Services

When considering credit repair, you have two primary options: DIY or hiring a professional service.

- DIY Credit Repair: No upfront costs but requires significant time and effort.

- Professional Services: Higher costs but offer expertise and faster results.

Each option has its pros and cons, and the best choice depends on your specific situation and financial goals.

Evaluating The Return On Investment In Credit Repair

Investing in credit repair can lead to significant financial benefits. Here are some potential returns:

- Lower interest rates on loans and credit cards.

- Increased credit limits.

- Better terms on mortgages and auto loans.

- Improved job prospects, as some employers check credit scores.

The return on investment (ROI) can be substantial, making the initial costs of credit repair worthwhile.

For those dealing with debt disputes, Solo offers an automated solution. Solo assists with responding to debt lawsuits and settling debts, providing comprehensive assistance across all 50 states. With professional review and support, Solo ensures your responses are accurate and timely.

Visit SoloSuit to learn more about their services and how they can help you navigate your debt issues effectively.

Pros And Cons Of Credit Repair Programs

Credit repair programs can help individuals improve their credit scores. However, like any service, they come with both advantages and disadvantages. Understanding these can help you make an informed decision.

Advantages Of Using Credit Repair Services

Credit repair services offer several benefits that can help you manage and improve your credit score more efficiently:

- Expert Assistance: Professionals with experience in credit repair can navigate complex credit issues.

- Time-Saving: They handle the tedious and time-consuming task of disputing inaccuracies on your credit report.

- Legal Knowledge: Many services are familiar with credit laws and can leverage them to your benefit.

- Structured Approach: These services often follow a systematic process, ensuring that all aspects of credit repair are addressed.

Using a service like SoloSuit can provide comprehensive assistance. It helps users respond to debt lawsuits and settle debts outside of court, potentially reducing the amount owed.

Potential Drawbacks And Limitations

While credit repair services can be beneficial, they also have some downsides:

- Cost: Services can be expensive, and fees can add up over time.

- No Guarantees: There is no guarantee that your credit score will improve significantly.

- Temporary Fix: If poor financial habits persist, credit issues may return.

- Dependency: Relying on services might prevent you from learning to manage credit effectively on your own.

It’s important to note that SoloSuit is a self-help tool. It provides legal information without creating an attorney-client relationship and does not offer refunds or returns as governed by its Terms of Service.

Balancing Expectations With Reality

To get the most out of credit repair programs, balance your expectations with reality:

- Set Realistic Goals: Understand that credit repair is a gradual process. Significant improvements take time.

- Educate Yourself: Learn about credit management to sustain improvements made by repair services.

- Monitor Progress: Regularly check your credit report to track changes and spot new issues early.

- Adopt Good Habits: Develop good financial habits to maintain a healthy credit score.

SoloSuit can assist you in navigating debt disputes and settling debts, but it’s essential to stay informed and proactive about your financial health.

Recommendations For Ideal Users

Credit repair services can offer significant advantages for many individuals. Understanding who can benefit the most is crucial for maximizing these services.

Who Can Benefit Most From Credit Repair Services

- Individuals with poor credit scores: Those struggling with low credit scores can see significant improvements.

- People facing debt lawsuits: Using tools like Solo can assist in responding to debt lawsuits, ensuring timely and legally sound replies.

- Consumers seeking debt settlement: SoloSettle helps negotiate settlements outside of court, potentially reducing the amount owed.

- Users needing professional oversight: Solo provides attorney-reviewed responses, adding a layer of professionalism and accuracy.

Scenarios Where Credit Repair Is Most Effective

Credit repair is most effective in specific scenarios where users need structured help:

| Scenario | Effectiveness of Credit Repair |

|---|---|

| Debt lawsuits | Solo assists in preparing and filing legal responses, reducing the risk of losing by default. |

| Settling debts | SoloSettle facilitates negotiations, making it easier to reach affordable settlements. |

| Credit score improvement | Consistent use of credit repair services can gradually enhance credit scores. |

Tips For Maximizing The Benefits Of Credit Repair Programs

To get the most out of credit repair programs, consider these tips:

- Act promptly: Respond to debt lawsuits within the specified timeframe using tools like Solo.

- Engage in settlements: Use SoloSettle to negotiate and potentially reduce your debt.

- Seek professional review: Ensure all responses are reviewed by an attorney for accuracy and legality.

- Monitor your credit: Regularly check your credit reports to track improvements and identify errors.

- Stay informed: Understand the terms and conditions of the credit repair services you use.

Conclusion: Achieving Financial Freedom Through Credit Repair

Credit repair can lead you to financial freedom. Many have found success in improving their credit scores and achieving their financial goals. By taking the right steps and using helpful tools, you too can experience a transformation in your financial life.

Recap Of Key Points

- Credit repair involves correcting errors on your credit report and negotiating with creditors.

- Improved credit scores can lead to better loan terms and lower interest rates.

- Using tools like SoloSuit can help you navigate debt disputes and settle debts efficiently.

Encouragement For Those Considering Credit Repair

Starting credit repair may seem daunting, but it is worth the effort. Many people have successfully improved their financial standing by addressing their credit issues. With determination and the right resources, you can achieve similar success.

SoloSuit offers comprehensive assistance to help you through the process. It supports users in all 50 states, and attorney-reviewed responses ensure your case is handled professionally.

Next Steps To Take For Financial Improvement

- Review your credit report for errors and dispute any inaccuracies.

- Communicate with creditors to negotiate better terms or settle debts.

- Consider using SoloSuit to handle debt disputes and settlements.

- Create a budget to manage your finances effectively and avoid future debt.

- Regularly monitor your credit score to track your progress.

Taking these steps can set you on the path to financial freedom. Start today and watch your financial situation improve over time.

Frequently Asked Questions

What Are Common Credit Repair Success Stories?

Credit repair success stories often include removing errors, boosting scores, and achieving financial goals. These stories inspire and show the possibility of financial recovery.

How Long Does Credit Repair Take?

Credit repair can take from a few months to over a year. The duration depends on individual financial situations and the complexity of errors.

Can Credit Repair Increase My Credit Score?

Yes, credit repair can increase your credit score. By correcting inaccuracies and managing debts, individuals can see significant improvements.

Are Credit Repair Services Worth It?

Credit repair services can be worth it if you lack time or expertise. They can efficiently dispute errors and guide you through the process.

Conclusion

Hearing about credit repair success stories can inspire many. These stories show real progress and hope. One tool that can assist in your journey is Solo. It helps with debt disputes and lawsuits. Solo provides comprehensive assistance, ensuring professional review and potential out-of-court settlements. Take the first step towards financial freedom with Solo. Learn more about Solo here and start your credit repair journey today.