Credit Repair Solutions: Transform Your Financial Future Today

**** Improving your credit score can be challenging. Credit repair solutions are essential for financial health.

In this blog, we explore effective credit repair methods to help you regain control of your finances. A good credit score opens many doors, from better loan rates to more financial opportunities. Many people struggle with poor credit, but with the right tools and strategies, improvement is possible. Credit repair solutions offer tailored approaches to fix your credit issues. By understanding and using these solutions, you can take significant steps towards a healthier financial future. One such effective tool is the Cheese Credit Builder Account. This account helps you build credit history without the need for a credit card. Let’s dive into how these solutions can work for you.

Credit: www.amazon.com

Introduction To Credit Repair Solutions

Many face challenges with their credit scores. Low credit scores can affect loan approvals, interest rates, and even job opportunities. Credit repair solutions help improve these scores, making financial goals more achievable. One such solution is the Cheese Credit Builder.

Understanding Credit Repair

Credit repair involves correcting errors and improving poor credit scores. It starts with reviewing your credit report. Identifying inaccuracies or old data is crucial. Once identified, these errors are disputed with the credit bureaus.

The Cheese Credit Builder helps in a unique way. Users save money while building their credit history. There’s no need for a credit card. The process is simple: open an account, choose a deposit amount, and enable autopay. Payments are reported to all three major credit bureaus.

Importance Of Credit Repair

A good credit score opens many doors. It can lead to better loan terms, lower interest rates, and increased financial opportunities. Poor credit scores can limit your options. They affect your ability to secure loans, rent homes, or even get jobs.

The Cheese Credit Builder offers numerous benefits. It allows for customizable goals, whether you’re aiming to buy a home or qualify for a new credit card. The plan is flexible, with deposit amounts ranging from $500 to $2,000 and terms of 12 or 24 months. There are no hidden fees, and funds are protected in a bank account.

| Main Features | Benefits |

|---|---|

| Reports to all major credit bureaus | Improve credit score by making on-time payments |

| No admin or membership fee | No extra charges |

| No credit check required | Does not affect your credit score |

| Simple process | Choose a deposit amount and enable autopay |

| Build by saving | Money is protected in a bank account |

| No hard pull | Will not negatively impact your credit score |

| Credit monitoring | Track your credit and identify issues |

For more information, visit the Cheese Credit Builder website.

Key Features Of Effective Credit Repair Solutions

Effective credit repair solutions provide a clear path to improving your credit score. Here are some key features to look for when choosing a credit repair solution.

Comprehensive Credit Report Analysis

Understanding your credit report is the first step. A good solution offers a thorough analysis of your credit report. It identifies errors and areas needing improvement. This helps you understand where you stand.

- Identifies inaccuracies

- Pinpoints areas for improvement

- Provides a clear action plan

Dispute Handling And Resolution

Errors on your credit report can lower your score. Effective solutions manage dispute handling on your behalf. They communicate with credit bureaus to fix errors. This ensures your report is accurate.

- Handles disputes with credit bureaus

- Ensures errors are corrected

- Improves your credit score

Credit Score Monitoring

Monitoring your credit score regularly is crucial. A good credit repair solution provides credit score monitoring. This helps you track progress and stay informed. Cheese Credit Builder offers this feature.

| Feature | Details |

|---|---|

| Credit Bureau Reporting | Reports to all major credit bureaus |

| Credit Check | No credit check required |

| Fees | No admin or membership fee |

Personalized Financial Advice

Everyone’s financial situation is unique. Effective credit repair solutions offer personalized financial advice. This advice helps you make informed decisions. Cheese Credit Builder allows you to tailor your plan to meet specific credit goals.

- Choose deposit amounts: $500, $1,000, or $2,000

- Select term lengths: 12 or 24 months

- Set specific credit goals

These features ensure you receive the support needed to improve your credit score effectively.

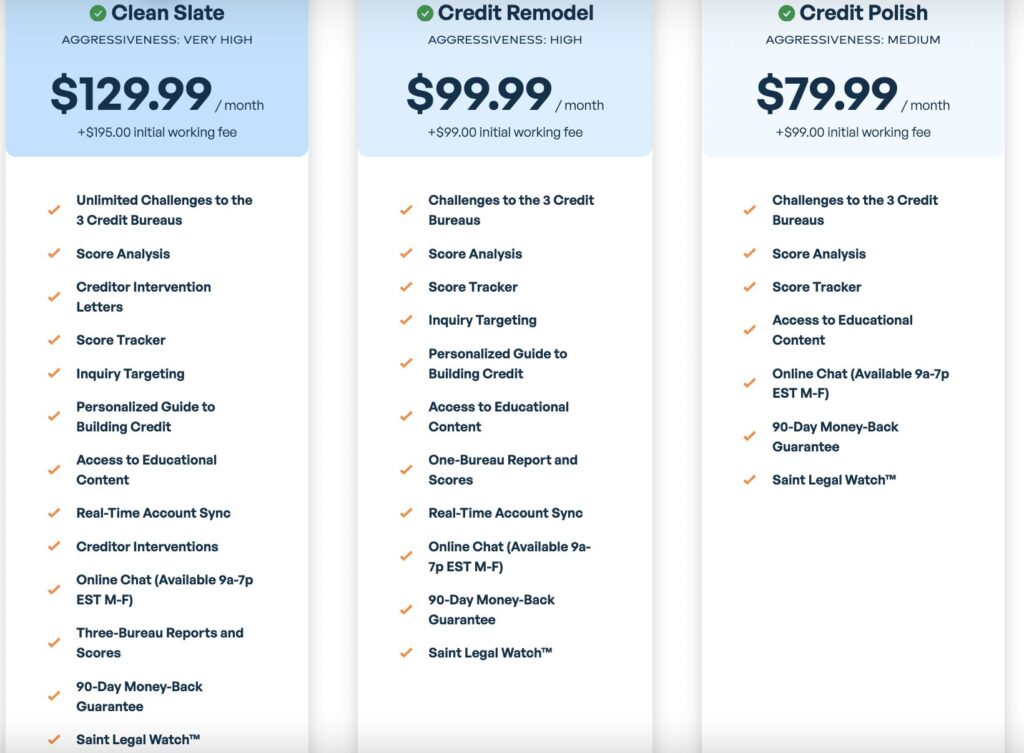

Pricing And Affordability Of Credit Repair Solutions

Credit repair solutions can significantly impact your financial future. Understanding the pricing and affordability of these services is crucial. In this section, we will explore various pricing models, analyze the costs versus benefits, and provide affordable options for every budget.

Different Pricing Models

Credit repair solutions generally follow three main pricing models:

- Subscription-based: Monthly fees are charged, typically ranging from $50 to $100.

- Pay-per-deletion: Fees are based on the removal of negative items from your credit report.

- One-time fees: A single payment covers the complete credit repair process.

Cheese Credit Builder Account offers a unique approach. Instead of traditional fees, it charges a low fixed APR, making it an affordable option.

Cost Vs. Benefit Analysis

Evaluating the cost versus the benefit of credit repair solutions is essential. Here’s a comparison:

| Solution | Cost | Benefit |

|---|---|---|

| Subscription-based | $50-$100/month | Gradual credit improvement |

| Pay-per-deletion | $30-$100/item | Specific item removal |

| Cheese Credit Builder | Starting at $24/month | Build credit by saving |

Cheese Credit Builder is cost-effective. With no membership or admin fees, it focuses on building credit through savings.

Affordable Options For Various Budgets

Credit repair solutions are available for different budgets. Here are some affordable options:

- Low Budget: Cheese Credit Builder starting at $24/month. Ideal for those looking to save while building credit.

- Moderate Budget: Subscription-based services for consistent monthly support.

- High Budget: Pay-per-deletion for targeted credit repair efforts.

Cheese Credit Builder is flexible with deposit amounts and term lengths. Choose from $500, $1,000, or $2,000 and 12 or 24 months.

This makes it adaptable to various financial situations.

- Credit and Loan Inquiries: Email loans@synapsefi.com or call 844-525-6247

- General Support: Email support@earncheese.com

- Address: 130 W Union St, Pasadena, CA 91103

Choosing the right credit repair solution depends on your budget and goals. Cheese Credit Builder provides a balance of affordability and effectiveness.

Credit: identitytheft.org

Pros And Cons Of Using Credit Repair Solutions

Credit repair solutions can be a valuable tool for improving your credit score. However, like any financial service, they come with their own set of advantages and drawbacks. In this section, we will explore the pros and cons of using credit repair solutions, providing a clear understanding of what to expect.

Advantages Of Professional Credit Repair Services

- Expert Guidance: Professional services offer expert advice tailored to your unique situation.

- Time-Saving: They handle the tedious work of contacting credit bureaus and creditors.

- Improved Credit Score: Can lead to faster improvements in your credit score.

- Better Financial Management: Professionals provide tips and strategies for maintaining good credit.

Potential Drawbacks And Limitations

- Cost: Professional services can be expensive.

- No Guarantees: There is no guarantee of success.

- Scams: Some companies may not be legitimate.

- Limited Impact: May not significantly improve your credit score if severe issues exist.

Real-world Usage Scenarios

| Scenario | Advantages | Drawbacks |

|---|---|---|

| Buying a Home |

|

|

| Qualifying for a Credit Card |

|

|

| Building Credit History |

|

|

Recommendations For Ideal Users Of Credit Repair Solutions

Credit repair solutions can be a valuable resource for individuals looking to improve their credit scores. Identifying who can benefit the most and understanding specific scenarios where credit repair is essential can help you make informed decisions. Below, we provide insights on who should consider credit repair solutions, specific scenarios requiring these services, and tips for choosing the right credit repair service.

Who Can Benefit The Most?

Credit repair solutions are ideal for individuals with poor or limited credit history. Here are some groups who can benefit the most:

- Young Adults: Those starting to build their credit history.

- Recent Graduates: Individuals with student loans and new financial responsibilities.

- Individuals with Past Credit Issues: Those recovering from financial setbacks such as bankruptcies or defaults.

- Immigrants: Newcomers to the country needing to establish a credit history.

Specific Scenarios Where Credit Repair Is Essential

There are certain situations where credit repair is not just beneficial, but essential. Here are some specific scenarios:

- Buying a Home: A higher credit score can secure better mortgage rates.

- Qualifying for a Loan: Essential for obtaining personal or business loans.

- Employment Opportunities: Some employers check credit scores as part of their hiring process.

- Reducing Interest Rates: Improving credit scores can lead to lower interest rates on existing debts.

Tips For Choosing The Right Credit Repair Service

Choosing the right credit repair service is crucial. Here are some tips to help you make the best choice:

| Tip | Description |

|---|---|

| Research and Reviews | Check customer reviews and testimonials to gauge the service’s effectiveness. |

| Transparency | Ensure the service provides clear information about fees and processes. |

| Accreditation | Look for services accredited by organizations like the Better Business Bureau (BBB). |

| Customer Support | Choose a service with responsive and helpful customer support. |

| Money-Back Guarantee | Opt for services that offer a money-back guarantee if you are not satisfied. |

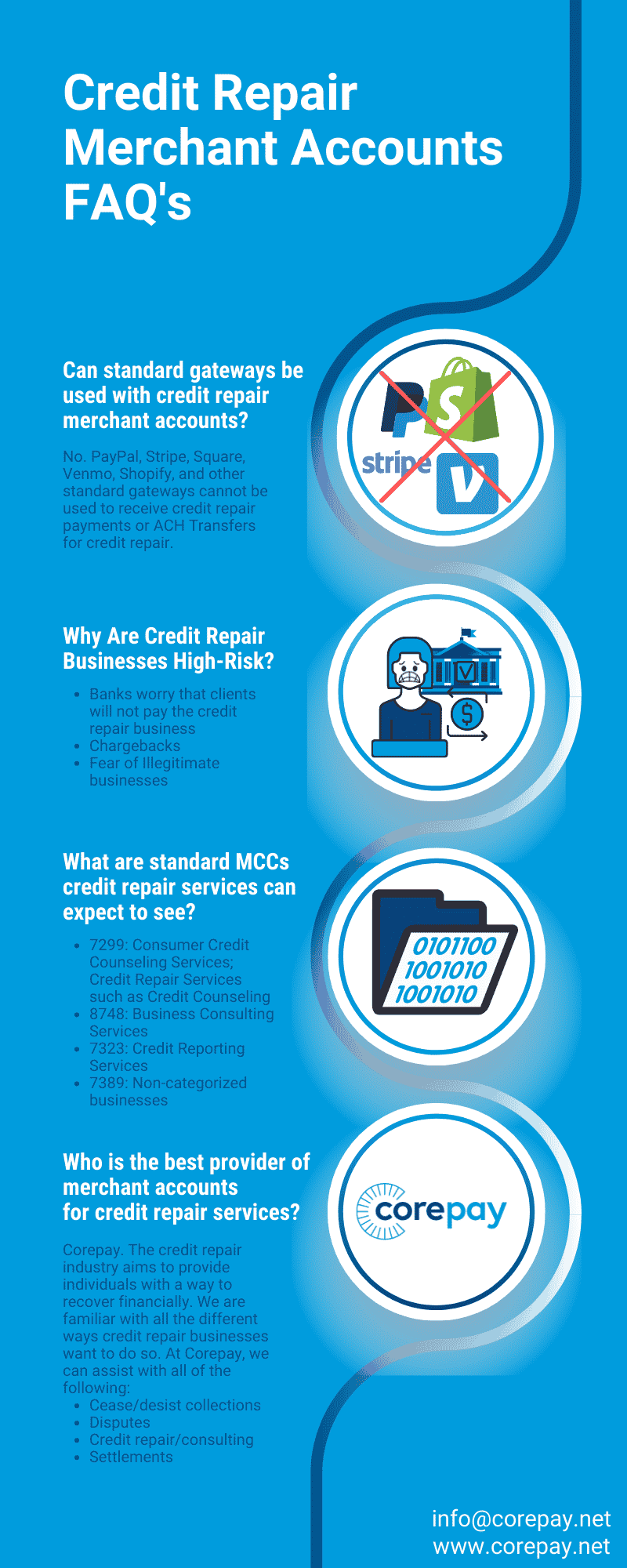

Credit: corepay.net

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves fixing your credit to improve your credit score. It includes disputing errors on credit reports and negotiating with creditors.

How Long Does Credit Repair Take?

Credit repair can take a few months to a year. The time depends on the number of errors and your actions.

Can Credit Repair Companies Help?

Credit repair companies can help by disputing errors and negotiating with creditors. However, you can also do it yourself.

What Affects My Credit Score?

Your credit score is affected by payment history, credit utilization, credit age, new credit, and credit mix.

Conclusion

Wrapping up, credit repair is essential for financial health. Consider using the Cheese Credit Builder. It offers a straightforward way to build credit. No fees, no credit checks. Secure and flexible. Start your journey to better credit today. Your future self will thank you.