Credit Repair Software: Transform Your Credit Score Today!

Credit repair software can be a valuable tool in managing your financial health. It helps you address and resolve issues that negatively affect your credit score.

SoloSettle is one such software that stands out in the credit repair niche. Designed to help individuals resolve debt disputes, SoloSettle provides automated assistance for responding to debt lawsuits and negotiating debt settlements. This user-friendly software simplifies the complex process of dealing with debt collectors, making it easier for you to handle financial challenges. With attorney-reviewed responses and nationwide coverage, SoloSettle has proven its effectiveness by protecting $1.71 billion in debt and assisting over 262,000 people. Ready to take control of your finances? Discover how SoloSettle can help by visiting their website here.

Introduction To Credit Repair Software

Managing credit can be challenging. Many people face difficulties in maintaining a good credit score. That’s where credit repair software like SoloSettle comes in. This software helps individuals resolve debt disputes and improve their credit scores efficiently.

What Is Credit Repair Software?

Credit repair software is a tool designed to help individuals improve their credit scores. It automates the process of identifying and disputing inaccuracies in credit reports. The software provides users with templates, tracking tools, and guidance to address credit issues effectively.

Purpose And Importance Of Credit Repair Software

The primary purpose of credit repair software is to simplify the credit repair process. It helps users to:

- Identify errors in their credit reports

- Dispute inaccuracies with credit bureaus

- Monitor credit score changes

Using credit repair software, users can save time and effort. The software provides a structured approach to tackle credit issues, ensuring that users follow the correct steps to improve their credit scores.

One example of such software is SoloSettle. This automated tool assists individuals in resolving debt disputes. It helps users respond to debt lawsuits and negotiate with collectors to settle debts outside of court.

SoloSettle offers several benefits:

- Automated Assistance: Simplifies the debt dispute process

- Attorney Review: Ensures responses to debt lawsuits are reviewed by an attorney

- Nationwide Coverage: Available in all 50 states

- Proven Impact: $1.71 billion in debt protected, 262,000 people helped

By using credit repair software like SoloSettle, individuals can manage their debts more effectively and work towards improving their credit scores.

Key Features Of Credit Repair Software

Credit repair software like SoloSettle offers valuable features that assist users in improving their credit scores and managing debt disputes efficiently. Below are the key features that make this software a valuable tool for individuals seeking to enhance their financial health.

Automated Dispute Resolution

The automated dispute resolution feature simplifies the process of addressing debt disputes. SoloSettle helps users compile a response to a debt lawsuit within 14-30 days. An attorney reviews the response before filing, ensuring accuracy and legal compliance. This feature is critical for those who need quick and professional assistance in handling debt-related issues.

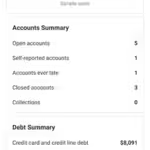

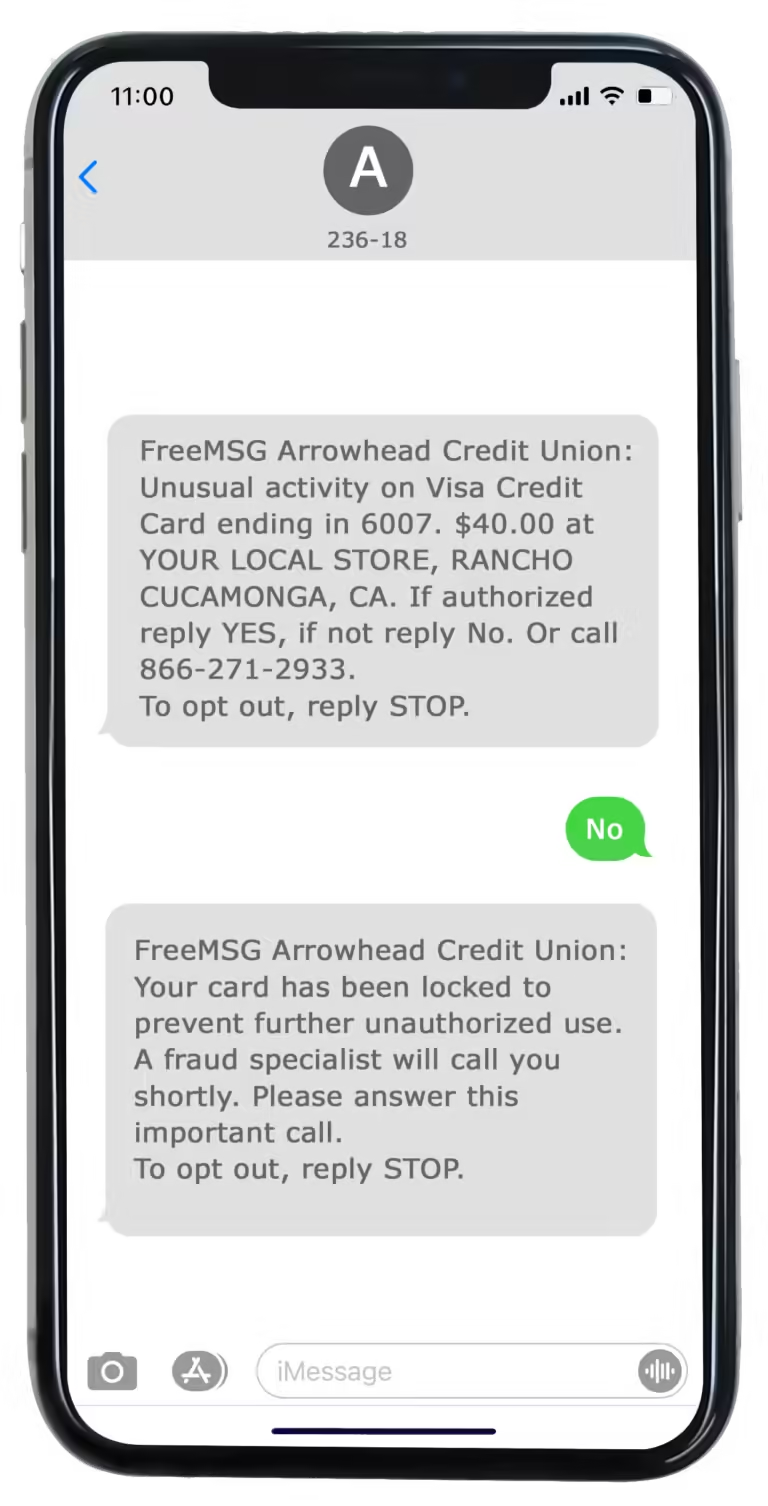

Credit Monitoring And Alerts

Credit monitoring is essential for maintaining a healthy credit score. SoloSettle provides credit monitoring and alerts, allowing users to stay informed about their credit status. These alerts notify users of any changes to their credit report, enabling them to take prompt action if necessary. Staying on top of your credit can help prevent issues before they escalate.

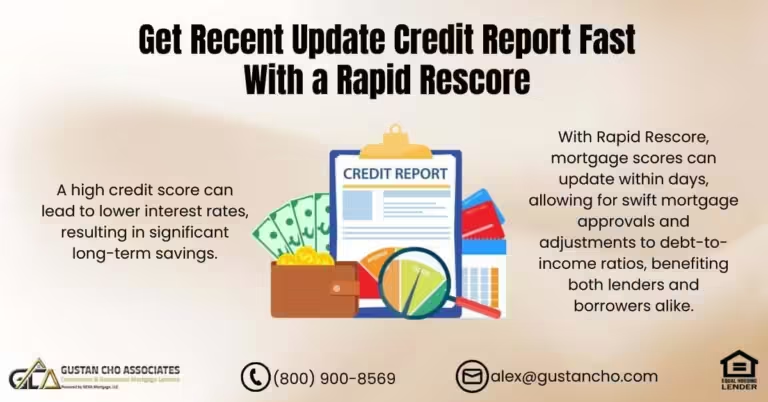

Personalized Credit Score Improvement Plans

Every individual’s financial situation is unique. SoloSettle offers personalized credit score improvement plans tailored to each user’s specific needs. These plans provide actionable steps to improve credit scores over time. Users receive guidance on managing their debts, optimizing their credit utilization, and addressing negative items on their credit reports.

Educational Resources And Tools

Understanding credit and debt management is crucial for long-term financial health. SoloSettle includes a wealth of educational resources and tools. These resources help users learn about credit scores, debt management, and financial planning. By educating themselves, users can make informed decisions and avoid common pitfalls.

User-friendly Interface And Navigation

A user-friendly interface and navigation make SoloSettle accessible to everyone, even those with limited technical knowledge. The software is designed to be intuitive, with clear instructions and easy-to-follow steps. This ensures that users can navigate the platform effortlessly and utilize its features to their fullest potential.

In summary, SoloSettle’s key features, including automated dispute resolution, credit monitoring, personalized plans, educational resources, and a user-friendly interface, make it an excellent tool for credit repair and debt management.

Pricing And Affordability

Understanding the pricing and affordability of credit repair software can help you make an informed decision. This section will cover different pricing models, compare costs across popular software, and discuss the value for money at various price points.

Overview Of Pricing Models

Credit repair software typically follows one of three pricing models:

- Subscription-Based: Users pay a monthly or annual fee for continuous access.

- One-Time Purchase: Users make a single payment to own the software indefinitely.

- Pay-Per-Use: Users pay each time they use the service or specific features.

Each model offers unique benefits, catering to different user needs and budgets.

Comparing Costs Across Popular Credit Repair Software

| Software | Pricing Model | Cost |

|---|---|---|

| SoloSettle | Subscription-Based | Not Specified |

| Credit Repair Cloud | Subscription-Based | Starting at $179/month |

| DisputeBee | Subscription-Based | Starting at $39/month |

| Credit-Aid | One-Time Purchase | Starting at $69.95 |

Value For Money: What You Get At Different Price Points

Evaluating the value for money involves looking at the features and benefits offered at various price points:

- Low-Cost Options: Basic features like credit report analysis and dispute templates.

- Mid-Range Options: Advanced features like automated disputes and credit monitoring.

- Premium Options: Comprehensive solutions including attorney reviews and nationwide coverage.

For example, SoloSettle offers automated assistance and attorney review. It supports users in all 50 states and has a proven impact, protecting $1.71 billion in debt and helping 262,000 people.

Choosing the right software depends on your specific needs and budget. Assess the features and benefits at each price point to determine the best value for your money.

Pros And Cons Of Credit Repair Software

Credit repair software can be a helpful tool for managing financial health. Like any tool, it has its advantages and drawbacks. Understanding these can help you decide if it’s the right choice for you.

Advantages Of Using Credit Repair Software

Using credit repair software offers several benefits:

- Automated Assistance: The software simplifies complex tasks, such as disputing errors on your credit report.

- Time-Saving: Manages multiple disputes quickly, saving you time.

- Cost-Effective: Generally more affordable than hiring a professional credit repair service.

- User-Friendly: Designed for ease of use, even for those with minimal technical skills.

- Tracking and Monitoring: Provides tools to monitor your progress and stay organized.

Potential Drawbacks And Limitations

While credit repair software has many benefits, it also has some limitations:

- Limited Scope: Software may not handle complex issues that require legal expertise.

- DIY Aspect: Requires a degree of self-motivation and diligence.

- Potential Costs: While cheaper than hiring a professional, it still involves some costs.

- Data Security: Storing sensitive personal information can pose security risks.

- No Guarantees: The software does not guarantee specific outcomes.

Understanding these pros and cons can help you make an informed decision. For example, SoloSettle offers automated assistance and attorney review for debt disputes. It helps users reply to debt lawsuits and settle debts outside of court. This can save time and money, while providing professional oversight.

Who Should Use Credit Repair Software?

Credit repair software can be a powerful tool for those looking to improve their credit scores. Understanding who should use credit repair software can help you determine if it’s the right solution for your financial situation.

Ideal Users And Scenarios

There are several types of individuals who can benefit from using credit repair software:

- Individuals with Multiple Credit Report Errors: Those who find multiple inaccuracies on their credit reports can use software to dispute these errors effectively.

- People with Limited Time: For those who cannot dedicate many hours to manually repairing their credit, automated software can save significant time.

- DIY Enthusiasts: Individuals who prefer to handle their financial issues themselves, rather than hiring a credit repair company, can find software to be a cost-effective solution.

Situations Where Credit Repair Software Is Most Beneficial

Credit repair software is most beneficial in the following situations:

| Situation | Benefit |

|---|---|

| Disputing Multiple Errors | Automates the dispute process and tracks progress. |

| Time-Constrained Individuals | Saves time with automated tasks and reminders. |

| Debt Settlement | Helps negotiate with collectors to settle debts for less. |

For instance, SoloSettle, an automated software designed for resolving debt disputes, is ideal for those needing to respond to debt lawsuits or settle debts outside of court. SoloSettle simplifies the process and ensures that an attorney reviews your response before filing. This can be particularly helpful in ensuring accuracy and legal compliance.

In summary, if you are dealing with multiple credit report errors, have limited time, or prefer to handle credit repair yourself, credit repair software can be a great asset. It offers a structured and efficient way to manage and improve your credit score.

Conclusion: Transforming Your Credit Score Today

Improving your credit score can seem challenging. With SoloSettle, it becomes manageable. This software simplifies the process of resolving debt disputes. You can respond to debt lawsuits or settle debts outside of court. Let’s summarize the benefits and recommendations for using SoloSettle.

Recap Of Benefits

- Automated Assistance: SoloSettle simplifies debt dispute processes.

- Attorney Review: Ensures responses are reviewed by an attorney before filing.

- Nationwide Coverage: Available in all 50 states.

- Proven Impact: $1.71 billion in debt protected and 262,000 people helped.

Final Thoughts And Recommendations

SoloSettle offers significant advantages for individuals dealing with debt disputes. The software provides automated assistance, making the process less stressful. The attorney review feature ensures that your responses are legally sound. With nationwide coverage, anyone in the US can benefit from this service.

Recommendation: If you need help with debt disputes, consider using SoloSettle. It simplifies the process and offers valuable legal support.

Remember, SoloSettle is not a substitute for professional legal advice. Always consider consulting with a qualified attorney for complex legal matters.

Frequently Asked Questions

What Is Credit Repair Software?

Credit repair software is a tool that helps users improve their credit scores. It identifies errors on credit reports and disputes them. The software automates the process, saving time and effort.

How Does Credit Repair Software Work?

Credit repair software works by analyzing your credit report for errors. It generates dispute letters for inaccuracies found. The software then tracks the progress of disputes, ensuring issues are resolved.

Is Credit Repair Software Effective?

Yes, credit repair software can be effective. It streamlines the credit repair process and increases efficiency. However, results depend on the accuracy of your credit report and the nature of disputes.

Can I Use Credit Repair Software Myself?

Yes, you can use credit repair software yourself. It’s designed for user-friendliness and requires no special expertise. The software guides you through the process step-by-step.

Conclusion

Credit repair software like SoloSettle offers valuable help. It simplifies debt disputes and lawsuits. Users can respond to lawsuits quickly, with attorney-reviewed responses. Negotiating debt settlements becomes easier and less stressful. SoloSettle has helped many people, protecting over $1.71 billion in debt. Consider using SoloSettle for your credit repair needs. It provides nationwide coverage and proven results. For more information, visit SoloSuit. Simplify your debt resolution process today.