Credit Repair Reviews: Unbiased Insights to Boost Your Score

Credit repair reviews can guide you to the best solutions available. They help you understand different options to fix your credit score.

Dealing with credit issues can be stressful and overwhelming. With many services out there, choosing the right one is crucial for your financial health. That’s where credit repair reviews come in handy. These reviews provide insights into the effectiveness, reliability, and customer satisfaction of various credit repair services. One notable service in this field is Mitigately. Mitigately uses AI to consolidate debts, helping individuals manage their repayments better and save money. Understanding the experiences of others can help you make an informed decision about which service might best suit your needs. Let’s dive into what makes a great credit repair service and how reviews can guide your choice.

Introduction To Credit Repair Services

Credit repair services are essential for individuals aiming to improve their credit scores. These services help in identifying and resolving issues on credit reports, leading to better financial opportunities.

What Are Credit Repair Services?

Credit repair services involve working with credit bureaus and creditors to fix errors on credit reports. These services can dispute inaccurate information, negotiate with creditors, and offer guidance on improving credit habits.

Many credit repair companies, like Mitigately, use advanced technology to streamline this process. Mitigately offers an AI-powered debt consolidation service that helps users manage their debts effectively. The service consolidates multiple debt payments into one manageable payment, making it easier to become debt-free faster.

Importance Of A Good Credit Score

A good credit score is vital for financial health. It impacts your ability to secure loans, credit cards, and even renting an apartment. Better credit scores can lead to lower interest rates, saving you money over time.

Using a service like Mitigately can help in improving your credit score. Mitigately’s AI-powered agent matches users with the best debt solutions in approximately 6½ minutes. This quick and efficient service can significantly improve your financial standing.

| Feature | Details |

|---|---|

| AI-powered agent | Matches users with debt solutions quickly. |

| Free Service | Service is free until accounts settle. |

| Debt Repayment Calculator | Estimate potential savings. |

| Secure Handling | 256-bit encryption ensures privacy. |

With over 400 reviews and a 4.9-star rating, Mitigately has proven effective. Many users report significant savings and successful debt resolution.

Here’s how Mitigately works:

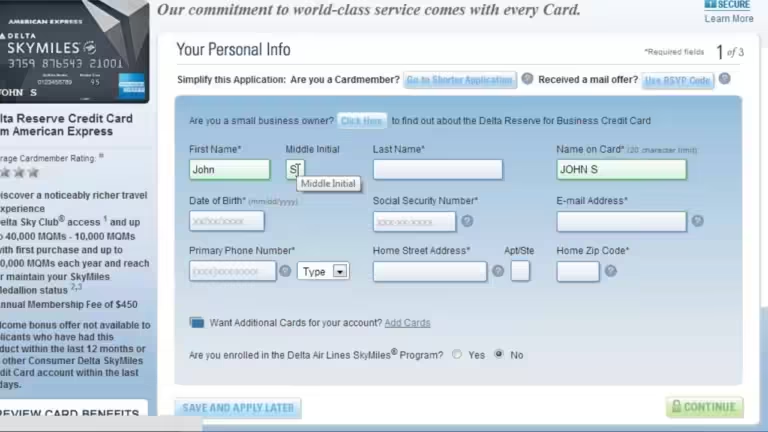

- Getting Started: Users submit details securely to the AI-powered agent.

- Your Perfect Plan: The agent matches users with the best debt solution.

- The Follow Through: Users follow their plan while Mitigately deals with creditors.

- You Made it Happen: Debts are consolidated, and users pay less than they originally owed.

Understanding the importance of a good credit score and using services like Mitigately can pave the way for financial freedom.

Key Features Of Top Credit Repair Services

Choosing the right credit repair service can make a significant difference in your financial journey. Top credit repair services offer a range of features designed to improve your credit score efficiently and effectively. Here are the key features you should look for:

Credit Report Analysis

A comprehensive credit report analysis is a fundamental feature of top credit repair services. Experts thoroughly review your credit reports from major credit bureaus. They identify errors, inaccuracies, and negative items that impact your score. This analysis helps in creating a personalized plan to address these issues and improve your credit health.

Dispute Letter Generation

Generating dispute letters is crucial for removing inaccuracies from your credit report. Top services provide automated tools or expert assistance to create effective dispute letters. These letters are sent to credit bureaus and creditors to challenge erroneous items. The goal is to correct or remove these items, resulting in a better credit score.

Credit Monitoring And Alerts

Credit monitoring is essential for staying updated on changes to your credit report. Leading credit repair services offer real-time alerts about new inquiries, account changes, or suspicious activities. This feature helps you take prompt action to protect your credit score and personal information.

Financial Education Resources

Educational resources are vital for long-term credit health. Top credit repair services provide access to financial education resources. These may include articles, guides, webinars, and personalized advice. Learning about credit management, budgeting, and debt repayment empowers you to make informed financial decisions and maintain a good credit score.

Pricing And Affordability Breakdown

Understanding the cost of credit repair services is crucial for managing your finances. Mitigately offers a range of pricing options to suit different needs and budgets. Let’s explore the pricing and affordability of Mitigately in detail.

Monthly Subscription Costs

Mitigately stands out by offering its services for free until your accounts settle. This means no monthly subscription costs. Users can enjoy the benefits of debt consolidation without worrying about recurring fees. This makes Mitigately an attractive option for those seeking affordable debt management solutions.

One-time Service Fees

Mitigately does not charge any upfront or one-time service fees. The service is designed to be cost-effective, allowing users to focus on reducing their debt without incurring additional expenses. The absence of one-time fees further underscores Mitigately’s commitment to affordability and customer satisfaction.

Free Vs. Paid Services

Mitigately’s service model is unique because it is free until your debts are settled. The AI-powered debt consolidation service ensures users receive the best possible solutions without any initial costs. This contrasts with many other services that charge fees upfront or on a monthly basis.

Mitigately offers significant savings, as users can potentially save up to 35% on the total amount owed. The service is also highly rated, with a 4.9-star rating from over 400 reviews, highlighting its effectiveness and value.

| Service Type | Cost |

|---|---|

| Monthly Subscription | Free until accounts settle |

| One-Time Service Fee | None |

| Potential Savings | Up to 35% on total debt |

Choosing the right credit repair service involves understanding the costs involved. Mitigately’s pricing structure offers a clear and affordable path to financial freedom.

Pros And Cons Of Using Credit Repair Services

Credit repair services can be a valuable resource for improving credit scores. However, they come with their own set of advantages and disadvantages. Understanding these can help you make an informed decision.

Advantages: Time-saving And Expertise

One of the main advantages of using credit repair services is the time-saving aspect. Repairing your credit on your own can be a lengthy and complicated process. Credit repair services handle the paperwork, follow up with creditors, and track progress. This allows you to focus on other important aspects of your life.

Another significant benefit is the expertise that comes with professional services. These companies have a deep understanding of credit laws and regulations. They know how to dispute errors effectively and improve your credit score. This expertise can make a big difference in the success and speed of credit repair.

Disadvantages: Costs And Potential Scams

Despite the benefits, credit repair services also have drawbacks. One of the main disadvantages is the cost. Many services charge monthly fees or a one-time payment, which can add up over time. It’s important to weigh these costs against the potential benefits.

Another concern is the potential for scams. Not all credit repair services are legitimate. Some companies make false promises or charge high fees without delivering results. It’s crucial to research and choose a reputable service to avoid falling victim to scams.

| Advantages | Disadvantages |

|---|---|

|

|

In summary, using credit repair services can save you time and provide expert assistance. However, it’s essential to be aware of the costs and the potential for scams. Conduct thorough research before choosing a service to ensure you get the best results.

Specific Recommendations For Ideal Users

Mitigately offers tailored debt consolidation solutions for various types of users. Here are some specific recommendations for those who can benefit the most from Mitigately’s services.

Individuals With Poor Credit History

For individuals struggling with a poor credit history, Mitigately provides a lifeline. The service helps consolidate multiple debt payments into a single manageable payment. This can significantly improve credit scores over time.

Benefits:

- Consolidates debts, reducing the risk of missed payments.

- Offers potential savings of up to 35% on the total amount owed.

- AI-powered agent finds the best debt solutions quickly.

Users Looking For Professional Assistance

Mitigately is ideal for users seeking professional assistance without upfront costs. The AI-powered agent provides customized debt relief options, ensuring users get the best plan suited to their needs.

Features:

| Service | Details |

|---|---|

| AI-powered agent | Matches users with debt solutions in approximately 6½ minutes. |

| Free service | Until accounts settle, no initial costs involved. |

| Secure handling | Personal information is secured with 256-bit encryption. |

Those Seeking Long-term Credit Improvement

For users aiming for long-term credit improvement, Mitigately offers a structured path to financial stability. The service not only consolidates debts but also deals with creditors directly, potentially saving users up to 80% on their debts.

How It Works:

- Getting Started: Users submit their details securely to the AI-powered agent.

- Your Perfect Plan: The agent matches users with the best debt consolidation or relief option.

- The Follow Through: Users follow their plan while Mitigately deals with creditors.

- You Made it Happen: Debts are consolidated, and users pay a fraction of what they originally owed.

In conclusion, Mitigately’s unique features and benefits make it an excellent choice for individuals with poor credit history, those seeking professional assistance, and anyone looking for long-term credit improvement.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of improving your credit score. It involves disputing inaccuracies on your credit report.

How Does Credit Repair Work?

Credit repair works by identifying and disputing errors on your credit report. This can improve your credit score.

Are Credit Repair Companies Effective?

Some credit repair companies are effective in disputing errors. Research and choose a reputable company for best results.

How Long Does Credit Repair Take?

Credit repair can take several months to see results. The exact time varies depending on individual circumstances.

Conclusion

Choosing the right debt consolidation service can be overwhelming. Mitigately stands out with its AI-powered solutions. Users have praised its effectiveness in achieving financial freedom. Consolidate your debt and save money with confidence. Interested? Learn more about Mitigately here. Take control of your financial future today.