Credit Repair Programs: Boost Your Financial Health Today

Credit repair programs can help you improve your credit score. They address negative items on your credit report.

For many, a good credit score is essential. It opens doors to better loan rates, more credit card options, and even job opportunities. But sometimes, our credit score doesn’t reflect our financial behavior accurately. This is where credit repair programs come in.

These services help you identify and fix errors on your credit report, negotiate with creditors, and provide guidance on improving your credit habits. Whether you’re looking to buy a home, start a business, or just get back on track financially, understanding credit repair programs can be a game-changer. Ready to learn more about how these programs work and how they can benefit you? Let’s dive in.

Introduction To Credit Repair Programs

Credit repair programs play a crucial role in maintaining and improving your credit score. Understanding these programs can help you make informed decisions about managing your finances and accessing better credit options.

What Are Credit Repair Programs?

Credit repair programs are services designed to help individuals and businesses improve their credit scores. They typically involve identifying errors in credit reports, disputing inaccurate information, and providing strategies to boost credit ratings.

For businesses, credit repair programs like the FairFigure Capital Card offer comprehensive solutions. These include credit monitoring, access to funding, and tools for credit building. FairFigure’s platform ensures that businesses can correct wrong information and monitor their credit scores in real-time.

The Importance Of Credit Repair

Good credit is essential for securing loans, getting better interest rates, and accessing various financial products. For businesses, a strong credit score can lead to increased funding opportunities and lower costs of borrowing.

With the FairFigure Capital Card, businesses can see up to a 60% improvement in their credit scores within three months. This improvement can open doors to better financing options and more favorable terms.

Accurate credit monitoring is crucial. Errors in credit reports can significantly impact scores. FairFigure’s Business Credit Correct tool helps identify and correct these errors, ensuring accurate scores.

Additionally, the FairFigure platform provides secure access to financial data, ensuring privacy and data security through PCI compliant data centers and Plaid integration.

Key Features Of Effective Credit Repair Programs

Effective credit repair programs provide essential services to improve your credit score. They involve personalized credit analysis, dispute resolution, credit counseling, and ongoing monitoring. Understanding these features can help you choose the best program for your needs.

Personalized Credit Analysis

An effective credit repair program begins with a personalized credit analysis. This involves a detailed review of your credit reports from major bureaus. The aim is to identify errors, inaccuracies, and potential areas for improvement.

| Service | Details |

|---|---|

| Credit Report Review | Detailed analysis of credit reports |

| Identification of Errors | Spotting inaccuracies affecting your score |

| Improvement Plan | Customized strategy to enhance your credit |

Dispute Resolution Services

Dispute resolution services are vital for correcting errors on your credit report. Effective programs will help you dispute inaccuracies with credit bureaus and creditors. This process can involve sending letters and tracking the status of disputes.

- Drafting dispute letters

- Tracking dispute progress

- Communicating with credit bureaus

Credit Counseling And Education

Effective credit repair programs offer credit counseling and education. These services help you understand credit management and develop better financial habits. Education is key to maintaining a good credit score long term.

- Credit management tips

- Debt reduction strategies

- Financial literacy workshops

Ongoing Credit Monitoring

Ongoing credit monitoring is essential for tracking your progress. Effective programs provide regular updates on your credit status. This helps you stay informed and address issues promptly.

Benefits of ongoing monitoring include:

- Real-time alerts

- Monthly credit score updates

- Access to detailed credit reports

By understanding these key features, you can choose a credit repair program that best suits your needs.

Pricing And Affordability Of Credit Repair Programs

Understanding the pricing and affordability of credit repair programs is crucial for businesses looking to improve their credit scores. Various programs offer different pricing models and services. Here’s a detailed look at the cost breakdown and value offered by these programs.

Cost Breakdown Of Popular Programs

Credit repair programs vary significantly in their pricing structures. Some popular programs include basic monitoring services, while others offer comprehensive credit repair and funding solutions.

| Program | Initial Fee | Monthly Fee | Services Included |

|---|---|---|---|

| FairFigure Capital Card | Sign up to verify business | Varies (check website for details) | Credit monitoring, same-day funding, credit building, data security |

| Program B | $99 | $79 | Credit report analysis, dispute errors, credit score improvement |

| Program C | $129 | $89 | Full-service credit repair, identity theft protection, financial education |

Free Vs. Paid Services

There are both free and paid credit repair services available. Free services often provide limited features, while paid services offer comprehensive solutions.

- Free Services: These typically include basic credit report access and simple dispute tools.

- Paid Services: Offer extensive credit monitoring, detailed dispute management, and additional features like funding access.

Choosing between free and paid services depends on your business needs and budget. Paid services often provide better value due to their extensive features.

Evaluating The Value For Money

Evaluating the value for money is essential when selecting a credit repair program. Consider the services offered, the impact on credit scores, and the overall benefits to your business.

- Service Range: Ensure the program covers all necessary aspects like credit monitoring, funding access, and credit building.

- Improvement Potential: Look for programs that report significant credit score improvements, such as the FairFigure Capital Card, which can boost scores by up to 60%.

- Security and Support: Choose programs that offer robust data security and reliable customer support.

For example, the FairFigure Capital Card provides a comprehensive solution with credit monitoring, same-day funding, and secure data handling, making it a valuable option for businesses.

Pros And Cons Of Using Credit Repair Programs

Credit repair programs offer a structured approach to improve your credit scores. They can be beneficial, but they also come with potential drawbacks. This section will explore the benefits and risks of using these programs.

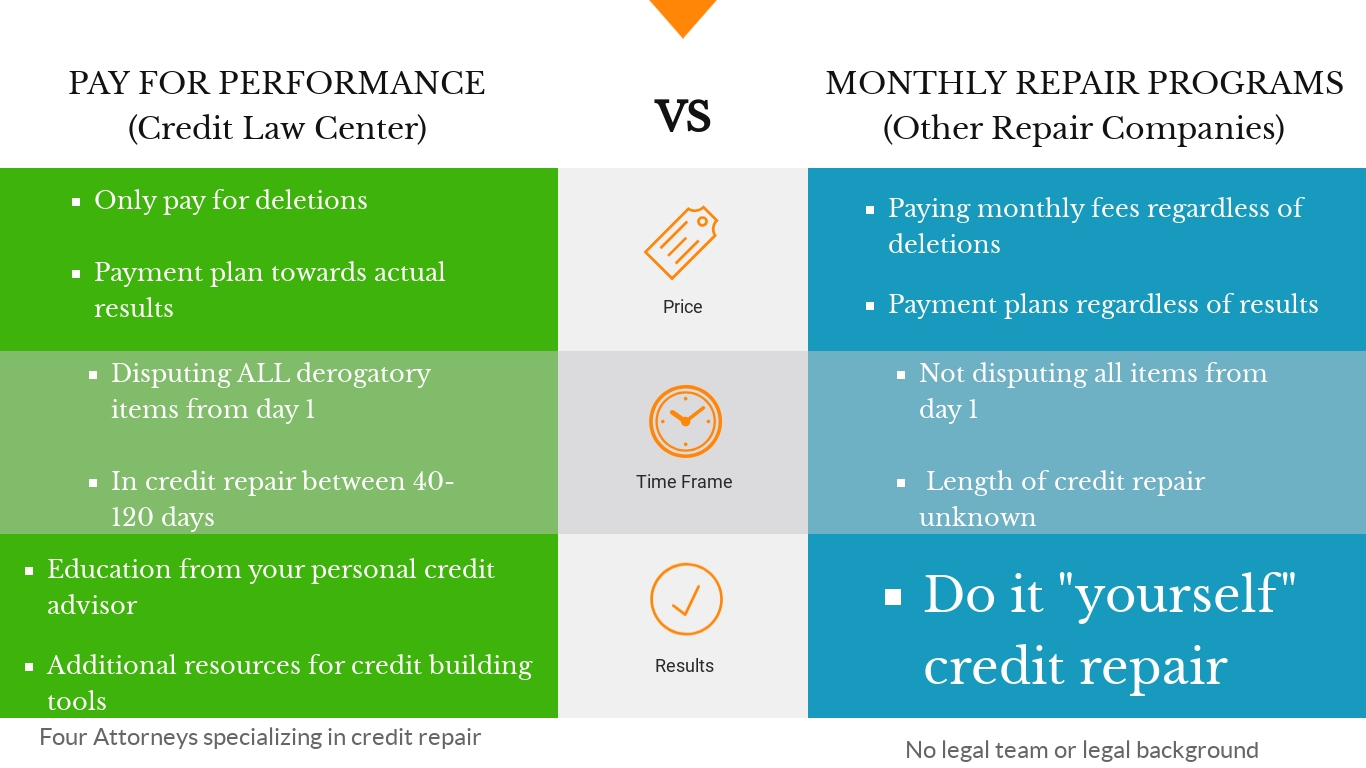

Benefits Of Professional Credit Repair Services

- Expertise: Professionals have knowledge of credit laws and regulations. They know how to navigate disputes and correct inaccuracies.

- Time-saving: Credit repair services handle the legwork. They contact credit bureaus and creditors on your behalf.

- Improved Credit Scores: Effective credit repair can lead to higher credit scores. This opens doors to better loan rates and financial opportunities.

- Customized Plans: Services often provide personalized plans. They tailor their approach based on your specific credit issues.

Potential Drawbacks And Risks

- Cost: Credit repair services can be expensive. Fees may vary depending on the complexity of your credit issues.

- No Guarantees: There are no guarantees that your credit score will improve. The success of the service depends on various factors.

- Scams: The industry has its share of fraudulent companies. It’s important to research and choose a reputable service.

- Limited Impact: Some negative items may be difficult to remove. Credit repair services cannot remove accurate negative information.

Comparing Diy Credit Repair To Professional Services

| Aspect | DIY Credit Repair | Professional Services |

|---|---|---|

| Cost | Lower cost, often free | Higher cost, service fees |

| Time and Effort | Requires significant personal time and effort | Less personal time, handled by experts |

| Expertise | Limited to your own knowledge and research | Access to professionals with credit repair experience |

| Customization | Generic, one-size-fits-all approach | Personalized plans tailored to your credit situation |

| Results | Results may vary based on personal effort and knowledge | Potentially faster and more effective results |

Choosing between DIY and professional credit repair services depends on your needs and resources. Professional services offer expertise and time-saving benefits but come at a cost. DIY credit repair can be cost-effective but requires significant effort and knowledge.

Specific Recommendations For Ideal Users

FairFigure Capital Card offers unique benefits for businesses. This program suits various scenarios where credit repair is crucial. Below are specific recommendations for ideal users.

Who Can Benefit Most From Credit Repair Programs?

Businesses struggling with low credit scores can benefit significantly. The FairFigure Capital Card helps in improving credit ratings quickly. This is ideal for:

- Startups needing to build credit history.

- Established businesses with inaccurate credit reports.

- Companies aiming to secure better loan rates.

Businesses seeking same-day funding without personal credit checks find this program invaluable. The FairFigure Capital Card reports payment history to commercial bureaus, enhancing credit scores by up to 60%.

Scenarios Where Credit Repair Programs Are Most Effective

Several scenarios show the effectiveness of credit repair programs. Here are some:

| Scenario | Benefit |

|---|---|

| Incorrect Credit Reports | Correct errors and ensure accurate scores with the Business Credit Correct tool. |

| Need for Immediate Funding | Access same-day funding without personal credit checks. |

| Building Business Credit | Report payment history to commercial bureaus to boost scores. |

FairFigure offers secure data handling through Plaid, ensuring business financial data remains safe. This is crucial for businesses managing sensitive information. Also, higher credit scores from FairFigure open doors to better rates and more funding options.

Conclusion: Boost Your Financial Health With Credit Repair Programs

Credit repair programs, such as FairFigure, offer a comprehensive solution to improve your business credit. These programs provide the tools and support needed to correct inaccuracies, build credit, and access funding. By leveraging these programs, businesses can achieve better financial stability and opportunities.

Recap Of Key Points

- Credit Monitoring: Real-time tracking of business tri-bureau scores.

- Funding Access: Same-day funding without personal credit checks.

- Credit Building: Reports payment history to commercial bureaus, potentially increasing scores by up to 60%.

- No Personal Credit Impact: Uses only business EIN for reporting and decisions.

- Data Security: Secure access to financial data through PCI compliant data centers.

Taking The Next Steps Towards Better Credit

- Sign Up: Register and verify your business with the bureaus.

- Apply for the Card: Use your business EIN to apply for the FairFigure Capital Card.

- Monitor and Use: Utilize the card for purchases and monitor vendor reporting. FairFigure handles reporting and corrections.

FairFigure’s credit repair program offers a pathway to improved business credit scores. Accurate reporting and funding opportunities can help your business grow. Start today to secure your financial future.

Frequently Asked Questions

What Are Credit Repair Programs?

Credit repair programs are services that help improve your credit score. They identify and dispute inaccurate information on your credit report.

How Do Credit Repair Programs Work?

Credit repair programs work by reviewing your credit report for errors. They then dispute inaccuracies with credit bureaus on your behalf.

Are Credit Repair Programs Effective?

Credit repair programs can be effective if done correctly. They help remove incorrect data, potentially improving your credit score.

How Long Does Credit Repair Take?

Credit repair typically takes three to six months. The time varies based on the number of disputes and the responsiveness of credit bureaus.

Conclusion

Credit repair programs can transform your financial future. FairFigure Capital Card offers invaluable credit monitoring and funding solutions. Improve your business credit scores and enjoy easy access to funds. Start today and see real results. Learn more by visiting FairFigure.