Credit Repair Process: Unlock Your Path to Financial Freedom

Credit repair can seem daunting. It’s a vital step to financial wellness.

In this blog, we’ll break down the credit repair process in simple terms. Understanding your credit score and how to improve it is essential. Many people struggle with credit issues but don’t know where to start. This guide will help you navigate the steps to repair your credit effectively. We’ll cover everything from reviewing your credit report to disputing errors and improving your credit score over time. Whether you’re looking to buy a home, get a loan, or simply boost your financial health, knowing how to repair your credit is crucial. Let’s dive in and see how the credit repair process can benefit you and your financial future. For more tools and insights on improving your business’s financial health, consider exploring Hello Alice.

Introduction To Credit Repair

Credit repair is a process aimed at fixing your credit score. It involves identifying errors, disputing them, and taking steps to improve your financial health. Understanding this process is crucial for anyone looking to improve their creditworthiness.

Understanding Credit Scores

Your credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Higher scores indicate better credit health.

Credit scores are calculated based on several factors, including:

- Payment History: Timely payments positively affect your score.

- Credit Utilization: The ratio of your credit card balances to credit limits.

- Length of Credit History: Longer credit histories generally improve scores.

- New Credit: Opening multiple new accounts in a short period can lower your score.

- Credit Mix: Having a variety of credit types (loans, credit cards) can benefit your score.

The Importance Of Good Credit

Maintaining a good credit score has several benefits:

- Lower interest rates on loans and credit cards.

- Better chances of loan approval.

- Higher credit limits.

- More favorable terms on mortgages and auto loans.

- Potential job opportunities, as some employers check credit scores.

Good credit can open doors to various financial opportunities. It helps in securing business loans, which is essential for small businesses aiming for growth.

| Credit Score Range | Creditworthiness |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

For small business owners, tools like Hello Alice can provide personalized growth plans. These plans help in improving your business health score, which is crucial for securing better financial terms.

By understanding the credit repair process and the importance of good credit, you can take meaningful steps to enhance your financial health and open new opportunities for growth.

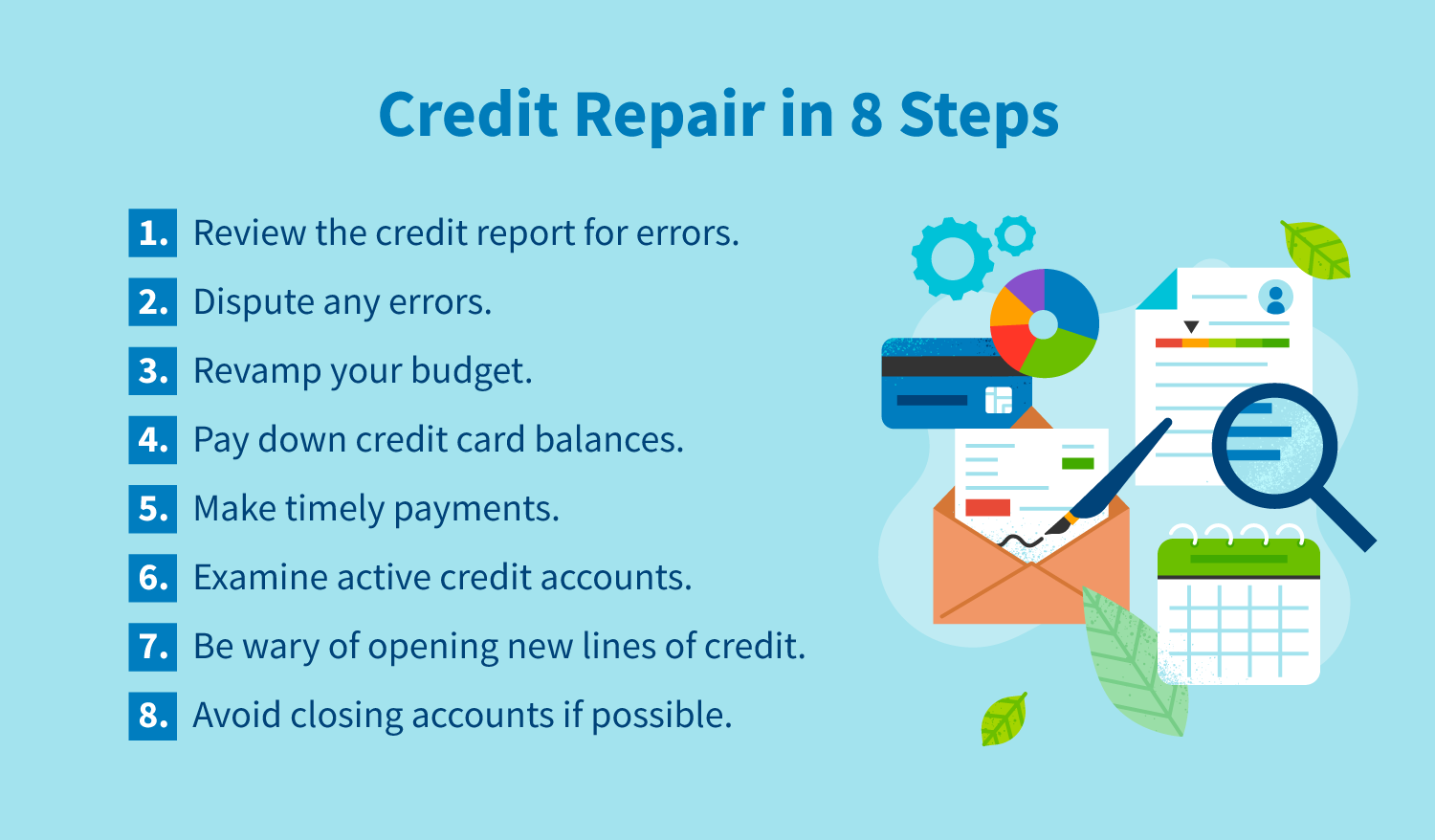

The Credit Repair Process Explained

Repairing your credit can seem daunting, but understanding the process makes it manageable. This guide breaks down the steps to help you improve your credit score. Follow these steps to start your credit repair journey.

Steps To Assess Your Credit Report

The first step in the credit repair process is to assess your credit report. Obtain a copy from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Look for the following:

- Personal information accuracy

- Credit account details

- Public records

- Credit inquiries

Review each section carefully to ensure all the details are correct. Keep an eye out for any discrepancies or unfamiliar accounts.

Identifying Errors And Disputing Them

After reviewing your credit report, the next step is to identify errors and dispute them. Common errors include:

- Incorrect personal information

- Accounts that do not belong to you

- Duplicate accounts

- Incorrect account status

To dispute an error, gather supporting documents and contact the credit bureau. Most bureaus allow disputes online, by phone, or by mail. Clearly state the error and provide evidence to support your claim.

Negotiating With Creditors

Sometimes, negotiating with creditors can help improve your credit score. Contact your creditors to discuss:

- Payment plans

- Settlements

- Removing negative items

Explain your situation and request a goodwill adjustment. Creditors may be willing to remove late payments or other negative items if you have a good payment history.

Establishing A Plan For Improvement

Finally, establish a plan to improve your credit score. This plan should include:

- Paying bills on time

- Reducing debt

- Keeping credit card balances low

- Avoiding new credit inquiries

Consistency is key. Follow your plan diligently to see gradual improvements in your credit score.

Remember, the credit repair process takes time and effort. Stay patient and persistent. With a clear plan and steady progress, you can improve your credit score and achieve financial health.

Key Features Of Effective Credit Repair

Effective credit repair involves multiple steps and strategies. By focusing on key features, individuals can improve their credit scores and financial health. Below are the essential aspects of a successful credit repair process.

Comprehensive Credit Report Analysis

A thorough analysis of your credit report is the first step. This involves examining all details, identifying errors, and understanding the factors affecting your score. By doing so, you can pinpoint areas that need improvement.

- Identify inaccuracies

- Understand negative items

- Recognize patterns in spending and credit use

Personalized Dispute Strategies

Disputing incorrect items on your credit report is crucial. Creating a personalized strategy ensures each dispute is accurate and effective. Tailored disputes increase the chances of removing errors and boosting your credit score.

- Gather supporting documents

- Write clear and concise dispute letters

- Follow up with credit bureaus and creditors

Debt Management And Negotiation

Managing and negotiating debt plays a significant role in credit repair. Reducing outstanding balances and negotiating better terms can improve your credit standing. Effective debt management strategies include:

- Creating a budget to manage expenses

- Negotiating lower interest rates

- Consolidating debts for easier management

Ongoing Credit Monitoring

Regularly monitoring your credit report is essential for maintaining a healthy score. Ongoing credit monitoring helps you stay on top of changes and quickly address any discrepancies. Benefits of credit monitoring include:

- Early detection of errors and fraud

- Tracking progress in credit repair

- Receiving alerts on significant changes

By focusing on these key features, you can navigate the credit repair process effectively and achieve a better credit score.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial. It helps you make informed decisions about improving your credit score. This section breaks down the typical costs involved, compares DIY and professional services, and explains what value you can expect for your money.

Typical Costs Involved

Credit repair services can vary in cost based on the provider and the services offered. Here’s a breakdown of typical costs:

- Initial Setup Fee: Often ranges from $19 to $149.

- Monthly Subscription: Usually between $39 and $129 per month.

- One-Time Fees: Some services may charge a flat fee for specific tasks.

It’s essential to understand these fees before committing to a service.

Comparing Diy Vs. Professional Services

There are two main approaches to credit repair: DIY and professional services. Here’s a comparison:

| Aspect | DIY | Professional Services |

|---|---|---|

| Cost | Low, mainly postage and time | Moderate to high, includes fees |

| Time | Time-consuming, requires personal effort | Less time for you, handled by experts |

| Expertise | Limited, self-education required | High, professionals with experience |

| Effectiveness | Varies based on knowledge and effort | Generally more effective, faster results |

Value For Money: What To Expect

When paying for credit repair services, you should expect several key benefits:

- Professional Expertise: Access to knowledgeable professionals who understand credit laws and regulations.

- Time Savings: Less personal time spent on credit repair tasks.

- Personalized Plans: Customized strategies tailored to your specific credit situation.

- Faster Results: Potentially quicker improvements in your credit score.

While credit repair services come at a cost, the benefits often outweigh the expenses, making it a worthwhile investment for many.

Pros And Cons Of Credit Repair

Understanding the pros and cons of credit repair can help you make informed decisions about improving your credit score. Let’s explore the benefits and potential risks associated with professional credit repair services.

Advantages Of Professional Credit Repair

- Expertise: Credit repair professionals have extensive knowledge of credit laws and regulations.

- Time-saving: They handle the paperwork and negotiations, saving you valuable time.

- Better Results: Professionals may have higher success rates in removing negative items from your credit report.

- Personalized Advice: You receive tailored advice to improve your credit score efficiently.

Potential Drawbacks And Risks

| Drawback | Details |

|---|---|

| Cost: | Credit repair services can be expensive, with fees adding up quickly. |

| Scams: | Some companies may make false promises and not deliver results. |

| Temporary Fix: | Credit repair can be a short-term solution if you don’t change your financial habits. |

Real-world Usage: Success Stories And Challenges

- Success Stories: Many individuals have seen significant improvements in their credit scores, enabling them to qualify for loans and better interest rates.

- Challenges: Some people face difficulties in finding reputable credit repair services and may encounter delays in the process.

In summary, professional credit repair services offer several advantages, including expertise and time-saving benefits. However, potential drawbacks such as costs and scams should be considered. Real-world usage reveals both success stories and challenges, emphasizing the importance of thorough research and informed decision-making.

Who Should Consider Credit Repair?

Credit repair can be a crucial step for many individuals. It helps improve credit scores and opens up financial opportunities. But not everyone needs credit repair. Let’s explore who should consider this process.

Ideal Candidates For Credit Repair

Individuals with low credit scores are prime candidates for credit repair. This often includes people with:

- Late payments on their credit report

- High credit card balances

- Charge-offs or collections listed

These individuals can benefit from removing negative items and improving their credit habits.

Scenarios Where Credit Repair Is Most Beneficial

Credit repair is most beneficial in the following scenarios:

| Scenario | Benefit of Credit Repair |

|---|---|

| Applying for a mortgage | Improved credit score can lead to better interest rates |

| Starting a business | Good credit can help secure business loans |

| Refinancing existing loans | Potentially lower monthly payments |

Improving credit is key in these life-changing financial situations.

When To Seek Professional Help

Credit repair can be complex. It may be wise to seek professional help if:

- You have multiple negative items on your report

- You find errors that you can’t resolve on your own

- You lack the time or knowledge to handle it yourself

Professionals can navigate the process efficiently, helping you achieve better results.

Credit repair can be a game-changer for those who need it. Identify if you are an ideal candidate and consider professional help if needed.

Conclusion: Achieving Financial Freedom Through Credit Repair

Rebuilding your credit can lead to financial freedom. A good credit score opens doors to better financial opportunities. By following a structured credit repair process, you can achieve this goal. Here’s a summary of the benefits and some final tips to maintain good credit.

Summarizing The Benefits

Credit repair offers numerous benefits, including:

- Lower Interest Rates: A higher credit score can qualify you for lower interest rates on loans and credit cards.

- Better Loan Approval Chances: Lenders are more likely to approve loans for individuals with good credit.

- Improved Renting Opportunities: Many landlords check credit scores before approving rental applications.

- Enhanced Financial Security: Good credit provides a safety net in times of financial need.

These benefits contribute to overall financial well-being. They help you save money and access better financial products.

Final Tips For Maintaining Good Credit

Maintaining good credit requires consistent effort. Here are some final tips:

- Pay Bills on Time: Timely payments are crucial for a good credit score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit.

- Monitor Your Credit Report: Regularly check your credit report for errors and dispute any inaccuracies.

- Avoid Opening Too Many Accounts: Each credit inquiry can lower your score temporarily.

- Maintain a Healthy Mix of Credit: A mix of credit types, such as credit cards, mortgages, and auto loans, can positively impact your score.

By following these tips, you can maintain a strong credit score. This will help you achieve long-term financial stability.

| Action | Benefit |

|---|---|

| Pay Bills on Time | Improves payment history |

| Keep Credit Utilization Low | Boosts credit score |

| Monitor Your Credit Report | Detects and corrects errors |

| Avoid Opening Too Many Accounts | Prevents unnecessary credit inquiries |

| Maintain a Healthy Mix of Credit | Enhances credit profile |

Frequently Asked Questions

What Is The Credit Repair Process?

The credit repair process involves identifying and disputing errors on your credit report. It aims to improve your credit score. This process includes reviewing your report, disputing inaccuracies, and negotiating with creditors.

How Long Does Credit Repair Take?

Credit repair can take several months. The timeline depends on the number of errors and the response time of creditors and credit bureaus. Generally, it can take three to six months to see significant improvements.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. You need to obtain your credit report, identify errors, and dispute them with credit bureaus. You can also negotiate with creditors for better terms.

Is Credit Repair Legal?

Yes, credit repair is legal. You have the right to dispute inaccurate information on your credit report. The Fair Credit Reporting Act allows you to challenge and correct errors.

Conclusion

Understanding the credit repair process can greatly improve your financial health. By following the steps outlined, you can boost your credit score. Consistency and patience are key in this journey. For small businesses, platforms like Hello Alice offer valuable tools. They provide growth plans tailored to your needs. This can enhance your business’s financial standing. Start today and take control of your financial future. Remember, better credit opens more opportunities. Stay committed and watch your financial health improve.