Credit Repair FAQs: Essential Tips for Financial Freedom

Credit repair can seem confusing. Many questions arise when trying to improve your credit score.

This blog post will answer common questions about credit repair. Credit repair involves actions to fix poor credit standing. It often includes disputing errors on credit reports, paying off debts, and managing finances better. Understanding the process can make a big difference in your financial health. We will cover essential FAQs to help you navigate credit repair smoothly. Whether you are new to credit repair or need a refresher, this guide will provide clarity. Let’s dive in and demystify the world of credit repair together. For those seeking quick financing solutions, consider Funding Societies. Learn more here.

Introduction To Credit Repair

Credit repair is a crucial topic for individuals and businesses alike. Understanding the basics of credit repair can help you take control of your financial health and improve your credit score. Let’s delve into some frequently asked questions about credit repair to shed light on this important subject.

What Is Credit Repair?

Credit repair is the process of identifying and addressing errors on your credit report. This may involve disputing inaccuracies, negotiating with creditors, and taking steps to improve your credit score. The goal is to enhance your creditworthiness and open up better financial opportunities.

Why Is Credit Repair Important?

Having a good credit score is essential for various reasons:

- Loan Approval: A good score increases your chances of getting loans approved.

- Interest Rates: Better credit often means lower interest rates.

- Financial Opportunities: It opens doors to better financial products and opportunities.

- Business Growth: For SMEs, good credit can lead to crucial funding and investment.

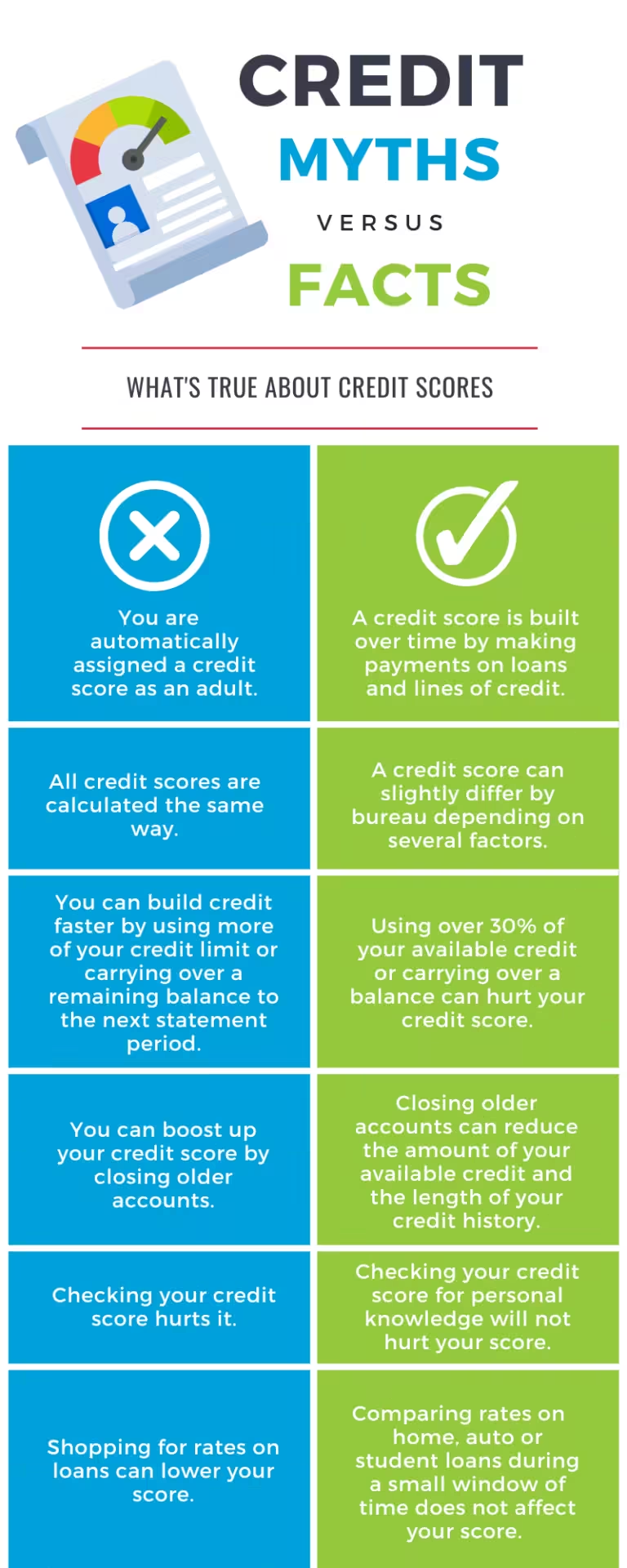

Common Misconceptions About Credit Repair

There are several myths surrounding credit repair that need to be debunked:

| Myth | Reality |

|---|---|

| Credit Repair is Illegal | Credit repair is legal if done correctly. |

| All Credit Repair Services are Scams | Many reputable services can help improve your credit. |

| You Can’t Repair Bad Credit | With effort and time, bad credit can be improved. |

Understanding these myths helps you make informed decisions about managing your credit health.

Understanding Your Credit Report

Understanding your credit report is essential for maintaining healthy finances. It impacts your ability to secure loans, credit cards, and even employment. By familiarizing yourself with how to obtain your report, the key components it contains, and how to identify errors, you can take control of your financial health.

How To Obtain Your Credit Report

There are several ways to obtain your credit report. In many countries, you are entitled to a free report from each of the major credit bureaus annually. Here’s a simple guide to get your report:

- Visit the official website of a credit bureau.

- Fill out a request form with your personal details.

- Submit the form and verify your identity.

- Download or receive your report by mail.

Make sure to request your report from all major bureaus to get a complete picture.

Key Components Of A Credit Report

A credit report is divided into several sections, each providing important information about your financial history. Here are the key components:

- Personal Information: Includes your name, address, Social Security number, and date of birth.

- Credit Accounts: Details of your credit accounts such as credit cards, mortgages, and loans.

- Credit Inquiries: A list of entities that have requested your credit report.

- Public Records: Information about bankruptcies, foreclosures, and other public record items.

- Collections: Accounts that have been turned over to collection agencies.

Identifying Errors In Your Credit Report

Errors in your credit report can negatively impact your credit score. Here’s how to identify and address them:

| Type of Error | Example | Action |

|---|---|---|

| Personal Information | Incorrect name or address | Contact the credit bureau to correct it. |

| Account Information | Incorrect account balance | Dispute the error with the credit bureau. |

| Public Records | Incorrectly listed bankruptcy | Provide evidence to the credit bureau to remove it. |

| Credit Inquiries | Unauthorized hard inquiries | Request the bureau to investigate and remove. |

Regularly reviewing your credit report helps ensure its accuracy. Dispute any incorrect information promptly to maintain a good credit score.

Essential Tips For Credit Repair

Repairing your credit is crucial for financial stability. Here are some essential tips to guide you through the process.

Reviewing And Disputing Errors

Start by reviewing your credit report. Look for errors such as incorrect personal information, duplicated accounts, or inaccurate payment statuses.

If you find any discrepancies, dispute them. Contact the credit bureau and provide supporting documents to correct these errors.

Building Positive Credit History

Positive credit history is essential. Open a secured credit card or become an authorized user on someone else’s account. Use these accounts responsibly.

Keep your credit utilization low. Aim to use less than 30% of your available credit limit.

Managing Debt Effectively

Create a budget to manage your debts. List all your debts, interest rates, and minimum payments. Prioritize paying off high-interest debts first.

Consider debt consolidation. It can simplify your payments and reduce interest rates.

The Importance Of Timely Payments

Make all your payments on time. Payment history significantly impacts your credit score. Set up automatic payments or reminders to avoid missing due dates.

If you’re struggling, contact your creditors. They may offer payment plans or deferments.

Key Features Of Credit Repair Services

Credit repair services offer valuable assistance to individuals looking to improve their credit scores. These services provide a range of features designed to help clients navigate the complexities of credit improvement. Below are some of the key features provided by credit repair services.

Professional Credit Counseling

Professional credit counseling is a crucial feature of credit repair services. Trained counselors provide personalized advice to help clients understand their credit reports. They also offer strategies for improving credit scores. These professionals help identify errors and provide guidance on how to address them. This service can be especially beneficial for those who feel overwhelmed by their credit situation.

Credit Monitoring Tools

Credit monitoring tools are another essential feature. These tools track changes in your credit report. They alert you to any suspicious activity. This helps prevent identity theft and fraud. Regular updates keep you informed about your credit status. With these tools, you can monitor progress and stay on top of your credit health.

Negotiation With Creditors

Negotiation with creditors is a vital part of credit repair. Services often act on behalf of clients to negotiate better terms. This can include reducing interest rates or settling debts for less than owed. Skilled negotiators can help remove negative items from credit reports. This can significantly improve a client’s credit score. Effective negotiation can lead to more favorable credit terms in the future.

Legal Rights And Protections

Credit repair services also focus on legal rights and protections. They educate clients about their rights under laws like the Fair Credit Reporting Act (FCRA). Knowing these rights can help clients challenge inaccurate or unfair information on their credit reports. Legal protections ensure that credit bureaus and creditors adhere to the law. This can provide a sense of security and empowerment for clients working to improve their credit.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial for anyone looking to improve their credit score. This section will break down the costs involved, compare free and paid services, and help you evaluate the value of these services.

Cost Breakdown Of Credit Repair Services

Credit repair services come with various costs. Here’s a breakdown of what you might expect:

| Service Type | Cost Range | Description |

|---|---|---|

| Initial Setup Fee | $10 – $100 | One-time fee for setting up the service. |

| Monthly Fee | $50 – $150 | Ongoing cost for continued service. |

| Per Deletion Fee | $20 – $75 | Charged for each item successfully removed from your credit report. |

Free Vs Paid Services

Many wonder if they should go for free or paid credit repair services. Here’s a comparison:

- Free Services: Typically involve DIY methods. They are cost-effective but may require more time and effort.

- Paid Services: Offer professional assistance. They can be more efficient but come with a cost.

Evaluating The Value Of Credit Repair Services

When evaluating the value of credit repair services, consider these factors:

- Success Rate: Check the success stories and reviews of the service provider.

- Time Efficiency: Professional services often resolve issues faster than DIY methods.

- Customer Support: Quality of customer service and support can make a significant difference.

- Cost vs. Benefit: Weigh the cost of the service against the potential credit score improvement.

By understanding these factors, you can make a more informed decision about which credit repair service is right for you.

Pros And Cons Of Credit Repair

Credit repair can be a powerful tool for improving your credit score. Understanding the pros and cons of credit repair services is essential. This section covers the advantages and potential drawbacks of using these services. We will also compare DIY credit repair with professional services.

Advantages Of Using Credit Repair Services

Credit repair services offer several benefits:

- Expertise: Professionals understand the laws and know how to handle credit disputes effectively.

- Time-Saving: They handle all the paperwork and negotiations, saving you time.

- Improved Credit Score: These services can help remove negative items, boosting your credit score.

- Personalized Strategies: Customized plans to address your specific credit issues.

Potential Drawbacks To Consider

Despite their benefits, credit repair services have some drawbacks:

- Cost: These services can be expensive, with no guarantees of success.

- Scams: Some companies may make false promises or engage in unethical practices.

- Limited Power: They cannot remove accurate negative information from your credit report.

- Dependency: Relying on these services may prevent you from learning how to manage your credit independently.

Comparing Diy Credit Repair Vs Professional Services

| Aspect | DIY Credit Repair | Professional Services |

|---|---|---|

| Cost | Free or minimal expenses | Fees for services |

| Time Required | Requires significant personal time | Less personal time required |

| Expertise | Learning curve involved | Professional knowledge and experience |

| Control | Full control over the process | Limited control, relying on the service |

Choosing between DIY and professional credit repair depends on your needs and resources. Weigh the advantages and drawbacks carefully to make an informed decision.

Specific Recommendations For Ideal Users

Understanding credit repair services can help you make informed decisions. Here are specific recommendations for those who might benefit from credit repair services.

Who Should Consider Credit Repair Services?

Credit repair services can be beneficial for individuals facing significant credit issues. If you have multiple negative items on your credit report, such as late payments, collections, or bankruptcies, you might benefit from professional help.

Small business owners who need to improve their credit score to secure financing can also consider these services. For example, using platforms like Funding Societies can be an option for SMEs needing quick access to funds.

Best Scenarios For Seeking Professional Help

- Complex Credit Situations: If your credit report has many errors or hard-to-understand entries.

- Time Constraints: If you lack time to manage credit repair on your own.

- Upcoming Major Purchases: If you plan to buy a house or car soon and need a better credit score.

For small businesses, services like Funding Societies offer micro loans and term loans that can be helpful if you need urgent financing or larger funds for business expansion.

When To Avoid Credit Repair Services

- Minor Credit Issues: If your credit problems are minimal and can be fixed by self-effort.

- Cost Concerns: If you find the cost of credit repair services high compared to your financial situation.

- Credibility Doubts: If you encounter a credit repair company with questionable practices or reviews.

In such cases, consider managing your credit repair yourself or seeking advice from trusted financial advisors.

For small business owners, platforms like Funding Societies provide quick and convenient access to financing without extensive credit repair requirements. This can be a practical alternative if you need funds urgently.

Conclusion: Achieving Financial Freedom

Credit repair is a vital step towards achieving financial freedom. Improving your credit score opens many doors. It allows better financing options, lower interest rates, and greater purchasing power. With consistent effort, you can turn your financial situation around.

Long-term Benefits Of Good Credit

Good credit has numerous long-term benefits. Here are some key advantages:

- Lower Interest Rates: A good credit score often means lower interest rates on loans and credit cards.

- Better Loan Approval Chances: Lenders prefer borrowers with good credit, increasing your chances of loan approval.

- Higher Credit Limits: Good credit may lead to higher credit limits, giving you more financial flexibility.

- Insurance Premiums: Some insurance companies offer lower premiums to individuals with good credit.

- Rental Opportunities: Landlords often check credit scores, and a good score can make finding a rental easier.

Maintaining Healthy Financial Habits

Maintaining a good credit score requires healthy financial habits. Here are some tips:

- Pay Bills on Time: Consistently paying your bills on time is crucial.

- Keep Balances Low: Try to keep your credit card balances low relative to your credit limits.

- Limit New Credit Requests: Too many credit inquiries can negatively impact your score.

- Monitor Your Credit Report: Regularly check your credit report for inaccuracies and dispute any errors.

- Create a Budget: A budget helps you manage your finances and avoid unnecessary debt.

Final Thoughts And Encouragement

Achieving financial freedom through credit repair is possible. With dedication and smart financial habits, you can improve your credit score. Remember, it’s not just about fixing your credit; it’s about maintaining good habits for the future.

Stay disciplined, be patient, and keep your financial goals in sight. Financial freedom is within your reach!

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of fixing poor credit standing. It involves disputing inaccurate information on your credit report.

How Long Does Credit Repair Take?

Credit repair typically takes between three to six months. The duration depends on the issues needing correction.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. It involves disputing inaccuracies and negotiating with creditors.

Does Credit Repair Really Work?

Yes, credit repair can work if done correctly. It involves removing errors and improving credit habits.

Conclusion

Understanding credit repair can feel challenging. With the right knowledge, it becomes manageable. Knowledge empowers you to improve your credit score. Funding Societies offers a valuable resource for SMEs needing quick financing solutions. Their platform supports business growth and investment opportunities. Explore more about how Funding Societies can help your business by visiting their website. Taking control of your financial health starts with informed decisions. Remember, consistent efforts lead to significant improvements. Stay proactive, and you’ll see positive changes over time.