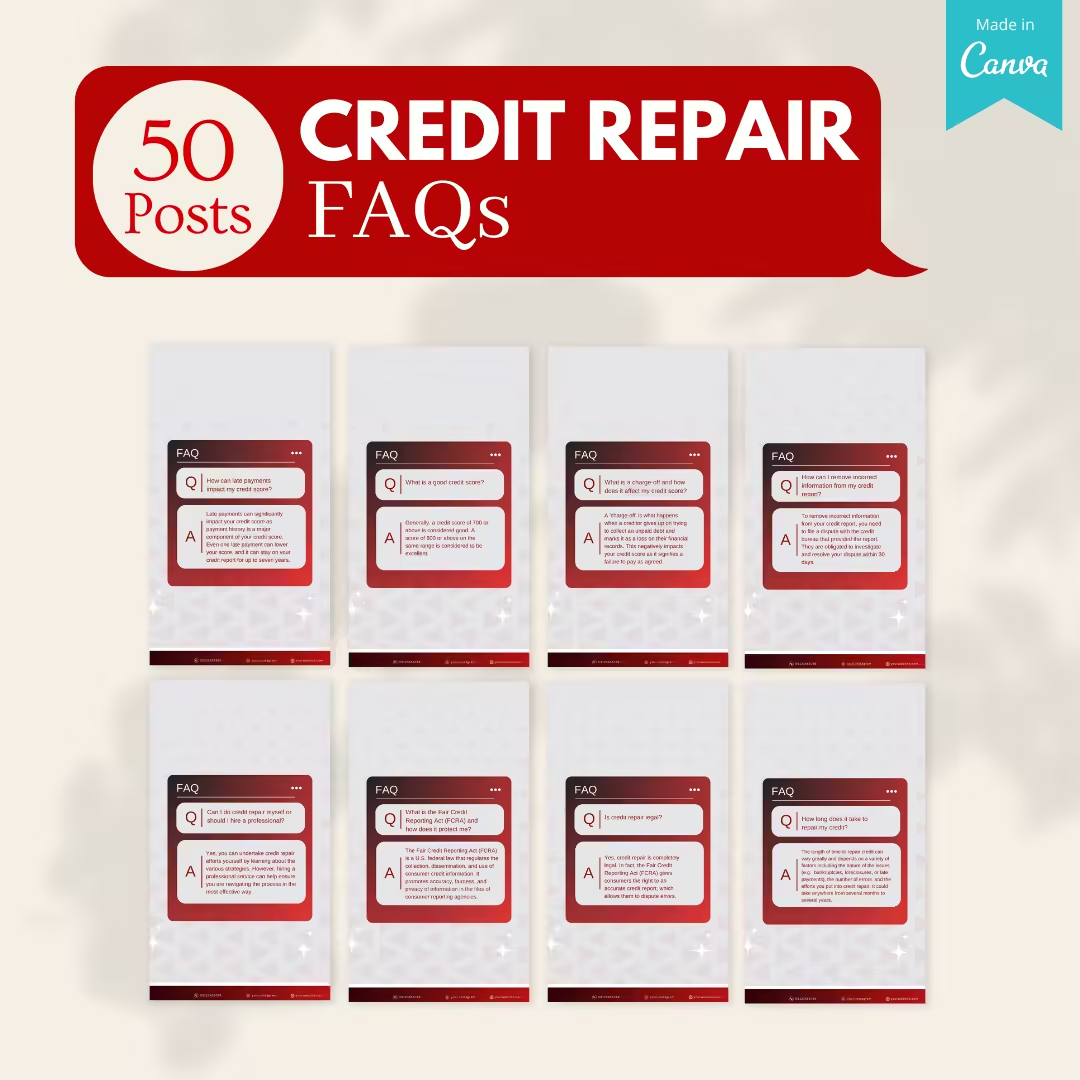

Credit Repair FAQs: Essential Tips and Insights

Credit repair can be a confusing process. Many questions arise when trying to understand it.

In this blog post, we address common Credit Repair FAQs to help you navigate this journey with ease. Credit repair involves fixing your credit to improve your credit score. This can include disputing errors on your credit report, negotiating with creditors, and taking steps to manage your finances better. A good credit score is essential for securing loans, credit cards, and even housing. Understanding how to repair your credit can save you money and stress in the long run. Our aim is to demystify credit repair and provide clear, actionable answers to your most pressing questions. Whether you’re dealing with debt lawsuits or just need to clean up your credit report, we’ve got you covered. For more help with debt disputes, consider using the Solo Debt Resolution Tool. Learn more about SoloSuit here.

Introduction To Credit Repair

Credit repair involves improving your creditworthiness. It’s about fixing errors and building a healthier credit profile. This process can include disputing inaccuracies on your credit report. It can also involve negotiating with creditors. Understanding credit repair is crucial to financial health.

Understanding Credit Repair

Credit repair is a step-by-step process. The goal is to improve your credit score. Here are some important aspects:

- Disputing Errors: You can challenge incorrect entries on your credit report.

- Negotiating with Creditors: Settle your debts for less than the original amount.

- Monitoring Reports: Keep an eye on your credit reports for accuracy.

SoloSuit is a useful tool in this process. It provides automated software to help resolve debt issues. Their service helps respond to debt lawsuits and settle debts outside of court. This can simplify the credit repair journey.

Why Credit Repair Is Important

A good credit score opens doors to financial opportunities. Here are some key reasons to focus on credit repair:

- Loan Approval: Higher scores lead to better loan terms.

- Lower Interest Rates: Good credit saves money on interest.

- Employment Opportunities: Some employers check credit reports.

- Insurance Premiums: Better credit can lower insurance costs.

SoloSuit’s automated assistance can help maintain a clean credit report. Their attorney-reviewed responses ensure accuracy. This can prevent further damage to your credit score.

Remember, credit repair is a marathon, not a sprint. It requires patience and consistent effort. Using tools like SoloSuit can ease the process and lead to better financial health.

Key Features Of Effective Credit Repair

Effective credit repair involves several essential components that can help individuals improve their credit scores. Understanding these key features can make the process more manageable and successful. Below are some important aspects that define an effective credit repair strategy.

Accurate Credit Report Analysis

An accurate credit report analysis is the first step in credit repair. It involves obtaining your credit reports from the major credit bureaus: Equifax, Experian, and TransUnion. Carefully review each report for errors, such as incorrect personal information, inaccurate account details, and unauthorized inquiries. Identifying and correcting these mistakes can significantly improve your credit score.

Dispute Resolution Process

The dispute resolution process is crucial for addressing any inaccuracies found in your credit report. This involves contacting the credit bureaus to challenge incorrect entries. Providing supporting documentation helps strengthen your case. Tools like the Solo Debt Resolution Tool can simplify this process by helping users compile responses, ensuring an attorney reviews them, and filing them on their behalf.

Here are the steps involved:

- Identify inaccuracies in your credit report.

- Collect evidence to support your dispute.

- Submit a dispute to the credit bureau.

- Follow up to ensure the dispute is resolved.

Credit Score Monitoring And Improvement Tips

Consistent credit score monitoring is essential for effective credit repair. It helps you track your progress and stay informed about changes to your credit report. Here are some tips for improving your credit score:

- Pay bills on time to build a positive payment history.

- Reduce outstanding debt to lower your credit utilization ratio.

- Avoid opening new credit accounts frequently.

- Keep old credit accounts open to maintain a longer credit history.

- Review your credit report regularly for new errors.

By following these tips and utilizing tools like Solo’s automated software, you can effectively manage and improve your credit score over time.

Common Credit Repair Myths Debunked

Credit repair is often misunderstood. Many myths surround the process, causing confusion. In this section, we debunk some common credit repair myths to help you understand better.

Myth: You Can’t Repair Your Credit On Your Own

Many believe they need professional help to repair their credit. This is not true. You can fix your credit yourself. With the right tools and knowledge, you can dispute errors on your credit report. Start by getting a copy of your credit report. Identify any inaccuracies and dispute them with the credit bureau. Remember, it’s your right to have accurate information on your credit report.

Myth: Credit Repair Is Illegal

Some think credit repair is against the law. This is false. Credit repair is legal. The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccurate information on your credit report. You can work to correct errors and improve your credit score. Just be wary of companies that promise to remove accurate information or charge upfront fees. They may be scams.

Myth: Credit Repair Provides Instant Results

Credit repair is not a quick fix. It takes time. Disputing errors and waiting for corrections can take weeks or months. Be patient and persistent. Monitor your credit report regularly. Make on-time payments and reduce your debt. Over time, these actions will improve your credit score.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial. Many individuals seek help to improve their credit scores. Knowing the costs involved can help make an informed decision.

Cost Of Professional Credit Repair Services

Professional credit repair services can vary in cost. Fees may depend on the complexity of your credit issues and the reputation of the service provider. Here is a general breakdown of potential costs:

- Initial Setup Fee: Some companies charge an initial fee for setting up your account and reviewing your credit report. This fee typically ranges from $15 to $90.

- Monthly Fees: Monthly fees for ongoing services can range from $50 to $130. These fees cover the continuous work done on your credit report.

- Additional Costs: Extra charges might apply for specific services, such as credit report monitoring or expedited disputes.

While professional services can be costly, they offer expertise and convenience.

Affordable Diy Credit Repair Options

For those on a budget, DIY credit repair options are available. These methods require time and effort but can be cost-effective. Here are some steps for DIY credit repair:

- Obtain Your Credit Report: Request a free copy of your credit report from each of the three major credit bureaus.

- Review Your Report: Check for errors or inaccuracies in your credit report. Dispute any incorrect information with the credit bureau.

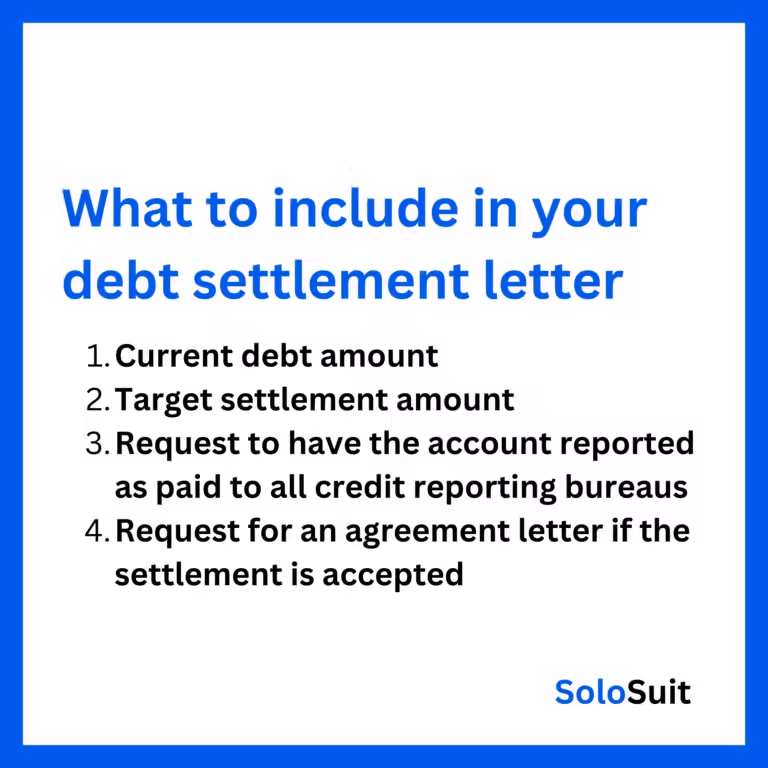

- Negotiate with Creditors: Contact your creditors to negotiate settlements or payment plans for outstanding debts.

- Manage Your Debts: Make consistent payments on all your debts and avoid taking on new debt.

Using automated tools like the Solo Debt Resolution Tool can simplify this process. Solo provides software to help respond to debt lawsuits and settle debts outside of court. This tool offers automated assistance, attorney review, and nationwide coverage.

Choosing between professional services and DIY methods depends on your financial situation and comfort level with handling credit issues.

Pros And Cons Of Credit Repair

Credit repair can be a critical step for many individuals who want to improve their financial health. Understanding the pros and cons of credit repair will help you make informed decisions. Below, we will explore the benefits and potential risks associated with credit repair services.

Benefits Of Professional Credit Repair Services

Engaging professional credit repair services can offer several benefits:

- Expertise and Knowledge: Professionals are well-versed in credit laws and regulations, ensuring accurate and effective dispute handling.

- Time-Saving: Credit repair companies handle the communication and paperwork, saving you valuable time.

- Improved Credit Score: Effective dispute resolution can lead to the removal of incorrect information, improving your credit score.

- Professional Guidance: Ongoing advice and support from experts can help you maintain a healthy credit profile.

Drawbacks And Potential Risks

While there are benefits, there are also drawbacks and potential risks to consider:

- Cost: Professional credit repair services can be expensive, with fees adding up over time.

- No Guarantees: There is no guarantee that credit repair efforts will always lead to improved credit scores.

- Scams and Fraud: The industry has its share of fraudulent companies making false promises. Always research and choose reputable services.

- Temporary Fixes: Some solutions may only provide short-term fixes without addressing underlying financial habits.

Tips For Choosing The Right Credit Repair Service

Choosing the right credit repair service is crucial to improving your financial health. Many companies offer credit repair services, but not all are trustworthy or effective. The following tips will help you select a reliable service.

Researching Credit Repair Companies

Researching credit repair companies is the first step. Start by looking at their track record. A reputable company will have years of experience and a history of helping clients improve their credit scores.

Check if the company is registered with the Better Business Bureau (BBB). A high rating from the BBB is a good sign. Additionally, consider their transparency. Legitimate companies will clearly explain their services, fees, and policies.

Key Questions To Ask Before Hiring

Before hiring a credit repair service, ask these essential questions:

- What services do you provide? Ensure they offer the services you need, like disputing errors or negotiating with creditors.

- Are there any upfront fees? Be cautious of companies that demand large fees before providing any services.

- How long will it take? Understand the timeline for seeing improvements in your credit score.

- Can you provide references? A reliable company should offer references or testimonials from satisfied clients.

- What is your cancellation policy? Ensure you know the terms in case you decide to stop using their services.

Reading Reviews And Testimonials

Reading reviews and testimonials from previous clients is crucial. Search for reviews on independent websites to get an unbiased view. Look for feedback on the company’s success rate, customer service, and overall satisfaction.

Consider both positive and negative reviews. Negative reviews can highlight potential red flags. Pay attention to how the company responds to complaints. A professional response indicates good customer service.

In summary, choosing the right credit repair service involves thorough research, asking key questions, and reading reviews. This ensures you select a trustworthy company that can effectively help improve your credit score.

Specific Recommendations For Ideal Users

Understanding who should consider credit repair and the best approach is crucial. Each scenario requires a different strategy. Let’s explore who can benefit from professional credit repair, when to tackle it yourself, and how to handle special situations like bankruptcy or identity theft.

Who Should Consider Professional Credit Repair?

Professional credit repair services are ideal for individuals who:

- Lack the time or knowledge to navigate credit repair themselves.

- Have multiple errors or complex issues on their credit reports.

- Need quicker results to qualify for a mortgage or loan.

Professional services can provide expertise, save time, and potentially achieve faster results.

When To Opt For Diy Credit Repair

DIY credit repair can be effective for those who:

- Have a clear understanding of their credit reports.

- Need to correct minor errors or inaccuracies.

- Prefer to save money by handling the process themselves.

DIY approaches include disputing errors with credit bureaus and negotiating directly with creditors.

Special Scenarios: Bankruptcy, Identity Theft, Etc.

Certain situations demand specific strategies:

- Bankruptcy: Post-bankruptcy credit repair focuses on rebuilding credit and ensuring accurate reporting of discharged debts.

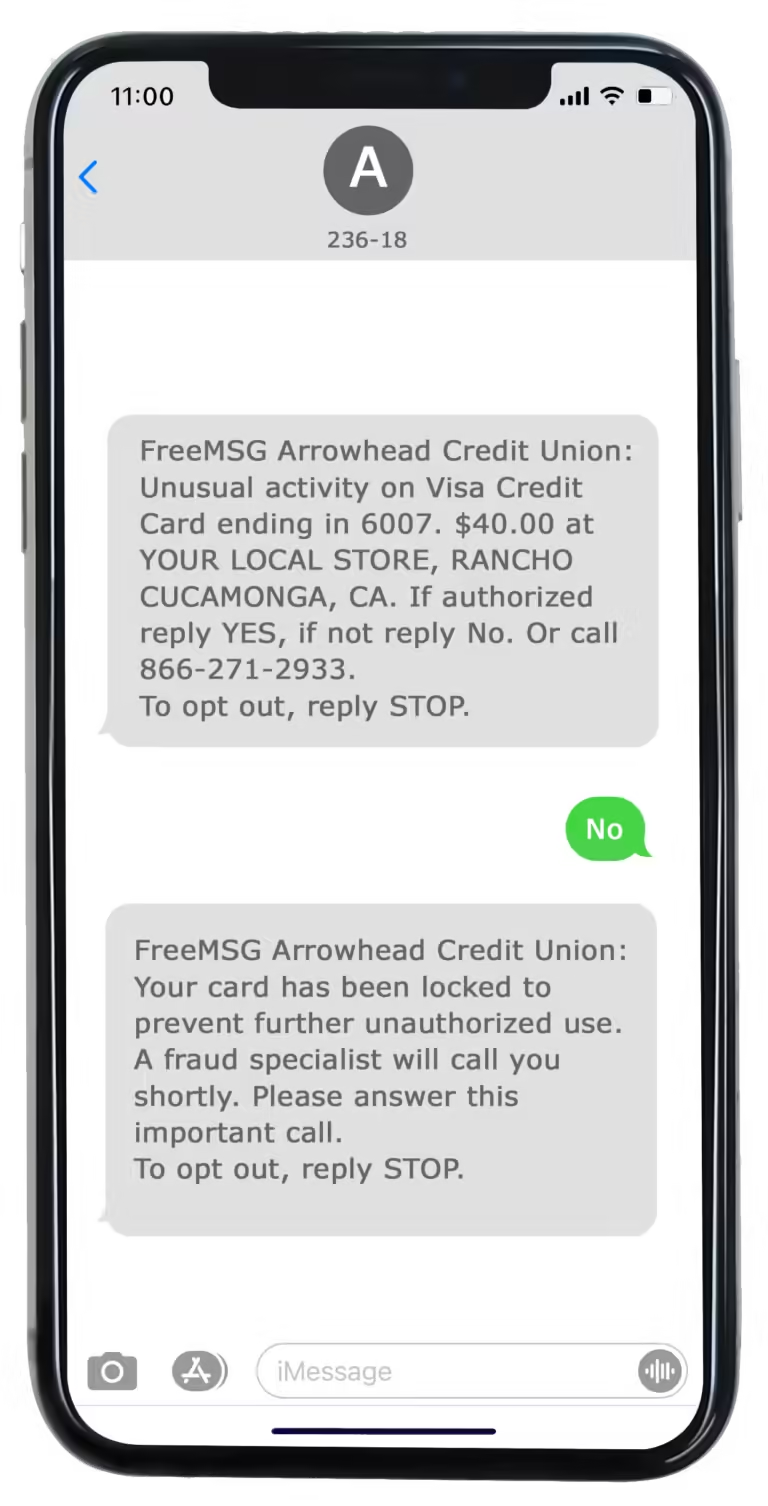

- Identity Theft: Victims must work to remove fraudulent accounts and monitor their credit reports closely.

Tools like SoloSuit can assist in these scenarios by helping individuals respond to debt lawsuits and negotiate settlements outside of court.

SoloSuit offers automated assistance, attorney review, and nationwide coverage. It’s proven effective, having protected $1.71 billion and helped 262,000 people.

Conclusion: Final Thoughts On Credit Repair

Credit repair can seem daunting, but understanding the process is the first step. With the right tools and knowledge, anyone can improve their credit score. SoloSuit offers valuable resources to help with debt disputes and credit repair. Their automated software makes the process easier and more manageable.

Summarizing Key Takeaways

Here are some key takeaways from our discussion on credit repair:

- Understanding Your Credit Report: Regularly check your credit report for errors.

- Disputing Errors: Use automated tools like SoloSuit to dispute inaccuracies.

- Debt Settlement: Negotiate debts to avoid court proceedings.

- Legal Assistance: Ensure responses are reviewed by an attorney for accuracy.

- Nationwide Coverage: Services are available across all 50 states.

Encouragement For Taking Action

Taking action is the most important part of credit repair. Don’t let debt overwhelm you. Use tools like SoloSuit to simplify the process.

Remember, improving your credit score takes time and effort. Stay patient and persistent. Every small step counts toward financial freedom.

SoloSuit has a proven track record, protecting $1.71 billion and helping 262,000 people. You are not alone in this journey.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of improving your credit score. This involves disputing inaccuracies on your credit report. It also includes managing your debts effectively.

How Does Credit Repair Work?

Credit repair works by disputing errors on your credit report. You can do this yourself or hire a service. It also involves improving your credit habits.

Can Credit Repair Companies Help?

Yes, credit repair companies can assist you. They help by disputing inaccuracies on your behalf. They also offer advice on improving your credit score.

Is Credit Repair Legal?

Yes, credit repair is legal. You have the right to dispute any inaccuracies on your credit report. Always ensure you work with a reputable company.

Conclusion

Navigating credit repair can feel overwhelming. SoloSuit’s Solo Debt Resolution Tool offers essential support. With automated assistance, it helps respond to debt lawsuits and negotiate settlements. An attorney reviews every response, ensuring accuracy. SoloSuit is available nationwide, aiding many in debt disputes. Learn more about SoloSuit’s services here. Understanding credit repair FAQs and using the right tools can improve your financial health. Take control of your debt today.