Credit Repair Effectiveness: Proven Strategies for Better Scores

Credit repair effectiveness is a topic many people are curious about. Does it really work?

Let’s find out. Credit repair involves improving one’s credit score by addressing errors on credit reports and managing debts. While the process can be complex, tools like Solo can simplify it. Solo offers automated software to help individuals navigate debt disputes, respond to debt lawsuits, and settle debts outside of court. With attorney-reviewed responses and nationwide coverage, Solo has a proven track record of helping thousands. In this blog post, we’ll explore how effective credit repair can be and how tools like Solo can assist in the journey to better credit health. Curious about improving your credit? Read on to discover more about credit repair effectiveness and helpful tools like Solo. Learn more about SoloSuit and its benefits for managing your debt.

Introduction To Credit Repair

Credit repair is a vital process for individuals seeking to improve their credit scores. It involves identifying and addressing errors or issues on credit reports. Effective credit repair can open doors to better financial opportunities.

Understanding Credit Scores

A credit score is a numerical representation of an individual’s creditworthiness. It is derived from various factors, including:

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit

Credit scores typically range from 300 to 850. Higher scores indicate better creditworthiness. Lenders use these scores to assess the risk of lending money or extending credit.

The Importance Of Credit Repair

Credit repair is crucial because it can significantly impact financial health. Here are some key benefits:

- Lower Interest Rates: Better credit scores can lead to lower interest rates on loans and credit cards.

- Improved Loan Approval: Higher scores increase the chances of loan approval.

- Better Insurance Rates: Some insurers offer lower premiums to individuals with good credit.

- Employment Opportunities: Some employers check credit reports as part of their hiring process.

Proper credit repair can lead to significant financial savings and opportunities.

Key Features Of Effective Credit Repair

Effective credit repair involves several key features that can significantly improve your credit score. These features include accurate credit report analysis, disputing errors, debt management strategies, and building a positive credit history. Understanding these aspects can help individuals navigate their credit repair journey more efficiently.

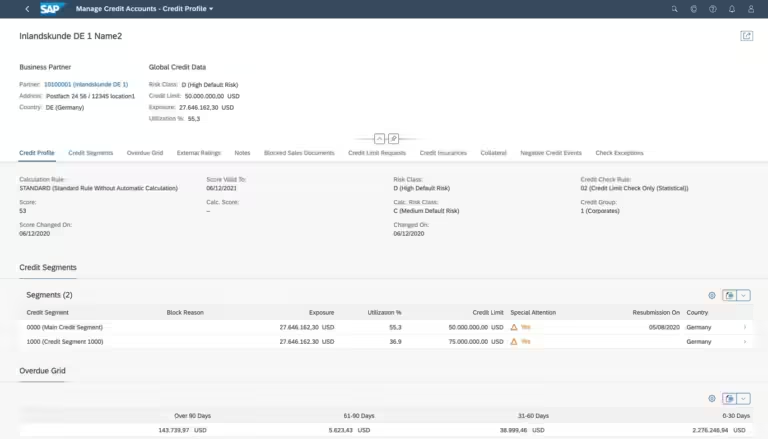

Accurate Credit Report Analysis

Accurate credit report analysis is the first step towards effective credit repair. Reviewing your credit report for errors or discrepancies is crucial. Look for incorrect personal information, wrong account details, or inaccurate payment histories. Identifying these mistakes early can prevent future credit issues.

Disputing Errors On Your Credit Report

Disputing errors on your credit report is essential for maintaining a healthy credit score. If you find inaccuracies, contact the credit bureaus to dispute them. Provide evidence supporting your claim. Ensure that the disputed information is corrected or removed. This process can improve your credit score significantly.

Debt Management Strategies

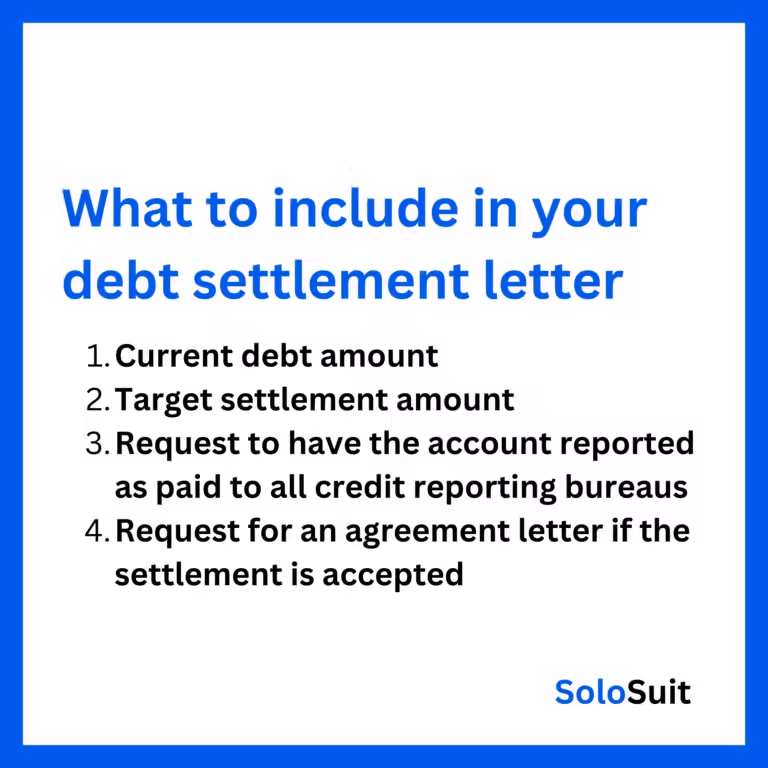

Implementing effective debt management strategies is vital for credit repair. Focus on paying off high-interest debts first. Consider consolidating debts to make payments more manageable. Use automated tools like SoloSuit to respond to debt lawsuits or negotiate settlements. SoloSuit offers automated assistance, attorney review, and nationwide coverage, helping users resolve debts efficiently.

Building Positive Credit History

Building a positive credit history involves making timely payments and maintaining low credit card balances. Open new accounts responsibly and avoid closing old accounts. Consistently monitor your credit report to ensure accuracy. These actions contribute to a stronger credit profile over time.

| Key Feature | Description |

|---|---|

| Accurate Credit Report Analysis | Review your credit report for errors and discrepancies. |

| Disputing Errors | Contact credit bureaus to correct inaccuracies. |

| Debt Management | Implement strategies to manage and reduce debt. |

| Positive Credit History | Make timely payments and maintain low balances. |

Effective credit repair requires a combination of accurate analysis, proactive dispute resolution, smart debt management, and building a positive credit history. Using tools like SoloSuit can streamline this process and help individuals achieve their credit goals.

Proven Strategies For Better Credit Scores

Improving your credit score can be a daunting task. However, with the right strategies, you can see significant improvements. This section covers some proven methods that can help you achieve a better credit score.

Timely Payments And Their Impact

Making timely payments is crucial. Late payments can significantly harm your credit score. Set up reminders or automate payments to ensure you never miss a due date.

Consider using a calendar or an app to track your payment schedules. Consistency in paying on time builds a positive payment history, which is a key factor in credit scoring models.

Optimizing Credit Utilization

Credit utilization refers to the amount of credit you are using compared to your credit limit. Keeping this ratio below 30% is advisable. High credit utilization can negatively affect your credit score.

To optimize your credit utilization, try the following:

- Pay off balances in full each month

- Request a credit limit increase

- Pay down high balances

Strategic Use Of Credit Cards

Using credit cards strategically can help improve your credit score. Avoid closing old accounts, as they contribute to your credit history length. Instead, keep them active with occasional small purchases.

Consider using multiple credit cards to distribute your spending. This can help maintain a lower credit utilization rate on each card.

The Role Of Credit Counseling

Credit counseling can provide you with guidance on managing your debt and improving your credit score. These services can help you create a budget, negotiate with creditors, and offer personalized advice.

Look for reputable credit counseling agencies that offer free initial consultations. They can help you develop a long-term plan for financial stability.

For those facing debt lawsuits or looking to settle debts, Solo provides automated software to help navigate these disputes. With features like replying to debt lawsuits and settling debts, Solo assists users in managing their financial challenges effectively.

| Main Features | Description |

|---|---|

| Reply to a Debt Lawsuit | Helps users compile responses to debt lawsuits within 14-30 days of receiving a Complaint, with attorney review and filing. |

| Settle a Debt | Assists users in negotiating settlements with collectors to resolve debts for less than the face value. |

Solo’s automated assistance, attorney review, and nationwide coverage make it a reliable tool for those dealing with debt-related issues.

Visit SoloSuit for more information on how their services can help you manage your debt effectively.

Pricing And Affordability Of Credit Repair Services

Understanding the cost and affordability of credit repair services is crucial. Many factors influence the choice between professional services, DIY methods, and free resources. This section will help you understand the various pricing aspects.

Cost Of Professional Credit Repair Services

Professional credit repair services often come with different pricing models. These can be monthly subscriptions or one-time fees. Here is a general breakdown:

| Service Type | Price Range |

|---|---|

| Monthly Subscription | $50 – $150 per month |

| One-Time Service | $500 – $1,500 |

Professional services include credit report analysis, dispute letters, and credit score monitoring. The cost can vary based on the complexity of your credit issues.

Diy Credit Repair: Cost-effective Or Not?

DIY credit repair is an option for those willing to invest time and effort. The primary costs involved are:

- Credit report fees

- Postage for dispute letters

- Time and effort

While DIY methods can be cheaper, they may not be as effective as professional services. Consider your comfort level with handling financial documents and legal jargon.

Free Vs. Paid Credit Repair Resources

There are both free and paid resources available for credit repair. Here’s a comparison:

| Resource Type | Examples | Cost |

|---|---|---|

| Free Resources | Government websites, Non-profits | $0 |

| Paid Resources | Books, Online courses | $10 – $200 |

Free resources can provide valuable information and tools. But paid resources may offer more detailed guidance and structured programs.

Choosing between free and paid options depends on your specific needs and budget. Evaluate the value each resource brings to your situation.

Pros And Cons Of Various Credit Repair Methods

Credit repair is essential for improving financial health. There are several methods to repair credit, each with its pros and cons. Understanding these will help you decide which is best for you.

Benefits Of Professional Credit Repair

Professional credit repair services offer many advantages:

- Expert Guidance: Professionals have extensive knowledge of credit laws and can navigate complex issues.

- Time-Saving: They handle the entire process, freeing up your time for other tasks.

- Higher Success Rate: Their experience often leads to better results and faster improvements.

- Comprehensive Services: Many firms offer additional services like credit counseling and debt settlement.

Downsides Of Diy Credit Repair

While handling credit repair yourself can save money, it has several drawbacks:

- Time-Consuming: Gathering information, disputing errors, and following up can take a lot of time.

- Lack of Expertise: Without in-depth knowledge, you might miss important details or make mistakes.

- Limited Resources: You may not have access to the same tools and resources as professionals.

Risks Of Using Unverified Credit Repair Services

Using unverified credit repair services can pose significant risks:

- Scams: Some services may charge upfront fees and then disappear without providing any help.

- False Promises: They might guarantee specific results, which is often a red flag.

- Legal Issues: Unverified services may use unethical or illegal methods, putting you at risk.

Choose a reputable service like SoloSuit to ensure you receive reliable and legal assistance. SoloSuit offers automated software to help respond to debt lawsuits and settle debts, with attorney review to ensure everything is accurate and legal.

Specific Recommendations For Ideal Credit Repair Strategies

Improving credit requires a strategic approach tailored to individual circumstances. Different strategies work best for different financial situations. Below are specific recommendations for high debt individuals, young adults building credit, and those with a bankruptcy history.

Best Strategies For High Debt Individuals

For individuals managing high debt, it is crucial to focus on reducing overall debt and improving credit utilization ratios. Here are some effective strategies:

- Create a Budget: Track income and expenses to identify areas for potential savings.

- Debt Snowball Method: Pay off small debts first, then move to larger ones. This helps build momentum.

- Negotiate with Creditors: Use tools like SoloSuit to settle debts for less than the owed amount.

- Automated Payments: Set up automatic payments to avoid missed payments and reduce interest rates.

Effective Methods For Young Adults Building Credit

Young adults often start with little to no credit history. Building credit requires consistency and careful planning. Here are some tips:

- Secure a Credit Card: Obtain a secured credit card to start building a credit history.

- Pay Bills on Time: Ensure all bills, including utilities and rent, are paid on time.

- Keep Balances Low: Maintain low balances on credit cards to improve credit utilization.

- Monitor Credit Reports: Regularly check credit reports for errors and address them promptly.

Tailored Approaches For Individuals With Bankruptcy History

Recovering from bankruptcy requires patience and a well-planned strategy. Here are some tailored approaches:

- Rebuild Credit Gradually: Start with a secured credit card and make timely payments.

- Track Credit Scores: Monitor credit scores regularly to track improvement.

- Avoid New Debt: Focus on paying existing debts and avoid taking on new debt.

- Seek Professional Help: Consider consulting financial advisors or using platforms like SoloSuit for automated assistance in managing debt.

Conclusion: Achieving And Maintaining Better Credit Scores

Improving your credit score is a journey that requires dedication and consistent effort. Utilizing tools like SoloSuit can significantly aid this process, particularly in handling debt disputes and lawsuits. To ensure you maintain a healthy credit score, it’s essential to adopt certain long-term strategies.

Long-term Credit Management Tips

Effective credit management involves several key practices:

- Pay bills on time: Late payments can negatively impact your credit score.

- Keep credit card balances low: High balances can reduce your credit score.

- Avoid opening too many new accounts: Each new account results in a hard inquiry, which can lower your score.

- Maintain a mix of credit types: Having a variety of credit (loans, credit cards) can be beneficial.

- Stay within your credit limit: Try to use less than 30% of your available credit.

Continual Monitoring Of Credit Reports

Regularly checking your credit reports is crucial. It helps you identify errors and detect fraudulent activity early. Here’s how you can monitor your credit effectively:

- Check reports from all three credit bureaus: Equifax, Experian, and TransUnion.

- Review your reports at least annually: Use annualcreditreport.com for free reports.

- Dispute any inaccuracies: Contact the credit bureau to correct errors.

- Use credit monitoring services: These can alert you to changes in your credit report.

By following these strategies and utilizing resources like SoloSuit, you can achieve and maintain better credit scores. Remember, consistent and informed actions are key to long-term credit health.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of improving one’s credit score. It involves correcting errors on credit reports. It may also include negotiating with creditors to remove negative items. Credit repair can significantly improve financial health.

How Long Does Credit Repair Take?

Credit repair typically takes between three to six months. The duration depends on the severity of the credit issues. Some cases may take longer if there are many errors. Consistent efforts usually yield better results.

Can Credit Repair Companies Help?

Credit repair companies can help by disputing inaccuracies on credit reports. They may also negotiate with creditors on your behalf. However, be cautious of scams. Always research and choose reputable companies.

Is Credit Repair Worth It?

Credit repair is worth it for many individuals. A higher credit score can lead to better loan terms. It can also lower interest rates and improve financial opportunities. Investing in credit repair can save money in the long term.

Conclusion

Effective credit repair is possible with the right tools and guidance. SoloSuit offers automated solutions to handle debt disputes. Their software simplifies the process of responding to debt lawsuits and negotiating settlements. With attorney-reviewed documents and nationwide coverage, SoloSuit provides reliable support. Try SoloSuit today and take control of your financial future.