Credit Repair Consultations: Boost Your Financial Health Today

Are you struggling with your credit score? Credit repair consultations could be your solution.

Credit repair services help improve your credit score by identifying and disputing errors on your credit report. Understanding how credit repair consultations work can be the first step towards financial freedom. Many people find it hard to navigate the complex world of credit scores and reports. A credit repair service can guide you through this process. They help you understand your credit report, identify errors, and work to correct them. This can lead to a better credit score, making it easier to qualify for loans, credit cards, and other financial products. If you are looking for help, consider services like Mitigately. They offer AI-powered debt consolidation to help users become debt-free faster. Learn more about their service here: Mitigately.

Introduction To Credit Repair Consultations

Understanding the importance of credit repair consultations can be the first step towards achieving financial stability. These consultations provide valuable insights and guidance to help improve your credit health. Let’s dive into what these consultations entail and why maintaining good credit is crucial.

What Are Credit Repair Consultations?

Credit repair consultations are sessions where a credit expert reviews your credit report. They identify any inaccuracies and suggest strategies to improve your credit score. The goal is to help you understand your credit situation and take steps to enhance your credit profile.

During these consultations, experts may:

- Analyze your credit report for errors

- Provide tips for improving your credit score

- Offer personalized advice based on your financial situation

These consultations can be especially beneficial for those dealing with debt. Services like Mitigately offer AI-powered debt consolidation, which can simplify the process of managing multiple debts.

Importance Of Good Credit Health

Maintaining good credit health is essential for several reasons:

- Loan Approvals: Higher credit scores increase your chances of loan approvals.

- Lower Interest Rates: Better credit can lead to lower interest rates on loans and credit cards.

- Financial Flexibility: Good credit provides more financial options and security.

Using services like Mitigately can help you achieve good credit health. Mitigately combines multiple debt payments into one manageable payment. This can expedite debt repayment and save you thousands of dollars.

| Benefits of Mitigately | Details |

|---|---|

| Free Service | No fees until accounts are settled |

| Quick Matching | Average of 6½ minutes to match users to a debt solution |

| Significant Savings | Save an average of 35% on debts |

Credit repair consultations are a valuable tool in your financial toolkit. They help you identify and correct issues on your credit report. They also provide strategies for maintaining good credit health.

By leveraging services like Mitigately, you can simplify debt management and work towards financial freedom.

Key Features Of Credit Repair Consultations

Credit repair consultations offer essential services to help individuals improve their credit scores. These consultations provide personalized analysis, tailored improvement plans, and expert guidance. Understanding these key features can empower you to make informed decisions about your financial future.

Personalized Credit Analysis

During a credit repair consultation, professionals perform a thorough review of your credit report. They identify errors, discrepancies, and areas that need improvement. This analysis helps to create a clear picture of your current credit status.

Consultants use advanced tools to analyze your credit report. They focus on:

- Identifying inaccuracies

- Highlighting negative items

- Evaluating credit utilization

This personalized approach ensures that the analysis is specific to your financial situation.

Tailored Credit Improvement Plans

Based on the analysis, consultants develop customized plans to enhance your credit score. These plans are tailored to address your unique financial challenges and goals.

Key components of a tailored credit improvement plan include:

- Dispute strategies for incorrect items

- Debt repayment plans

- Credit utilization recommendations

These strategies are designed to maximize your credit score improvement efforts.

Expert Guidance And Support

Credit repair consultations provide continuous expert guidance throughout the process. Experienced consultants offer advice and support to help you navigate credit-related issues.

Support services include:

- Regular progress updates

- Advice on financial decisions

- Assistance with creditor negotiations

This expert support ensures that you have the necessary resources and knowledge to improve your credit score effectively.

How Credit Repair Consultations Benefit You

Credit repair consultations offer numerous advantages that can significantly improve your financial situation. Understanding these benefits can help you make informed decisions about your credit and finances.

Improved Credit Scores

One of the primary benefits of credit repair consultations is the potential for improved credit scores. A higher credit score can open up many financial opportunities and save you money in the long run.

- Identify and correct errors on your credit report

- Develop strategies to pay down debt efficiently

- Receive personalized advice to enhance your creditworthiness

Better Loan And Credit Card Offers

With a better credit score, you can qualify for more favorable loan and credit card offers. This means lower interest rates and better terms.

- Access to higher credit limits

- Lower interest rates on loans and credit cards

- Better terms and conditions on financial products

Enhanced Financial Literacy

Credit repair consultations also contribute to enhanced financial literacy. Understanding your credit and how to manage it can lead to long-term financial health.

- Learn how to budget and manage your finances

- Understand the factors that impact your credit score

- Gain insights into effective debt management strategies

By leveraging the benefits of credit repair consultations, you can take control of your financial future. Whether you aim to improve your credit score, secure better loan offers, or boost your financial knowledge, credit repair consultations can be a valuable tool.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial. Knowing the costs involved helps you make informed decisions. Below, we break down the costs, value, and comparisons of different service providers.

Cost Breakdown

Credit repair services vary in pricing. Typically, they charge a setup fee and a monthly fee. Here’s a general breakdown:

| Service Type | Average Cost |

|---|---|

| Setup Fee | $50 – $100 |

| Monthly Fee | $50 – $150 |

Value For Money

Paying for credit repair services can be worth it. Mitigately, for instance, offers significant benefits:

- AI-Powered Agent: Quick matching to debt solutions in 6½ minutes.

- Free Service: No fees until accounts are settled.

- Significant Savings: Users save an average of 35% on their debts.

- Financial Freedom: Become debt-free faster with less financial burden.

Comparing Different Service Providers

Comparing credit repair services helps in choosing the best option. Consider these factors:

- Cost: Look at both setup and monthly fees.

- Features: Does the service offer additional tools like debt repayment calculators?

- Ratings: User reviews and ratings can provide insight into service quality.

- Customer Support: Ensure the provider offers reliable support.

Mitigately stands out with a high user rating of 4.9 stars from over 400 reviews. The service is free until your debts are settled, making it a cost-effective choice.

Pros And Cons Of Credit Repair Consultations

Credit repair consultations can be a valuable step towards improving your financial health. While the benefits are significant, it’s essential to weigh both the pros and cons before committing. This section will help you understand the potential advantages and drawbacks of opting for credit repair consultations.

Pros: Professional Expertise And Efficiency

Credit repair consultations offer access to professional expertise. Experienced consultants understand the complexities of credit reports and can identify errors quickly. Their knowledge can save you time and ensure your credit issues are addressed efficiently.

Another advantage is efficiency. Professionals can often resolve issues faster than you could on your own. They use proven strategies and have established connections with credit bureaus, making the process smoother.

Cons: Potential Costs And Time Commitment

One downside is the potential costs. While some services may offer free initial consultations, ongoing assistance can be expensive. It’s crucial to evaluate if the cost is justified by the potential benefits to your credit score.

Additionally, there is a time commitment involved. Credit repair is not an overnight process. It requires patience and consistent communication with your consultant. This can be a significant commitment for those with busy schedules.

Ideal Candidates For Credit Repair Consultations

Not everyone may need credit repair consultations, but certain individuals can benefit greatly from them. Identifying these ideal candidates helps ensure that the services are tailored to those who need them most.

Individuals With Poor Credit History

People with a poor credit history often struggle with high-interest rates and loan denials. If you have a credit score below 600, you may find it hard to secure favorable financial products. Credit repair consultations can help you understand the factors affecting your credit score and develop a plan to improve it.

People Seeking Major Financial Goals

Those aiming for major financial goals like buying a home, starting a business, or securing a loan for education can benefit from credit repair consultations. Improving your credit score can lead to better interest rates and loan terms. This can save you thousands of dollars in the long run.

Those Experiencing Identity Theft Or Credit Report Errors

Identity theft and credit report errors can significantly damage your credit score. Victims of identity theft or those who find inaccuracies on their credit reports are ideal candidates for credit repair consultations. These professionals can help correct errors and mitigate the impact of fraudulent activities on your credit.

Conclusion: Boost Your Financial Health With Credit Repair Consultations

Credit repair consultations can significantly improve your financial health. These consultations offer tailored advice for better credit management. They help you understand and rectify your credit report issues. Let’s explore the benefits and how to start your journey toward better credit.

Recap Of Benefits

- Personalized Advice: Tailored strategies to improve your credit score.

- Error Correction: Identifies and corrects errors on your credit report.

- Debt Management: Provides guidance on managing and reducing debt.

- Financial Education: Offers tips and knowledge for long-term financial health.

- Improved Credit Score: Helps you achieve a better credit score over time.

Taking The First Step Towards Better Credit

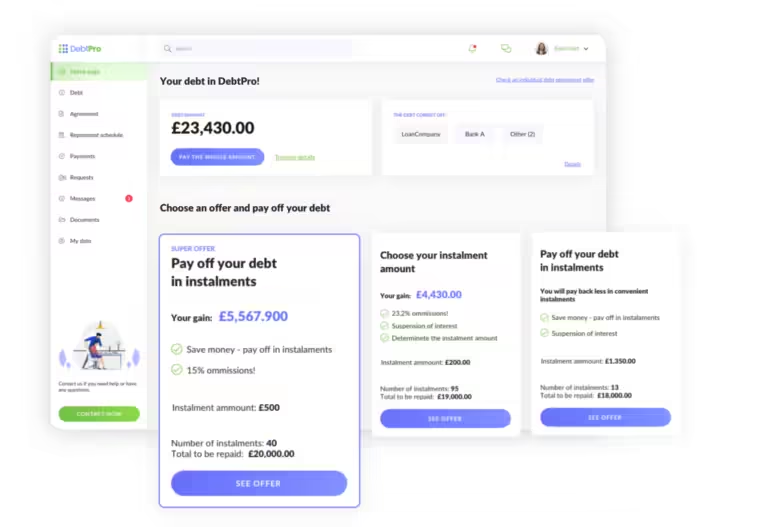

Starting your journey towards better credit is simple with Mitigately. Follow these steps to improve your financial health:

- Visit the Website: Go to Mitigately.

- Submit Your Details: Securely provide your information to the AI-powered agent.

- Get Matched: The agent will find the best debt consolidation or relief option for you.

- Follow the Plan: Stick to the recommended plan while Mitigately handles creditor negotiations.

- Achieve Financial Freedom: Consolidate your debts and save money in the long run.

By taking these steps, you can manage your debts more effectively. Mitigately’s AI-powered service ensures a smooth and efficient process. Start today and take control of your financial future.

Frequently Asked Questions

What Is A Credit Repair Consultation?

A credit repair consultation is a service where experts review your credit report. They identify errors and suggest ways to improve your score.

How Does Credit Repair Consultation Work?

During a credit repair consultation, specialists analyze your credit report. They identify inaccuracies and provide actionable steps to correct them.

Can Credit Repair Consultation Improve My Credit Score?

Yes, credit repair consultations can improve your credit score. Experts help identify and dispute errors, leading to potential score improvements.

How Long Does A Credit Repair Consultation Take?

A credit repair consultation typically takes about 30 minutes to an hour. The duration varies based on individual credit report complexities.

Conclusion

Credit repair consultations can help improve your financial health. Understanding your credit situation is crucial. Seeking professional advice can make a difference. Mitigately offers AI-powered debt consolidation services to help you manage debt better. Save time and money with their efficient solutions. Check out their services at Mitigately for more information. Take control of your financial future today.