Credit Repair Comparison: Find the Best Service for Your Needs

When it comes to repairing credit, choosing the right service is crucial. With so many options, making a decision can be daunting.

Credit repair comparisons help you understand which service suits your needs best. By evaluating different options, you get a clear picture of what each offers. This comparison saves you time and ensures you make an informed choice. Whether you are new to credit repair or looking for better services, understanding the differences is key. Let’s dive into a comprehensive comparison to help you find the best credit repair service for your unique situation. For those interested in real estate investing and creative financing, Subto offers a valuable educational resource. SubTo is designed for both experienced and novice investors, focusing on community support, essential tools, and actionable guidance. Through this comparison, you will discover if SubTo meets your needs and how it stands out in the world of credit repair and real estate investing.

Introduction To Credit Repair Services

Credit repair services play a crucial role in maintaining a healthy financial life. They help individuals improve their credit scores by addressing errors and inaccuracies on credit reports. Understanding these services can make a significant difference in financial well-being.

What Is Credit Repair?

Credit repair involves identifying and rectifying errors in credit reports. These errors can range from incorrect personal information to inaccurate account details. Professional credit repair services often work with credit bureaus to dispute these errors and ensure accurate reporting.

Credit repair can also involve negotiating with creditors to remove or correct negative items. This process requires patience and knowledge of consumer rights under laws like the Fair Credit Reporting Act (FCRA).

Importance Of Credit Repair For Financial Health

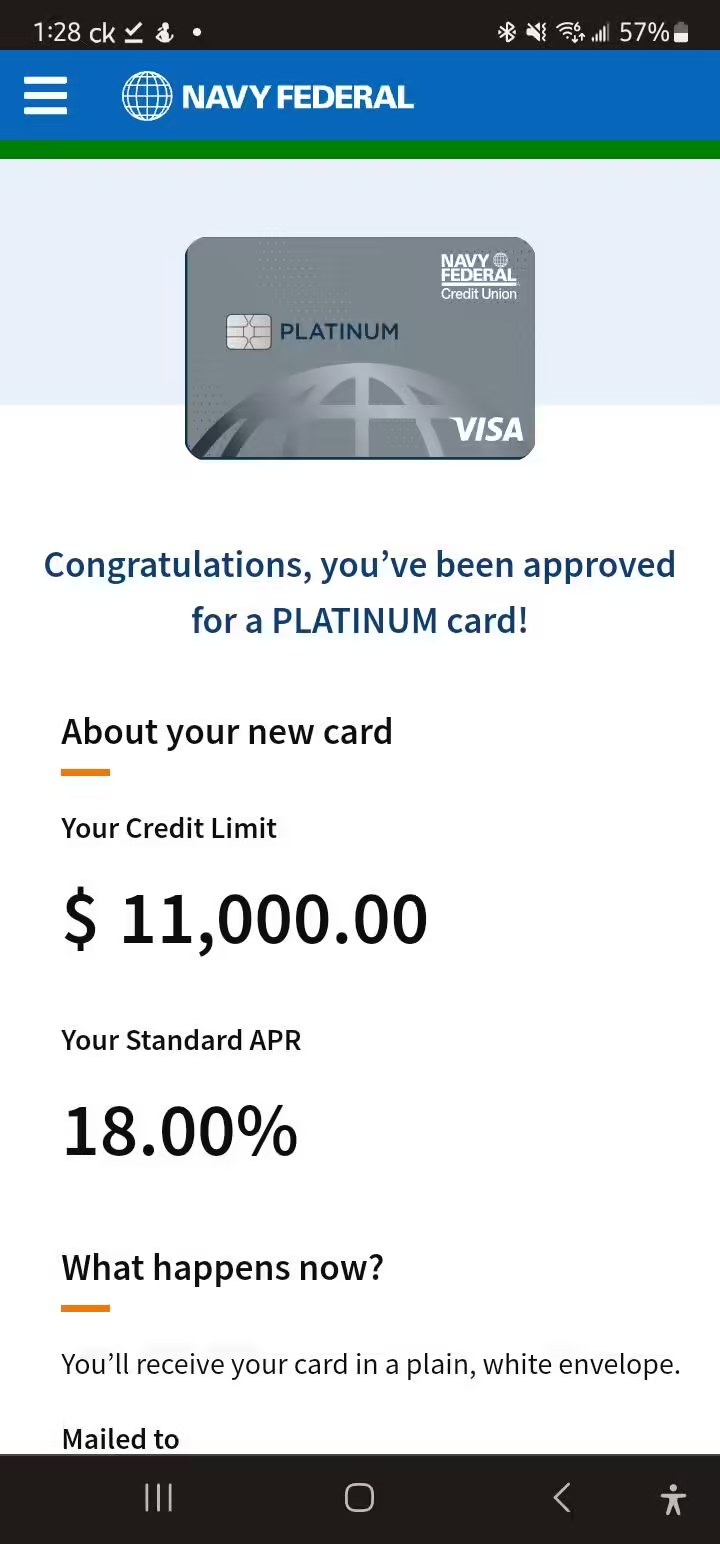

A good credit score is essential for securing loans, mortgages, and even certain jobs. Credit repair ensures that your credit report reflects accurate and fair information, which can improve your score significantly.

Here are some key benefits of maintaining a good credit score:

- Lower interest rates on loans and credit cards

- Better chances of loan approval

- Higher credit limits

- Improved insurance rates

- Enhanced job prospects

Regularly monitoring and repairing your credit can lead to long-term financial stability. It helps avoid issues that can arise from inaccurate reporting, such as higher borrowing costs and reduced financial opportunities.

In summary, credit repair services provide valuable assistance in maintaining and improving credit scores. Understanding their role and benefits can lead to better financial health and opportunities.

Key Features Of Top Credit Repair Services

Choosing the right credit repair service can be overwhelming. To help you decide, we have highlighted the key features that top credit repair services offer. These features ensure comprehensive support and effective results in improving your credit score.

Personalized Credit Repair Plans

Top credit repair services provide personalized credit repair plans. These plans are tailored to your unique credit situation. They analyze your credit report and identify the areas that need improvement. This customized approach maximizes the effectiveness of the repair process.

Credit Monitoring And Alerts

Another crucial feature is credit monitoring and alerts. These services keep track of your credit report and notify you of any changes. This allows you to stay updated and address any issues promptly. Regular monitoring helps in maintaining a healthy credit score.

Dispute Resolution Services

Effective dispute resolution services are essential for credit repair. Top services assist you in disputing inaccurate or unfair items on your credit report. They handle the communication with credit bureaus and creditors, ensuring a smooth and professional process.

Educational Resources And Tools

Top credit repair services offer a range of educational resources and tools. These resources include articles, webinars, and guides. They help you understand credit management and build better financial habits. Access to these tools empowers you to maintain and improve your credit score in the long run.

| Feature | Description |

|---|---|

| Personalized Credit Repair Plans | Customized plans based on individual credit situations. |

| Credit Monitoring and Alerts | Regular updates and notifications on credit report changes. |

| Dispute Resolution Services | Assistance in disputing inaccurate items on credit reports. |

| Educational Resources and Tools | Access to articles, webinars, and guides on credit management. |

These features are fundamental in choosing the best credit repair service. They ensure you receive comprehensive support and achieve your credit goals efficiently.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit repair services is crucial. This section will provide a detailed look at different cost structures and what you get for your money.

Monthly Subscription Costs

Most credit repair companies offer monthly subscription plans. These plans usually range from $50 to $150 per month. The exact cost depends on the level of service offered. For example:

- Basic plans: $50 – $70 per month

- Standard plans: $80 – $100 per month

- Premium plans: $120 – $150 per month

Higher-priced plans often include additional features like personalized support and faster dispute resolutions.

One-time Fees

Some companies charge one-time fees for specific services. These could include initial setup fees or fees for accessing certain documents. The average one-time fee ranges from $100 to $200. Key examples include:

- Initial setup fee: $100

- Document access fee: $50

- Special service fee: $150

Free Vs. Paid Services

Free services often provide basic credit monitoring and educational resources. Paid services offer more comprehensive solutions. These include personalized support, dispute handling, and advanced tools. Here’s a comparison:

| Service Type | Free Services | Paid Services |

|---|---|---|

| Credit Monitoring | Basic | Advanced |

| Dispute Handling | Self-service | Professional assistance |

| Support | Limited | 24/7 personalized support |

Value For Money Analysis

When evaluating the value for money, consider both costs and benefits. For instance:

- Lower-priced plans might save money but offer fewer features.

- Mid-range plans balance cost with essential services.

- Higher-priced plans provide extensive support and faster results.

Ultimately, choose a plan that fits your needs and budget. Look for services that offer the best balance of cost and benefit.

Pros And Cons Of Popular Credit Repair Services

Choosing the right credit repair service can be overwhelming. Each service has its strengths and weaknesses. Here’s a comparison of some popular credit repair services to help you decide which one suits your needs.

Lexington Law: Strengths And Weaknesses

Lexington Law is one of the most well-known credit repair companies. They offer a range of services to help improve your credit score.

| Strengths | Weaknesses |

|---|---|

|

|

Creditrepair.com: Benefits And Drawbacks

CreditRepair.com offers personalized credit repair plans and has a user-friendly interface.

| Benefits | Drawbacks |

|---|---|

|

|

Sky Blue Credit: Pros And Cons

Sky Blue Credit is known for its straightforward pricing and customer service.

| Pros | Cons |

|---|---|

|

|

The Credit People: Advantages And Disadvantages

The Credit People offer a satisfaction guarantee and a simple pricing model.

| Advantages | Disadvantages |

|---|---|

|

|

Specific Recommendations For Ideal Users

Choosing the right credit repair service can be daunting. To make it easier, we have specific recommendations tailored to different needs. Whether you require comprehensive service, budget-friendly options, quick disputes, or educational support, there’s something for everyone.

Best For Comprehensive Service: Lexington Law

Lexington Law offers a thorough approach to credit repair. They provide a wide range of services, from credit report analysis to legal interventions. Their team of professionals works diligently to remove negative items from your credit report. This service is ideal for those who need a complete overhaul of their credit profile. They also offer personalized credit counseling and support to ensure long-term improvement.

Best For Budget-friendly Options: Sky Blue Credit

Sky Blue Credit stands out for its affordability. They offer competitive pricing without compromising on quality. Their services include disputing errors on your credit report and providing practical advice to improve your credit score. Sky Blue Credit also has a 90-day money-back guarantee, ensuring you get value for your money. This service is perfect for users who need effective credit repair on a budget.

Best For Quick Disputes: The Credit People

The Credit People are known for their swift dispute resolution. They aim to remove negative items from your credit report quickly. Their process includes a detailed analysis of your credit report and aggressive disputing of errors. The Credit People offer a low monthly fee and a satisfaction guarantee. This service is best for those who need quick results and efficient dispute handling.

Best For Educational Support: Creditrepair.com

CreditRepair.com excels in providing educational resources alongside credit repair services. They offer tools and advice to help you understand and manage your credit better. Their services include credit monitoring, financial management tips, and personalized credit score improvement plans. CreditRepair.com is ideal for users who want to learn about credit management while repairing their credit.

For more details or to sign up, visit the SubTo website.

Conclusion: Choosing The Right Credit Repair Service For Your Needs

Finding the right credit repair service can be challenging. It’s important to weigh various factors to make an informed decision. This section will guide you through the key considerations and provide final recommendations.

Factors To Consider When Choosing A Service

| Factor | Details |

|---|---|

| Reputation | Check reviews and testimonials to gauge the service’s reliability. |

| Transparency | Look for clear explanations of fees and processes. |

| Support | Ensure they offer continuous support and guidance. |

| Cost | Compare pricing and check for hidden fees. |

| Effectiveness | Look for proven results and case studies. |

| Legal Compliance | Ensure the service follows legal guidelines and industry standards. |

Final Thoughts And Recommendations

Choosing the right credit repair service requires careful consideration. Evaluate each option based on the factors listed above. A well-rounded service should offer comprehensive support, clear communication, and proven results.

SubTo, an educational resource for real estate investors, emphasizes community support and creative financing education. With its grounded support, forward-thinking approach, and member leadership, SubTo can be a valuable resource for those looking to improve their financial situation.

- Community: Active network of high-level investors.

- Education: Comprehensive creative financing education.

- Support: Encouragement from experienced advisers.

- Resources: Essential documents and tools.

- Action-Oriented: Motivation to take immediate action.

For more information on SubTo, including testimonials and pricing details, visit their website.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves fixing your credit score by disputing errors on your credit report. It also includes improving credit habits.

How Do Credit Repair Companies Work?

Credit repair companies review your credit report for errors. They dispute inaccuracies with credit bureaus to improve your score.

Is Credit Repair Legal?

Yes, credit repair is legal. Consumers have the right to dispute errors on their credit reports under the Fair Credit Reporting Act.

How Long Does Credit Repair Take?

Credit repair can take several months. The timeline depends on the number of errors and the responsiveness of credit bureaus.

Conclusion

Choosing the right credit repair solution is crucial. Understanding your needs helps a lot. Compare various options carefully. Consider the features and support provided. SubTo offers great resources for real estate investors. It’s worth checking out. For more details, visit SubTo and see how it can help you. Make informed decisions for a better financial future. Remember, taking action is the first step. Start your credit repair journey today.