Credit Repair Alternatives: Boost Your Score Without Traditional Methods

Repairing your credit can seem daunting. But there are alternatives to traditional methods.

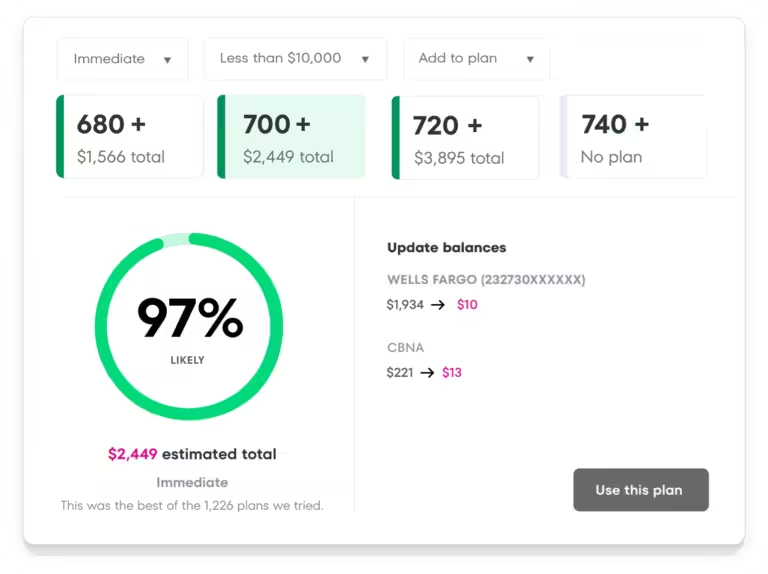

Credit repair alternatives offer various ways to improve your credit score without using credit repair companies. These options can help you navigate financial challenges and find solutions that fit your needs. Exploring credit repair alternatives can lead to more personalized and cost-effective solutions. For instance, tools like Solo Debt Resolution Software assist individuals in managing debt disputes and responding to debt lawsuits. This automated software helps users settle debts outside of court, often saving time and money. With features like attorney reviews and a proven track record, SoloSuit can be a viable option for those seeking to improve their financial situation. Learn more about SoloSuit here.

Introduction To Credit Repair Alternatives

Improving credit can be daunting. Many seek traditional credit repair services. Yet, alternatives exist that can be as effective. These options offer a fresh approach, often with added benefits. Let’s explore why you might consider these alternatives and what they involve.

Why Look For Alternatives?

Traditional credit repair services can be expensive and time-consuming. Not everyone can afford them. Some services might not deliver the promised results. Credit repair alternatives offer diverse options to suit different needs. They can be more affordable and quicker.

People seek alternatives to avoid legal trouble. For instance, Solo Debt Resolution Software helps manage debt disputes. It guides users through responding to debt lawsuits and settling debts outside court. This option can be less stressful and more efficient.

Overview Of Non-traditional Credit Repair Methods

Several non-traditional methods exist for credit repair. Here are some popular ones:

- Debt Resolution Software: Like Solo, this software automates the process of handling debt lawsuits. It includes attorney reviews for accuracy.

- Debt Settlement: Negotiating directly with creditors to settle debts for less than the full amount.

- Credit Counseling: Working with credit counselors to create a debt management plan.

- DIY Credit Repair: Individuals take steps to dispute errors on their credit reports and manage their finances better.

Each of these methods has its own advantages. For example, Solo Debt Resolution Software can save time and money by avoiding court proceedings. It also covers all 50 states and has a proven track record of helping thousands.

Using these alternatives can be practical and effective. They provide different ways to address credit issues without traditional services. These methods empower individuals to take control of their financial situations.

Understanding Your Credit Report

Your credit report is a crucial component of your financial health. It contains detailed information about your credit history, which lenders use to determine your creditworthiness. Understanding your credit report can help you identify areas for improvement and take steps to repair your credit.

How To Obtain Your Credit Report

Obtaining your credit report is the first step in understanding your credit. You can get a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Visit annualcreditreport.com to request your free report.

It is advisable to check your credit report from all three bureaus. Each bureau may have different information, and reviewing all three can provide a comprehensive view of your credit history.

Interpreting The Key Components Of Your Credit Report

Once you have your credit report, it’s important to understand the key components:

- Personal Information: Includes your name, address, Social Security number, and date of birth.

- Credit Accounts: Lists your credit accounts, including the type of account, the date it was opened, the credit limit or loan amount, the account balance, and payment history.

- Credit Inquiries: Shows who has accessed your credit report and when.

- Public Records: Includes bankruptcies, foreclosures, and other legal actions.

- Collections: Lists any accounts that have been turned over to collections agencies.

Identifying Errors And Discrepancies

Errors in your credit report can negatively impact your credit score. Carefully review each section of your report to identify any inaccuracies. Common errors include:

- Incorrect personal information.

- Accounts that do not belong to you.

- Duplicate accounts.

- Incorrect account status.

- Outdated information.

If you find errors, you need to dispute them with the credit bureau that issued the report. Provide any documentation that supports your claim. The bureau will investigate and correct any verified errors.

Diy Credit Repair Techniques

Repairing your credit doesn’t always require professional help. You can take control of your financial future with some simple do-it-yourself techniques. Below, we will explore three effective methods for improving your credit score on your own.

Disputing Errors On Your Credit Report

Errors on your credit report can significantly impact your credit score. Identifying and disputing these errors is a critical first step in DIY credit repair. Follow these steps:

- Get a copy of your credit report from all three major credit bureaus (Experian, TransUnion, and Equifax).

- Carefully review each report for inaccuracies, such as incorrect account information or outdated entries.

- Dispute any errors by contacting the credit bureau with a detailed explanation and supporting documents.

- Monitor the status of your dispute and follow up if necessary.

Correcting these errors can lead to a quick improvement in your credit score.

Creating A Personalized Debt Repayment Plan

Managing debt is crucial for credit repair. A personalized debt repayment plan can help you stay organized and focused. Here’s how to create one:

- List all your debts, including balances, interest rates, and minimum payments.

- Determine your monthly budget and how much you can allocate to debt repayment.

- Choose a repayment strategy, such as the debt snowball or debt avalanche method.

- Stick to your plan and make consistent, on-time payments.

Consistency is key. Over time, your credit score will reflect your efforts.

Utilizing Credit Counseling Services

Sometimes, professional guidance is beneficial even in a DIY approach. Credit counseling services can provide valuable advice and support. Consider these benefits:

- Budgeting assistance to help you manage your finances more effectively.

- Debt management plans that consolidate your debts into a single monthly payment.

- Education on credit management and financial planning.

Credit counseling services are often free or low-cost, making them an accessible resource for many.

While DIY credit repair requires effort and discipline, it is a viable option for many people. By disputing errors, creating a debt repayment plan, and seeking credit counseling, you can take significant steps toward a healthier credit score.

Building Credit Through Alternative Financial Tools

Building credit can seem daunting, especially if you lack traditional credit options. Fortunately, there are several alternative financial tools designed to help you establish and improve your credit score. These tools can be particularly beneficial if you have no credit history or a low credit score.

Secured Credit Cards: How They Work And Their Benefits

Secured credit cards require a cash deposit as collateral. This deposit typically equals your credit limit. For example, if you deposit $500, your credit limit will be $500. This makes secured cards less risky for issuers, allowing more people to qualify.

- Accessible for low credit scores: Secured cards are available to those with poor or no credit history.

- Builds credit history: Payments are reported to credit bureaus, helping you build a positive credit history.

- Transition to unsecured cards: Over time, responsible use can lead to offers for unsecured credit cards.

Credit Builder Loans: An Effective Way To Improve Credit

Credit builder loans are small loans designed to help improve your credit score. Unlike traditional loans, the borrowed amount is held in a bank account while you make payments.

- Accessible to low credit scores: Easier to obtain than traditional loans.

- Builds credit: Payments are reported to credit bureaus.

- Savings component: At the end of the loan term, you receive the loan amount, often with interest.

Peer-to-peer Lending Platforms

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. These platforms can be a good alternative for those with low credit scores.

- Flexible terms: P2P loans often offer more flexible terms than traditional loans.

- Accessible to low credit scores: Easier to obtain compared to bank loans.

- Builds credit: Payments are reported to credit bureaus, helping improve your score.

Using these alternative financial tools can help you build and improve your credit score. Whether you choose secured credit cards, credit builder loans, or peer-to-peer lending, each option offers unique benefits to support your financial goals.

Leveraging Technology For Credit Improvement

In today’s digital age, technology can be a powerful ally in improving your credit score. Using innovative tools and resources can help you stay on top of your financial health and make informed decisions. Here are some effective ways to leverage technology for credit improvement:

Credit Monitoring Apps: Keeping Track Of Your Progress

Credit monitoring apps are essential for anyone looking to improve their credit score. These apps provide real-time updates on your credit report and alert you to any changes. This way, you can quickly address any errors or suspicious activities.

Popular credit monitoring apps include:

- Credit Karma: Offers free credit scores and reports from TransUnion and Equifax.

- Experian: Provides daily credit score updates and identity theft protection.

Using these apps, you can track your progress, set credit goals, and receive personalized tips to improve your score.

Automated Savings Programs

Automated savings programs are another effective tool for credit improvement. These programs help you save money without much effort. They automatically transfer small amounts from your checking account to your savings account.

Examples of automated savings programs include:

- Acorns: Rounds up your purchases and invests the spare change.

- Digit: Analyzes your spending habits and saves small amounts for you.

By building a savings cushion, you can pay down debts faster and improve your credit utilization ratio.

Online Financial Education Resources

Knowledge is power, especially when it comes to managing your finances. Online financial education resources can provide valuable insights and strategies for credit improvement. These resources include blogs, webinars, and courses that cover a wide range of topics.

Some notable resources are:

- SoloSuit: Offers tools and guidance for responding to debt lawsuits and settling debts outside of court.

- Investopedia: Provides in-depth articles and tutorials on personal finance and credit management.

By leveraging these educational resources, you can make informed decisions and take proactive steps to improve your credit score.

Lifestyle Changes To Enhance Your Credit Score

Improving your credit score doesn’t always require professional help. Simple lifestyle changes can make a big difference. Here are some effective strategies to consider.

The Impact Of Timely Bill Payments

Paying your bills on time is crucial. It shows lenders you are responsible. Consistency here boosts your credit score over time. Consider setting up automatic payments. This ensures you never miss a due date.

Managing And Reducing Debt

High debt levels can hurt your credit score. Focus on reducing your debt. Start by paying off high-interest debts first. This can save you money in the long run.

| Debt Type | Strategy |

|---|---|

| Credit Card Debt | Pay more than the minimum payment |

| Personal Loans | Consider refinancing for a lower rate |

Using software like Solo can help manage debt. Solo helps you respond to debt lawsuits and settle debts outside of court.

Building Healthy Financial Habits

Good habits are key to a healthy credit score. Here are some tips:

- Create and stick to a budget

- Check your credit report regularly

- Avoid unnecessary credit inquiries

Following these habits can lead to a stronger credit score over time. Take control of your financial future today!

Pros And Cons Of Credit Repair Alternatives

Exploring credit repair alternatives can be beneficial for some individuals. There are various non-traditional methods available, and each comes with its own set of advantages and challenges. Understanding the pros and cons of these alternatives can help you make an informed decision.

Benefits Of Non-traditional Methods

- Automated Assistance: Tools like Solo Debt Resolution Software streamline the process of responding to debt lawsuits and settling debts.

- Attorney Review: Professional review ensures your responses are legally accurate.

- Court Avoidance: Settling debts outside of court can save both time and money.

- Wide Coverage: Services are available in all 50 states, making it accessible to many users.

- Proven Track Record: Solo has protected over $1.71 billion and helped 262,000 people.

Potential Drawbacks And Challenges

Non-traditional credit repair methods are not without challenges. Some potential drawbacks include:

- Cost: While pricing details for tools like Solo are not specified, there may be costs involved.

- Self-Help Nature: Tools like Solo are self-help tools and not substitutes for legal advice.

- Legal Limitations: Users must adhere to terms of service, privacy policies, and legal disclaimers.

Comparing Traditional Vs. Alternative Approaches

| Aspect | Traditional Approach | Alternative Approach (e.g., Solo) |

|---|---|---|

| Cost | May involve high fees | Varies, but often more affordable |

| Legal Guidance | Direct attorney-client relationship | Attorney review but not a substitute for legal advice |

| Process | Can be lengthy and complex | Streamlined and automated |

| Coverage | Depends on the service provider | Available in all 50 states |

Understanding these aspects can guide you in choosing the best method for your credit repair needs.

Who Should Consider Credit Repair Alternatives?

Credit repair alternatives can be a vital resource for individuals seeking non-traditional methods to improve their credit. These alternatives offer diverse solutions tailored to varying financial situations. By understanding who benefits most, you can make an informed decision about your credit repair journey.

Ideal Candidates For Non-traditional Credit Repair

Non-traditional credit repair methods are ideal for those who require personalized approaches. This includes:

- Individuals with unique financial circumstances: Those dealing with complex financial issues that traditional methods might not address.

- People facing debt lawsuits: Solo Debt Resolution Software can help respond to debt lawsuits and settle debts outside of court.

- Users looking for automated assistance: Solo provides automated help, making it easier to navigate debt disputes.

- Anyone wanting to avoid court: The software aids in settling debts without legal proceedings, saving time and money.

When To Seek Professional Help

Professional help should be considered in specific scenarios:

- Complex legal issues: If you face legal complexities, attorney-reviewed software like Solo can ensure legal accuracy.

- Large debts: Significant debts may require professional negotiation to settle for less than the face value.

- Time-sensitive responses: If you need to respond to a debt lawsuit within 14-30 days, professional assistance ensures timely filing.

Tailoring Solutions To Individual Financial Situations

Credit repair alternatives like Solo Debt Resolution Software offer tailored solutions. These include:

| Feature | Benefit |

|---|---|

| Automated Assistance | Streamlined process for debt dispute navigation. |

| Attorney Review | Ensures legal accuracy of responses. |

| Debt Settlement | Negotiation with debt collectors to settle for less. |

| Wide Coverage | Available in all 50 states. |

Tailoring these solutions ensures that individuals receive the appropriate support based on their unique financial situations. This personalized approach can significantly impact their credit repair success.

Conclusion: Taking Control Of Your Credit Journey

Embarking on the path to credit repair can feel overwhelming. Understanding the various credit repair alternatives empowers you to make informed decisions. Let’s summarize the critical points, encourage action, and share final thoughts on these alternatives.

Recap Of Key Points

- Credit Counseling: Offers personalized advice and debt management plans.

- Debt Consolidation: Combines multiple debts into a single loan with lower interest.

- Debt Settlement: Negotiates with creditors to settle debts for less than the owed amount.

- Solo Debt Resolution Software: Provides automated assistance in debt disputes, including attorney reviews and helps settle debts outside of court.

Encouragement To Take Action

Taking control of your credit journey starts with a single step. Whether it’s seeking advice from a credit counselor or using tools like Solo Debt Resolution Software, each action moves you closer to financial stability.

Consider the benefits of each alternative and choose the one that aligns with your goals. With resources like Solo, you can respond to debt lawsuits and negotiate settlements efficiently.

Final Thoughts On Credit Repair Alternatives

Credit repair is not a one-size-fits-all solution. Evaluate your situation and select the method that best suits your needs. Solo Debt Resolution Software offers a unique solution by automating the process and providing professional reviews, making it a valuable tool in your credit repair arsenal.

Take charge of your credit journey today. Equip yourself with the right tools and knowledge to navigate the path to financial freedom. Remember, every step you take brings you closer to achieving your financial goals.

Frequently Asked Questions

What Are Credit Repair Alternatives?

Credit repair alternatives include debt consolidation, credit counseling, and negotiating directly with creditors. These methods can help improve your credit score without professional repair services. Additionally, maintaining good financial habits is essential.

How Does Debt Consolidation Work?

Debt consolidation combines multiple debts into one loan with a lower interest rate. This simplifies payments and can reduce overall interest costs. It helps manage debt more effectively and can improve your credit score.

Is Credit Counseling Effective?

Credit counseling provides professional advice on managing finances and reducing debt. Counselors help create a budget and a debt repayment plan. This can improve financial habits and credit scores over time.

Can I Negotiate With Creditors Myself?

Yes, you can negotiate with creditors yourself. Contact them to discuss payment plans or settlements. Many creditors are willing to work with you to find a mutually beneficial solution. This can help improve your credit score.

Conclusion

Exploring credit repair alternatives can lead to better financial health. SoloSuit offers a unique solution for debt disputes. This software helps respond to debt lawsuits and settle debts outside court. It simplifies the process and includes attorney reviews. Using SoloSuit can save time and money. Discover how SoloSuit can assist in navigating debt disputes by visiting SoloSuit. Take control of your financial future today.