Credit Rebuilding Programs: Transform Your Financial Future

Credit Rebuilding Programs can help restore your financial health. They offer structured plans to improve your credit score over time.

Building a strong credit history is crucial for financial freedom. Whether you have faced financial setbacks or are new to credit, the right program can make a difference. Credit rebuilding programs, like the FairFigure Capital Card, focus on enhancing your credit score, providing access to funds, and monitoring your progress. These programs are designed to help you rebuild and maintain a positive credit profile, which is essential for securing loans, getting better interest rates, and achieving business success. Ready to transform your credit journey? Discover more about the FairFigure Capital Card and its benefits.

Introduction To Credit Rebuilding Programs

Credit rebuilding programs are essential for individuals and businesses facing challenges with poor credit. These programs help improve credit scores, providing better financial opportunities. Understanding the importance of credit and how poor credit impacts financial health is crucial before exploring what these programs entail.

Understanding The Importance Of Credit

Credit is vital for securing loans, credit cards, and even housing. A good credit score opens doors to better interest rates and favorable loan terms. It reflects your financial responsibility and trustworthiness to lenders.

How Poor Credit Impacts Your Financial Health

Poor credit can lead to high-interest rates, loan denials, and limited financial options. It affects your ability to secure mortgages, auto loans, and even some jobs. Managing finances becomes tougher with poor credit as everyday expenses can become more expensive.

What Are Credit Rebuilding Programs?

Credit rebuilding programs are designed to help individuals and businesses improve their credit scores. One such program is the FairFigure Capital Card.

FairFigure offers a business credit building and monitoring service. Here are some key features:

- Business Credit Monitoring: Real-time tri-bureau score tracking and error correction.

- Funding: Same-day access to business capital without personal credit checks.

- Credit Building: Reports payment history to commercial bureaus, boosting scores up to 60%.

- Foundation Report: Detailed business credit and commercial scores report.

- Secure Platform: Uses Plaid for secure access and PCI compliant data protection.

FairFigure offers several benefits, including improved credit scores within three months, immediate funding access, and comprehensive credit monitoring. Their flexible payment plans and error correction tools make managing credit easier.

For more information, visit FairFigure.

Key Features Of Credit Rebuilding Programs

Credit rebuilding programs offer essential tools to help individuals and businesses improve their credit scores. These programs include various services designed to educate, manage debt, and build credit responsibly. Below are the key features of these programs:

Credit Counseling And Education

Credit counseling provides guidance on managing finances and improving credit scores. Education is a core component, teaching individuals about budgeting, credit reports, and financial planning. This foundational knowledge helps users make informed decisions and avoid future financial pitfalls.

Debt Management Plans

Debt management plans (DMPs) are structured repayment programs. They consolidate debts into a single monthly payment. Credit counselors negotiate with creditors to lower interest rates and waive fees, making it easier for individuals to pay off their debt. DMPs can significantly reduce the time it takes to become debt-free.

Secured Credit Cards

Secured credit cards are a valuable tool for rebuilding credit. They require a cash deposit as collateral, which acts as the credit limit. Responsible use of secured cards, such as making timely payments and keeping balances low, can positively impact credit scores. Over time, users may qualify for unsecured credit cards.

Credit Builder Loans

Credit builder loans are designed specifically to help individuals build or rebuild credit. The loan amount is typically held in a secured account while the borrower makes monthly payments. These payments are reported to credit bureaus, helping to establish a positive payment history. Once the loan is paid off, the borrower gains access to the funds.

FairFigure Capital Card offers a comprehensive credit building and monitoring service for businesses. Here is a summary of its features:

| Main Features | Details |

|---|---|

| Business Credit Monitoring | Real-time tri-bureau score tracking and error correction |

| Funding | Access to business capital with same-day funding, no personal credit checks |

| Credit Building | Reports payment history to commercial bureaus to boost scores |

| Foundation Report | Detailed business credit and commercial scores report |

| Secure Platform | Uses Plaid for secure access and PCI compliant data protection |

FairFigure Capital Card is an excellent choice for businesses aiming to improve credit scores and secure funding without affecting personal credit. For more details, visit FairFigure.

How Credit Rebuilding Programs Work

Understanding how credit rebuilding programs work is essential for anyone looking to improve their credit score. These programs provide structured plans and support to help rebuild your credit effectively. Let’s explore the key steps involved in a credit rebuilding program.

Initial Assessment And Credit Analysis

The first step in a credit rebuilding program is the initial assessment and credit analysis. During this phase, your current credit status is evaluated. The program will review your credit reports from the three major credit bureaus.

This assessment helps identify areas that need improvement, such as delinquent accounts, high credit utilization, and errors on your credit report. Accurate insights from this analysis are crucial for creating an effective improvement plan.

Creating A Personalized Credit Improvement Plan

Based on the initial assessment, a personalized credit improvement plan is created. This plan includes specific actions tailored to your financial situation. It might involve strategies like paying down debt, disputing inaccuracies on your credit report, and establishing new lines of credit responsibly.

For businesses, the FairFigure Capital Card offers a unique solution. It provides real-time credit monitoring, access to same-day funding, and reports payment history to commercial bureaus. These features can help boost business credit scores significantly.

Monitoring Progress And Adjustments

Once the plan is in place, ongoing monitoring and adjustments are essential. Progress is tracked regularly to ensure that the strategies are effective. The FairFigure platform offers comprehensive monitoring, including real-time updates on business credit scores and error correction tools.

Adjustments to the plan may be necessary based on the progress observed. This ensures that the credit rebuilding efforts remain on track and adapt to any changes in your financial situation.

With tools like the Business Credit Correct and detailed Foundation Reports, FairFigure provides a robust framework for monitoring and improving business credit scores.

By following these steps, credit rebuilding programs help individuals and businesses improve their credit scores and achieve their financial goals effectively.

Pricing And Affordability Of Credit Rebuilding Programs

Understanding the costs associated with credit rebuilding programs is crucial. This helps you make informed decisions about improving your credit scores. Different programs have varied pricing structures. Let’s explore the affordability and cost factors of these programs.

Cost Of Credit Counseling Services

Credit counseling services offer guidance on managing debts. Costs can vary widely. Many agencies offer free initial consultations. Ongoing services typically charge between $20 to $75 per month. Some non-profits offer low-cost or free services. Always check if the agency is accredited and has good reviews.

Fees For Debt Management Plans

Debt management plans (DMPs) help consolidate and pay off debts. These plans often have setup fees ranging from $30 to $50. Monthly fees typically range from $20 to $75. Some plans may waive fees based on financial hardship. Ensure you understand all costs before enrolling in a DMP.

Interest Rates On Credit Builder Loans

Credit builder loans can improve credit scores. These loans often have interest rates between 5% and 15%. Rates depend on the lender and your credit profile. Some lenders may charge additional fees. Compare different lenders to find the best rates and terms.

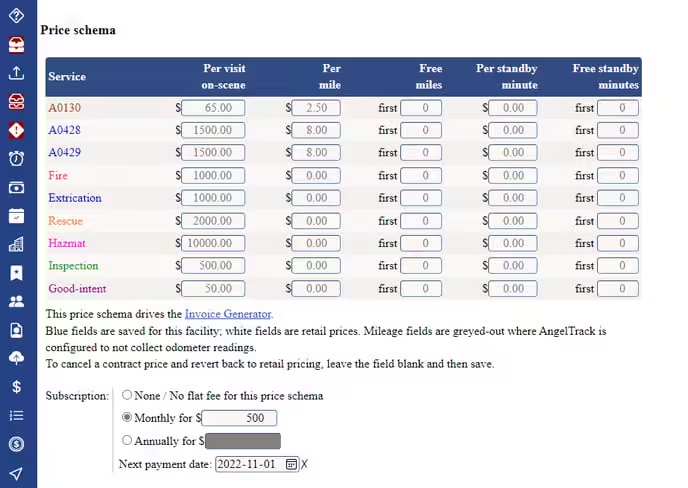

Fairfigure Premium Monitor Pricing Details

FairFigure offers a comprehensive credit building and monitoring service. The FairFigure Premium Monitor comes with a monthly subscription. This subscription provides access to detailed credit reports and score boosting tools.

| Service | Cost |

|---|---|

| Initial Setup Fee | Varies by plan |

| Monthly Subscription | $20 – $75 |

FairFigure also offers same-day funding options. These funding options are customized based on business performance. They provide flexible terms without personal credit checks.

For more details, you can visit FairFigure.

Pros And Cons Of Credit Rebuilding Programs

Credit rebuilding programs are designed to help individuals and businesses improve their credit scores. These programs can be highly beneficial, but they also come with certain limitations. Understanding the pros and cons is essential for making an informed decision.

Advantages Of Using Credit Rebuilding Programs

Credit rebuilding programs offer several advantages that can significantly benefit users. Here are some key benefits:

- Improved Credit Scores: Many programs, such as the FairFigure Capital Card, can boost business credit scores by up to 60% in just three months.

- Same-Day Funding: Access to funds without personal credit checks or guarantees, which is particularly useful for businesses needing immediate capital.

- Comprehensive Monitoring: Real-time updates and detailed reports help users stay informed about their credit status.

- Error Correction: Identifies and corrects inaccurate information, protecting your credit score from unnecessary damage.

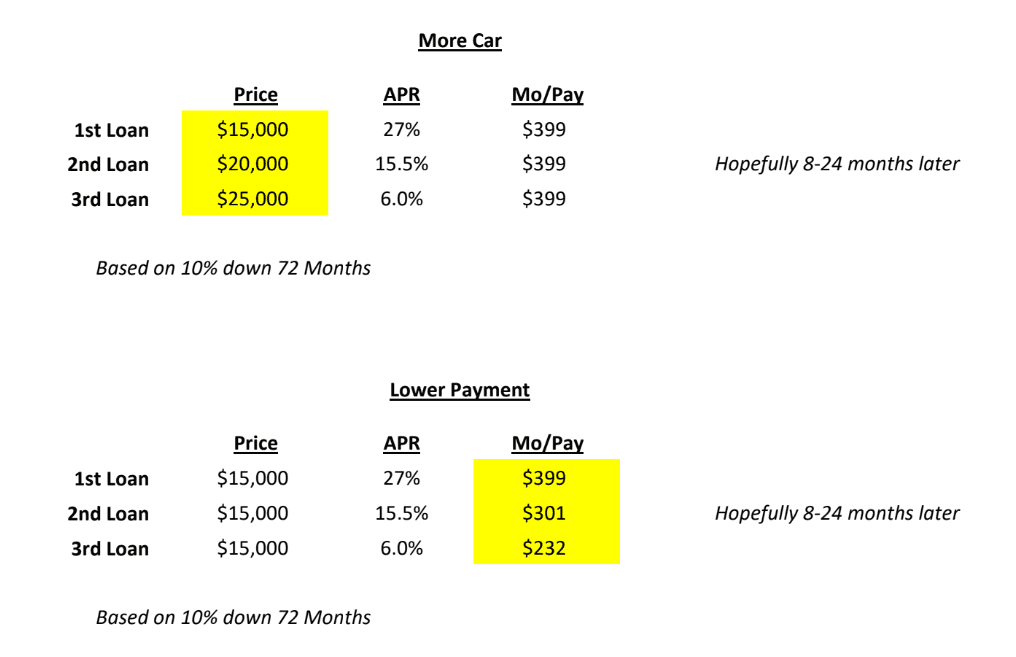

- Flexible Payment Plans: Users can control payment amounts and plans without dealing with confusing APRs.

Potential Drawbacks And Limitations

Despite the benefits, there are some potential drawbacks and limitations to credit rebuilding programs:

- Cost: Monthly subscriptions, like FairFigure Premium Monitor, can be expensive for some users.

- Limited Refund Policies: Specific refund or return policies may not be detailed, which can be a concern for some users.

- Dependence on Program: Over-reliance on these programs without improving financial habits can lead to long-term dependency.

Real-world User Experiences

Real-world user experiences provide valuable insights into how credit rebuilding programs perform:

- Positive Feedback: Users of the FairFigure Capital Card report significant improvements in their business credit scores and appreciate the easy access to funding.

- Convenience: Many users find the real-time monitoring and error correction tools extremely helpful for maintaining accurate credit reports.

- Cost Concerns: Some users mention that the cost of monthly subscriptions can add up, making it less affordable in the long run.

Overall, understanding the pros and cons of credit rebuilding programs helps you make a well-informed decision. Consider both the advantages and potential drawbacks to determine if a program like the FairFigure Capital Card suits your needs.

Who Should Consider Credit Rebuilding Programs?

Credit rebuilding programs offer a pathway to improve financial health. They are essential for individuals and businesses facing credit challenges. Understanding who should consider these programs is crucial for effective financial management. Below, we explore who can benefit the most from credit rebuilding programs.

Ideal Candidates For Credit Rebuilding

Not everyone needs credit rebuilding programs, but certain groups can benefit significantly:

- Individuals with Poor Credit Scores: People with low credit scores can use these programs to rebuild their credit and access better financial opportunities.

- New Business Owners: Those starting new businesses may lack established credit history. Programs like the FairFigure Capital Card can help build and monitor business credit scores.

- Those with Past Financial Mistakes: Individuals who have made financial errors in the past can use these programs to correct their mistakes and improve their credit profile.

Scenarios Where Credit Rebuilding Programs Are Most Effective

Credit rebuilding programs are particularly effective in the following scenarios:

- Post-Bankruptcy: Rebuilding credit after bankruptcy can be challenging. Credit rebuilding programs provide the tools and support needed to start afresh.

- Debt Settlement: After settling debts, these programs can help improve credit scores by ensuring timely payments and monitoring credit reports.

- Identity Theft Recovery: Victims of identity theft can use credit rebuilding programs to correct errors and recover their credit scores.

Alternatives To Credit Rebuilding Programs

While credit rebuilding programs are beneficial, there are alternatives for those who may not need a structured program:

- Secured Credit Cards: These cards require a security deposit and can help build credit with responsible use.

- Credit Counseling: Professional credit counselors can provide personalized advice and strategies for improving credit scores.

- Self-Monitoring: Regularly checking credit reports and addressing any issues can help maintain a healthy credit score.

Frequently Asked Questions

What Are Credit Rebuilding Programs?

Credit rebuilding programs help individuals improve their credit scores. They provide guidance, tools, and resources. These programs offer structured plans and support. They are designed to assist people with poor credit history.

How Do Credit Rebuilding Programs Work?

Credit rebuilding programs analyze your credit report. They identify issues affecting your score. They provide strategies to address these issues. Programs may include secured credit cards or loans. They help you establish positive credit habits.

Who Should Consider Credit Rebuilding Programs?

Individuals with poor or damaged credit should consider these programs. They are ideal for those struggling to secure loans. They benefit anyone wanting to improve their financial health.

Are Credit Rebuilding Programs Effective?

Yes, credit rebuilding programs can be effective. They offer structured plans and professional advice. Many people see significant improvements in their credit scores. Commitment and responsible financial behavior are essential for success.

Conclusion

Credit rebuilding programs offer a lifeline for financial recovery. They provide structured plans to improve credit scores. FairFigure Capital Card stands out in this space. It offers same-day funding and real-time credit monitoring. It helps businesses build and monitor credit effectively. FairFigure’s platform ensures secure data protection. Interested in rebuilding your business credit? Discover more at FairFigure. Start your journey towards better credit today!