Credit Rebuilding Programs: Transform Your Financial Future Today

Credit rebuilding programs can help improve your financial health. They offer structured ways to enhance your credit score.

Many people struggle with bad credit. It can affect your ability to get loans, rent an apartment, or even get a job. Rebuilding your credit is essential for financial freedom. Credit rebuilding programs are designed to help you step by step. They provide tools, resources, and support to repair your credit history. These programs can guide you through paying off debts, managing credit cards, and understanding credit reports. With dedication and the right program, you can rebuild your credit and take control of your financial future. For those starting a business, having good credit is crucial. Tools like Firstbase can further streamline your journey to financial stability and business success.

Introduction To Credit Rebuilding Programs

Credit rebuilding programs are essential for individuals who need to improve their credit scores. These programs offer various tools and strategies to help you achieve better credit health. This introduction will explore what credit rebuilding programs are and why rebuilding your credit is important.

What Are Credit Rebuilding Programs?

Credit rebuilding programs are structured plans designed to help individuals improve their credit scores. They often include:

- Credit counseling

- Debt management plans

- Secured credit cards

- Credit monitoring services

These programs guide you through the process of managing your debts and making timely payments. They also provide education on financial management and responsible credit use.

The Importance Of Rebuilding Your Credit

Rebuilding your credit is crucial for several reasons:

- Loan Approval: Better credit scores increase your chances of getting approved for loans.

- Lower Interest Rates: Good credit can lead to lower interest rates on loans and credit cards.

- Employment Opportunities: Some employers check credit scores as part of their hiring process.

- Rental Applications: Landlords may check credit scores when deciding to rent a property.

Maintaining a healthy credit score opens up more financial opportunities and can save you money in the long run.

Key Features Of Credit Rebuilding Programs

Credit rebuilding programs offer several features to help improve your credit score. These features are designed to assist you in managing your finances better, monitoring your credit, and providing the tools you need to rebuild your credit profile. Understanding these key features can help you make an informed decision about which credit rebuilding program is right for you.

Credit Monitoring Services

Credit monitoring services are essential in a credit rebuilding program. These services provide regular updates on your credit report, alerting you to any changes. This helps you stay informed about your credit activities and detect any fraudulent activities early. Regular monitoring can show you the impact of your financial habits on your credit score, allowing you to make necessary adjustments.

Personalized Financial Coaching

Personalized financial coaching is another critical feature. A financial coach provides one-on-one guidance tailored to your specific financial situation. They help you develop a budget, manage your debts, and create a plan to improve your credit score. This personalized approach ensures that you receive advice and strategies that are relevant to your financial circumstances, increasing your chances of success in rebuilding your credit.

Secured Credit Cards

Secured credit cards are a practical tool in credit rebuilding programs. Unlike regular credit cards, secured credit cards require a security deposit, which serves as your credit limit. Using a secured credit card responsibly can help you build or rebuild your credit history. Payments are reported to the credit bureaus, and timely payments can positively impact your credit score.

Debt Management Plans

Debt management plans (DMPs) are designed to help you manage and reduce your debts. A DMP consolidates your debts into one monthly payment, which is then distributed to your creditors. This can simplify your payment process and help you avoid missed payments. Additionally, DMPs often come with lower interest rates and waived fees, making it easier to pay off your debts and improve your credit score.

Overall, these key features of credit rebuilding programs work together to provide a comprehensive approach to improving your credit health. Whether through monitoring services, personalized coaching, secured credit cards, or debt management plans, these tools can help you take control of your financial future.

How Each Feature Benefits You

Credit rebuilding programs offer several key features that help improve your credit score. Each feature has specific benefits designed to guide you on your credit journey. Below, we discuss the advantages of these features in detail.

How Credit Monitoring Helps You Stay On Track

Credit monitoring keeps you updated on your credit status. This feature alerts you to any changes in your credit report. You can catch errors or fraud early, preventing bigger issues. Regular updates help you understand how your actions impact your credit score.

Benefits of credit monitoring include:

- Immediate alerts for suspicious activities.

- Monthly updates on your credit score.

- Access to your credit report.

The Value Of Personalized Financial Coaching

Personalized financial coaching provides tailored advice to improve your credit. A financial coach helps you set realistic financial goals. They offer strategies specific to your situation. This guidance can help you make informed decisions.

Key benefits of financial coaching:

- Customized plans to improve your credit score.

- Expert advice on managing finances.

- Support in setting and achieving financial goals.

Building Credit With Secured Credit Cards

Secured credit cards are an effective tool for rebuilding credit. They require a security deposit, which acts as your credit limit. Using a secured card responsibly can improve your credit score over time. It’s a safe way to build credit without the risk of high debt.

Advantages of secured credit cards:

- Helps establish or rebuild credit.

- Low risk of overspending.

- Reports to major credit bureaus.

Managing Debt Effectively With Debt Management Plans

Debt management plans (DMPs) offer structured ways to pay off debt. A credit counselor works with your creditors to lower interest rates. DMPs consolidate your debts into one manageable payment. This simplifies your finances and helps you get out of debt faster.

Benefits of debt management plans:

- Lower interest rates.

- Single monthly payment.

- Professional support in managing debt.

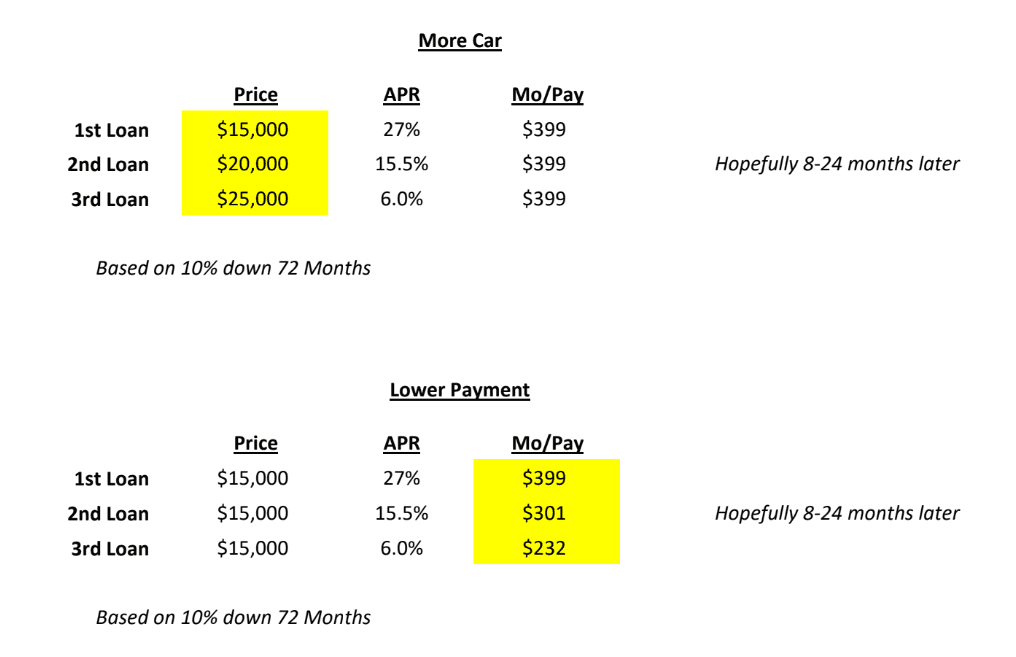

Pricing And Affordability

Credit rebuilding programs can be a crucial step for improving your financial health. Understanding the costs and affordability of these programs is essential. This section will explore the pricing details of credit rebuilding programs, compare different options available, and suggest affordable alternatives.

Cost Of Credit Rebuilding Programs

The cost of credit rebuilding programs varies widely depending on the services offered. Some programs provide basic services at a lower price, while others offer comprehensive packages that may be more expensive. It’s important to evaluate what each program includes to ensure it meets your specific needs.

| Program | Basic Services | Comprehensive Services |

|---|---|---|

| Program A | $50/month | $200/month |

| Program B | $30/month | $150/month |

| Program C | $40/month | $180/month |

It’s clear that basic services are more affordable but may not cover all your needs. Comprehensive services, although pricier, often provide a more thorough approach to credit rebuilding.

Comparing Different Program Options

When comparing different credit rebuilding programs, consider the following factors:

- Services Included: Does the program offer credit monitoring, dispute services, or financial counseling?

- Customer Support: Is customer support available 24/7? Are they responsive?

- Success Rate: What is the program’s track record? Do they have positive testimonials?

- Additional Perks: Are there any added benefits like discounts on other financial services?

By evaluating these factors, you can choose a program that offers the best value for your money.

Affordable Alternatives

If the cost of credit rebuilding programs is a concern, there are affordable alternatives to consider. Here are a few options:

- DIY Credit Repair: Educate yourself on credit repair and dispute errors on your credit report.

- Non-Profit Credit Counseling: Seek help from non-profit organizations that offer free or low-cost credit counseling services.

- Secured Credit Cards: Use secured credit cards to build credit. These require a deposit but can help improve your credit score.

- Budgeting Tools: Utilize free budgeting tools and apps to manage finances and avoid further debt.

These alternatives can be effective and cost-efficient ways to rebuild your credit without spending a lot of money.

Pros And Cons Based On Real-world Usage

Credit rebuilding programs offer a structured way to improve your credit score. These programs can make a difference in your financial health. Understanding their benefits and limitations is crucial.

Advantages Of Using Credit Rebuilding Programs

There are several advantages to using credit rebuilding programs:

- Structured Plans: These programs provide a clear roadmap to improving credit scores.

- Professional Guidance: Access to financial experts who can offer advice tailored to individual needs.

- Credit Monitoring: Regular updates on credit scores and changes, helping users stay informed.

- Debt Management: Assistance in managing and consolidating debt, making repayment more manageable.

- Positive Impact: Successful completion can lead to significant improvements in credit scores.

Potential Drawbacks To Consider

While beneficial, there are potential drawbacks to consider:

- Costs: These programs may come with fees that can add up over time.

- Time-Consuming: Rebuilding credit is a gradual process and requires patience and consistency.

- Limited Scope: Some programs may not address all aspects of financial health.

- Dependency: Over-reliance on programs may hinder the development of personal financial management skills.

Weighing these pros and cons can help determine if a credit rebuilding program is the right choice for you. Make an informed decision to improve your financial future.

Specific Recommendations For Ideal Users

Credit rebuilding programs can help many individuals improve their credit scores. These programs offer tailored solutions to repair and strengthen credit profiles. Understanding who can benefit the most and the situations where these programs are most effective is essential.

Who Can Benefit The Most From Credit Rebuilding Programs?

Credit rebuilding programs are designed for those with poor or damaged credit. Here are some specific groups who can benefit:

- Individuals with a history of late payments: Consistently missing payment deadlines can damage credit scores.

- People with high credit utilization rates: Maxing out credit cards can significantly lower scores.

- Those who have defaulted on loans: Defaulting on loans affects creditworthiness and future loan approvals.

- Individuals with a limited credit history: Limited credit data can make it hard to obtain new credit.

Situations Where Credit Rebuilding Programs Are Most Effective

Credit rebuilding programs work best in specific situations where traditional credit solutions may not be as effective:

- Post-Bankruptcy: After bankruptcy, rebuilding credit is crucial. These programs help establish new, positive credit accounts.

- After Defaulting on Loans: Programs can assist in negotiating payoffs or settlements to improve credit scores.

- Following Identity Theft: Identity theft can devastate credit. Rebuilding programs help dispute fraudulent charges and restore credit.

- During Credit Counseling: Credit rebuilding programs can complement credit counseling efforts, providing structured plans to improve scores.

Frequently Asked Questions

What Are Credit Rebuilding Programs?

Credit rebuilding programs are designed to help individuals improve their credit scores. They typically offer tools, education, and resources.

How Do Credit Rebuilding Programs Work?

These programs provide strategies and support to manage debts and build positive credit history. They may include secured credit cards.

Who Should Consider Credit Rebuilding Programs?

Anyone with poor or damaged credit should consider these programs. They can help improve creditworthiness over time.

Are Credit Rebuilding Programs Effective?

Yes, if followed diligently, these programs can significantly improve credit scores. They require consistent effort and responsible financial behavior.

Conclusion

Credit rebuilding programs offer a path to better financial health. They help improve credit scores through structured plans. Many tools and services simplify this process. One such tool is Firstbase. It supports business growth with services like incorporation and accounting. Consider exploring Firstbase for efficient credit rebuilding. To learn more, visit Firstbase.io. Starting your journey to a better credit score today can lead to a brighter financial future.