Credit Monitoring: Protect Your Finances and Identity Today

Credit monitoring is crucial for protecting your financial health. It helps you keep track of your credit score and report.

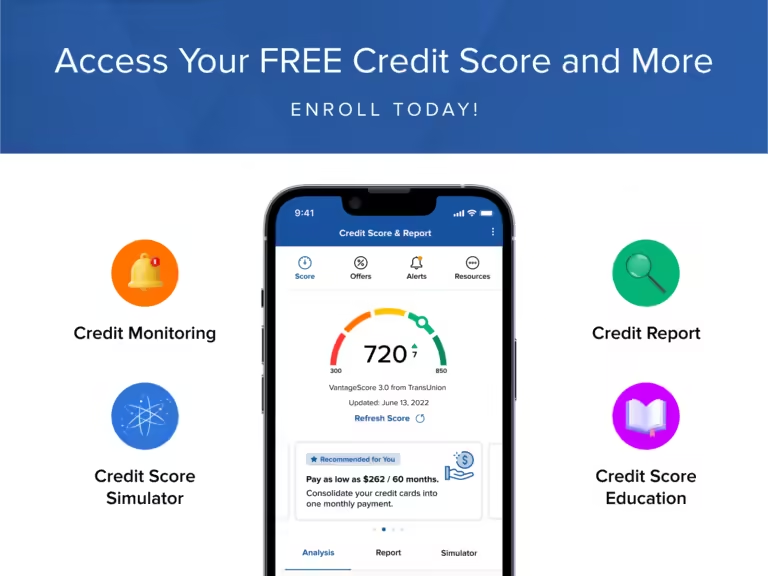

In today’s digital age, your credit score impacts many aspects of life. From getting a loan to renting an apartment, your credit score matters. Credit monitoring services provide real-time updates on your credit activity. They alert you to potential fraud or identity theft. This proactive approach can save you from financial headaches. By staying informed, you can take steps to improve your credit score. Whether it’s correcting errors or managing debt, credit monitoring is key. With tools like Personal Loans, you can access credit monitoring and more. It’s a smart move for anyone looking to safeguard their financial future.

Introduction To Credit Monitoring

Understanding and managing your credit is essential in today’s financial world. Credit monitoring plays a crucial role in this process. It helps you keep track of your credit activity and ensures you stay informed about any changes. Let’s dive into what credit monitoring is and why it’s important.

What Is Credit Monitoring?

Credit monitoring is a service that tracks your credit reports from major credit bureaus. It alerts you to any significant changes or suspicious activities. This can include new accounts opened in your name, changes to your credit score, and more.

With credit monitoring, you can quickly detect potential fraud or identity theft. It offers peace of mind by keeping you informed about your credit status.

The Importance Of Credit Monitoring

Monitoring your credit is vital for several reasons:

- Fraud Prevention: Early detection of suspicious activities can prevent identity theft.

- Credit Score Management: Stay updated on your credit score and understand the factors affecting it.

- Financial Planning: Helps in planning for loans or credit by knowing your creditworthiness.

In addition, many lenders and financial institutions consider your credit history when making decisions. Keeping a close eye on your credit can help you secure better loan terms and interest rates.

Services like Personal Loans® offer credit monitoring as part of their suite of financial tools. This can be an invaluable resource for anyone looking to maintain a healthy credit profile.

Key Features Of Credit Monitoring Services

Credit monitoring services provide essential tools to help you keep track of your credit health. These services offer real-time alerts, credit score tracking, identity theft protection, and access to updated credit reports. Below, we explore each feature in detail.

Real-time Alerts

Real-time alerts notify you of any changes to your credit report. These alerts can include new account openings, credit inquiries, or changes in your credit limits. Staying informed helps you respond quickly to any suspicious activity, reducing the risk of fraud.

Credit Score Tracking

Credit score tracking allows you to monitor your credit score regularly. Many credit monitoring services provide monthly or even daily updates. Knowing your credit score helps you understand your financial health and make informed decisions.

Identity Theft Protection

Identity theft protection is a crucial feature of credit monitoring services. It includes monitoring for suspicious activity and offering assistance if your identity is stolen. Some services also provide insurance to cover any losses due to identity theft.

Report Access And Updates

Credit monitoring services offer access to your credit reports from major bureaus. You can view and download your reports anytime. Regular updates ensure that you always have the latest information on your credit history.

By utilizing these features, you can better manage your credit and protect your financial future. For more information on credit monitoring, visit Personal Loans®.

Pricing And Affordability

Understanding the pricing and affordability of credit monitoring services is crucial. Whether you’re looking for free or paid options, knowing the cost breakdown can help you make an informed decision.

Free Vs Paid Credit Monitoring Services

Credit monitoring services generally fall into two categories: free and paid. Free services offer basic features, which can be sufficient for some users. Paid services, on the other hand, provide more comprehensive monitoring and alerts.

- Free Services: Limited features, basic alerts, and often supported by ads.

- Paid Services: Extensive features, real-time alerts, identity theft insurance, and customer support.

Choosing between free and paid services depends on your individual needs and budget. Free services are good for casual monitoring, while paid services offer more robust protection.

Cost Breakdown Of Popular Services

Let’s look at the cost breakdown of some popular credit monitoring services:

| Service | Monthly Cost | Key Features |

|---|---|---|

| PersonalLoans.com | Free | Basic monitoring, alerts, secure data encryption |

| Credit Karma | Free | Score updates, credit report insights, personalized recommendations |

| Experian CreditWorks | $24.99 | Daily credit report updates, FICO scores, identity theft insurance |

| Identity Guard | $19.99 | Dark web monitoring, risk management reports, $1M insurance |

| MyFICO | $29.95 | FICO scores, alerts, credit report updates, identity theft monitoring |

As seen in the table, free services like PersonalLoans.com and Credit Karma offer basic monitoring features without any cost. Paid services like Experian CreditWorks and MyFICO provide advanced features and comprehensive monitoring, but at a higher monthly cost.

Ultimately, the best choice depends on your specific needs and how much you are willing to spend on credit monitoring services.

Pros And Cons Of Credit Monitoring

Credit monitoring services help you keep track of your credit reports and alerts you to any changes. This can be very beneficial in many ways, but there are also some drawbacks to consider.

Advantages Of Using Credit Monitoring

- Early Fraud Detection: Credit monitoring alerts you to suspicious activities. This helps in detecting identity theft early.

- Improved Credit Management: Regular updates on your credit status can help in managing your credit better. You can make informed financial decisions.

- Peace of Mind: Knowing your credit is being monitored can reduce stress. It provides a sense of security.

- Access to Credit Reports: Many credit monitoring services provide regular access to your credit reports. This makes it easier to spot any errors.

Potential Drawbacks

- Cost: Many credit monitoring services charge a monthly fee. This can add up over time.

- False Sense of Security: Relying solely on credit monitoring might lead to complacency. It’s important to stay vigilant.

- Limited Protection: Credit monitoring doesn’t prevent identity theft. It only alerts you after the fact.

- Privacy Concerns: Sharing personal information with monitoring services can be a concern. Ensure the service has strong data protection measures.

Recommendations For Ideal Users

Credit monitoring can benefit various individuals by providing essential insights into their credit health. It offers timely alerts, protecting against fraud and helping maintain a good credit score. But who should use these services, and what are the best scenarios for leveraging them? Let’s explore.

Who Should Use Credit Monitoring?

Credit monitoring is ideal for several types of users:

- Individuals with existing loans: Keeping track of your credit can help manage existing debts and plan for future financial needs.

- Frequent credit card users: Regular monitoring can prevent overspending and maintain a good credit score.

- People planning major purchases: Whether buying a home or car, understanding your credit health is crucial for securing favorable loan terms.

- Identity theft victims: Monitoring services offer alerts to suspicious activities, helping detect and prevent fraud.

- Students and young professionals: Establishing good credit early on is vital for future financial stability.

Best Scenarios For Using Credit Monitoring Services

Credit monitoring services are beneficial in various scenarios:

| Scenario | Benefits |

|---|---|

| Applying for a loan | Ensures your credit report is accurate and helps you get better loan terms. |

| Managing multiple credit cards | Helps you keep track of balances, payments, and potential fraud. |

| Recovering from identity theft | Provides alerts to detect unauthorized transactions and activities. |

| Rebuilding credit | Monitors your progress and guides you on improving your credit score. |

In conclusion, credit monitoring services, like those offered by PersonalLoans.com, can be a valuable tool in managing and protecting your financial health. By understanding who should use these services and the best scenarios for their use, you can make informed decisions to secure your financial future.

Frequently Asked Questions

What Is Credit Monitoring?

Credit monitoring is a service that tracks your credit report and alerts you to changes.

Why Is Credit Monitoring Important?

Credit monitoring helps protect against identity theft by notifying you of suspicious activity on your credit report.

How Does Credit Monitoring Work?

Credit monitoring services regularly check your credit reports and send alerts for any changes or suspicious activities.

Can Credit Monitoring Improve My Credit Score?

Credit monitoring itself doesn’t improve your credit score, but it helps you stay informed and take action if needed.

Conclusion

Credit monitoring is essential for financial health and security. Regular checks help spot fraud early. A good credit score opens many financial doors. For a comprehensive financial solution, consider Personal Loans®. They offer competitive rates and fast funding. Monitor your credit and make informed choices. Stay proactive and protect your financial future.