Credit Management Tools: Boost Your Financial Health Today

Navigating finances can be challenging. Credit management tools make it easier.

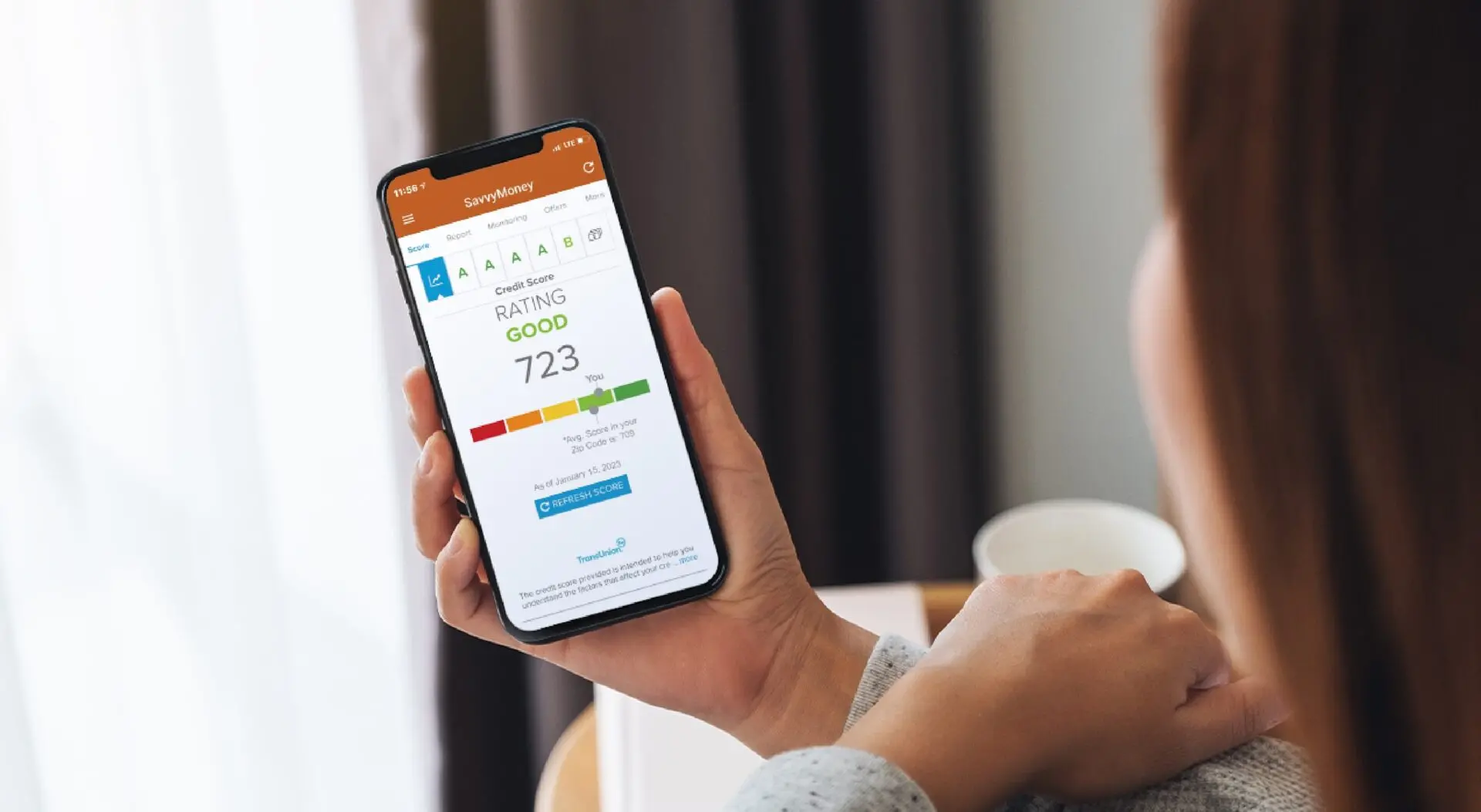

They help keep track of your spending, manage debts, and improve your credit score. Understanding and using these tools can transform how you handle your finances. They provide insights into your spending habits, help you stay on top of payments, and even assist in boosting your credit profile. With features like free credit score access and spending tracking, these tools are essential for anyone looking to take control of their financial health. Whether you’re rebuilding your credit score or simply looking for better financial management, tools like Zable UK offer comprehensive solutions. Ready to explore the benefits? Learn more about Zable UK’s credit card and personal loans here.

Introduction To Credit Management Tools

Credit management tools are essential for maintaining and improving your financial health. They help you track spending, manage debts, and enhance your credit score. One such effective tool is the Zable Credit Card and Personal Loans offered by Zable UK. These tools provide various features to help individuals build or improve their credit profiles efficiently.

Understanding The Purpose Of Credit Management Tools

Credit management tools serve a crucial role in personal finance. They help individuals keep track of their credit card usage, monitor spending patterns, and ensure timely payments. This aids in maintaining a good credit score.

| Feature | Description |

|---|---|

| Credit Card | Helps build credit score with timely payments and spending limits. |

| Personal Loans | Quick approvals, leveraging banking history to improve approval odds. |

| Spending Tracking | Provides insights into financial outflows and helps manage budget. |

| Free Credit Score Access | Access to Equifax credit score for free. |

Importance Of Credit Management In Financial Health

Effective credit management is vital for maintaining financial stability. It ensures that you do not exceed your credit limits, which can negatively impact your credit score. Tools like Zable Credit Card and Personal Loans help you stay on top of your finances.

Here are some key benefits:

- Easy online application process: Simplifies the process of applying for credit cards and loans.

- No impact on credit score: Checking eligibility does not affect your credit score.

- Virtual card usage: Enables immediate spending through Apple Pay or Google Pay.

- Financial tracking: Offers comprehensive insights into your spending via the Zable App.

Using credit management tools like those offered by Zable can help you build and improve your credit score while managing your finances more effectively.

For more information, visit the Zable website or download the Zable App.

Key Features Of Credit Management Tools

Credit management tools provide essential features to help you take control of your financial health. These tools offer various functionalities, such as monitoring credit scores, analyzing credit reports, tracking debt, assisting with budgeting, and sending alerts and notifications. Let’s dive into the key features of these tools and how they can benefit you.

Credit Score Monitoring: Stay Updated On Your Financial Standing

With credit score monitoring, you can stay updated on your financial standing. Tools like Zable offer free access to your Equifax credit score. This feature helps you track any changes in your score, ensuring you are always aware of your credit health. Regular monitoring can help you make informed decisions and take steps to improve your credit score.

Credit Report Analysis: Gain Insights Into Your Credit Profile

Credit report analysis provides detailed insights into your credit profile. This feature helps you understand the factors affecting your credit score. Zable’s credit report analysis can highlight areas where you need improvement, such as timely payments or reducing credit utilization. By understanding your credit report, you can take targeted actions to enhance your credit profile.

Debt Tracking: Manage And Reduce Your Liabilities

Debt tracking is crucial for managing and reducing your liabilities. Credit management tools like Zable offer spending tracking, allowing you to see where your money is going. By tracking your debt, you can create a plan to pay off loans and credit card balances. This feature helps you stay on top of your financial obligations and work towards becoming debt-free.

Budgeting Assistance: Plan And Control Your Spending

Effective budgeting is key to financial stability. Zable provides budgeting assistance to help you plan and control your spending. With this feature, you can set spending limits and allocate funds to different categories. Budgeting tools can help you avoid overspending and save money for future goals.

Alerts And Notifications: Never Miss Important Updates

Alerts and notifications ensure you never miss important updates. Credit management tools like Zable send alerts for due payments, credit score changes, and suspicious activities. These notifications help you stay proactive and take immediate action when needed. This feature adds an extra layer of security to your financial management.

Pricing And Affordability

Understanding the pricing and affordability of credit management tools is essential for making informed financial decisions. Zable UK offers both free and paid tools, each with its own set of features. Let’s explore what you get at each level and whether the investment is worth it.

Free Vs. Paid Tools: What You Get At Each Level

Free Tools:

- Free Equifax credit score access: Monitor your credit score without any cost.

- Spending tracking: Understand your financial outflows and manage your budget effectively.

- Eligibility check: Check your eligibility for credit cards and loans without affecting your credit score.

- Credit Card: Helps build your credit score with timely payments and staying within the credit limit. Representative APR: 48.9% (variable).

- Personal Loans: Quick loan approval, often within an hour. Loans range from £1,000 to £25,000 over 1-5 years with a representative APR of 32.5%.

- Virtual Card: Instant spending with a virtual card through Apple Pay or Google Pay, if eligible.

- Rent Reporting: Build your credit history without needing a mortgage or loan.

Cost-benefit Analysis: Is It Worth The Investment?

To determine if investing in Zable’s paid tools is worth it, let’s break down the costs and benefits:

| Feature | Cost | Benefit |

|---|---|---|

| Credit Card | 48.9% APR (variable) | Builds credit score, convenient virtual card usage |

| Personal Loans | 32.5% APR (example) | Quick approval, flexible loan amounts, boosts approval odds |

| Free Tools | No cost | Monitor credit score, track spending, eligibility check |

Benefits of Paid Tools:

- Credit Building: Timely payments on credit cards and loans enhance your credit profile.

- Immediate Access: Virtual card allows for instant spending.

- Flexible Financing: Personal loans provide quick access to funds with customizable terms.

Pros And Cons Of Credit Management Tools

Credit management tools can be a valuable asset for individuals looking to improve their financial health. These tools offer various features that help users manage their credit scores, track spending, and enhance their overall financial awareness. In this section, we will explore the advantages and drawbacks of using credit management tools.

Advantages: Enhanced Financial Awareness And Control

Using credit management tools like Zable UK offers several benefits:

- Free Credit Score Access: Users can monitor their credit score without any cost, aiding in better financial planning.

- Spending Tracking: Zable provides spending tracking features, helping users understand their financial outflows and manage their budget effectively.

- Rent Reporting: This service helps build credit history for those without a mortgage or loan.

- Instant Spending with Virtual Card: Users can use the virtual card for immediate purchases through Apple Pay or Google Pay, adding convenience.

- Boosted Approval Odds: Using banking history, Zable can increase approval chances by up to 35% for both credit cards and personal loans.

Drawbacks: Potential Limitations And Costs

While credit management tools offer many benefits, there are some potential drawbacks:

- High APR: Zable’s credit card has a representative APR of 48.9% (variable), which can be costly if balances are not paid off monthly.

- Personal Loan Costs: The APR for personal loans ranges from 9.9% to 49.9%, which can be expensive depending on the amount borrowed and loan term.

- Eligibility Impact: Although checking eligibility does not affect the credit score, actual credit applications can impact the score.

Understanding both the benefits and limitations of credit management tools is crucial for making informed financial decisions. Zable UK offers a range of features that can aid in credit score improvement and financial management, but users should be mindful of the associated costs and potential impacts on their credit.

Recommendations For Ideal Users

Choosing the right credit management tool is crucial for improving financial health. Different users have distinct needs based on their financial situations. Here are some recommendations for ideal users, categorized to help you find the best fit.

Best Tools For Individuals With Poor Credit Scores

Individuals with poor credit scores need tools that focus on credit building. Zable Credit Card is an excellent option. This card helps users build their credit score by making timely payments and staying within the credit limit.

- Representative APR: 48.9% (variable)

- Free access to Equifax credit score

- Spending tracking to monitor financial outflows

- Rent reporting to build credit history

The Zable Credit Card also offers an easy online application process, and checking eligibility does not affect your credit score. This card is designed to help you improve your credit score efficiently.

Top Picks For Small Business Owners

Small business owners need tools that offer quick access to funds and help manage business expenses. Zable Personal Loans are ideal for this purpose. These loans provide quick approval, often within an hour, and use banking history to boost approval odds by up to 35%.

| Loan Amount | Term | Representative APR |

|---|---|---|

| £1,000 to £25,000 | 1 to 5 years | 32.5% |

The loans are available at competitive rates and can be used to manage business expenses, invest in growth, or cover unexpected costs. The application process is straightforward, with no impact on your credit score when checking eligibility.

Most Suitable Options For Young Adults And Students

Young adults and students need tools that help them understand and manage their finances. The Zable App offers comprehensive financial tracking and insights, making it a suitable option.

- Instant spending with a virtual card through Apple Pay or Google Pay

- Free Equifax credit score access

- Spending tracking to understand financial outflows

- Rent reporting to build credit history

These features help young adults and students develop good financial habits, track their spending, and build their credit history. The Zable App is user-friendly and provides valuable insights into their financial health.

Frequently Asked Questions

What Are Credit Management Tools?

Credit management tools are software or methods that help individuals or businesses manage their credit. They monitor credit scores, track debt, and provide financial planning.

How Do Credit Management Tools Work?

Credit management tools gather financial data, analyze credit health, and provide actionable insights. They help users make informed decisions about credit and debt.

Why Are Credit Management Tools Important?

Credit management tools are important because they help maintain good credit health. They offer guidance on improving credit scores and managing debt effectively.

Can Credit Management Tools Improve My Credit Score?

Yes, credit management tools can improve your credit score. They offer personalized recommendations and strategies to boost your credit health.

Conclusion

Credit management tools streamline financial planning. They assist in tracking expenses. Effective tools enhance credit scores. Zable UK offers a powerful solution for this. Their credit cards and personal loans help build credit. They offer free credit score access. Spending tracking and rent reporting are included. Easy application with no impact on credit score. Visit Zable UK for more details.