Credit Management App: Transform Your Finances Today

Managing your credit can be overwhelming. But there’s a way to make it simple and effective.

Introducing Credit Sesame, a free service that helps you monitor and improve your credit scores. Credit Sesame offers daily updates on your credit score, personalized actions to boost your credit health, and tailored offers based on your credit profile. This app provides a comprehensive solution for anyone looking to keep their credit in check. With features like the Sesame Grade, which gives you a letter grade based on the five major credit factors, and the Credit Builder tool, you have everything you need in one place. Plus, its strong security measures ensure your data is safe. Explore more about Credit Sesame and take control of your credit today by visiting Credit Sesame.

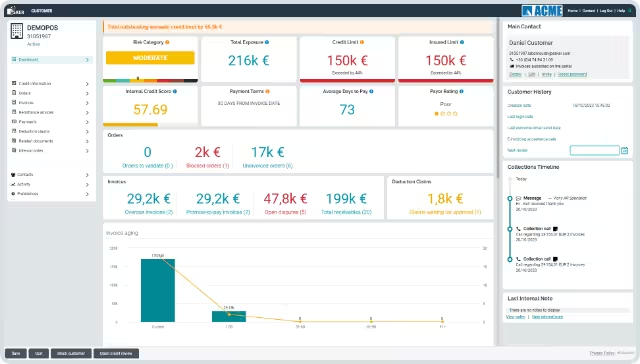

Introduction To Credit Management App

Managing credit can feel overwhelming. A credit management app like Credit Sesame simplifies the process. It provides tools to monitor and improve your credit health. This section introduces Credit Sesame, a free service offering daily credit score updates and personalized actions to help you achieve financial goals.

Purpose And Overview

Credit Sesame’s primary purpose is to help users understand and improve their credit scores. The app offers several features that make credit management easier:

- Daily Credit Score Updates: Keep track of your credit score and changes daily.

- Sesame Grade: A letter grade system based on the five major factors impacting your credit score.

- Personalized Actions: Get recommendations to boost your credit score.

- Tailored Offers: Receive credit product offers suited to your credit profile.

- Credit Builder: Use everyday purchases to build credit with a virtual secured credit card linked to a prepaid debit card.

Credit Sesame ensures the security of your data with 256-bit encryption and does not sell your personal information to third parties.

Importance Of Credit Management

Effective credit management is crucial for financial stability. Here are some reasons why:

- Free Credit Monitoring: Access credit scores and reports without any cost.

- Improved Credit Health: Utilize tools and actions to enhance your credit score.

- Convenience: Manage all credit-related needs in one place, including credit cards, home loans, auto loans, and credit help.

- Confidence in Applications: Increase your chances of approval for credit products.

- Credit Building: Build credit without a credit check or security deposit.

Credit Sesame helps users take control of their credit health, leading to better financial opportunities. The app’s features and benefits make it a valuable tool for anyone looking to improve their credit score and achieve financial goals.

| Feature | Benefit |

|---|---|

| Daily Credit Score Updates | Track changes to your credit score daily. |

| Personalized Actions | Receive recommendations to improve your credit health. |

| Tailored Offers | Get credit product offers suited to your profile. |

| Credit Builder | Build credit using everyday purchases. |

Credit Sesame offers a comprehensive approach to credit management. With its user-friendly features and secure platform, it is an excellent choice for anyone looking to monitor and improve their credit score.

Key Features Of Credit Management App

Credit Sesame is a powerful credit management tool that helps users monitor and improve their credit scores. Here are the key features that make it an essential app for managing your finances:

Credit Score Monitoring

Credit Sesame offers daily credit score updates, so users can check their score every day. This feature helps you stay informed about any changes in your credit score. The app uses data from TransUnion to ensure accurate and up-to-date information.

Personalized Financial Insights

The app provides personalized actions to help improve your credit score. These recommendations are based on your unique credit profile. The Sesame Grade system offers a letter grade based on the five major factors affecting your credit score. This helps you understand where you stand and what you need to focus on.

Bill Payment Reminders

Credit Sesame includes bill payment reminders to help you avoid late payments. This feature ensures you stay on top of your bills, which is crucial for maintaining a good credit score. Timely payments are a significant factor in your credit health.

Spending Analysis And Budgeting Tools

The app offers spending analysis and budgeting tools to help you manage your finances better. These tools allow you to track your spending habits and create a budget that aligns with your financial goals. Understanding where your money goes is the first step towards better financial management.

Credit Report Dispute Assistance

Credit Sesame provides credit report dispute assistance. If you find errors in your credit report, the app guides you through the process of disputing them. This service helps ensure your credit report is accurate, which can positively impact your credit score.

| Feature | Benefit |

|---|---|

| Daily Credit Score Updates | Stay informed about changes in your credit score. |

| Personalized Actions | Receive tailored recommendations to improve your credit. |

| Bill Payment Reminders | Avoid late payments and maintain a good credit score. |

| Spending Analysis & Budgeting | Track spending and create a budget that works for you. |

| Credit Report Dispute Assistance | Fix errors in your credit report easily. |

How Each Feature Benefits Users

Credit Sesame offers a variety of features aimed at helping users manage their credit effectively. Each feature provides distinct benefits, contributing to overall financial well-being. Below, we explore how these features impact users.

Improving Credit Scores

Credit Sesame provides daily credit score updates which allow users to monitor their credit health closely. With the Sesame Grade system, users receive a clear understanding of the factors affecting their credit score. Personalized actions are recommended to help improve credit scores, making it easier to achieve financial goals.

- Daily updates keep users informed.

- Sesame Grade offers a simplified view of credit factors.

- Personalized actions guide users towards better credit health.

Gaining Control Over Finances

Credit Sesame provides tools to manage all credit-related needs in one place. This convenience allows users to stay on top of their finances without juggling multiple platforms. The credit builder feature lets users build credit using everyday purchases, linking a virtual secured credit card to a prepaid debit card.

Key benefits include:

- All credit needs managed in one platform.

- Opportunity to build credit without a credit check.

- Virtual secured credit card linked to prepaid debit card.

Avoiding Late Payments

By providing daily updates and personalized recommendations, Credit Sesame helps users stay aware of their financial obligations. This awareness reduces the risk of missing payments, which can negatively impact credit scores.

Benefits of avoiding late payments:

- Maintains a healthy credit score.

- Avoids late payment fees.

- Reduces stress associated with financial management.

Understanding Spending Habits

Credit Sesame’s tools provide insights into spending habits, helping users make informed decisions. By understanding where their money goes, users can adjust their spending patterns to improve their financial situation.

Benefits of understanding spending habits:

- Better financial planning.

- Increased savings potential.

- Improved budget management.

Correcting Credit Report Errors

Credit Sesame users can monitor their credit reports regularly, identifying and correcting errors promptly. This proactive approach ensures that users’ credit scores accurately reflect their financial behavior.

Key benefits of correcting credit report errors:

- Ensures accurate credit scores.

- Avoids potential issues with credit applications.

- Maintains a trustworthy credit profile.

Credit Sesame’s features offer comprehensive support for users looking to enhance their credit health and financial stability. Visit Credit Sesame to learn more.

Pricing And Affordability

Choosing the right credit management app can be a game-changer for your financial health. One of the critical factors to consider is the pricing and affordability of the app. Credit Sesame offers various pricing options to cater to different needs, making it accessible to a broad audience. Let’s dive into the details.

Free Vs. Paid Versions

Credit Sesame provides a free service that includes essential features such as daily credit score updates, personalized actions to improve your credit health, and tailored offers based on your credit profile. This free version is ideal for users who want to monitor their credit without incurring any costs.

For those who need more advanced features, Credit Sesame offers Sesame Cash. While the basic service is free, Sesame Cash comes with additional functionalities. It has a $9.99 monthly fee, which can be waived if you meet specific conditions like a $500 direct deposit or $1,000 monthly spending. There is also a $3 monthly inactivity fee, waived with at least one transaction every 30 days.

Cost-benefit Analysis

Understanding the benefits of each pricing tier helps in making an informed decision. Here is a quick overview:

| Feature | Free Version | Paid Version (Sesame Cash) |

|---|---|---|

| Daily Credit Score Updates | ✔️ | ✔️ |

| Personalized Actions | ✔️ | ✔️ |

| Tailored Offers | ✔️ | ✔️ |

| Credit Builder | ❌ | ✔️ |

| Monthly Fee | Free | $9.99 (waived with conditions) |

| Inactivity Fee | Free | $3 (waived with activity) |

While the free version covers basic credit monitoring needs, the paid version adds value with the Credit Builder feature and other advanced tools. This can be particularly beneficial for users looking to build or improve their credit score actively.

Special Offers And Discounts

Credit Sesame occasionally provides special offers and discounts to enhance affordability. For instance, there are no fees for the first 30 days of account opening. This allows users to explore the features without any initial cost.

Additionally, users can avoid the $9.99 monthly fee by meeting specific conditions, such as a $500 direct deposit or $1,000 monthly spending. This flexibility makes it easier for users to benefit from the premium features without financial strain.

Always check the Credit Sesame website for the latest offers and terms to maximize your savings and make the most out of the service.

Pros And Cons Based On Real-world Usage

Credit Sesame provides a range of features designed to help users manage and improve their credit scores. Based on real-world usage, this section will explore the pros and cons of the app through different aspects such as the user interface, financial tools, limitations, and customer support.

User-friendly Interface

Many users appreciate the intuitive design of Credit Sesame. The interface is straightforward, making it easy for users to navigate through various features.

- Simple Navigation: Users can quickly access credit scores and reports.

- Clear Layout: The dashboard presents information in an organized manner.

- Ease of Use: Even those with limited tech skills can use the app efficiently.

Comprehensive Financial Tools

Credit Sesame offers a variety of tools to help users manage their credit health.

| Feature | Benefit |

|---|---|

| Daily Credit Score Updates | Monitor any changes to your credit score each day. |

| Sesame Grade | Understand your credit standing with a simple letter grade. |

| Personalized Actions | Get recommendations to improve your credit health. |

| Tailored Offers | Receive credit product offers based on your profile. |

Limitations And Drawbacks

Despite its benefits, Credit Sesame has some limitations.

- Inactivity Fees: A $3 monthly fee if there is no activity for 30 days.

- Service Fees: Additional charges for international and out-of-network transactions.

- Limited Provider Data: Only provides credit data from TransUnion.

These limitations can affect user experience, especially for those who travel often or prefer data from multiple credit bureaus.

Customer Support Experience

Customer support is an essential aspect of any service, and Credit Sesame offers several avenues for assistance.

- Help Center: Comprehensive FAQ section for common queries.

- Contact Options: Multiple ways to reach out to support.

- User Feedback: Most users report positive experiences with support staff.

Overall, the customer support experience is rated highly, contributing to the app’s overall user satisfaction.

Ideal Users And Scenarios

Credit Sesame is a comprehensive credit management app designed to serve a variety of users. Whether you are an individual looking to improve your credit health, a young professional managing finances, a family aiming for financial stability, or a small business owner, Credit Sesame offers tailored solutions for your needs.

Best For Individuals With Debt

Individuals with existing debt can benefit greatly from Credit Sesame. The app provides daily credit score updates and a unique Sesame Grade system. These features help users keep track of their credit health. Personalized actions and recommendations are tailored to help reduce debt and improve credit scores. It is an ideal tool for those who need guidance on managing their debt effectively.

Suitable For Young Professionals

Young professionals often face challenges in building and maintaining a good credit score. Credit Sesame offers tailored advice and tools to help them establish a solid credit foundation. The Credit Builder feature is particularly useful as it allows users to build credit using everyday purchases without a credit check or security deposit. This makes it easier for young professionals to enhance their credit scores and achieve financial goals.

Ideal For Families And Households

Managing finances as a family or household can be complex. Credit Sesame simplifies this process by providing a single platform for monitoring credit scores, managing credit cards, and planning for major expenses like home loans. The app’s personalized actions and tailored offers ensure that families can find the best financial products suited to their needs. This helps in achieving financial stability and confidence in financial decisions.

Use Cases For Small Business Owners

Small business owners can utilize Credit Sesame to manage both personal and business credit. Keeping a healthy credit score is crucial for securing business loans and favorable credit terms. The app offers tools and recommendations to help improve credit health, which in turn can lead to better financing options for the business. Additionally, the security features ensure that sensitive information remains protected.

Frequently Asked Questions

What Is A Credit Management App?

A Credit Management App helps you track and manage your credit score. It offers tools to monitor credit usage, payments, and improvements.

How Do Credit Management Apps Work?

Credit Management Apps sync with your financial accounts. They provide real-time updates on your credit score and offer tips for improvement.

Are Credit Management Apps Safe?

Yes, reputable Credit Management Apps use encryption to protect your data. Always choose apps with strong privacy policies and positive user reviews.

Can Credit Management Apps Improve My Credit Score?

Yes, they can. These apps offer personalized tips and reminders to help you maintain good credit habits and improve your score.

Conclusion

Credit Sesame offers a comprehensive solution for managing your credit. It provides daily updates, personalized actions, and tailored offers. With its free services, improving your credit health becomes easier. For more details, visit the Credit Sesame website today. Start taking control of your financial future. Your credit health matters.