Credit Education Resources: Empower Your Financial Future

Understanding credit can be confusing and stressful. Credit education resources provide the knowledge needed to navigate credit scores and reports.

Credit education is essential for financial health. Many people struggle to grasp credit concepts and how they impact daily life. Knowing where to find reliable information can make a difference. This is where Credit Sesame comes in. Credit Sesame offers a variety of tools to help you understand your credit score and improve it. By using their resources, you can make informed decisions and achieve your financial goals. Their services are free and easy to use, making them accessible for everyone. Credit Sesame offers free daily credit scores, personalized recommendations, and secure data protection. These features help users stay informed and improve their credit over time. Explore these resources to take control of your financial future.

Introduction To Credit Education Resources

Understanding your credit score and maintaining a good credit history is crucial for financial stability. Credit education resources provide the knowledge and tools needed to manage credit effectively. These resources help users improve their credit scores, make informed financial decisions, and achieve their financial goals.

Understanding The Importance Of Credit Education

Credit education is essential because it empowers individuals to take control of their financial health. Knowing how credit scores work, what affects them, and how to improve them can save money in the long run. A good credit score opens doors to better loan rates, credit cards, and other financial opportunities. It also reduces the risk of financial pitfalls.

Without proper credit education, individuals may face higher interest rates, loan rejections, and financial stress. Therefore, investing time in understanding credit education resources can lead to a more secure and prosperous financial future.

Overview Of Available Credit Education Resources

| Resource | Description | Features |

|---|---|---|

| Credit Sesame | Free access to credit score and report summary. |

|

| Financial Literacy Programs | Educational courses on managing personal finances. |

|

| Credit Counseling Services | Professional advice on managing debt and improving credit. |

|

These resources are designed to help individuals understand and manage their credit effectively. They offer personalized insights, secure data handling, and practical tools for credit improvement. By using these resources, individuals can make informed decisions and achieve their financial goals with confidence.

Key Features Of Effective Credit Education Resources

Effective credit education resources are essential for individuals seeking to understand and improve their credit scores. These resources offer various features designed to provide comprehensive knowledge, interactive learning experiences, expert guidance, and personalized learning paths. Let’s explore the key features that make credit education resources like Credit Sesame invaluable.

Comprehensive Curriculum

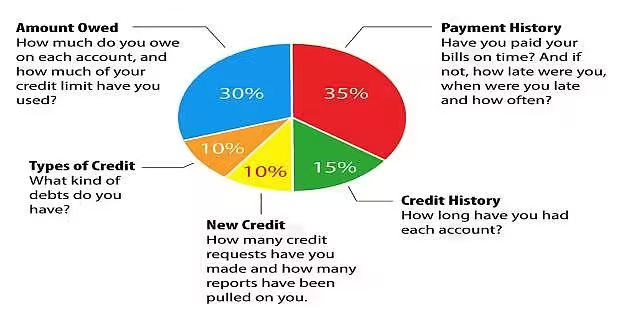

A comprehensive curriculum covers all critical aspects of credit education. It includes topics such as understanding credit scores, factors affecting credit, and strategies for credit improvement. This ensures users gain a well-rounded understanding of credit management.

| Topic | Description |

|---|---|

| Credit Scores | Understanding how credit scores are calculated and their importance. |

| Credit Reports | Learning how to read and interpret credit reports. |

| Credit Improvement | Strategies to improve credit scores over time. |

Interactive Tools And Simulations

Interactive tools and simulations engage users actively. These tools help users see the impact of different financial decisions on their credit scores. For example, Credit Sesame offers users a daily credit score check and personalized actions to improve their scores.

- Daily Credit Score: Users can check their credit scores daily for free.

- Simulations: Learn how different actions affect credit scores.

- Personalized Actions: Get recommendations tailored to individual financial goals.

Expert Guidance And Support

Expert guidance and support are crucial for effective credit education. Access to financial experts and support teams can help users navigate complex credit scenarios. Credit Sesame provides valuable insights and support to help users make informed decisions.

- Expert Insights: Recommendations based on major factors impacting credit scores.

- Customer Support: Access to help through the Credit Sesame website.

Tailored Learning Paths

Tailored learning paths ensure that education is personalized to each user’s needs. Credit Sesame offers personalized actions based on individual credit profiles, helping users achieve their specific financial goals. Tailored learning paths make the learning process more relevant and effective.

- Personalized Actions: Specific steps to improve credit scores.

- High Approval Odds: Offers with high likelihood of approval based on credit profile.

How Credit Education Resources Can Benefit You

Understanding credit is crucial for financial health. Credit education resources, like Credit Sesame, provide valuable tools and information. These resources help you make better financial decisions and improve your financial future.

Improving Your Credit Score

Credit Sesame offers a Daily Credit Score feature. This allows you to check your credit score every day. Understanding your score helps you take steps to improve it. The Sesame Grade gives a clear letter grade based on key factors. Personalized actions recommend ways to boost your score. Improved credit scores can lead to better loan rates and financial opportunities.

Managing Debt Effectively

Effective debt management is essential. Credit Sesame provides insights into your credit report summary. This helps you understand your debt situation. You can find offers with high approval odds, reducing the risk of negative marks. Proper debt management leads to financial stability.

Making Informed Financial Decisions

Credit Sesame helps you make informed financial decisions. The personalized actions guide you on improving your credit score. Offers tailored to your credit profile ensure you choose the best options. Informed decisions can save money and improve financial health.

Building Long-term Financial Stability

Long-term financial stability is a key goal. Credit Sesame helps you build credit with everyday purchases using a debit card. This is a convenient way to improve your credit without a credit check or security deposit. Secure data protection ensures your information is safe. Consistent use of these tools leads to long-term financial health.

| Feature | Benefit |

|---|---|

| Daily Credit Score | Monitor and improve credit score |

| Sesame Grade | Understand key factors impacting score |

| Personalized Actions | Recommendations to boost credit score |

| Secure Data | 256-bit encryption for data protection |

Using Credit Sesame’s resources can lead to a better understanding of your credit. This knowledge helps you manage debt, make informed decisions, and build long-term stability. Start your credit education journey today with Credit Sesame.

Pricing And Affordability Of Credit Education Resources

Credit education is crucial for financial health. Understanding the pricing and affordability of credit education resources can help users make informed decisions. Credit Sesame provides various credit education tools and services, some free and others at a cost. Let’s dive into the details.

Free Vs Paid Resources

Credit Sesame offers both free and paid resources. Here’s a comparison:

| Type | Features | Cost |

|---|---|---|

| Free Resources |

|

Free |

| Paid Resources |

|

$9.99/month (waived with $500 deposit or $1,000 spent monthly) |

Cost-benefit Analysis

Is the cost of paid resources worth it? Consider the benefits:

- Daily Credit Score Updates: Stay informed about your credit status.

- Personalized Recommendations: Improve your credit score with tailored advice.

- Credit Builder: Build credit with everyday purchases using a debit card.

- Secure Data: 256-bit encryption protects your information.

These benefits can outweigh the cost, especially for those serious about improving their credit.

Scholarships And Financial Assistance

Credit Sesame does not explicitly mention scholarships or financial assistance. However, users can access most features for free. For paid features, there are ways to avoid fees:

- Waived Monthly Fees: Deposit $500 via direct deposit or spend $1,000 monthly.

- Inactivity Fee Waiver: Make any purchase or money movement within 30 days.

These options provide flexibility and affordability for users on a budget.

Credit Sesame offers a balanced mix of free and paid resources. Users can choose what fits their financial needs while ensuring they receive valuable credit education and assistance.

Pros And Cons Of Using Credit Education Resources

Credit education resources like Credit Sesame can help users understand and improve their credit scores. They offer a range of tools and personalized advice. But like any service, they have their advantages and limitations.

Advantages Based On User Experiences

Many users find Credit Sesame helpful for several reasons:

- Free Access: Users can access their credit score and report summary at no cost.

- Daily Credit Score: Users can check their credit score daily, helping them stay informed.

- Personalized Actions: The service provides tailored recommendations to improve credit scores.

- High Approval Odds: Users get offers that they are likely to be approved for, saving time.

- Secure Data: The service uses 256-bit encryption to protect user data.

Users appreciate the convenience of having all credit-related needs in one place. They can manage credit cards, loans, and even use a credit builder tool.

Potential Drawbacks And Limitations

While Credit Sesame has many benefits, there are some drawbacks to consider:

- Inactivity Fees: There is a $3 monthly inactivity fee, waived only with money movement or purchases.

- Service Limitations: The free service provides a summary, but detailed reports may require additional costs.

- International Fees: Users may face additional fees for international transactions.

Some users may find the fees associated with Sesame Cash inconvenient. Although the monthly fee is waived with deposits or spending, it can still be a concern for some.

Understanding the balance between the benefits and limitations can help users make informed decisions about using Credit Sesame.

Recommendations For Ideal Users

Credit Sesame offers a wealth of resources to help individuals understand and improve their credit scores. But who stands to benefit the most from these services? Let’s explore the ideal users of Credit Sesame’s credit education resources.

Who Can Benefit The Most?

Credit Sesame is designed for a wide range of users. Here are some groups who can gain the most:

- Individuals Building Credit: Those new to credit can use the Credit Builder feature to establish a credit history with everyday purchases.

- People with Poor Credit Scores: Personalized actions help users take steps to improve their credit scores.

- Credit Conscious Consumers: Daily access to credit scores allows for regular monitoring and management.

- Loan Seekers: High approval odds for credit cards, home loans, and auto loans save time and reduce the risk of negative marks.

Scenarios Where Credit Education Resources Are Essential

Understanding your credit score is crucial in various life scenarios. Here are some situations where Credit Sesame’s resources are invaluable:

| Scenario | Importance |

|---|---|

| Applying for a Loan | Knowing your credit score and improving it can lead to better interest rates and loan approval chances. |

| Renting an Apartment | Landlords often check credit scores. A higher score can increase your chances of securing a rental. |

| Job Applications | Some employers review credit scores as part of the hiring process. A good score can enhance your job prospects. |

| Managing Debt | Understanding your credit situation helps in creating a plan to reduce debt effectively. |

Credit Sesame provides tools and resources to help in these scenarios. With features like daily credit score checks, personalized actions, and secure data, users can make informed decisions and take control of their financial health.

Conclusion: Empower Your Financial Future

Understanding and managing your credit is crucial for financial stability. Credit Sesame offers valuable resources to help you navigate your credit journey.

Recap Of Key Points

Here’s a quick recap of the key points about Credit Sesame:

- Daily Credit Score: Check your credit score daily.

- Sesame Grade: A clear letter grade based on major credit factors.

- Personalized Actions: Recommendations to improve your credit score.

- Offers: Find the best offers with high approval odds.

- Credit Builder: Build credit with everyday purchases using a debit card.

- Secure Data: 256-bit encryption to protect your information.

Steps To Get Started With Credit Education

Follow these steps to begin your journey with Credit Sesame:

- Sign Up: Visit the Credit Sesame website and create an account.

- Check Your Score: Access your daily credit score and report summary for free.

- Review Sesame Grade: Understand your credit grade based on five major factors.

- Follow Recommendations: Implement personalized actions to improve your credit score.

- Explore Offers: Find and apply for credit offers with high approval chances.

- Use Credit Builder: Build credit through everyday purchases without a credit check.

Empower your financial future with these tools and insights. Start today and take control of your credit health with Credit Sesame!

Frequently Asked Questions

What Are Credit Education Resources?

Credit education resources are tools and guides that help you understand credit. They offer insights on managing credit scores, reports, and debts.

Why Is Credit Education Important?

Credit education is crucial for financial health. It helps you make informed decisions, improve your credit score, and avoid debt pitfalls.

Where Can I Find Credit Education Resources?

You can find credit education resources online, at financial institutions, and through credit counseling agencies. Many are free and accessible.

How Do Credit Scores Impact Loans?

Credit scores impact loan approvals and interest rates. Higher scores lead to better loan terms, while lower scores can result in rejections or high rates.

Conclusion

Understanding your credit is crucial. Utilize the resources available to you. Credit Sesame offers valuable tools to help improve your credit score. Stay informed, make better financial decisions, and reach your goals. Explore Credit Sesame here for more information. Take control of your financial future today.