Credit Education Courses: Unlock Your Financial Future Today

Building a strong credit history is essential for financial health. Credit education courses can guide you through this crucial process.

Understanding how credit works and how to improve it can significantly impact your financial future. These courses provide valuable insights into managing credit responsibly, avoiding common pitfalls, and making informed decisions. Whether you are just starting or looking to rebuild your credit, the right education can make all the difference. With various topics covered, from credit scores to debt management, these courses offer practical knowledge that can lead to better financial stability. One effective tool for building credit is the Cheese Credit Builder Account. It helps users build credit with all three major credit bureaus without needing a credit card. For more information, visit the Cheese Credit Builder page.

Credit: www.stthomas.edu

Introduction To Credit Education Courses

Credit education courses are essential for anyone looking to improve their financial literacy. These courses provide valuable knowledge about credit scores, reports, and how to manage credit effectively. Understanding these concepts can lead to better financial decisions and improved credit health.

What Are Credit Education Courses?

Credit education courses are structured programs designed to teach individuals about credit. They cover various topics, including:

- Understanding credit scores

- Reading credit reports

- Managing credit card debt

- Strategies for improving credit scores

These courses can be taken online or in-person and often include interactive elements like quizzes and practical exercises. They are suitable for individuals at all stages of their credit journey, from beginners to those looking to fine-tune their credit management skills.

Importance Of Credit Education

Credit education is crucial for several reasons:

- Improved Financial Decisions: Knowledge about credit helps you make informed financial choices.

- Better Credit Scores: Understanding how credit works can lead to improved credit scores over time.

- Access to Better Financial Products: Higher credit scores can qualify you for better interest rates and credit products.

Credit education is not just about improving your credit score. It’s about gaining the confidence to manage your finances effectively. With the right knowledge, you can avoid common pitfalls and set yourself up for long-term financial success.

| Feature | Description |

|---|---|

| Build with All 3 Credit Bureaus | Reports to all three major credit bureaus. |

| No Admin or Membership Fee | No additional fees for account maintenance. |

| No Credit Check Required | Does not require a hard pull on your credit. |

| Autopay | Automatically manages payments. |

| Secure Savings | Money is protected in a bank account. |

| Fixed Low APR | Charges only a fixed and low Annual Percentage Rate (APR). |

| Credit Monitoring | Provides tools to monitor credit and track progress. |

For example, the Cheese Credit Builder Account is a product that helps build credit with all three major credit bureaus. It does not require a credit check and charges a fixed low APR. With features like autopay and secure savings, it simplifies the credit building process. The account also offers flexible deposit amounts and customizable term lengths, making it a versatile option for many users.

By engaging in credit education courses, you can learn how products like the Cheese Credit Builder Account work and how they can benefit your financial health. These courses empower you to take control of your credit and improve your overall financial well-being.

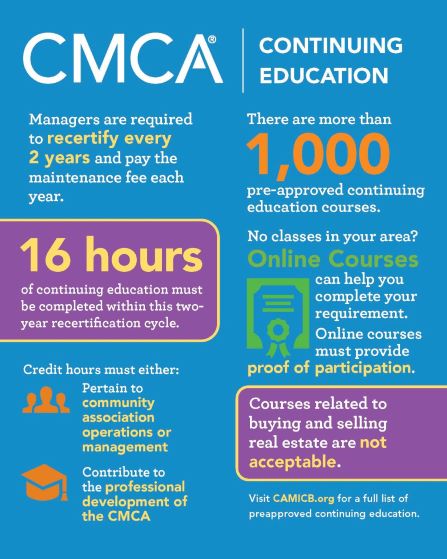

Credit: www.camicb.org

Key Features Of Credit Education Courses

Credit education courses offer essential tools and knowledge for individuals who want to build or improve their credit scores. These courses provide a comprehensive curriculum, interactive learning modules, real-world case studies, and access to expert instructors. Let’s explore these key features in detail.

Comprehensive Curriculum

The curriculum of credit education courses covers all aspects of credit management. Learners will understand how credit scores are calculated, the importance of credit reports, and the impact of various financial activities on credit health. The course also includes topics like budgeting, debt management, and financial planning. This comprehensive approach ensures that learners have a well-rounded understanding of credit.

Interactive Learning Modules

Interactive learning modules make credit education engaging and effective. These modules include quizzes, simulations, and practical exercises to reinforce learning. For example, a module might simulate the process of applying for a credit builder account, such as the Cheese Credit Builder Account, and guide users through each step. This hands-on approach helps learners apply theoretical knowledge in practical scenarios.

Real-world Case Studies

Real-world case studies provide valuable insights into credit management. Learners can analyze different scenarios and outcomes to understand the consequences of financial decisions. For instance, studying how individuals improved their credit scores using tools like the Cheese Credit Builder Account can offer practical examples and inspire learners to take similar actions.

Access To Expert Instructors

Having access to expert instructors is a significant advantage of credit education courses. Instructors with extensive experience in personal finance can provide valuable tips and personalized advice. Learners can ask questions, seek clarification, and receive guidance on specific issues. This direct interaction enhances the learning experience and ensures that learners have the support they need to succeed.

Credit education courses are essential for anyone looking to improve their financial health. By offering a comprehensive curriculum, interactive learning modules, real-world case studies, and access to expert instructors, these courses equip learners with the knowledge and skills they need to manage their credit effectively.

Benefits Of Enrolling In Credit Education Courses

Credit education courses offer a range of advantages. These courses can help improve your financial health and overall well-being. Below, we explore some key benefits of enrolling in these courses.

Improved Credit Scores

One of the primary benefits of credit education courses is the potential for improved credit scores. These courses teach you how to manage your credit effectively. For instance, products like the Cheese Credit Builder Account help users build credit with all three major credit bureaus. The Cheese Credit Builder Account reports to all three credit bureaus without requiring a credit card or a hard credit check. This feature alone can significantly impact your credit score positively.

Enhanced Financial Literacy

Credit education courses enhance your financial literacy. You will learn about various financial concepts and strategies. For example, understanding terms like APR (Annual Percentage Rate) and how it affects your loans and credit cards can be immensely beneficial. The Cheese Credit Builder Account offers a fixed low APR, making it easier to manage your finances. Additionally, these courses often include lessons on budget management, savings, and investment.

Better Loan And Credit Card Management

Managing loans and credit cards can be challenging. Credit education courses provide you with the skills needed to handle these responsibilities effectively. For instance, with the Cheese Credit Builder Account, you can choose flexible deposit amounts and customizable term lengths. This flexibility helps you manage your loans and credit cards better. Moreover, the autopay feature ensures that your payments are made on time, avoiding late fees and further improving your credit score.

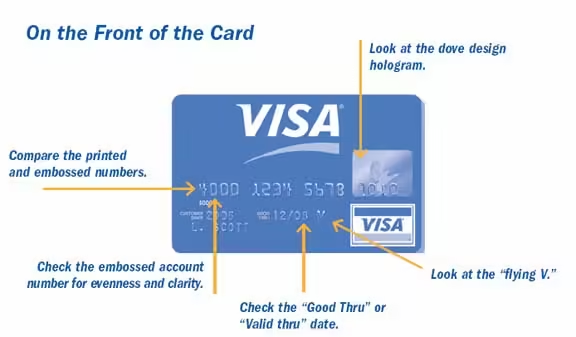

Protection Against Financial Fraud

Financial fraud is a significant concern for many people. Credit education courses teach you how to protect yourself against such threats. You will learn how to monitor your credit and detect any unusual activities. The Cheese Credit Builder Account provides tools for credit monitoring, helping you track your progress and identify any discrepancies early. By staying informed, you can take immediate action to protect your finances.

Enrolling in credit education courses offers numerous benefits. From improving your credit score to enhancing your financial literacy, these courses are a valuable investment in your financial future. Consider leveraging tools like the Cheese Credit Builder Account to support your journey towards better credit and financial health.

Pricing And Affordability

Understanding the cost of credit education courses is crucial for making an informed decision. With Cheese Credit Builder, you have multiple pricing options to suit your needs. Let’s break down the details.

Cost Of Enrollment

The Cheese Credit Builder Account offers a straightforward pricing model. Monthly payments start at $24 per month. This low cost makes it accessible to most users. Additionally, there are no admin or membership fees, ensuring you won’t encounter unexpected costs.

Available Payment Plans

Cheese Credit Builder provides flexible payment plans to accommodate various financial situations. Here are your options:

- Monthly payments start at $24.

- Choose deposit goals of $500, $1,000, or $2,000.

- Customizable term lengths of 12 or 24 months.

These options allow you to select a plan that fits your budget while building your credit effectively.

Scholarships And Discounts

While Cheese Credit Builder does not offer traditional scholarships, there are no additional fees for account maintenance. This feature acts as a built-in discount, saving you money over time. Moreover, the fixed low APR ensures that you are not burdened with high-interest rates.

For more information, visit the Cheese Credit Builder website.

Pros And Cons Of Credit Education Courses

Credit education courses offer many advantages, but they also have their downsides. Understanding both sides can help you make an informed decision. Below, we explore the pros and cons of these courses.

Pros

- Improved Financial Literacy: These courses provide valuable knowledge about managing credit and finances.

- Better Credit Scores: Learning how to handle credit responsibly can lead to a higher credit score.

- Money Management: Courses teach budgeting, saving, and spending wisely.

- Access to Resources: Participants often gain access to tools and resources for tracking credit progress.

- Increased Confidence: Understanding credit can boost your confidence in managing personal finances.

Cons

- Time-Consuming: Courses can require a significant time commitment.

- Potential Costs: Some courses may charge fees, which can add up.

- Quality Variability: Not all courses are created equal; some may offer outdated or inaccurate information.

- Motivation Required: Self-discipline is essential to complete the courses and apply the knowledge.

- Limited Immediate Results: Building credit takes time, and results may not be immediate.

Additional Information On Cheese Credit Builder

The Cheese Credit Builder Account can be a practical tool for those looking to build credit. It reports to all three major credit bureaus and does not require a credit check. With no admin or membership fees, and a fixed low APR, it offers an affordable way to improve your credit score. The autopay feature ensures timely payments, and the secure savings option protects your money. Flexible deposit amounts and customizable term lengths add to its appeal. At the end of the term, you receive your savings back, minus any interest.

| Feature | Details |

|---|---|

| Reporting | All 3 Credit Bureaus |

| Fees | No Admin or Membership Fee |

| Credit Check | Not Required |

| APR | Fixed Low APR |

| Monthly Payments | Start at $24 per month |

| Term Lengths | 12 or 24 months |

For more information about the Cheese Credit Builder Account, visit the Cheese website.

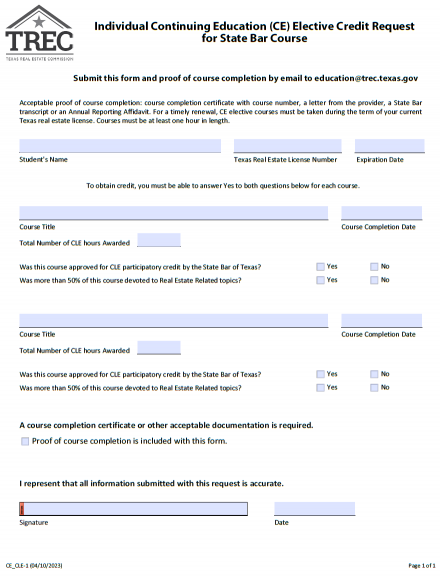

Credit: www.trec.texas.gov

Who Should Enroll In Credit Education Courses?

Credit education courses are beneficial for anyone aiming to improve their financial health. These courses provide valuable insights on managing credit, understanding credit scores, and making informed decisions.

Ideal Candidates

The following individuals are ideal candidates for credit education courses:

- Young Adults: Those entering adulthood and seeking to build a solid financial foundation.

- New Credit Users: Individuals who are new to using credit and want to avoid common pitfalls.

- Credit Repair Seekers: People looking to repair their credit scores and improve their financial standing.

- Homebuyers: Prospective homebuyers needing to boost their credit for mortgage approval.

Specific Scenarios Where Courses Are Beneficial

Here are specific scenarios where credit education courses can be highly beneficial:

| Scenario | Benefit of Course |

|---|---|

| High Debt Levels | Learn strategies to manage and reduce debt effectively. |

| Low Credit Scores | Understand factors affecting credit scores and how to improve them. |

| Frequent Loan Rejections | Identify reasons for rejections and steps to qualify for future loans. |

| Lack of Financial Knowledge | Gain essential knowledge on credit management and financial planning. |

By enrolling in credit education courses, you can take control of your financial future. These courses provide the tools and knowledge needed to navigate the complexities of credit.

Frequently Asked Questions

What Are Credit Education Courses?

Credit education courses teach individuals about managing credit, improving scores, and financial literacy. They help in understanding credit reports, scores, and debt management.

Who Should Take Credit Education Courses?

Anyone looking to improve their financial knowledge and credit score should take these courses. They benefit individuals with poor credit or those new to credit management.

How Do Credit Education Courses Help?

These courses provide tools and knowledge to manage credit effectively. They offer strategies to improve credit scores and avoid debt.

Are Credit Education Courses Online?

Yes, many credit education courses are available online. They offer flexibility and convenience, allowing you to learn at your own pace.

Conclusion

Credit education courses provide essential knowledge for financial success. They teach valuable skills to manage and improve credit. For effective credit building, consider using Cheese Credit Builder. It reports to all three major bureaus. No credit check is required, and there are no extra fees. Save money while boosting your credit score. Learn more about Cheese Credit Builder and start your journey to better credit today.