Credit Education: Unlock Financial Freedom Today

Credit education is essential for anyone looking to manage their finances wisely. Understanding how credit works can help you make informed decisions, avoid debt, and improve your financial health.

In today’s fast-paced world, the importance of credit education cannot be overstated. Many individuals find themselves struggling with debt and poor credit scores simply because they lack knowledge. This is where services like Mitigately come into play. Mitigately is a debt consolidation service designed to simplify debt management and help users save money. By consolidating multiple debts into a single payment, Mitigately makes it easier to pay off debt faster and more efficiently. Their AI-powered agent quickly matches users with the best debt solution, offering significant savings and a path towards financial freedom. For more information, check out Mitigately here: Mitigately.

Introduction To Credit Education

Understanding credit is essential in today’s financial landscape. Credit education helps individuals make informed decisions about managing their finances. By learning how credit works, you can improve your financial health and achieve your goals.

Understanding The Importance Of Credit Education

Credit education is the foundation of financial literacy. It teaches you how to manage debt, understand credit scores, and build a positive credit history. Here are some key reasons why credit education is important:

- Financial Independence: Knowledge of credit helps you make better financial decisions.

- Improved Credit Scores: Understanding credit management can lead to higher credit scores.

- Better Loan Terms: Good credit can help you secure loans with favorable terms.

- Reduced Debt: Effective credit management can help reduce overall debt.

How Credit Education Can Transform Your Financial Life

Credit education empowers you to take control of your financial future. By understanding how to manage credit, you can make significant improvements in your financial life. Here are some ways credit education can transform your finances:

- Debt Management: Learn strategies to manage and reduce debt, such as using services like Mitigately for debt consolidation.

- Saving Money: Knowledge of credit can help you avoid high-interest rates and fees, leading to savings.

- Enhanced Financial Planning: Understanding credit allows for better budgeting and financial planning.

- Stress Reduction: Effective credit management reduces financial stress and promotes peace of mind.

By investing time in credit education, you can pave the way for a healthier financial future. For those dealing with multiple debts, services like Mitigately offer valuable tools and resources to help manage and reduce debt efficiently.

Key Concepts In Credit Education

Understanding credit is crucial for managing finances effectively. Let’s explore some key concepts in credit education to help you make informed decisions.

What Is A Credit Score?

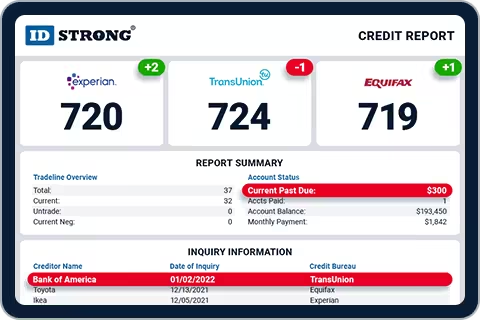

A credit score is a numerical expression of your creditworthiness. It ranges from 300 to 850. Lenders use it to evaluate the risk of lending money to you. A higher score means you are more likely to get loans with favorable terms. The three major credit bureaus—Equifax, Experian, and TransUnion—issue these scores.

The Components Of A Credit Report

A credit report provides a detailed history of your credit activities. It includes:

- Personal Information: Your name, address, and social security number.

- Credit Accounts: Details of your credit cards, mortgages, and loans.

- Credit Inquiries: Records of requests to view your credit report.

- Public Records: Information on bankruptcies, foreclosures, and liens.

Monitoring your credit report can help you detect inaccuracies and protect against identity theft.

The Role Of Credit History In Financial Health

Your credit history shows how you have managed debt over time. A good credit history can help you secure loans, get better interest rates, and even rent an apartment. Key factors influencing your credit history include:

- Payment History: Timely payments boost your credit score.

- Credit Utilization: Using less than 30% of your credit limit is ideal.

- Length of Credit History: Longer histories can lead to higher scores.

- Types of Credit: A mix of credit types is beneficial.

- New Credit: Too many new accounts can lower your score.

Maintaining a positive credit history is essential for financial well-being.

Benefits Of Having Good Credit

Good credit is a powerful tool that can greatly improve your financial life. It opens doors to better opportunities and can save you money in the long run. Understanding the benefits of maintaining a good credit score is crucial for anyone looking to achieve financial stability and freedom.

Lower Interest Rates On Loans

One of the most significant benefits of having good credit is access to lower interest rates on loans. Lenders view individuals with high credit scores as low-risk borrowers, which means they are more likely to offer favorable terms.

With lower interest rates, you can save a substantial amount of money over the life of a loan. For instance, on a $200,000 mortgage, even a 1% reduction in interest rate can save you thousands of dollars.

Better Chances Of Loan And Credit Card Approvals

A good credit score increases your chances of loan and credit card approvals. Lenders and credit card issuers prefer to work with individuals who have a proven track record of managing credit responsibly.

This means that when you apply for a loan or credit card, you’re more likely to get approved if you have a strong credit score. It also means you might qualify for higher credit limits and better terms.

Improved Housing Opportunities

Good credit can also lead to improved housing opportunities. Landlords and property managers often check credit scores when evaluating potential tenants.

If you have a good credit score, you’re more likely to get approved for rental properties. Additionally, you may be able to negotiate better terms on your lease, such as lower security deposits.

Access To Better Financial Products

Having good credit gives you access to better financial products. This includes credit cards with lower interest rates, better rewards, and higher credit limits.

You can also qualify for premium financial products such as personal loans with favorable terms, mortgages with low-interest rates, and auto loans with better financing options.

Overall, maintaining a good credit score can significantly enhance your financial well-being, providing you with more opportunities and saving you money in various aspects of your life.

Steps To Improve Your Credit Score

Improving your credit score can open doors to better financial opportunities. Whether you aim to qualify for a loan or achieve financial stability, taking these steps can help. Here are some crucial actions you can take to boost your credit score:

Regularly Review Your Credit Report

Regularly reviewing your credit report is essential. It helps you identify errors and discrepancies that might be hurting your score. Obtain a free credit report from each of the three major credit bureaus annually. Look for inaccuracies and report them immediately. Correcting errors can improve your score significantly.

Pay Your Bills On Time

Paying your bills on time is one of the most impactful steps. Late payments can severely damage your credit score. Set reminders or automate payments to ensure timeliness. If you miss a payment, try to pay as soon as possible. Consistency in timely payments builds a strong credit history.

Manage Your Debts Wisely

Managing your debts wisely is crucial. High debt levels can negatively impact your credit score. Try to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit. Consider debt consolidation services like Mitigately. They can help you combine multiple debts into a single payment. This can simplify repayment and potentially reduce your overall debt.

Limit Hard Inquiries On Your Credit

Limiting hard inquiries on your credit is important. Each hard inquiry can lower your credit score slightly. Only apply for credit when necessary. Multiple inquiries in a short period can signal financial distress. Instead, focus on maintaining and improving your existing credit accounts.

By following these steps, you can take control of your credit score. Regular monitoring, timely payments, wise debt management, and limiting hard inquiries are key strategies. Use tools like Mitigately to assist in managing and reducing your debt. Improving your credit score is a journey, but with dedication and the right steps, you can achieve financial freedom.

Common Credit Myths Debunked

Understanding credit can be confusing. Many myths make it harder. Let’s debunk some common ones to help you make better financial decisions.

Myth: Checking Your Credit Hurts Your Score

Many believe that checking their credit score will negatively affect it. This is not true. There are two types of credit checks: hard inquiries and soft inquiries. Hard inquiries, like applying for a loan, can impact your score. Soft inquiries, such as checking your own score, do not.

In fact, regularly checking your credit score helps you stay informed. It allows you to spot errors and monitor your financial health.

Myth: Closing Old Accounts Improves Your Score

Another common myth is that closing old credit accounts will improve your credit score. Closing accounts can actually harm your score. It can reduce your overall credit limit and increase your credit utilization ratio.

Your credit history length also matters. Keeping older accounts open shows a longer credit history, which can be beneficial. Think twice before closing old accounts.

Myth: Paying Off Debt Automatically Removes It From Your Report

Paying off debt is a great achievement. But, it does not mean the debt disappears from your credit report immediately. Most negative items, like late payments, stay on your report for seven years. Paid debts remain but are marked as “paid.”

This positive mark shows lenders that you are responsible. It can help improve your score over time.

Mitigately can help manage and reduce your debt. It offers debt consolidation and significant savings. Visit Mitigately to learn more.

Tools And Resources For Credit Education

Understanding credit can seem daunting, but numerous resources and tools can help. These tools are designed to help you manage your credit, understand your financial situation, and make informed decisions. Let’s explore some of the most effective options available to you.

Credit Counseling Services

Credit counseling services provide professional advice to help you manage your debt and improve your financial health. These services typically include:

- Personalized financial assessments

- Debt management plans

- Educational workshops

Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost counseling. They help you create a budget, reduce expenses, and develop a plan for paying off debt.

Financial Literacy Programs

Financial literacy programs focus on educating individuals about managing their money. These programs often cover:

- Budgeting techniques

- Savings strategies

- Understanding credit scores

Many nonprofit organizations, schools, and financial institutions offer these programs. They can be a valuable resource for anyone looking to enhance their financial knowledge.

Online Credit Education Platforms

Online credit education platforms provide convenient access to a wealth of information. These platforms often include:

- Interactive courses

- Webinars

- Credit score tracking tools

Websites like Credit Karma and Experian offer free resources to help you understand your credit report and score. They also provide tips for improving your credit health.

For those managing debt, Mitigately is an excellent option. Their AI-Powered Agent matches users to the best debt solution quickly. Mitigately consolidates multiple debts into a single payment, using a Savings Calculator to estimate potential savings. This user-friendly service can lead to significant savings and a debt-free life.

For more details, visit Mitigately’s official website.

Pros And Cons Of Credit Education

Credit education can be a powerful tool for managing finances. Understanding the advantages and disadvantages helps in making an informed decision. Below we explore the pros and cons of credit education.

Pros: Empowerment And Financial Control

Credit education offers numerous benefits, including empowerment and financial control. Here are some key advantages:

- Informed Decisions: Knowledge about credit enables making better financial choices.

- Improved Credit Scores: Understanding credit management can lead to higher credit scores.

- Debt Reduction: Effective credit education can help in reducing overall debt.

- Financial Stability: Learning about credit helps in achieving long-term financial stability.

With these benefits, individuals can take charge of their financial future. This empowerment leads to better control over finances and more secure financial health.

Cons: Time And Effort Investment

While credit education has its advantages, there are also some drawbacks. The main cons include the time and effort investment required:

- Time-Consuming: Learning about credit takes significant time and effort.

- Complex Information: Credit concepts can be difficult to understand initially.

- Ongoing Commitment: Continuous learning and staying updated is necessary.

Despite these challenges, the benefits of credit education often outweigh the cons. The initial investment of time and effort pays off in the long run.

| Pros | Cons |

|---|---|

| Informed Decisions | Time-Consuming |

| Improved Credit Scores | Complex Information |

| Debt Reduction | Ongoing Commitment |

| Financial Stability |

For a comprehensive debt management solution, consider using Mitigately. Visit Mitigately’s official website for more details.

Who Can Benefit From Credit Education?

Understanding credit is essential for everyone, but some groups can benefit more from credit education. Let’s explore who these groups are and how they can gain from learning about credit.

Young Adults And College Students

Young adults and college students often start their financial journey with little knowledge about credit. Learning the basics of credit can help them avoid common mistakes. They can understand the importance of credit scores, how to use credit cards wisely, and the long-term impact of their financial decisions.

- Building a strong credit history early

- Avoiding debt traps

- Understanding student loans and repayment options

New Immigrants

New immigrants may find the credit system in their new country confusing. Credit education can help them understand how to build and maintain good credit. They can learn about the benefits of using services like Mitigately for debt management and consolidation.

- Building a credit history from scratch

- Learning the local financial landscape

- Accessing better financial products and services

Individuals With Poor Credit History

Those with a poor credit history can benefit immensely from credit education. Understanding the causes of their credit issues and learning how to improve their credit scores can lead to better financial opportunities. Using tools like Mitigately’s savings calculator can help them manage and reduce debt.

- Identifying and fixing credit report errors

- Learning strategies to improve credit scores

- Understanding debt consolidation options

Anyone Looking To Improve Their Financial Literacy

Improving financial literacy is beneficial for everyone. Credit education provides valuable insights into managing personal finances, avoiding debt, and achieving financial freedom. Mitigately offers resources like financial blogs and debt repayment calculators to help individuals make informed decisions.

- Better money management skills

- Informed decision-making

- Long-term financial stability

Frequently Asked Questions

What Is A Credit Score?

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Lenders use it to assess your risk.

How To Improve Your Credit Score?

Pay bills on time, reduce outstanding debt, and avoid opening many new accounts. Regularly check your credit report for errors.

Why Is Credit Education Important?

Credit education helps you understand how to manage credit responsibly. It can save you money and improve your financial health.

How Does Credit Affect Loan Approval?

Lenders check your credit score to determine your loan eligibility. A higher score increases your chances of approval and better terms.

Conclusion

Credit education is crucial for managing your financial health. Understanding credit can transform your financial future. Want help with debt management? Consider using Mitigately. It offers reliable debt consolidation services. Remember, informed decisions lead to financial freedom. Start your journey to better credit today.