Credit Card User Guide: Master Your Finances with Ease

Credit cards can be a powerful tool for managing finances. But they require knowledge and responsibility.

In this Credit Card User Guide, we’ll explore key aspects of using credit cards effectively. From understanding interest rates to managing credit limits, this guide will cover essential tips and strategies. By the end, you’ll feel confident in making informed decisions about credit card usage. Whether you’re new to credit cards or looking to improve your financial habits, this guide is for you. Discover how to use credit cards to your advantage and avoid common pitfalls. Let’s dive into the world of credit cards with ease and clarity. For more financial solutions, check out Possible Finance. Possible Finance offers products like the Possible Loan and Possible Card to help build credit history and manage funds responsibly.

Introduction To Credit Card Usage

Credit cards have become an essential financial tool. They offer convenience and flexibility in managing your finances. This guide will help you understand how to use credit cards effectively.

Understanding Credit Cards

A credit card is a payment card issued by a bank or financial institution. It allows you to borrow money to pay for goods and services. You must repay the borrowed amount, usually with interest.

| Feature | Description |

|---|---|

| Credit Limit | The maximum amount you can borrow using the card. |

| Interest Rate | The cost of borrowing money, expressed as a percentage. |

| Grace Period | The time you have to pay your bill without incurring interest. |

| Fees | Charges such as annual fees, late payment fees, and over-limit fees. |

Purpose And Benefits Of Using Credit Cards

Credit cards serve various purposes and offer several benefits:

- Convenience: Easy to carry and use for everyday purchases.

- Building Credit History: Helps establish and improve your credit score.

- Emergency Funds: Provides access to funds in unexpected situations.

- Rewards: Earn cashback, points, or miles on purchases.

- Security: Fraud protection and dispute resolution services.

One noteworthy option is the Possible Card from Possible Finance. It offers an instant credit limit of $400 or $800 with no credit check. The card has 0% interest and no late fees. It helps build your credit history with on-time payments. Monthly fees are $8 or $16.

For more details on the Possible Card, visit the Possible Finance website.

Key Features Of Credit Cards

Credit cards offer numerous features designed to provide financial flexibility and benefits. Understanding these features can help you make informed decisions. Below, we explore some of the key aspects that make credit cards a valuable financial tool.

Rewards Programs And Cash Back

Credit cards often come with rewards programs that allow you to earn points, miles, or cash back on purchases. These rewards can be redeemed for travel, merchandise, or statement credits. For example, a card may offer 1% cash back on all purchases and 2% on specific categories like groceries or fuel. Earning rewards on everyday spending can help you save money over time.

Introductory Apr Offers

Many credit cards feature introductory APR offers. These offers provide a low or 0% interest rate on purchases or balance transfers for a set period. This can be beneficial if you plan to make a large purchase or transfer a balance from a high-interest card. Note the duration of the introductory period and the regular APR that applies after it ends.

Credit Building And Score Improvement

Using a credit card responsibly can help build your credit history and improve your credit score. On-time payments and maintaining a low balance relative to your credit limit positively impact your credit. Products like the Possible Card are designed to assist with credit building by reporting your payment history to credit bureaus.

Fraud Protection And Security Features

Credit cards come with robust fraud protection and security features. Many cards offer zero liability for unauthorized transactions and advanced security measures like EMV chips and tokenization. Regularly monitoring your account and setting up alerts can further enhance your security.

Additional Perks And Benefits

Beyond rewards and security, credit cards often include additional perks such as travel insurance, purchase protection, and extended warranties. Some cards offer access to exclusive events, concierge services, and discounts on various products and services. Understanding these benefits can help you maximize the value of your credit card.

| Feature | Description |

|---|---|

| Rewards Programs | Earn points, miles, or cash back on purchases. |

| Introductory APR | Low or 0% interest rate for an initial period. |

| Credit Building | Helps improve credit score with responsible use. |

| Fraud Protection | Zero liability for unauthorized transactions. |

| Additional Benefits | Travel insurance, purchase protection, and more. |

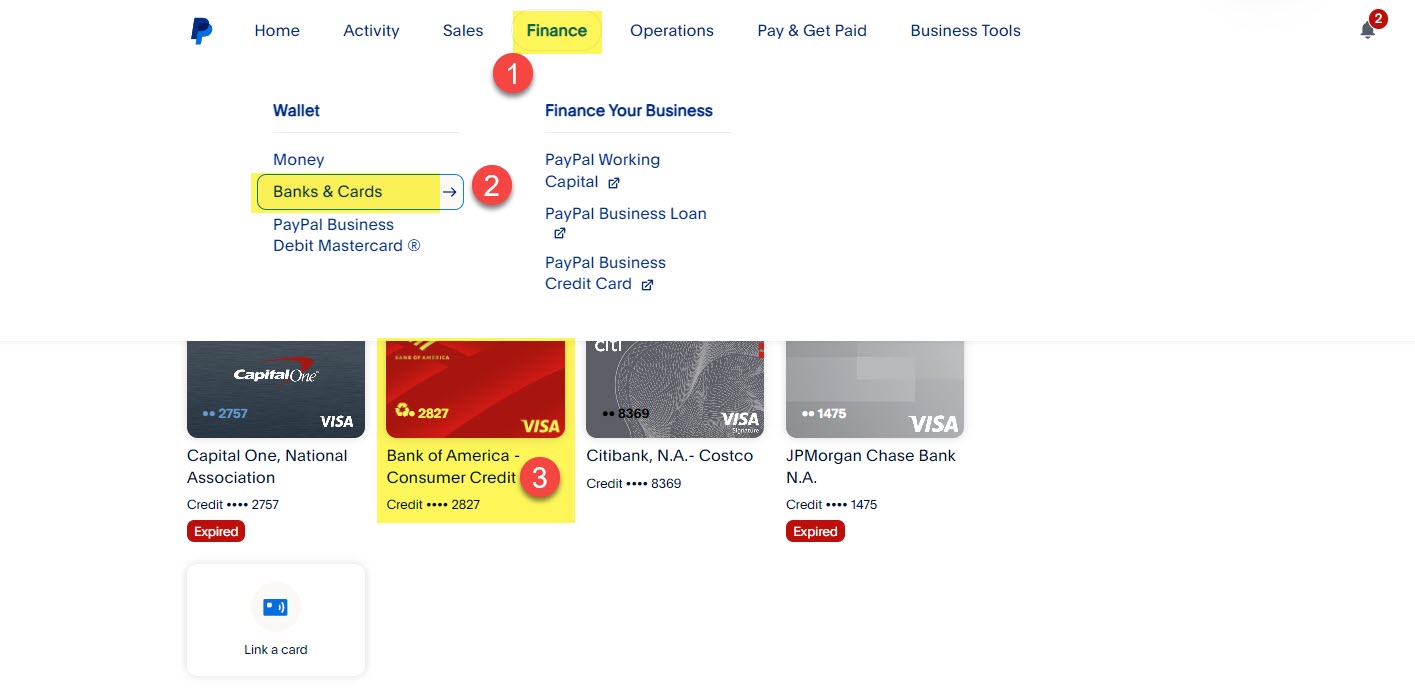

Choosing The Right Credit Card

Choosing the right credit card can be overwhelming with many options available. It’s important to select a card that aligns with your financial goals and needs. Here’s a guide to help you make an informed decision.

Identifying Your Financial Goals

Before selecting a credit card, identify your financial goals. Ask yourself:

- Do you want to build credit?

- Are you looking for rewards or cash back?

- Do you need a card with a low-interest rate?

Understanding your goals will help narrow down the options. For example, the Possible Card by Possible Finance is great for building credit with no hidden fees.

Comparing Interest Rates And Fees

Interest rates and fees can significantly impact your finances. Compare the Annual Percentage Rate (APR) and any associated fees:

| Card | APR | Fees |

|---|---|---|

| Possible Card | 0% interest, forever | $8 or $16 monthly fee |

The Possible Card stands out with its 0% interest rate and transparent monthly fee structure.

Examining Rewards And Incentives

Many credit cards offer rewards and incentives. Determine which benefits align with your spending habits:

- Cash back on purchases

- Travel rewards and miles

- Points for shopping at specific retailers

While the Possible Card focuses on building credit, other cards may offer rewards that suit your lifestyle better.

Considering Credit Limits And Spending Needs

Your spending needs and credit limit are crucial factors. Evaluate the credit limits offered and ensure they meet your requirements:

- Possible Card: $400 or $800 credit limit

The Possible Card provides instant credit limits without requiring a credit check or deposit, making it accessible for many users.

By considering these factors, you can choose a credit card that supports your financial goals and needs effectively.

Managing Credit Card Debt

Managing credit card debt is crucial for maintaining financial stability. Credit cards offer convenience, but without proper management, debt can accumulate. Here’s a guide to help you manage and reduce your credit card debt efficiently.

Creating A Repayment Plan

Start by creating a clear repayment plan. List all your credit card debts and their respective interest rates. Prioritize paying off the debt with the highest interest rate first. This approach, known as the avalanche method, minimizes the total interest paid over time.

- Compile a list of all debts

- Note interest rates and minimum payments

- Focus on high-interest debt first

Alternatively, use the snowball method. Pay off the smallest debt first, then move to the next smallest. This can provide quick wins and motivation.

Understanding Minimum Payments

Paying only the minimum amount can lead to prolonged debt. The minimum payment is typically a small percentage of the total balance, which means the majority of your payment goes towards interest.

| Payment Type | Description |

|---|---|

| Minimum Payment | Small percentage of the total balance |

| Full Payment | Entire balance cleared each month |

Always aim to pay more than the minimum to reduce your debt faster and save on interest.

Avoiding Common Pitfalls

Common pitfalls can make managing credit card debt challenging. Avoid using credit cards for non-essential purchases. This can lead to unnecessary debt.

- Avoid using cards for non-essential items.

- Do not miss payments; it can hurt your credit score.

- Stay clear of cash advances; they have high fees and interest rates.

Track your spending and stick to a budget. This will help you avoid accumulating more debt.

Strategies For Paying Off High-interest Debt

High-interest debt can be overwhelming. Consider these strategies to pay it off effectively:

- Balance Transfer: Transfer high-interest debt to a card with a lower interest rate. This can save you money on interest.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Refinancing: Refinance your debt to secure a better interest rate.

Use these strategies to manage and reduce your high-interest credit card debt efficiently.

For financial products that help manage debt and build credit, consider Possible Finance. They offer transparent and fair repayment plans with no hidden fees, helping you avoid debt traps and improve your credit score.

Maximizing Credit Card Benefits

Credit cards can be powerful financial tools. They offer rewards, perks, and benefits that can enhance your financial well-being. To get the most out of your credit card, it’s essential to understand how to maximize these benefits. This guide will help you use rewards wisely, take advantage of introductory offers, leverage credit card perks, and maintain a good credit score.

Using Rewards Wisely

Most credit cards offer rewards for spending. These rewards can be in the form of cashback, points, or miles. To make the most of these rewards, it’s important to align your spending with the rewards program.

- Cashback Rewards: Use your card for everyday purchases. Pay off your balance each month to avoid interest charges.

- Points Programs: Redeem points for travel, gift cards, or merchandise. Look for cards with bonus points on categories you spend the most.

- Travel Miles: Use miles for flights, hotel stays, and travel experiences. Choose a card that partners with your preferred airline or hotel chain.

Taking Advantage Of Introductory Offers

Many credit cards come with attractive introductory offers. These can include zero interest on balance transfers or purchases for a set period. Here’s how to make the most of these offers:

- Balance Transfers: Transfer high-interest debt to a card with a 0% introductory rate. Pay down the balance before the introductory period ends.

- Sign-Up Bonuses: Spend the required amount within the specified time to earn bonus points or cashback. Plan your spending to meet this requirement without overspending.

Leveraging Credit Card Perks

Credit cards often come with additional perks. These can provide significant value if used correctly. Here are some common perks:

| Perk | Details |

|---|---|

| Travel Insurance | Covers trip cancellations, lost luggage, and medical emergencies. |

| Purchase Protection | Protects against theft or damage for a certain period after purchase. |

| Extended Warranties | Extends the manufacturer’s warranty on purchased items. |

Maintaining A Good Credit Score

A good credit score is crucial for maximizing credit card benefits. Here are some tips to maintain a good credit score:

- Pay on Time: Always pay your credit card bill on time. Late payments can significantly harm your credit score.

- Keep Balances Low: Use only a small percentage of your available credit. Aim to keep your credit utilization below 30%.

- Monitor Your Credit Report: Regularly check your credit report for errors and discrepancies. Report any inaccuracies immediately.

Using credit cards wisely can enhance your financial situation. Understand the features and benefits of your cards. Use them to your advantage. For more details, visit the Possible Finance website.

Pricing And Affordability

Understanding the costs involved with credit cards is crucial. The Possible Card makes this easier with clear, fair pricing. Here, we break down the key fees and rates to help you manage your finances effectively.

Annual Fees And Interest Rates

Unlike many credit cards, the Possible Card comes with a fixed monthly fee. You can expect to pay either $8 or $16 per month. This is dependent on your chosen credit limit of $400 or $800. The best part? There are no interest charges, ever. This means you can use your card without worrying about accumulating debt due to high-interest rates.

Balance Transfer Fees

Currently, the Possible Card does not support balance transfers. This means you cannot transfer balances from other credit cards to the Possible Card. This simplifies the fee structure and ensures transparency.

Foreign Transaction Fees

If you travel abroad, rest assured. The Possible Card does not have foreign transaction fees. You can use your card internationally without incurring extra charges. This is great for those who travel often or make purchases from international retailers.

Late Payment And Over-limit Fees

One of the most significant advantages of the Possible Card is the absence of late fees. No matter when you pay, you won’t face penalties. Additionally, there are no over-limit fees. This means you can manage your credit limit without the worry of unexpected charges.

| Fee Type | Details |

|---|---|

| Monthly Fee | $8 or $16 |

| Interest Rates | 0% Interest, forever |

| Balance Transfer Fee | Not Supported |

| Foreign Transaction Fee | None |

| Late Payment Fee | None |

| Over-Limit Fee | None |

The Possible Card is designed to be straightforward and affordable. With clear fees and no hidden charges, it helps you manage your finances better. For more details, visit the Possible Finance website.

Pros And Cons Of Using Credit Cards

Credit cards are powerful financial tools. They offer convenience and rewards. But they also come with potential risks. Understanding the advantages and drawbacks can help you make informed decisions.

Advantages Of Credit Card Usage

- Convenience: Credit cards are easy to use. They reduce the need to carry cash.

- Rewards: Many cards offer rewards. These include cashback, points, or travel miles.

- Build Credit History: Using credit cards responsibly can improve your credit score. This helps in getting loans with better terms.

- Protection: Credit cards often provide fraud protection. They also offer purchase protection and extended warranties.

- Interest-Free Period: Many cards offer a grace period. You can avoid interest if you pay the balance in full each month.

Potential Drawbacks To Consider

- High-Interest Rates: Credit cards can have high-interest rates. This can lead to debt if not managed properly.

- Fees: Some cards have annual fees, late payment fees, and foreign transaction fees.

- Overspending: Easy access to credit can lead to overspending. This can result in debt accumulation.

- Credit Score Impact: Missing payments or maxing out cards can negatively affect your credit score.

Balancing Rewards With Responsible Spending

To get the most out of your credit card, balance rewards with responsible spending. Follow these tips:

- Pay on Time: Always pay your bill on time to avoid late fees and interest.

- Pay in Full: Pay your balance in full each month to avoid interest charges.

- Track Spending: Keep track of your expenses to stay within budget.

- Use Rewards Wisely: Redeem rewards strategically for maximum benefit.

By managing your credit card usage, you can enjoy the benefits and avoid the pitfalls.

| Possible Loan | Possible Card |

|---|---|

| Borrow up to $500 instantly | Instant credit limit of $400 or $800 |

| No late or penalty fees | No credit check or deposit required |

| Repayment in 4 installments | 0% interest, forever |

| Helps build credit history | No late fees |

For more details, visit the Possible Finance website.

Specific Recommendations

Choosing the right credit card can be confusing. To help, here are specific recommendations tailored to different needs. Find the best cards for beginners, frequent travelers, cashback enthusiasts, and those seeking low-interest rates.

Best Credit Cards For Beginners

Beginners need credit cards that are easy to manage with low fees and simple terms. Here are some top picks:

- Possible Card: Instant credit limit of $400 or $800, no credit check, 0% interest, no late fees, and a monthly fee of $8 or $16.

- Discover it® Secured: No annual fee, reports to all three major credit bureaus, cash back on purchases.

Ideal Cards For Frequent Travelers

For frequent travelers, credit cards with travel rewards and no foreign transaction fees are a must. Consider these options:

- Chase Sapphire Preferred® Card: Earn points on travel and dining, no foreign transaction fees, great travel insurance.

- Capital One Venture Rewards Credit Card: Unlimited 2x miles per dollar on every purchase, no foreign transaction fees.

Top Picks For Cashback Enthusiasts

If you love earning cashback on everyday purchases, these cards are perfect:

- Citi® Double Cash Card: Earn up to 2% cashback on all purchases, no annual fee.

- Blue Cash Preferred® Card from American Express: Earn 6% cashback at U.S. supermarkets, 3% on transit, and 1% on other purchases.

Recommendations For Low-interest Cards

Low-interest cards help you save money on finance charges. Here are some recommended options:

- Possible Card: Enjoy 0% interest forever, with a monthly fee of $8 or $16, and no late fees.

- U.S. Bank Visa® Platinum Card: Offers a long 0% introductory APR on purchases and balance transfers.

Choosing the right credit card depends on your spending habits and financial goals. Evaluate these recommendations to find the best fit for you.

Frequently Asked Questions

How Do I Choose The Right Credit Card?

Choosing the right credit card depends on your spending habits. Look for cards with rewards that match your lifestyle. Consider interest rates, fees, and additional benefits. Compare different cards and read reviews before making a decision.

What Are The Benefits Of Using A Credit Card?

Credit cards offer various benefits, such as rewards, cash back, and travel points. They help build credit history and provide purchase protection. Many cards also offer additional perks like travel insurance and extended warranties.

How Can I Improve My Credit Score?

Improving your credit score involves paying bills on time and keeping balances low. Regularly check your credit report for errors. Avoid opening too many new accounts at once. Use credit cards responsibly and pay off the full balance each month.

What Should I Do If I Lose My Credit Card?

If you lose your credit card, immediately contact your card issuer. They will cancel the card and issue a new one. Monitor your account for unauthorized transactions. Consider setting up alerts to track your account activity.

Conclusion

Navigating credit cards can be simple with the right guidance. By using tools like Possible Finance, you can manage funds effectively. Their Possible Loan and Possible Card offer quick access to money without hidden fees. These options can help build your credit history while avoiding debt traps. Remember, making timely payments is crucial. Stay informed and use these resources wisely to enhance your financial health.