Credit Card Tips for College Students

Pay your credit card bills on time and keep your spending within your budget. Avoid carrying a – to minimize interest charges.Credit Card Tips for College Students

Credit cards can be both helpful and risky for college students. They offer convenience and the opportunity to build a credit history. But without proper management, they can lead to debt and financial stress. Establishing good credit card habits early is essential.

Start by understanding your credit card terms, including interest rates and fees. Always aim to pay your balance in full each month. Track your spending to avoid overspending and accumulating debt. Use your credit card responsibly to build a positive credit history. This will benefit you in future financial endeavors, such as securing loans or renting an apartment.

Read Also: Best Credit Cards for college Students 2024

Best Credit Cards for College Students 2024

Choosing The Right Card

Choosing the right credit card is crucial for college students. A well-chosen card helps build credit and manage expenses effectively. Here are some essential tips.

Low Interest Rates

Interest rates can significantly impact your financial health. Look for a card with low interest rates. This ensures that you pay less in interest if you carry a balance. Here are some things to consider:

- Annual Percentage Rate (APR): A lower APR means lower interest charges.

- Introductory Offers: Some cards offer 0% APR for an introductory period.

- Variable vs. Fixed Rates: Fixed rates stay the same, while variable rates can change.

Student-specific Offers

Many credit cards offer special perks for students. These student-specific offers can be highly beneficial. Consider the following:

- Rewards Programs: Earn points for purchases, which can be redeemed for cash or gifts.

- Cash Back: Some cards offer a percentage of your spending back as cash.

- Low Fees: Look for cards with no annual fees or low late fees.

Here’s a quick comparison of some popular student credit cards:

| Card | APR | Rewards | Fees |

|---|---|---|---|

|

Capital One SavorOne Cash Rewards Credit Card

|

14.99% – 24.99% | 2% cash back | No annual fee |

|

Citi Double Cash® Card

|

13.99% – 23.99% | 1 point per dollar | $25 annual fee |

|

Capital One Quicksilver Cash Rewards Credit Card

|

15.49% – 25.49% | 3% cash back on groceries | No annual fee |

Understanding Credit Scores

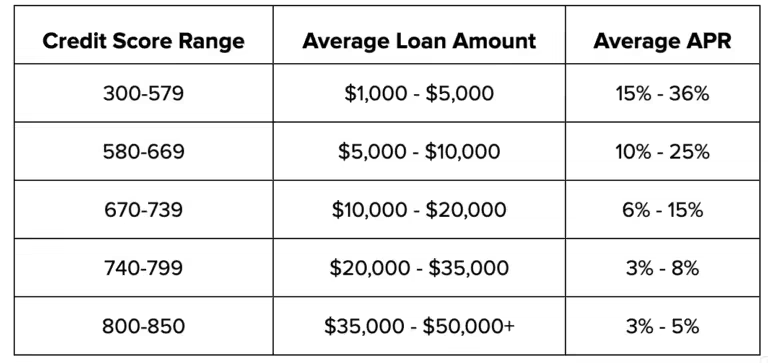

College students often face financial challenges. One crucial aspect is understanding credit scores. A credit score affects your financial future. This score impacts loans, renting, and even job opportunities. Learn how to manage and build your credit score wisely.

Importance Of Credit Scores

Credit scores range from 300 to 850. Higher scores mean better financial health. A good credit score opens many doors. It’s essential for:

- Getting approved for loans

- Lower interest rates

- Renting an apartment

- Job applications

Maintaining a good credit score is vital. It influences many aspects of your life. Start building a strong credit history now.

How To Build Credit

Building credit requires careful planning. Follow these steps to improve your credit score:

- Get a Credit Card: Choose a student credit card. Use it for small purchases.

- Pay On Time: Always pay your credit card bill on time. Late payments harm your score.

- Keep Balances Low: Use less than 30% of your credit limit. This shows responsible usage.

- Monitor Your Credit Report: Check your credit report regularly. Ensure there are no errors.

- Build a Credit Mix: Having different types of credit can help. Consider a small loan or other credit types.

Here’s a quick overview of steps to build credit:

| Step | Action |

|---|---|

| 1 | Get a Credit Card |

| 2 | Pay On Time |

| 3 | Keep Balances Low |

| 4 | Monitor Your Credit Report |

| 5 | Build a Credit Mix |

Using these tips can help build a solid credit history. Start early for better financial health. Your future self will thank you.

Managing Your Spending

Managing your spending is essential for college students using credit cards. Credit cards can be a great tool, but only if used wisely. By following a few tips, you can avoid debt and build a strong credit history.

Creating A Budget

Start by creating a budget. A budget helps you track your income and expenses. Knowing your limits is crucial to staying debt-free.

| Category | Monthly Budget |

|---|---|

| Food | $200 |

| Transport | $100 |

| Books | $50 |

| Entertainment | $50 |

Use the table above to set your budget categories. Adjust amounts based on your needs.

Tracking Expenses

Next, focus on tracking expenses. Keep a record of every purchase. This helps you stay within your budget.

- Use a spreadsheet or a budgeting app.

- Check your credit card statements regularly.

- Note down each transaction immediately.

Tracking expenses helps you see where your money goes. It also helps you make better financial decisions.

By creating a budget and tracking expenses, you can manage your spending effectively. This ensures you use your credit card wisely.

Avoiding Debt

Managing credit cards in college can be challenging. Many students end up with debt. Here are some tips for avoiding debt.

Paying The Balance

Always try to pay your balance in full each month. This prevents interest charges from adding up. If you can’t pay the full amount, pay more than the minimum. This helps reduce your balance faster.

- Set reminders to pay on time.

- Use automatic payments.

- Keep track of your spending.

Using Credit Wisely

Use your credit card wisely to avoid debt. Only charge what you can pay off. This keeps your balance low and manageable.

- Limit your purchases to needs, not wants.

- Avoid using credit for large expenses.

- Monitor your credit limit to avoid overspending.

| Tips | Benefits |

|---|---|

| Pay balance in full | Avoid interest charges |

| Use automatic payments | Never miss a payment |

| Track spending | Stay within budget |

Remember, using credit wisely is crucial. It helps build a good credit score. This will benefit you in the future.

Benefits Of Credit Cards

Credit cards offer many benefits to college students. They can help build credit history, manage expenses, and provide financial flexibility. Understanding these advantages can help students make informed decisions about their finances.

Rewards Programs

Many credit cards offer rewards programs. Students can earn points for every dollar spent. These points can be redeemed for travel, merchandise, or gift cards. It’s like getting free stuff for spending money wisely!

Cashback Offers

Some credit cards offer cashback on purchases. This means students get a small percentage of their money back. Cashback can be used to pay off the credit card bill or saved for future expenses. It’s a great way to save money while spending.

| Benefit | Description |

|---|---|

| Rewards Programs | Earn points for purchases and redeem for rewards. |

| Cashback Offers | Get a percentage of money back on purchases. |

Reading The Fine Print

Understanding the terms of your credit card is essential. College students often overlook the fine print. This could lead to unexpected fees or high interest rates. Here’s what you need to know.

Understanding Fees

Fees can quickly add up if you’re not careful. Always read the fine print to understand all charges. Common fees include:

- Annual fees: Some cards charge a yearly fee.

- Late payment fees: You get charged if you miss a payment.

- Over-the-limit fees: Exceeding your credit limit can cost you.

- Cash advance fees: Withdrawing cash has extra charges.

Interest Rate Terms

Interest rates can vary based on your credit card agreement. Knowing your Annual Percentage Rate (APR) is crucial. The APR is the interest you’ll pay on balances. Here are key points to understand:

- Introductory APR: Some cards offer lower rates initially.

- Standard APR: This is the rate after the introductory period.

- Penalty APR: Higher rates if you miss payments.

- Variable APR: This rate can change over time.

Use this information to avoid costly mistakes. Always read the fine print carefully.

Security Tips

College students often use credit cards to manage their finances. Understanding security tips is crucial to protect your financial information. Here are some tips to keep your credit card safe.

Protecting Your Information

Always keep your credit card in a safe place. Avoid sharing your credit card number online or over the phone unless absolutely necessary. When shopping online, ensure the website is secure. Look for “https” in the URL.

Use strong, unique passwords for your online accounts. Change your passwords regularly. Avoid using easily guessed information like birthdays or names.

Enable alerts for your credit card transactions. This will help you track purchases and detect unauthorized activity quickly.

| Tip | Description |

|---|---|

| Safe Storage | Keep your card in a secure place. |

| Secure Websites | Look for “https” before entering details. |

| Strong Passwords | Use unique passwords and change them often. |

| Transaction Alerts | Enable alerts to track your purchases. |

Reporting Fraud

If you notice any unauthorized transactions, report them immediately. Contact your credit card issuer using the number on the back of your card.

Write down the details of the fraudulent charge. Include the date, amount, and merchant. This will help when you report the fraud.

Consider filing a report with the local police. This can provide extra documentation and help in resolving the issue.

- Contact your issuer immediately.

- Document the fraudulent charge details.

- File a police report if necessary.

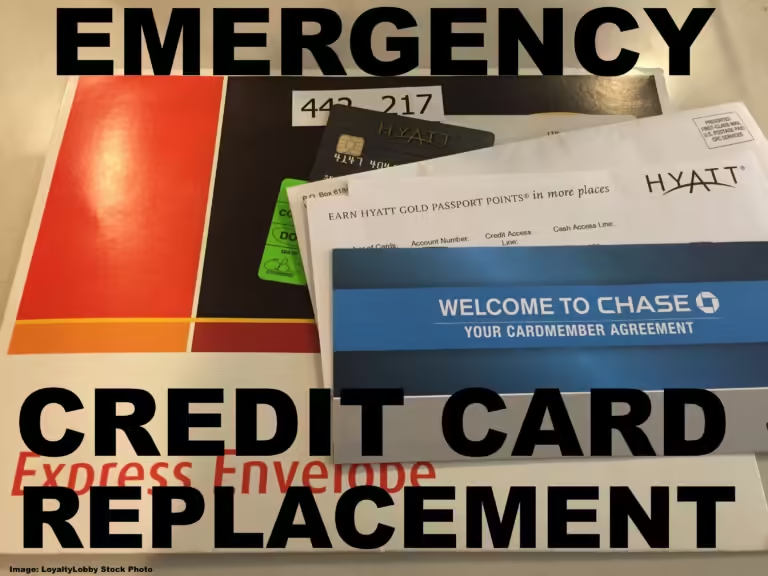

Handling Financial Emergencies

Handling financial emergencies can be challenging for college students. Knowing how to manage these situations is essential. This section will provide valuable tips for handling financial emergencies using credit cards.

Emergency Funds

Emergency funds are essential for unexpected expenses. An emergency fund can prevent financial stress. Aim to save at least $500 to start. Having a small fund can cover minor emergencies like car repairs or medical bills.

| Emergency | Estimated Cost |

|---|---|

| Car Repairs | $200 – $600 |

| Medical Bills | $100 – $500 |

| Textbook Replacement | $50 – $200 |

Using Credit In Emergencies

Using credit cards in emergencies can be a smart move. But, it must be done carefully. Only use credit cards for true emergencies. Avoid using them for non-essential purchases.

- Know Your Limit: Be aware of your credit limit.

- Pay on Time: Always pay your credit card bill on time.

- Keep Track: Monitor your spending and balance regularly.

If you use a credit card, create a repayment plan. Try to pay off the balance quickly. This helps avoid high-interest charges. Remember, using credit wisely can build a good credit score.

Frequently Asked Questions

How Can College Students Build Credit?

College students can build credit by using a credit card responsibly. Make small purchases and pay off the balance in full each month.

What Type Of Credit Card Is Best For Students?

A student credit card with low fees and a good rewards program is ideal. Look for one that reports to credit bureaus.

Should Students Pay Off Their Balance Monthly?

Yes, students should pay off their balance every month. This helps avoid interest and builds a positive credit history.

How Can Students Avoid Credit Card Debt?

Students can avoid debt by budgeting and only spending what they can afford. Use the card for necessities, not luxuries.

Conclusion

Mastering credit card use in college sets the foundation for future financial health. Remember to spend wisely and pay on time. Building good habits now will boost your credit score and ensure long-term benefits. Stay informed and use these tips to navigate your financial journey successfully.

Your future self will thank you.