Credit Card Tips For Beginners: Essential Advice to Get Started

Navigating the world of credit cards can be overwhelming for beginners. Understanding the basics and learning a few tips can make a big difference.

Credit cards are powerful financial tools, offering convenience and the potential to build your credit score. As a beginner, it’s essential to grasp how to use them wisely to avoid common pitfalls. In this guide, we will explore simple yet effective tips to help you manage your credit card responsibly. From understanding interest rates to knowing the importance of timely payments, these tips will set you on the right path. With the right knowledge and habits, you can make the most of your credit card and secure your financial future. For businesses looking to build their credit, consider using tools like the FairFigure Card. It offers real-time credit monitoring, same-day funding, and opportunities to boost your business credit scores.

Introduction To Credit Cards

Credit cards are an essential tool for managing personal finance. They offer convenience and the ability to build credit scores. Understanding how they work is crucial for beginners.

What Is A Credit Card?

A credit card is a payment card issued by financial institutions. It allows cardholders to borrow funds to pay for goods and services. The borrowed amount must be repaid with interest, if not paid back in full by the due date.

How Credit Cards Work

Credit cards function based on a credit limit set by the issuer. When you use a credit card, the issuer pays the merchant on your behalf. You then repay the issuer either in full or over time.

Here’s a simple breakdown:

- Credit Limit: The maximum amount you can borrow.

- Billing Cycle: The period during which transactions are recorded.

- Interest Rate: The cost of borrowing if the balance is not paid in full.

- Minimum Payment: The smallest amount you must pay to avoid penalties.

The Importance Of Understanding Credit Cards

Understanding credit cards is vital for financial health. Misusing credit cards can lead to debt and poor credit scores. Educate yourself on fees, interest rates, and repayment terms.

Consider the following tips:

- Read the terms and conditions carefully.

- Pay your balance in full each month to avoid interest.

- Monitor your statements for errors.

- Keep your credit utilization low.

Being informed helps you use credit cards wisely. It ensures you reap the benefits without falling into debt traps.

Choosing The Right Credit Card

Selecting the right credit card is a crucial step for beginners. It can influence your financial health and spending habits. It’s important to understand the different types of credit cards, evaluate your spending habits, and grasp the implications of interest rates and fees.

Types Of Credit Cards

Credit cards come in various types, each with unique features. Understanding these can help you make an informed decision.

- Rewards Cards: These cards offer points, cashback, or miles on purchases. They are great for frequent shoppers.

- Balance Transfer Cards: These cards offer low or zero interest on transferred balances. Ideal for consolidating debt.

- Secured Credit Cards: These require a cash deposit as collateral. They are perfect for building or rebuilding credit.

- Business Credit Cards: These are designed for business expenses and often come with higher credit limits and specific rewards.

Evaluating Your Spending Habits

Understanding your spending habits is essential when choosing a credit card. Consider the following factors:

| Factor | Considerations |

|---|---|

| Monthly Expenses | Track your monthly spending to choose a card with suitable rewards. |

| Payment Capacity | If you can pay off balances monthly, a rewards card could be beneficial. |

| Spending Categories | Identify categories like groceries, travel, or dining where you spend the most. |

Understanding Interest Rates And Fees

Interest rates and fees can significantly impact your credit card experience. Here’s what to consider:

- Annual Percentage Rate (APR): This is the interest rate you’ll pay on balances. Look for cards with low APRs if you plan to carry a balance.

- Annual Fees: Some cards come with yearly fees. Ensure the benefits outweigh the costs.

- Late Payment Fees: Missing a payment can incur hefty fees. Choose a card with reasonable late fees.

- Foreign Transaction Fees: If you travel internationally, opt for a card with no foreign transaction fees.

Choosing the right credit card involves careful consideration of your financial situation and goals. By understanding the types of credit cards, evaluating your spending habits, and being aware of interest rates and fees, you can make an informed decision that benefits your financial health.

Key Features Of Credit Cards

Understanding the key features of credit cards is essential for beginners. Each feature offers unique benefits and can impact your overall credit experience. Let’s explore some of the most important features to consider.

Credit Limits

Credit limits represent the maximum amount you can spend using your credit card. It’s crucial to know your limit to avoid overspending and potential penalties. Staying within your credit limit helps maintain a good credit score.

Rewards And Cashback Programs

Many credit cards offer rewards and cashback programs. These programs provide incentives like points, miles, or cash back for every dollar spent. Here are some common types of rewards:

- Points: Earn points for purchases which can be redeemed for various rewards.

- Cashback: Receive a percentage of your spending back as cash.

- Miles: Accumulate miles for travel-related expenses.

Choose a credit card that aligns with your spending habits to maximize benefits.

Introductory Offers And Sign-up Bonuses

Credit cards often come with introductory offers and sign-up bonuses. These offers may include:

- 0% APR: No interest on purchases or balance transfers for a specified period.

- Bonus Points: Earn extra points after meeting spending requirements within a set timeframe.

- Waived Fees: No annual fees for the first year.

Introductory offers can provide significant savings and perks, making them appealing for new cardholders.

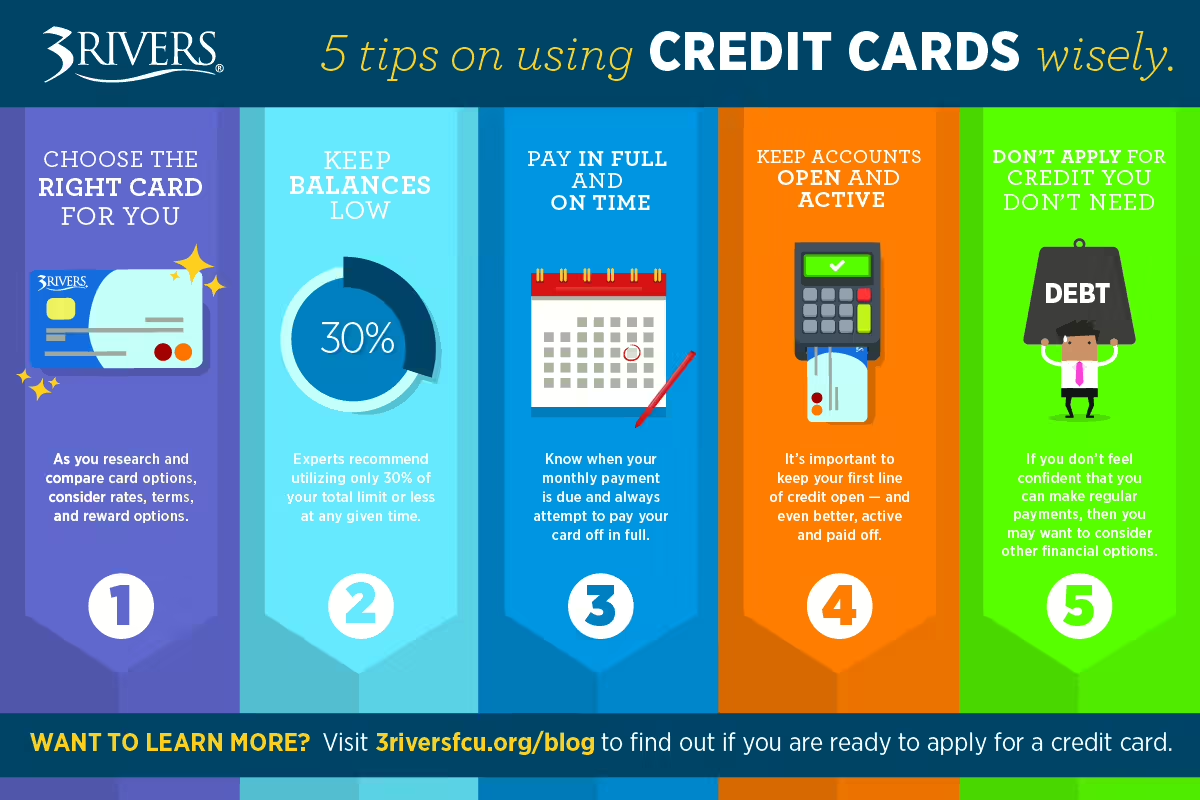

Managing Your Credit Card Wisely

Using a credit card can be a smart financial move if managed wisely. It helps build your credit score, offers convenience, and can provide rewards. But, misuse can lead to debt and financial trouble. Here are some essential tips to help you manage your credit card effectively.

Creating A Budget

Establishing a budget is crucial. It helps you track your spending and ensures you do not overspend. Allocate a specific amount for credit card expenses each month. Stick to this limit to avoid unnecessary debt.

- Track your monthly income and expenses.

- Set aside a fixed amount for credit card use.

- Adjust your budget as needed to stay within your limits.

Paying Your Bill On Time

Paying your credit card bill on time is vital. Late payments can negatively impact your credit score. They also incur late fees and higher interest rates.

- Set up automatic payments to ensure timely payments.

- Mark your calendar with due dates as a reminder.

- Pay more than the minimum amount to reduce your balance faster.

Avoiding Common Pitfalls

Many beginners fall into common credit card traps. Avoid these to maintain a healthy credit profile.

| Common Pitfall | Solution |

|---|---|

| Maxing out your credit limit | Keep your balance below 30% of your credit limit. |

| Ignoring your credit score | Regularly check your credit report for errors. |

| Applying for too many cards | Limit the number of new credit applications. |

Using these tips, you can manage your credit card responsibly. This will help you build a strong credit history and avoid financial stress.

Building And Maintaining Good Credit

Understanding how to build and maintain good credit is essential for financial health. A strong credit score opens doors to better interest rates, higher credit limits, and more financial opportunities. Let’s explore key strategies to help you establish and keep a good credit standing.

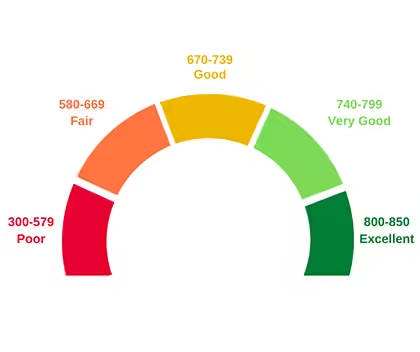

Monitoring Your Credit Score

Regularly checking your credit score is crucial. It helps you stay informed about your credit health. The FairFigure Card offers real-time credit score tracking for businesses, making it easier to monitor and improve your credit.

Here’s how you can monitor your credit score effectively:

- Use credit monitoring services to get regular updates.

- Review your credit report from all three major bureaus.

- Set up alerts to notify you of significant changes.

The Impact Of Credit Utilization

Credit utilization refers to the amount of credit you use compared to your credit limit. It is a crucial factor in your credit score calculation. Keeping your credit utilization below 30% is recommended for a good credit score.

To manage your credit utilization:

- Pay off balances in full each month.

- Ask for a higher credit limit to reduce utilization.

- Spread out your purchases across different credit cards.

Dispute Errors On Your Credit Report

Errors on your credit report can negatively impact your score. It’s important to review your reports and dispute any inaccuracies. The FairFigure Card features a Business Credit Correct Tool that identifies and corrects incorrect information, ensuring your credit report is accurate.

Steps to dispute errors:

- Request a copy of your credit report from each bureau.

- Review the report for any errors or discrepancies.

- Contact the credit bureau to dispute incorrect information.

- Provide supporting documents to prove your claim.

Use these tips to build and maintain a strong credit profile. The FairFigure Card can help you track and improve your business credit effectively.

Pros And Cons Of Using Credit Cards

Credit cards offer numerous benefits but also come with certain risks. Understanding both the pros and cons can help beginners make informed decisions. Let’s dive into the key advantages and potential drawbacks of using credit cards.

Advantages Of Credit Cards

- Convenience: Credit cards are easy to use and accepted almost everywhere. They eliminate the need to carry cash.

- Building Credit: Responsible usage of credit cards can help build a good credit score. This is crucial for future loans and mortgages.

- Rewards and Benefits: Many credit cards offer rewards like cashback, points, and travel miles. These can save you money.

- Purchase Protection: Credit cards often come with purchase protection and extended warranties on items bought.

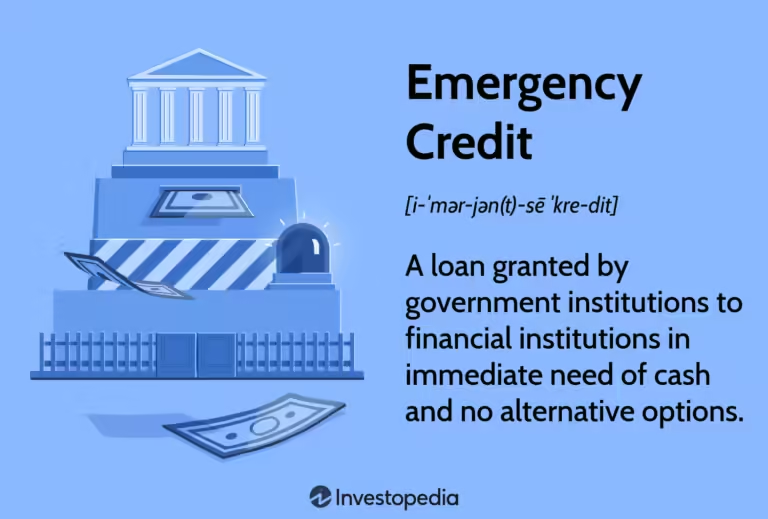

- Emergency Funds: Credit cards provide a financial cushion in emergencies. They can be lifesavers when unexpected expenses arise.

Potential Drawbacks

- High-Interest Rates: Carrying a balance can lead to high-interest charges. This can quickly accumulate and become overwhelming.

- Debt Accumulation: It’s easy to spend more than you can afford. This can lead to significant debt.

- Fees: Credit cards may have various fees. These include annual fees, late payment fees, and foreign transaction fees.

- Credit Score Impact: Late payments or high balances can negatively affect your credit score. This can impact future financial opportunities.

- Fraud Risk: Credit cards are susceptible to fraud. While protection exists, dealing with fraud can be stressful.

Balancing Benefits And Risks

Using credit cards wisely involves balancing the benefits and risks. Here are some tips:

- Pay on Time: Always pay your bill on time to avoid late fees and interest charges.

- Keep Balances Low: Try to pay off your balance in full each month. This helps avoid interest charges and maintains a good credit score.

- Monitor Your Spending: Keep track of your spending to stay within your budget and avoid debt.

- Use Rewards Wisely: Take advantage of rewards, but don’t overspend to earn them. Ensure the rewards align with your spending habits.

- Stay Informed: Regularly check your credit report for errors or signs of fraud. Correct any inaccuracies promptly.

By understanding the pros and cons and following these tips, you can make the most of your credit card while minimizing risks.

Recommendations For New Credit Card Users

Starting out with a credit card can be exciting but daunting. Knowing how to manage it wisely is crucial to building a good credit history. Here are some essential tips for new credit card users to help them get started on the right foot.

Starting With A Secured Credit Card

For beginners, a secured credit card is a great option. It requires a cash deposit as collateral, which acts as your credit limit. This type of card is easier to obtain and helps you build credit responsibly.

- Lower Risk: The deposit minimizes the risk for lenders.

- Credit Building: Payments are reported to credit bureaus.

- Upgrade Potential: Many secured cards can be upgraded to unsecured cards.

Using Credit Cards For Everyday Purchases

Using your credit card for everyday purchases can be beneficial if done wisely. It helps in building a credit history and can offer rewards.

- Track Spending: Keep a close eye on your spending to avoid overspending.

- Pay in Full: Always try to pay your balance in full to avoid interest charges.

- Utilize Rewards: Take advantage of reward points or cashback offers.

When To Seek Professional Advice

If you find managing your credit card overwhelming, it might be time to seek professional advice. Experts can provide guidance tailored to your financial situation.

| Situation | Action |

|---|---|

| High Credit Card Debt | Consult a credit counselor |

| Credit Score Issues | Consider using tools like the FairFigure Card |

| Financial Planning | Seek advice from a financial advisor |

The FairFigure Card is a business credit monitoring tool that helps businesses build their credit ratings and obtain funding. It offers real-time credit score tracking, credit-building opportunities, and same-day funding access. This can be very helpful for businesses needing to correct credit report errors or improve their credit scores quickly.

Frequently Asked Questions

What Is The Best Way To Use A Credit Card?

The best way to use a credit card is to pay off the balance in full every month. This avoids interest charges and helps build a positive credit history.

How Can I Improve My Credit Score With A Credit Card?

To improve your credit score, make timely payments, keep your credit utilization low, and avoid opening too many new accounts at once.

Should I Get A Credit Card As A Beginner?

Yes, getting a credit card as a beginner can help build credit history. Choose a card with no annual fee and manageable credit limit.

What Are The Benefits Of Using A Credit Card?

Credit cards offer benefits like rewards points, cash back, and fraud protection. They also help build your credit score when used responsibly.

Conclusion

Starting with credit cards can be daunting. Use these tips to build confidence. Remember, responsible usage is key. Monitor your spending and pay on time. Interested in improving your business credit? Consider the FairFigure Card. It offers real-time credit monitoring and same-day funding. Learn more about FairFigure’s benefits here. Stay financially smart and make informed decisions. Happy credit building!