Credit Card Tips And Tricks: Maximize Rewards and Minimize Fees

Credit cards can be powerful tools when used wisely. They can help manage expenses and build credit.

In this blog post, we will share essential tips and tricks for getting the most out of your credit cards. Whether you’re new to credit or looking to optimize your spending, these insights will be valuable. From understanding interest rates to maximizing rewards, we’ll cover key strategies to enhance your financial health. Learn how to avoid common pitfalls and make informed decisions. Ready to take control of your credit card usage? Let’s get started with these practical tips and tricks. For more details on a reliable credit card option, check out Zable UK.

Introduction To Credit Card Tips And Tricks

Credit cards can be powerful tools for managing finances and building credit. Knowing the right tips and tricks can help you maximize rewards and minimize fees. This guide aims to equip you with essential knowledge about using credit cards effectively.

Understanding Credit Cards

Credit cards are more than just plastic payment tools. They offer a variety of benefits, including rewards, credit building, and financial management. Understanding how they work is key to using them wisely.

A credit card allows you to borrow money up to a certain limit for purchases. You need to pay back the borrowed amount within a specified period to avoid interest charges. Different cards offer different features, such as rewards, cash back, or travel points.

With Zable Credit Cards, for example, you can access instant virtual cards via Apple Pay or Google Pay, monitor your credit score, and track spending. These features make it easier to manage your finances efficiently.

Purpose Of Maximizing Rewards And Minimizing Fees

The primary goal of credit card tips and tricks is to maximize rewards while minimizing fees. By doing so, you can get the most out of your credit card without overspending.

Here are some strategies to help you achieve this:

- Use rewards cards: Choose a card that offers rewards like cash back or travel points for your regular spending.

- Pay your balance in full: Avoid interest charges by paying your balance in full each month.

- Monitor your spending: Use tools like the Zable app to track your spending and stay within your budget.

- Take advantage of offers: Look for promotional offers like sign-up bonuses or 0% APR on purchases.

- Report rent payments: Build your credit history by reporting rent payments through services like the Zable app.

Managing a credit card effectively can lead to improved credit scores, better financial management, and more rewarding benefits. Zable Credit Cards offer features to help you achieve these goals, such as free access to your Equifax credit score and detailed financial insights.

Key Features Of Reward Credit Cards

Reward credit cards offer numerous benefits that can significantly enhance your financial experience. With a variety of rewards programs, these cards cater to diverse preferences and spending habits. Let’s explore the key features that make reward credit cards appealing.

Types Of Rewards Programs

Reward credit cards come with different types of rewards programs, each designed to benefit specific spending behaviors. Here are some common types:

- Cashback Programs: Earn a percentage of your purchases back as cash.

- Travel Rewards: Accumulate points or miles for travel-related expenses.

- Points Programs: Earn points that can be redeemed for various goods and services.

Cashback Benefits

Cashback rewards are straightforward and popular among cardholders. Here’s why:

- Simple Earnings: Earn a percentage back on every purchase.

- Flexible Use: Use cashback for statement credits, gift cards, or deposits.

- Easy to Track: Monitor earnings through your credit card app.

For example, the Zable Credit Card offers instant virtual card access and tools for spending tracking, making it easy to manage and benefit from cashback rewards.

Travel Rewards

Travel reward cards are perfect for those who love to explore. These cards offer:

- Miles and Points: Earn miles or points for flights, hotels, and more.

- Exclusive Perks: Access to airport lounges, travel insurance, and priority boarding.

- Global Usability: Use your rewards worldwide for a seamless travel experience.

With a card like Zable, which integrates with Apple Pay and Google Pay, you can enjoy travel rewards effortlessly.

Points And Miles

Points and miles programs offer flexibility and value. Here’s what you need to know:

- Versatile Redemption: Redeem points for travel, merchandise, or gift cards.

- Bonus Categories: Earn extra points on specific categories like dining and groceries.

- Transferable Points: Transfer points to airline and hotel partners.

For instance, with a credit card like Zable, you can monitor your spending, ensuring you maximize your points and miles while building your credit score.

| Feature | Description |

|---|---|

| Credit Building | Helps improve credit score with responsible usage. |

| Instant Access | Use a virtual card immediately upon approval. |

| Quick Loan Approval | Funds typically received in under an hour. |

| Comprehensive Financial Management | Tools for tracking spending and credit score monitoring. |

Strategies To Maximize Credit Card Rewards

Maximizing credit card rewards can help you save money and gain various benefits. Using the right strategies, you can make the most out of your spending. Here are some effective tips to help you achieve this goal.

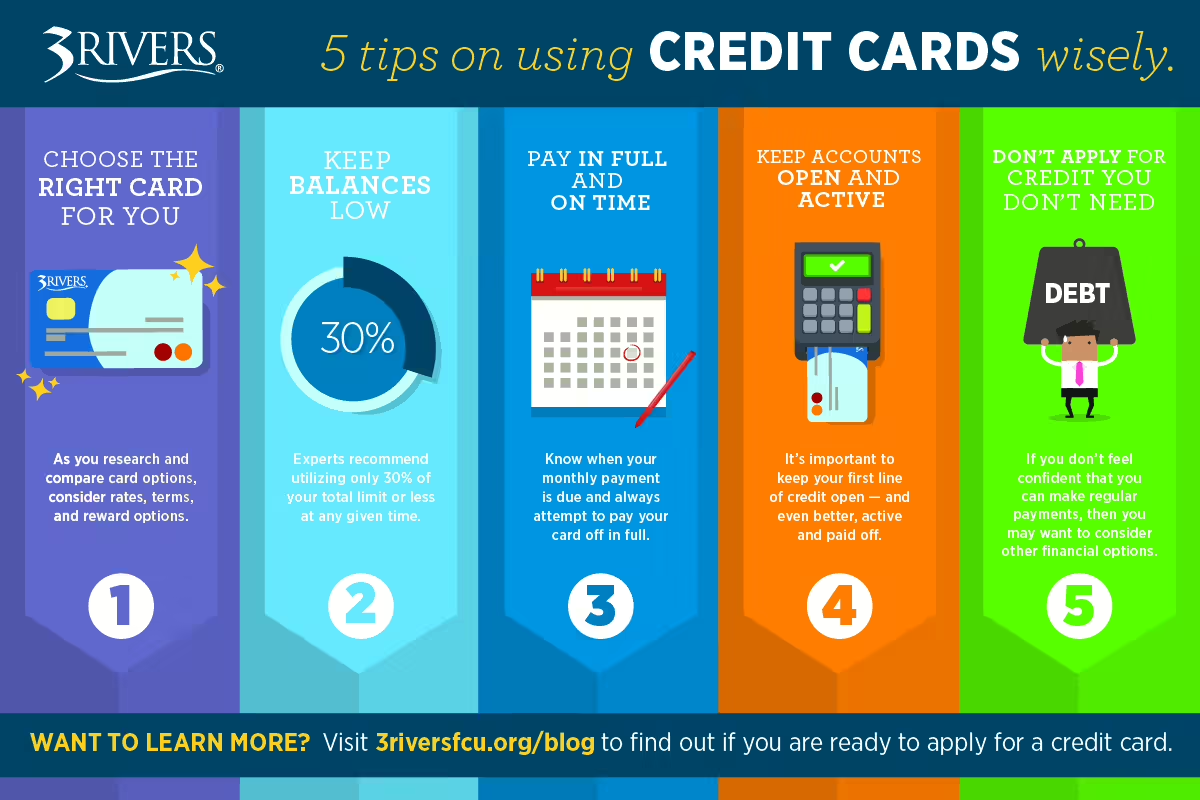

Choosing The Right Card For Your Spending Habits

Selecting a credit card that aligns with your spending habits is crucial. Different cards offer different rewards. For example, if you travel frequently, a card with travel rewards would be beneficial. On the other hand, if you spend a lot on groceries, choose a card that offers high rewards for grocery purchases.

Here’s a simple table to help you decide:

| Spending Category | Recommended Card Type |

|---|---|

| Travel | Travel Rewards Card |

| Groceries | Cashback Card |

| Dining | Dining Rewards Card |

Using Multiple Cards For Different Purchases

Using multiple cards can help you maximize your rewards. Different cards offer different benefits for various purchases. For example, use one card for fuel, another for dining, and another for online shopping. This way, you can earn the highest rewards possible for each category.

Consider these points:

- Keep track of each card’s reward categories.

- Pay off balances in full to avoid interest charges.

- Ensure you meet the minimum spend requirements for rewards.

Taking Advantage Of Sign-up Bonuses

Many credit cards offer sign-up bonuses. These are usually given when you spend a certain amount within the first few months. This can be a great way to earn extra rewards quickly. Make sure to check the terms and conditions to understand the requirements.

Steps to maximize sign-up bonuses:

- Choose a card with a high sign-up bonus.

- Plan your spending to meet the required amount.

- Track your spending to ensure you reach the target.

Maximizing Rewards On Everyday Spending

Everyday spending can also yield significant rewards. Use your credit card for regular expenses like groceries, utilities, and transportation. Many cards offer higher rewards for these categories.

Tips for maximizing rewards:

- Pay bills with your credit card.

- Shop at stores that offer bonus points.

- Take advantage of promotional offers.

By implementing these strategies, you can effectively maximize your credit card rewards and enjoy significant savings and benefits.

Tips To Minimize Credit Card Fees

Credit card fees can add up quickly, hurting your finances. Managing these fees helps you save money and maintain a healthy credit score. Here are some practical tips to minimize credit card fees.

Understanding Annual Fees

Annual fees are a common charge on many credit cards. Some cards, like those from Zable UK, may offer benefits like credit score monitoring and rent reporting. Ensure the benefits outweigh the cost. If not, consider a no-annual-fee card.

Avoiding Late Payment Fees

Late payment fees can be hefty. To avoid these, set up automatic payments or reminders on your phone. Paying on time not only saves you money but also helps improve your credit score.

How To Prevent Foreign Transaction Fees

Foreign transaction fees apply when you use your card abroad. Use cards that waive these fees, or consider a travel-specific card. Always check the terms and conditions before traveling.

Managing Balance Transfer Fees

Balance transfer fees are charged when you move debt from one card to another. Before transferring, calculate if the fee is worth the interest saved. Some cards offer 0% APR on balance transfers for a limited time.

Here’s a quick reference table to summarize these tips:

| Fee Type | Tips to Minimize |

|---|---|

| Annual Fees | Evaluate benefits vs. cost; consider no-annual-fee cards |

| Late Payment Fees | Set up automatic payments or reminders |

| Foreign Transaction Fees | Use cards that waive these fees; check terms before traveling |

| Balance Transfer Fees | Calculate if the fee saves on interest; look for 0% APR offers |

Pros And Cons Of Using Reward Credit Cards

Reward credit cards offer great perks like cash back and travel points. They can, however, lead to overspending and high interest if not managed well.

Reward credit cards offer numerous benefits. They can make every purchase more rewarding. But they also come with some potential downsides. Understanding both sides can help you make an informed decision.Benefits Of Reward Credit Cards

Reward credit cards provide multiple advantages. Here are some key benefits:- Earn Rewards: Accumulate points, miles, or cashback on every purchase.

- Special Offers: Enjoy promotional offers like sign-up bonuses.

- Travel Perks: Access travel-related benefits, including free flights or hotel stays.

- Cashback: Get a percentage of your spending back as cash.

- Exclusive Discounts: Receive discounts on dining, shopping, and entertainment.

Potential Downsides And Pitfalls

While reward credit cards offer many benefits, there are some potential downsides:- High APR: Reward cards often come with higher interest rates.

- Annual Fees: Some cards charge annual fees, which can reduce overall benefits.

- Complexity: Understanding reward programs can be complicated.

- Overspending: The allure of rewards can lead to increased spending.

| Benefits | Potential Downsides |

|---|---|

| Earn rewards on every purchase | Higher interest rates |

| Access exclusive offers and discounts | Annual fees |

| Travel perks and cashback options | Complex reward programs |

| Instant virtual card access | Risk of overspending |

Specific Recommendations For Different Users

Credit cards are not one-size-fits-all. Different users have varied needs and preferences. Whether you travel frequently, love cash back offers, are a student, or aim to build your credit, there is a card for you. Let’s explore the best options for each type of user.

Best Cards For Frequent Travelers

If you are a frequent traveler, you need a card that offers travel rewards, no foreign transaction fees, and other travel-related perks. Look for cards that provide:

- Travel Rewards: Earn points or miles for every purchase.

- No Foreign Transaction Fees: Save money on international purchases.

- Travel Insurance: Get coverage for trip cancellations, lost luggage, and more.

- Lounge Access: Enjoy access to airport lounges for a more comfortable travel experience.

| Card Name | Annual Fee | Key Benefits |

|---|---|---|

| Chase Sapphire Preferred | $95 | 2x points on travel and dining, no foreign transaction fees |

| American Express Gold Card | $250 | 3x points on flights, travel insurance |

Best Cards For Cash Back Enthusiasts

Cash back cards are ideal for those who want to earn rewards on everyday purchases. These cards offer:

- High Cash Back Rates: Earn a percentage of your spending back.

- Bonus Categories: Higher cash back rates on specific categories like groceries or gas.

- Introductory Offers: Sign-up bonuses and 0% APR for a limited period.

| Card Name | Annual Fee | Key Benefits |

|---|---|---|

| Discover it Cash Back | $0 | 5% cash back on rotating categories, dollar-for-dollar match of all cash back earned in the first year |

| Citi Double Cash Card | $0 | 2% cash back on all purchases (1% when you buy, 1% as you pay) |

Best Cards For Students

Students need credit cards that help them build credit responsibly while offering rewards. Look for cards with:

- No Annual Fee: Affordable options for budget-conscious students.

- Rewards on Everyday Spending: Earn points or cash back on common student expenses.

- Credit Building Tools: Access to credit score monitoring and tips.

| Card Name | Annual Fee | Key Benefits |

|---|---|---|

| Discover it Student Cash Back | $0 | 5% cash back on rotating categories, free FICO score |

| Journey Student Rewards from Capital One | $0 | 1% cash back on all purchases, 1.25% cash back for on-time payments |

Best Cards For Building Credit

For those aiming to build or rebuild their credit, secured cards are a great option. These cards offer:

- Low Deposit Requirements: Start with a small deposit to secure your credit line.

- Credit Reporting: Reports to all three major credit bureaus.

- Credit Building Tools: Access to credit monitoring and tips.

| Card Name | Deposit Requirement | Key Benefits |

|---|---|---|

| Capital One Secured Mastercard | $49, $99, or $200 | Reports to all three major credit bureaus, access to higher credit line after making first five monthly payments on time |

| Discover it Secured | $200 | 2% cash back at gas stations and restaurants, free FICO score |

Frequently Asked Questions

How Can I Maximize Credit Card Rewards?

To maximize credit card rewards, choose a card that aligns with your spending habits. Pay off your balance monthly. Use your card for everyday purchases and take advantage of sign-up bonuses and special promotions.

What Are The Best Ways To Avoid Credit Card Debt?

Avoid credit card debt by spending within your means. Pay your balance in full each month. Set up automatic payments to avoid late fees. Track your spending to stay aware of your financial habits.

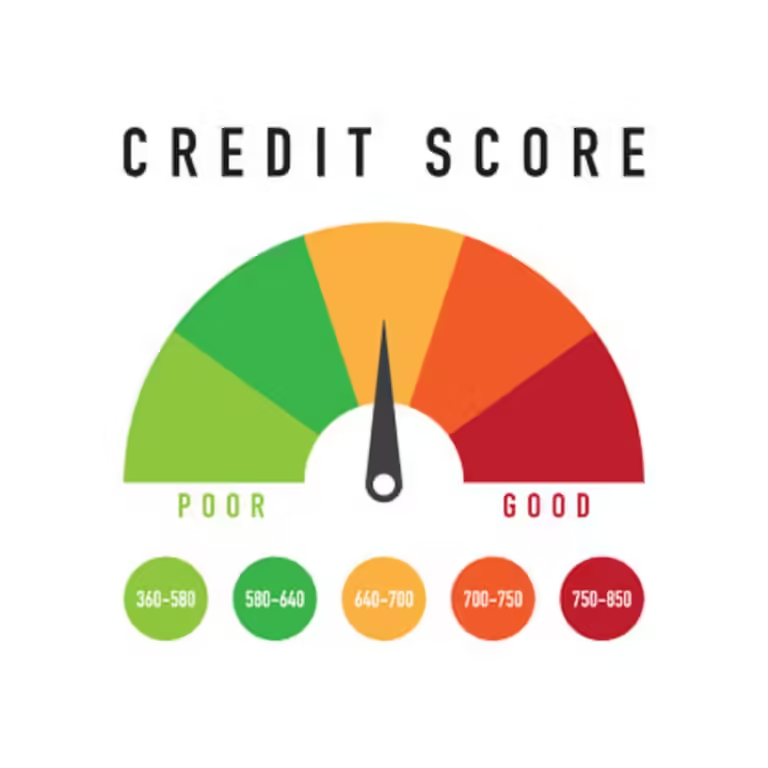

How Does A Credit Card Impact My Credit Score?

A credit card impacts your credit score by affecting your credit utilization and payment history. Paying on time and keeping balances low can positively impact your score. Regularly monitor your credit report for accuracy.

Should I Use A Credit Card For Everyday Purchases?

Using a credit card for everyday purchases can be beneficial if you pay off your balance monthly. This helps you earn rewards and build credit. However, avoid overspending and accumulating debt.

Conclusion

Mastering credit card use can bring many benefits. Apply these tips and tricks to manage your finances better and build your credit score. Zable UK offers a great option for those looking to improve their credit. Explore Zable Credit Cards and Personal Loans for helpful tools and fast access to funds. Learn more and apply today by visiting Zable UK.