Credit Card Tips: Maximize Rewards and Minimize Fees

Managing credit cards can be challenging. But with the right tips, it becomes easier.

Credit cards offer convenience, rewards, and financial flexibility. Yet, without proper management, they can lead to debt and financial stress. This blog post will provide practical tips to help you use your credit cards wisely. From understanding interest rates to maximizing rewards, we’ll cover essential advice for both new and experienced cardholders. Whether you aim to improve your credit score or simply manage expenses better, these tips will guide you toward smarter financial decisions. Read on to discover valuable insights and make the most of your credit cards. Wallester offers innovative solutions for managing business expenses and launching branded card programs. Explore their features and benefits to streamline corporate spending and enhance financial control.

Introduction To Credit Card Tips

Credit cards offer convenience and financial flexibility. Using them wisely can enhance your financial health. This guide covers essential tips to help you manage credit cards effectively.

Understanding The Importance Of Credit Card Management

Credit card management is crucial for maintaining a healthy credit score. Poor management can lead to high-interest debt and financial stress. Here are key points to consider:

- Pay your balance in full: Avoid interest charges by paying the full balance each month.

- Monitor your spending: Regularly check statements for unauthorized transactions.

- Keep credit utilization low: Use less than 30% of your credit limit to boost your credit score.

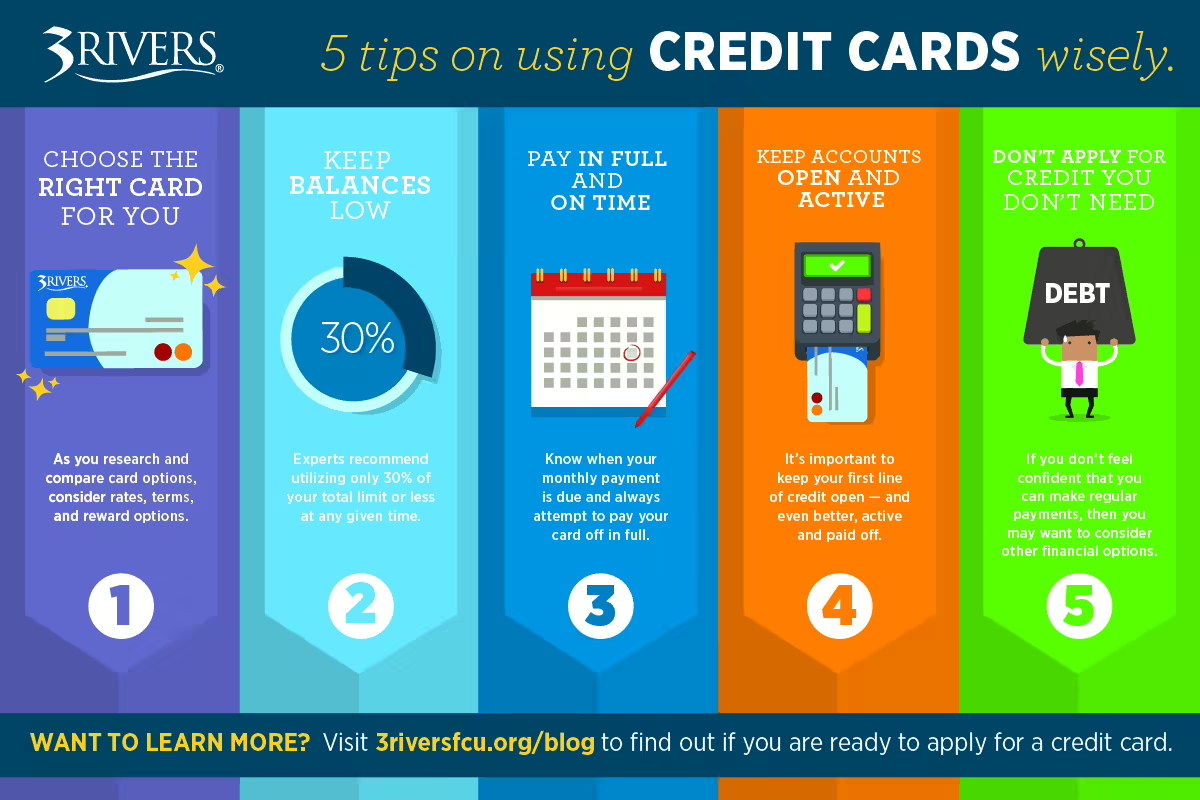

Overview Of Maximizing Rewards And Minimizing Fees

Maximizing rewards and minimizing fees can enhance the benefits of using credit cards. Here are some strategies:

| Strategy | Description |

|---|---|

| Choose the right card: | Select a card that offers rewards matching your spending habits. |

| Understand reward categories: | Identify spending categories that offer the highest rewards. |

| Avoid unnecessary fees: | Pay on time and avoid cash advances to minimize fees. |

Using these tips, you can make the most of your credit cards while avoiding common pitfalls. Implementing smart credit card strategies can lead to better financial outcomes.

Choosing The Right Credit Card

Finding the right credit card can be challenging. Different cards offer various benefits. Understanding your needs is key. Let’s explore how to choose the best card for you.

Identifying Your Spending Habits

First, identify your spending habits. Ask yourself these questions:

- Do you travel often?

- Do you dine out frequently?

- Do you prefer online shopping?

Understanding your spending patterns helps in selecting a card that maximizes rewards. For instance, frequent travelers should look for travel rewards cards.

Researching Different Types Of Credit Cards

Next, research the different types of credit cards available. Common types include:

| Type of Credit Card | Description |

|---|---|

| Travel Rewards Cards | Earn miles or points for travel-related expenses. |

| Cashback Cards | Get a percentage of your spending back as cash rewards. |

| Balance Transfer Cards | Transfer existing balances to a card with lower interest rates. |

Each card type offers unique benefits. Choose one that aligns with your needs.

Evaluating Rewards Programs

Evaluating rewards programs is crucial. Consider these factors:

- The types of rewards offered (points, miles, cashback).

- The rate at which you earn rewards.

- How easy it is to redeem rewards.

- Any annual fees or other charges.

For example, Wallester offers business expense cards with no hidden fees. They provide real-time expense control and easy management. Their white-label card issuing solution is customizable and secure.

Understanding these aspects helps in choosing a card that offers the best value. Make informed decisions to maximize benefits.

Maximizing Credit Card Rewards

Credit cards can offer more than just convenience. They can also provide significant rewards. By understanding how to maximize these rewards, you can make the most of your credit card usage. Below are some tips to help you get the best out of your credit card rewards.

Using Credit Cards For Everyday Purchases

Using your credit card for everyday purchases can help you accumulate rewards quickly. This includes expenses like groceries, gas, and utility bills. By putting these regular expenses on your credit card, you can earn points or cashback on money you already plan to spend.

| Expense Type | Potential Rewards |

|---|---|

| Groceries | 2% Cashback |

| Gas | 3% Cashback |

| Utility Bills | 1% Cashback |

Taking Advantage Of Sign-up Bonuses

Many credit cards offer sign-up bonuses. These bonuses can be substantial. To qualify, you usually need to spend a certain amount within the first few months of opening your account. Plan your spending to meet these requirements without overspending.

- Check the sign-up bonus requirements.

- Plan your spending to meet the requirement.

- Track your progress regularly.

Leveraging Category-specific Rewards

Some credit cards offer higher rewards for specific spending categories. For example, you might earn more points for dining, travel, or entertainment. Identify your spending patterns and choose a card that aligns with these categories.

- Dining: Up to 4x points

- Travel: Up to 3x points

- Entertainment: Up to 2x points

Utilizing Cashback And Points Efficiently

Efficient use of cashback and points is crucial. Redeem them for maximum value. For example, some programs offer higher value when you redeem points for travel instead of cash. Always check the redemption options and choose the one that offers the best value.

Use this table to compare redemption options:

| Redemption Option | Value per Point |

|---|---|

| Travel | $0.02 |

| Cashback | $0.01 |

| Gift Cards | $0.015 |

By following these tips, you can make the most of your credit card rewards.

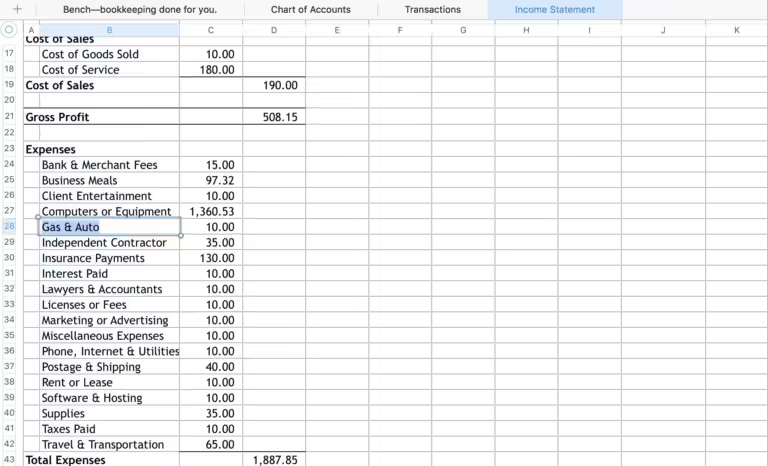

Minimizing Credit Card Fees

Credit cards can be a great financial tool when used wisely. However, if not managed properly, they can also lead to hefty fees. By understanding and minimizing these fees, you can save money and keep your finances in check. Here are some tips to help you minimize credit card fees.

Understanding Common Credit Card Fees

Credit card fees can vary, but some of the most common ones include:

- Annual Fees: A yearly charge for using the card.

- Late Payment Fees: Charged when a payment is not made by the due date.

- Foreign Transaction Fees: Charged on purchases made outside your home country.

- Cash Advance Fees: Charged when you withdraw cash using your credit card.

- Balance Transfer Fees: Charged for transferring a balance from one card to another.

Strategies To Avoid Annual Fees

Annual fees can add up over time. Here are some strategies to avoid them:

- Choose a no-annual-fee card: Many credit cards offer no annual fees. Look for these options when selecting a card.

- Negotiate with your issuer: Sometimes, you can ask your card issuer to waive the annual fee, especially if you have a good payment history.

- Utilize rewards: Some cards provide enough rewards and benefits to offset the annual fee. Make sure to use these perks to your advantage.

Tips To Avoid Late Payment Fees

Late payment fees can be easily avoided with a few simple steps:

- Set up automatic payments: Schedule automatic payments to ensure you never miss a due date.

- Use payment reminders: Set up alerts on your phone or email to remind you of upcoming payments.

- Pay more than the minimum: Paying more than the minimum due can help you stay ahead and avoid late fees.

Managing Foreign Transaction Fees

If you travel frequently, foreign transaction fees can add up. Here are some tips to manage them:

- Choose a card with no foreign transaction fees: Some credit cards do not charge fees for international purchases. Find one that suits your needs.

- Use local currency: When traveling, always choose to pay in the local currency to avoid additional conversion fees.

- Plan your spending: Consider using cash for small purchases to minimize the frequency of credit card transactions.

By understanding and applying these tips, you can effectively minimize credit card fees and make the most out of your credit card usage. For more information on credit cards and financial solutions, visit Wallester.

Maintaining A Healthy Credit Score

A healthy credit score opens the door to many financial opportunities. From securing loans to getting better interest rates, your credit score matters. Here are some key tips to help you maintain and improve your credit score.

Paying Your Balance In Full

Paying your credit card balance in full each month is crucial. It prevents debt accumulation and avoids interest charges. This practice shows lenders that you are responsible with credit.

Here are some tips to ensure you can pay your balance in full:

- Track your spending regularly.

- Set a budget and stick to it.

- Use payment reminders to avoid missing due dates.

Keeping Your Credit Utilization Low

Credit utilization is the ratio of your credit card balances to your credit limits. Keeping this ratio low is important for a healthy credit score. Experts recommend using less than 30% of your available credit.

For example:

| Credit Limit | Recommended Utilization |

|---|---|

| $1,000 | Less than $300 |

| $5,000 | Less than $1,500 |

To keep your credit utilization low:

- Pay off balances before the statement period ends.

- Increase your credit limit if possible.

- Avoid maxing out your credit cards.

Monitoring Your Credit Report Regularly

Regularly checking your credit report helps you stay informed about your credit status. It also helps you spot errors or fraudulent activities early. You can get a free credit report from each of the three major credit bureaus once a year.

To monitor your credit report:

- Visit AnnualCreditReport.com for free reports.

- Review your report for inaccuracies.

- Report any discrepancies immediately.

By following these tips, you can maintain a healthy credit score. This opens up more financial opportunities and ensures you get the best terms possible.

Pros And Cons Of Using Credit Cards

Credit cards are a popular financial tool. They offer both advantages and disadvantages. Understanding these can help you make informed decisions.

Benefits Of Credit Card Usage

Credit cards provide several benefits that can simplify your financial life.

- Convenience: Credit cards are easy to carry and use. You don’t need to carry large amounts of cash.

- Rewards Programs: Many credit cards offer rewards like cashback, points, or miles.

- Building Credit: Using a credit card responsibly can help you build a good credit history.

- Fraud Protection: Credit cards offer protection against unauthorized transactions.

- Emergency Funds: They can be a handy source of funds during emergencies.

Potential Drawbacks To Be Aware Of

While credit cards have benefits, there are also potential downsides.

- High-Interest Rates: Credit cards often have high-interest rates if you carry a balance.

- Debt Accumulation: It can be easy to overspend and accumulate debt.

- Fees: Some credit cards come with annual fees, late payment fees, and other charges.

- Impact on Credit Score: Poor management can negatively affect your credit score.

- Spending Temptation: Having a credit card can lead to impulse buying and unnecessary spending.

By understanding the pros and cons, you can use credit cards more effectively. Make sure to weigh the benefits and drawbacks before making a decision.

Specific Recommendations For Different Users

Choosing the right credit card can be tricky. Different users have different needs. Here are some tailored tips for various users. Whether you are a frequent traveler, a student, a young professional, or a family shopper, these recommendations will help you make informed decisions.

Best Strategies For Frequent Travelers

Frequent travelers need cards that offer travel benefits. Look for cards with no foreign transaction fees. Choose cards that offer airline miles and hotel points. Some cards provide travel insurance and airport lounge access. Consider cards that have partnerships with airlines or hotel chains.

- No foreign transaction fees

- Airline miles and hotel points

- Travel insurance

- Airport lounge access

Tips For Students And Young Professionals

Students and young professionals should look for cards with low interest rates. Consider cards that offer cashback on everyday purchases. Many cards offer rewards for good grades. Some cards provide financial education resources to help build credit history.

- Low interest rates

- Cashback on everyday purchases

- Rewards for good grades

- Financial education resources

Advice For Families And Regular Shoppers

Families and regular shoppers should choose cards that offer cashback on groceries and gas. Look for cards with high spending limits. Some cards provide discounts at partner stores. Consider cards that offer family rewards programs.

- Cashback on groceries and gas

- High spending limits

- Discounts at partner stores

- Family rewards programs

Frequently Asked Questions

How To Choose The Right Credit Card?

Choosing the right credit card depends on your spending habits. Consider rewards, interest rates, and annual fees. Compare different cards to find the best fit.

What Are The Benefits Of Using Credit Cards?

Credit cards offer rewards, cashback, and travel points. They also provide fraud protection and help build credit history when used responsibly.

How Can I Avoid Credit Card Debt?

To avoid debt, pay your balance in full each month. Set a budget and track your spending. Avoid unnecessary purchases.

What Should I Do If I Lose My Credit Card?

Immediately report the loss to your credit card issuer. They will deactivate your card and issue a new one to prevent fraud.

Conclusion

Smart credit card use can enhance your financial health. Always pay bills on time and monitor expenses. Consider tools like Wallester to streamline spending. For more details, visit Wallester. Stay informed, spend wisely, and enjoy the benefits of responsible credit card use.