Credit Card Terminals: Essential Tips for Small Businesses

Credit card terminals are vital for modern businesses. They enable secure and efficient transactions.

Whether you run a small shop or a large enterprise, having a reliable credit card terminal is crucial. These devices not only streamline payments but also enhance customer experience. One standout solution in this space is Nayax. Nayax offers advanced payment systems designed to boost revenue, enhance customer loyalty, and reduce operational costs. With features like cashless transactions, loyalty programs, and versatile applications across various business types, Nayax is a powerful tool for any business. Investing in a quality credit card terminal can transform your operations and drive growth. Ready to learn more? Keep reading to discover how Nayax can benefit your business.

Introduction To Credit Card Terminals

In today’s fast-paced world, credit card terminals have become essential for businesses of all sizes. These devices allow businesses to process payments quickly and securely. Understanding their importance can help you make the best choice for your business.

What Are Credit Card Terminals?

Credit card terminals are devices that allow merchants to accept payments from customers using credit or debit cards. These terminals can be used in various settings, including retail stores, restaurants, and service-based businesses.

They come in different forms, such as traditional countertop models, portable wireless devices, and mobile card readers that connect to smartphones. Each type offers unique features and benefits, catering to different business needs.

Importance Of Credit Card Terminals For Small Businesses

For small businesses, having a reliable credit card terminal is crucial. Here are some key reasons:

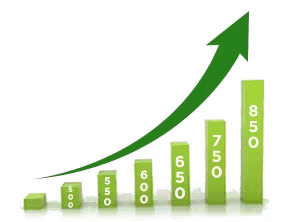

- Increase Sales: By accepting card payments, businesses can cater to more customers who prefer cashless transactions. Nayax reports up to a 10x increase in sales with 72% of sales being cashless.

- Operational Efficiency: Credit card terminals streamline payment processes, reducing the time spent on manual transactions and minimizing errors. This leads to lower operational costs and improved efficiency.

- Customer Satisfaction: Offering multiple payment options enhances the customer experience. It makes transactions quicker and more convenient, encouraging repeat business.

- Versatility: Credit card terminals are suitable for a wide range of businesses, from vending machines to food trucks and beauty services. The versatility ensures that all types of businesses can benefit from cashless transactions.

Choosing the right credit card terminal, like those offered by Nayax, can provide significant advantages. These include advanced payment systems, customer loyalty programs, and tools for revenue growth. For more details, you can visit the Nayax website.

Key Features Of Credit Card Terminals

Credit card terminals have become essential for businesses. They help in processing payments quickly and securely. Below are the key features that make these devices indispensable.

User-friendly Interface

A user-friendly interface is crucial for efficient transactions. Nayax terminals feature intuitive touchscreens and easy-to-navigate menus. This reduces the learning curve for employees and speeds up the payment process.

Security Features

Security is a top concern for businesses handling sensitive data. Nayax terminals come with advanced security features. These include encryption and tokenization, ensuring that customer information remains safe.

Compatibility With Different Payment Methods

Today’s customers use various payment methods. Nayax terminals support credit cards, debit cards, mobile wallets, and even contactless payments. This versatility meets the needs of a diverse customer base.

Portability And Mobility

For businesses on the move, portability is key. Nayax offers portable terminals that are ideal for food trucks, pop-up shops, and more. These devices are lightweight and easy to carry.

Integration With Business Software

Integration with business software can streamline operations. Nayax terminals easily integrate with POS systems, inventory management, and loyalty programs. This creates a seamless business environment.

For more details on how Nayax can benefit your business, visit their official website.

Pricing And Affordability Breakdown

Choosing the right credit card terminal is crucial for your business. Understanding the costs involved helps in making an informed decision. This section will break down the pricing and affordability of credit card terminals.

Initial Purchase Costs

Initial purchase costs can vary based on the model and features. Some terminals are simple and inexpensive, while others offer advanced functionalities. For example, Nayax Ltd offers various models with advanced payment systems enabling cashless transactions.

The initial cost might include:

- Hardware price

- Software installation fees

- Additional accessories

Transaction Fees

Transaction fees are charges applied for each transaction processed through the terminal. These fees can impact your overall profitability. Consider:

- Percentage of each sale

- Flat-rate fees per transaction

- Monthly minimum fees

Providers like Nayax can help maximize revenue by supporting cashless transactions, which can lead to a significant increase in sales.

Maintenance And Support Costs

Maintenance and support costs are ongoing expenses for keeping your terminal functional. These may include:

- Regular software updates

- Hardware repairs or replacements

- Customer support services

Nayax offers tools to enhance customer engagement and loyalty, which can help reduce operational costs and streamline processes.

Comparing Different Providers

When comparing different providers, it is essential to look at the overall value they offer. Consider:

- Initial and ongoing costs

- Transaction fee structure

- Level of customer support and maintenance services

For example, Nayax’s versatile applications are suitable for various business types and have shown a 50% year-on-year growth. They offer a comprehensive solution that can transform transactions into long-term customer relationships.

For more details, visit Nayax’s official website.

Pros And Cons Of Using Credit Card Terminals

Credit card terminals offer convenience and security in transactions. They require maintenance and can incur additional costs. Balancing benefits and drawbacks is essential for businesses.

Credit card terminals have revolutionized how businesses handle transactions. While they offer numerous benefits, there are also some drawbacks to consider. Below, we will discuss the pros and cons of using credit card terminals.Pros: Convenience And Speed

Credit card terminals provide convenience and speed in transactions. Customers can quickly swipe or tap their cards, reducing wait times. This efficiency is beneficial during peak hours. It also improves the overall customer experience, leading to higher satisfaction.Pros: Increased Sales Opportunities

Using credit card terminals can increase sales opportunities. Businesses can attract customers who prefer cashless payments. This can lead to a 10x increase in sales, as seen with Nayax. Moreover, 72% of sales are typically cashless, showcasing the importance of offering this payment option.Cons: Transaction Fees

One downside of using credit card terminals is the transaction fees. These fees can add up, affecting the overall profit margins. Businesses need to account for these costs when pricing their products and services. It is essential to find a balance to maintain profitability.Cons: Technical Issues And Downtime

Technical issues and downtime can be significant drawbacks. Credit card terminals rely on technology and internet connectivity. Any malfunction or network issue can disrupt transactions. This can lead to frustrated customers and potential loss of sales. Regular maintenance and reliable equipment are vital to minimize these disruptions. For more details or to get started with Nayax, visit their official website. “`Specific Recommendations For Ideal Users Or Scenarios

Choosing the right credit card terminal is crucial for your business. Different business types have unique needs and scenarios. Here are specific recommendations for ideal users or scenarios for Nayax credit card terminals.

Best For Retail Stores

Retail stores often see high volumes of transactions. Nayax terminals offer advanced payment systems. This feature ensures quick and smooth transactions. Retailers benefit from the loyalty programs available. These programs help in enhancing customer retention and loyalty.

The revenue growth feature is particularly useful. Retailers can expect a 10x increase in sales. With 72% of sales being cashless, operational efficiency improves significantly. Nayax terminals also support various payment methods, making it versatile for different customer preferences.

Ideal For Food And Beverage Businesses

Food and beverage businesses need fast and reliable payment solutions. Nayax terminals provide cashless transactions that are efficient and secure. This is essential for businesses with high customer turnover.

Additionally, Nayax offers tools for customer engagement. These tools help transform transactions into long-term relationships. The loyalty programs can increase repeat visits and customer satisfaction. Restaurants, cafes, and food trucks can greatly benefit from these features.

Perfect For Mobile Businesses

Mobile businesses like food trucks and pop-up shops need flexible payment solutions. Nayax terminals are portable and easy to set up. The versatile application of Nayax terminals suits various mobile business needs.

With the advanced payment systems, mobile businesses can accept various payment methods. This includes contactless payments, which are becoming increasingly popular. The revenue increase feature also helps in driving sales, ensuring operational efficiency on the go.

Suitability For Service-based Businesses

Service-based businesses such as beauty salons, car washes, and laundries require reliable payment solutions. Nayax terminals offer operational efficiency and reduce operational costs. This is crucial for businesses where service speed impacts customer satisfaction.

The customer engagement tools provided by Nayax help build long-term relationships. This is important for service-based businesses that rely on repeat customers. The loyalty programs enhance customer retention and satisfaction.

Overall, Nayax terminals are a versatile solution for various business types. They simplify transactions, maximize customer loyalty, and drive revenue growth.

Frequently Asked Questions

What Is A Credit Card Terminal?

A credit card terminal is a device used to process card payments. It reads card information and communicates with the bank. Businesses use it to accept customer payments securely and efficiently.

How Do Credit Card Terminals Work?

Credit card terminals work by reading card data and sending it to the payment processor. The processor then authorizes the transaction. It ensures funds are transferred from the customer’s bank to the merchant’s account.

Are Credit Card Terminals Secure?

Yes, credit card terminals are secure. They use encryption and other security measures. These measures protect card information during transactions and prevent fraud.

Can Credit Card Terminals Accept Contactless Payments?

Yes, most modern credit card terminals accept contactless payments. They support NFC technology for quick transactions. This allows customers to tap their card or phone for payment.

Conclusion

Credit card terminals are essential for modern businesses. They streamline transactions and enhance customer experiences. Nayax Ltd offers advanced payment solutions to simplify operations and boost revenue. Their systems are versatile, suitable for various industries like vending, transportation, and hospitality. With Nayax, businesses can enjoy up to 10x sales increase and improved operational efficiency. For more information on Nayax’s advanced payment systems, visit their official website. Embrace efficient, cashless transactions today and drive your business forward with Nayax.