Credit Card Sign-Up Bonuses: Maximize Your Rewards Today

Credit card sign-up bonuses can offer great rewards. Many cards provide attractive perks upon signing up.

Understanding these bonuses helps you choose the best card. Credit card companies often give generous rewards to new users. These can include cash back, travel points, or other incentives. It’s essential to know how these bonuses work and what benefits they offer. With the right card, you can maximize your earnings and savings. For those interested in additional ways to earn, platforms like Freecash offer opportunities to make extra money. By completing tasks, surveys, and offers, you can boost your income without extra effort. Explore your options, and start enjoying the rewards today.

Introduction To Credit Card Sign-up Bonuses

Credit card sign-up bonuses offer a great way to earn extra rewards. These bonuses can provide significant value when used wisely. In this section, we will explore what these bonuses are and why they matter.

What Are Credit Card Sign-up Bonuses?

Credit card sign-up bonuses are rewards offered to new cardholders. To earn these bonuses, you must meet certain spending requirements within a specified period. The rewards can be in the form of points, miles, or cash back.

For example, a card may offer a bonus of 50,000 points if you spend $3,000 within the first three months. These rewards can be redeemed for travel, gift cards, or statement credits.

Why Credit Card Sign-up Bonuses Matter

Sign-up bonuses provide immediate value and can offset annual fees. They can also help you reach your financial goals faster.

Here are some benefits of credit card sign-up bonuses:

- Extra Rewards: Earn more points, miles, or cash back.

- Travel Perks: Redeem points for flights or hotel stays.

- Financial Flexibility: Use rewards for statement credits.

In summary, credit card sign-up bonuses are a valuable tool. They offer extra rewards and help achieve financial goals. Always read the terms and conditions before applying for a card.

Key Features Of Credit Card Sign-up Bonuses

Credit card sign-up bonuses can be highly rewarding. They offer various benefits to new cardholders. Understanding the key features of these bonuses can help you make an informed decision.

Initial Spending Requirements

Most credit cards come with initial spending requirements. To earn the sign-up bonus, you need to spend a certain amount within a specific period. For instance:

| Card | Spending Requirement | Time Frame |

|---|---|---|

| Card A | $1,000 | 3 months |

| Card B | $3,000 | 6 months |

Ensure you can meet these requirements before applying.

Bonus Points And Miles

Many cards offer bonus points and miles. These rewards can be redeemed for travel, merchandise, or other perks. Examples include:

- 40,000 points for spending $2,000 in 3 months.

- 50,000 miles for spending $4,000 in 6 months.

Check the redemption options before you choose a card.

Cash Back Offers

Some credit cards offer cash back bonuses. This means you get a percentage of your spending back as cash. For example:

- 5% cash back on groceries for the first 3 months.

- 3% cash back on all purchases for the first year.

Cash back offers can provide immediate savings on everyday expenses.

Limited Time Promotions

Credit card issuers often run limited time promotions. These promotions may offer enhanced bonuses or reduced spending requirements. Examples include:

- Earn double points for the first 3 months.

- Reduced spending requirement of $500 for a $200 bonus.

Keep an eye out for these promotions to maximize your rewards.

For more ways to earn extra income, consider checking out Freecash.com. It’s an online platform where users can earn cash by completing various tasks, surveys, and offers. The platform is secure, reliable, and user-friendly.

Maximizing Your Rewards

Credit card sign-up bonuses are a great way to earn extra rewards. By strategically managing your applications and spending, you can maximize your benefits. Here are some effective strategies to help you get the most out of your credit card sign-up bonuses.

Strategic Timing Of Applications

Timing your credit card applications can significantly impact your rewards. Apply for new cards when you have upcoming large expenses. This ensures you can meet the minimum spending requirements without overspending. Consider the following tips:

- Plan applications around major life events such as vacations or home renovations.

- Space out applications to avoid negatively affecting your credit score.

- Check the expiration dates of offers to apply before they end.

Combining Bonuses With Regular Rewards Programs

Combining sign-up bonuses with regular rewards programs can amplify your earnings. Here’s how you can do it:

- Use the same card for everyday purchases to accumulate points faster.

- Link your card to loyalty programs of your favorite retailers or airlines.

- Take advantage of special promotions that offer extra points or cashback.

For instance, if you’re a member of a hotel loyalty program, use a credit card that offers bonus points for hotel stays. This way, you earn points from both the credit card and the hotel loyalty program.

Meeting Spending Requirements Efficiently

Meeting the spending requirements for sign-up bonuses can be challenging. Here are some tips to do it efficiently:

- Pay for necessities like groceries, gas, and utilities with your new card.

- Use the card for big-ticket items such as electronics or furniture.

- Pay bills in advance if possible, to meet the spending threshold quickly.

Another tip is to use your card for group expenses. For instance, pay the bill at a group dinner and have your friends reimburse you. This helps you reach the spending limit without incurring extra costs.

By following these strategies, you can maximize your credit card rewards effectively. Remember to always spend within your means and avoid unnecessary debt.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit card sign-up bonuses is essential. This breakdown will help you make informed decisions. Let’s explore the key factors.

Annual Fees Vs. No Annual Fees

Credit cards often come with annual fees. These fees can range from $0 to several hundred dollars. Cards with higher fees usually offer more perks and rewards.

No annual fee cards are available too. These cards are great for those looking to save money. They may offer fewer rewards but can still provide good value.

| Feature | Annual Fee Cards | No Annual Fee Cards |

|---|---|---|

| Rewards | High | Moderate |

| Perks | Many | Few |

| Cost | Higher | Lower |

Interest Rates And Apr Considerations

The interest rate or APR is crucial. It affects how much you pay if you carry a balance. Credit cards can have APRs ranging from low to high.

Consider these points:

- Low APR cards are ideal if you carry a balance.

- High APR cards may offer better rewards but cost more if not paid in full.

Other Hidden Costs

Credit cards can have hidden costs. These include late fees, foreign transaction fees, and balance transfer fees.

Late fees are charged if you miss a payment. Foreign transaction fees apply when you use your card abroad. Balance transfer fees can be a percentage of the amount transferred.

Always read the terms and conditions. Knowing these fees can help you avoid surprises.

Pros And Cons Of Credit Card Sign-up Bonuses

Credit card sign-up bonuses can be tempting. They offer rewards for new account holders. But like many financial products, they come with pros and cons. Understanding these can help you decide if a sign-up bonus is right for you.

Advantages Of Sign-up Bonuses

Credit card sign-up bonuses provide immediate value. Here are some benefits:

- Instant Rewards: You can earn points, cash back, or travel perks quickly.

- Boosted Earning: The bonuses often give a significant amount, enhancing your overall rewards.

- Special Offers: Some cards offer exclusive deals, increasing the value of the bonus.

- Flexible Spending: Use the rewards for various purchases, including travel, shopping, and dining.

These advantages make sign-up bonuses attractive. They can provide substantial benefits in a short period.

Potential Drawbacks And Pitfalls

While sign-up bonuses can be valuable, they also have potential downsides:

- High Spending Requirements: Many bonuses require substantial spending within a limited time frame.

- Annual Fees: Some cards come with high annual fees, reducing the net benefit of the bonus.

- Interest Rates: High interest rates can negate the bonus value if you carry a balance.

- Credit Score Impact: Opening multiple new accounts can impact your credit score.

Consider these factors before applying for a card. Ensure the bonus aligns with your financial goals.

Ideal Users And Scenarios

Credit card sign-up bonuses can be highly rewarding when used effectively. Whether you are a frequent traveler, an everyday shopper, a high-spender, or an occasional user, there is a sign-up bonus tailored to suit your lifestyle. Let’s explore the different user scenarios to determine which bonus is ideal for you.

Frequent Travelers

Frequent travelers benefit the most from credit card sign-up bonuses. These bonuses often offer miles or points that can be redeemed for flights, hotel stays, and other travel-related expenses. Here are some key benefits:

- Bonus Miles: Earn extra miles on sign-up, boosting your travel rewards.

- Travel Perks: Access to airport lounges, priority boarding, and travel insurance.

- Discounts: Special discounts on partner airlines and hotels.

Travel credit cards are perfect for those who travel frequently for business or pleasure. The rewards can significantly reduce travel costs and enhance the overall travel experience.

Everyday Shoppers

Everyday shoppers can make the most out of credit card sign-up bonuses designed for regular spending. These cards offer cashback or points on everyday purchases like groceries, fuel, and dining out. Key advantages include:

- Cashback: Get a percentage of your spending back as cash.

- Reward Points: Earn points on every purchase, which can be redeemed later.

- Special Offers: Exclusive discounts and offers from retail partners.

Such credit cards are ideal for those who want to save money on everyday expenses. The rewards can add up quickly, providing substantial savings over time.

High-spenders

High-spenders can maximize the benefits of credit card sign-up bonuses that offer large rewards for substantial spending. These cards often have higher spending thresholds but provide significant rewards. Benefits include:

- Large Bonuses: High reward points or cashback for meeting spending requirements.

- Premium Perks: Access to luxury services and exclusive events.

- Travel Benefits: Enhanced travel rewards and premium travel services.

These cards are suitable for individuals who make large purchases regularly. The rewards can justify the higher spending requirements and provide excellent value.

Occasional Users

Occasional users can still benefit from credit card sign-up bonuses with lower spending requirements. These cards offer modest rewards but are easier to qualify for. Key features include:

- Low Spending Threshold: Easier to meet initial spending requirements.

- Reward Flexibility: Points or cashback that can be used for various purposes.

- No Annual Fee: Many options available without an annual fee.

These cards are perfect for those who use credit cards infrequently. The bonuses provide added value without the pressure of high spending requirements.

Conclusion And Final Recommendations

In the world of credit cards, sign-up bonuses can be a fantastic way to maximize your rewards. By understanding and leveraging these bonuses, you can make the most out of your credit card usage. Let’s summarize the key points and share some final tips to help you maximize your rewards.

Summary Of Key Points

- Sign-up bonuses offer significant rewards for new cardholders.

- Ensure you meet the minimum spending requirements to qualify for the bonus.

- Be aware of the time frame within which you need to meet the spending requirements.

- Compare different credit card offers to find the best sign-up bonus for your needs.

- Consider the annual fee and other card benefits when choosing a card.

- Use your card regularly but responsibly to maximize the rewards.

Final Tips For Maximizing Rewards

- Plan your spending: Ensure your regular expenses align with the bonus requirements.

- Track your progress: Regularly monitor your spending to ensure you meet the minimum spend.

- Utilize multiple cards: If possible, use more than one card to take advantage of multiple bonuses.

- Stay informed: Keep up-to-date with new card offers and changes in terms.

- Pay your balance: Always pay your balance in full to avoid interest charges.

By following these tips, you can significantly enhance your earning potential with credit card sign-up bonuses. Remember to use your credit cards wisely and enjoy the rewards.

Frequently Asked Questions

What Are Credit Card Sign-up Bonuses?

Credit card sign-up bonuses are rewards given to new cardholders. They are typically offered after meeting a spending requirement within a set period.

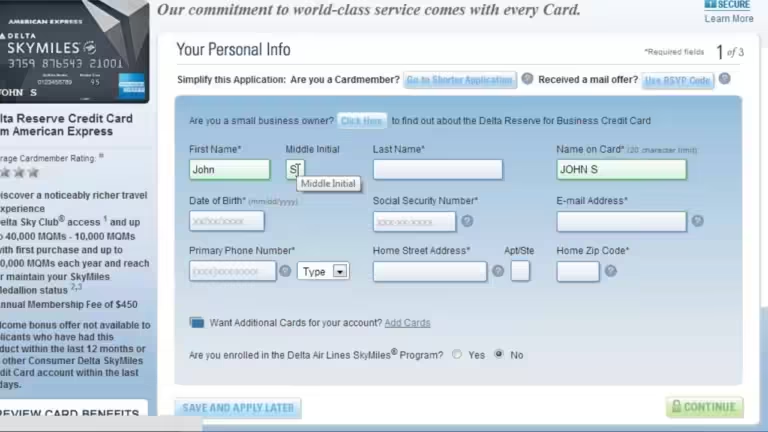

How Do I Qualify For A Sign-up Bonus?

To qualify, you must apply for a new credit card. Then, you need to meet the spending requirement within a specified time frame.

Are Sign-up Bonuses Worth It?

Yes, sign-up bonuses can be worth it. They provide significant rewards, like cash back, points, or miles, for meeting spending requirements.

Do Sign-up Bonuses Affect Credit Score?

Applying for a new credit card can temporarily lower your credit score. However, responsible use of the card can improve your credit over time.

Conclusion

Exploring credit card sign-up bonuses can yield great rewards. Always compare offers to find the best deal. Remember, responsible usage is key. For additional ways to earn, check out Freecash. It offers simple tasks and quick payouts. Safe, easy, and no hidden fees. Start earning today!