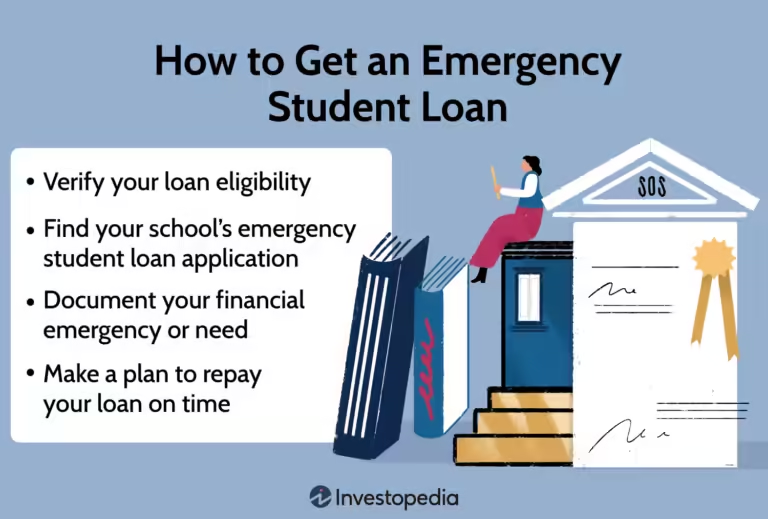

Credit Card Security Features: Protect Your Finances Today

Credit card security is vital in today’s digital age. As cyber threats evolve, card issuers are enhancing security features.

Understanding these features can save you from potential fraud. In this blog post, we will explore the key security measures that credit cards offer. From advanced chip technology to real-time alerts, these features ensure your financial safety. Knowing how these protections work can give you peace of mind. Let’s dive into the essential security features that keep your credit card information safe. For a robust financial tool that pairs investment with top-notch security, consider Nemo Money. Nemo offers global investment opportunities with stringent data protection. Learn more about Nemo’s features and benefits here.

Introduction To Credit Card Security Features

Credit cards have become a staple of modern finance, offering convenience and security for transactions. Understanding the security features of your credit card is essential to protect your finances and personal information.

Understanding The Importance Of Credit Card Security

Credit card security is crucial in preventing fraud and unauthorized transactions. With the rise of online shopping and digital payments, the need for robust security measures has never been higher. Modern credit cards come equipped with various features designed to safeguard your information.

Here are some of the key reasons why credit card security is important:

- Fraud Prevention: Protects against unauthorized use.

- Identity Protection: Secures your personal information.

- Financial Safety: Ensures your money is safe.

Overview Of Common Security Threats

Credit card security threats come in many forms. Being aware of these threats can help you take preventive measures.

| Threat Type | Description |

|---|---|

| Phishing | Fraudulent emails or messages asking for card details. |

| Skimming | Devices that steal card information during transactions. |

| Data Breaches | Hackers accessing company databases with card info. |

To mitigate these threats, credit cards incorporate several security features:

- EMV Chips: Provide dynamic data for each transaction, making it harder to clone cards.

- Tokenization: Replaces sensitive information with unique tokens.

- Two-Factor Authentication: Adds an extra layer of security for online transactions.

Understanding these features and threats can help you use your credit card more securely. Always stay informed and vigilant to protect your financial health.

Key Features That Enhance Credit Card Security

Credit card security has become more vital in today’s digital age. To keep your financial data safe, credit cards now offer various advanced security features. Here are some key features that enhance credit card security.

EMV chip technology, also known as chip and PIN, provides an extra layer of security. Unlike magnetic stripes, EMV chips generate a unique transaction code each time they are used. This makes it difficult for fraudsters to duplicate your card.

Two-factor authentication (2FA) requires you to verify your identity using two distinct methods. Commonly, you enter your password and then receive a code on your phone. This makes it harder for unauthorized users to access your account.

Real-time fraud alerts notify you immediately about suspicious activities. You get alerts through SMS or email if any unusual transaction occurs. This allows you to take swift action to protect your account.

Tokenization replaces your actual credit card number with a unique identifier. This identifier, or token, is used in place of your card details during transactions. Even if the token is intercepted, it is useless without the original card information.

Virtual card numbers are temporary numbers that link to your actual credit card. These numbers can be used for online transactions, adding an extra layer of security. If a virtual number is compromised, it can be easily deactivated without affecting your main account.

Emv Chip Technology

In today’s digital age, credit card security is paramount. One of the most significant advancements in this field is the EMV chip technology. This technology enhances the security of credit card transactions, reducing the risk of fraud.

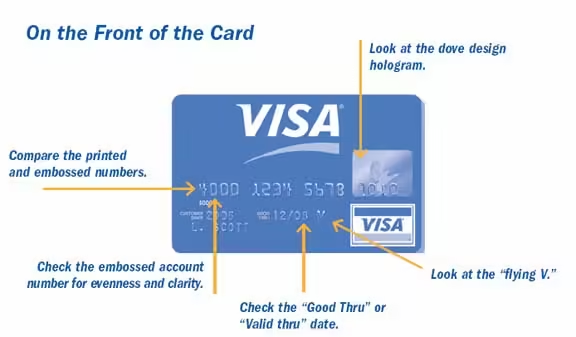

How Emv Chips Work

EMV stands for Europay, Mastercard, and Visa. These chips store data on integrated circuits rather than magnetic strips. During a transaction, the chip creates a unique transaction code. This code cannot be reused, making it difficult for fraudsters to replicate.

The process involves inserting the card into a terminal and waiting for authentication. The chip then communicates with the terminal, validating the transaction. This method ensures a higher level of security compared to traditional magnetic strip cards.

Benefits Of Emv Chips

- Enhanced Security: EMV chips generate a unique code for each transaction.

- Reduced Fraud: Difficult for criminals to clone or copy the chip.

- Global Acceptance: Widely accepted at retail locations worldwide.

- Improved Customer Trust: Users feel safer knowing their transactions are secure.

Comparing Emv Chips To Magnetic Strips

| Feature | EMV Chips | Magnetic Strips |

|---|---|---|

| Security | High | Low |

| Fraud Resistance | High | Low |

| Global Acceptance | Yes | Limited |

| Transaction Speed | Moderate | Fast |

The transition from magnetic strips to EMV chips has been crucial. While magnetic strips are easy to clone, EMV chips provide a robust defense against such threats. This technology ensures safer transactions and builds trust among consumers.

Two-factor Authentication

Two-Factor Authentication (2FA) adds an extra layer of security to your credit card usage. It ensures only you can access your account. Nemo Money emphasizes high-level security, making 2FA a crucial feature for its users.

What Is Two-factor Authentication?

Two-Factor Authentication, or 2FA, requires users to provide two forms of identification before accessing their accounts. This typically involves something you know (like a password) and something you have (like a mobile device).

Benefits Of Two-factor Authentication

2FA offers several benefits:

- Enhanced Security: It significantly reduces the risk of unauthorized access.

- Peace of Mind: Users feel more secure knowing their accounts are protected.

- Compliance: Meets regulatory requirements for data protection.

Implementing Two-factor Authentication

Implementing 2FA is straightforward with Nemo Money. Here’s how you can set it up:

- Log into your Nemo Money account.

- Go to the security settings.

- Select the Two-Factor Authentication option.

- Follow the prompts to link your mobile device.

- Verify your device through the code sent to your phone.

Once set up, every time you log in, you will need to enter your password and the code sent to your device.

Nemo Money’s commitment to data security includes SSL encryption and adherence to ADGM Data Protection Regulations. This ensures your investments and personal information remain safe.

For more information, visit Nemo Money.

Real-time Fraud Alerts

In today’s digital world, credit card security is crucial. Real-time fraud alerts play a significant role in protecting your finances. These alerts notify you instantly when suspicious activity is detected on your credit card.

How Real-time Fraud Alerts Work

Real-time fraud alerts use advanced algorithms to monitor your credit card transactions. When unusual activity is detected, you receive an instant notification. This could be through a text message, email, or app notification.

For example, if a transaction is made in a different country or a large purchase is attempted, the system flags it. You can then review the transaction and confirm if it is legitimate.

Benefits Of Real-time Fraud Alerts

Real-time fraud alerts offer several benefits:

- Immediate Notification: You get instant alerts about suspicious activities.

- Quick Response: You can quickly react to unauthorized transactions.

- Peace of Mind: Knowing your card is being monitored 24/7.

These features help protect your finances and reduce the risk of fraud.

Customizing Fraud Alert Preferences

Customizing fraud alert preferences allows you to control how and when you receive notifications. Here’s how you can do it:

- Log in to your credit card account online.

- Go to the settings or security section.

- Choose the types of alerts you want to receive (e.g., international transactions, large purchases).

- Select your preferred notification method (e.g., SMS, email).

By customizing these settings, you can ensure you receive alerts that are relevant to your spending habits.

For more information about credit card security features, visit Nemo Money.

Tokenization

In the digital age, credit card security is crucial. One significant feature enhancing security is tokenization. It protects sensitive information during transactions, making it harder for unauthorized parties to access data.

What Is Tokenization?

Tokenization is the process of replacing sensitive data with unique identification symbols, known as tokens. These tokens retain essential information without compromising security. For instance, instead of storing a 16-digit credit card number, a token is generated to represent the card.

Benefits Of Tokenization

Tokenization offers several key benefits:

- Enhanced Security: Tokens are meaningless to hackers, reducing the risk of data breaches.

- Compliance: It helps businesses comply with regulations like PCI DSS, protecting customer information.

- Simplified Audits: With less sensitive data stored, audits become more straightforward and less invasive.

Tokenization In Online Transactions

Online transactions benefit greatly from tokenization. When making a purchase, the merchant receives a token instead of the actual credit card number. This token is then used to complete the transaction securely.

For example, Nemo Money, an investment app, likely uses tokenization to secure its users’ data. Nemo offers a wide range of features, including global investment opportunities and commission-free trading. With robust security measures like SSL encryption and adherence to data protection regulations, Nemo ensures a secure investing experience.

In summary, tokenization is a powerful tool in credit card security, especially for online transactions. Its ability to protect sensitive information while maintaining ease of use makes it an essential feature for modern financial services.

Virtual Card Numbers

Virtual card numbers provide an extra layer of security for online transactions. They serve as temporary card numbers linked to your main credit card, reducing the risk of fraud.

What Are Virtual Card Numbers?

Virtual card numbers are temporary numbers generated for online purchases. These numbers are linked to your primary credit card but can be set to expire after a single use or a set time period.

| Feature | Description |

|---|---|

| Temporary Usage | Used for one-time or short-term purchases |

| Linked to Main Card | Connected to your primary credit card |

| Expiry Settings | Can be configured to expire after a specific duration |

Benefits Of Using Virtual Card Numbers

- Enhanced Security: Reduces the risk of fraud by using a temporary number.

- Privacy Protection: Keeps your actual credit card number safe.

- Control Over Spending: Set limits and expiry dates for each virtual number.

How To Use Virtual Card Numbers

- Log in to your credit card account.

- Navigate to the virtual card number section.

- Generate a new virtual card number.

- Set the usage limits and expiry date.

- Use the virtual number for your online purchase.

Using virtual card numbers is a simple yet effective way to protect your online transactions. By implementing this feature, you add an extra layer of security to your financial activities.

Pricing And Affordability

Understanding the cost of credit card security features is essential for both providers and cardholders. These features ensure the safety of transactions and personal information. However, the implementation and maintenance of these features come with costs. This section will explore the pricing and affordability of these security measures.

Cost Of Implementing Security Features

Implementing credit card security features involves various costs. Providers invest in advanced technologies to protect user data. These technologies include:

- SSL encryption: Ensures secure data transmission.

- Two-factor authentication (2FA): Adds an extra layer of security.

- Fraud detection systems: Monitors transactions for suspicious activities.

These technologies require initial setup costs and ongoing maintenance. Providers also need to comply with regulations like the ADGM Data Protection Regulations. This compliance involves additional expenses to ensure that all security measures meet required standards.

Affordability For Cardholders

Cardholders benefit from these security features without bearing direct costs. The expenses are typically covered by the provider. This model ensures that cardholders can enjoy secure transactions without additional fees. For instance, Nemo Money offers high-level security with SSL encryption and deposit protection up to $500,000 without any extra charge.

Additionally, Nemo Money provides commission-free trading on stocks and ETFs. This approach makes investing more affordable while maintaining robust security measures.

Comparing Costs Across Providers

Comparing the costs of security features across different providers can be challenging. Each provider has its own pricing model and security measures. However, some key points to consider include:

| Provider | Security Features | Cost to Cardholders |

|---|---|---|

| Nemo Money | SSL encryption, 2FA, Fraud Detection | Commission-Free |

| Provider B | SSL encryption, 2FA | Annual Fee |

| Provider C | SSL encryption, Fraud Detection | Transaction Fee |

Nemo Money stands out by offering comprehensive security features without commission fees. This approach ensures affordability for cardholders while maintaining high security standards.

Pros And Cons Of Credit Card Security Features

Credit card security features have evolved to protect users from fraud and unauthorized transactions. While these features offer significant advantages, they also come with certain limitations. Understanding both sides can help users make informed decisions about their credit card usage.

Advantages Of Enhanced Security Features

Enhanced security features provide several benefits:

- Fraud Protection: Advanced security measures, like EMV chips, reduce the risk of fraudulent transactions.

- Real-time Alerts: Instant notifications for suspicious activities enable quick responses to potential threats.

- Secure Transactions: Encryption technologies ensure that transactions are safe and secure.

EMV chips, for example, generate unique transaction codes, making it harder for fraudsters to duplicate card information. Real-time alerts notify users of any unusual activity, enabling them to take immediate action. Encryption technologies protect data during online transactions, enhancing overall security.

Potential Drawbacks And Limitations

Despite the benefits, there are some drawbacks:

- Complexity: Enhanced security features can be difficult for some users to understand.

- Inconvenience: Additional verification steps may slow down transactions.

- Cost: Some banks may pass on the cost of security enhancements to users.

Complex security measures can be confusing, especially for those not tech-savvy. Additional steps, like two-factor authentication, may make the transaction process longer. The costs of implementing these advanced features might be transferred to users through higher fees.

Balancing Security And Convenience

Finding a balance between security and convenience is crucial:

- Understand Features: Educate yourself about the security features of your credit card.

- Use Alerts: Enable real-time alerts to monitor transactions.

- Choose Trusted Providers: Opt for cards from reputable issuers with strong security measures.

To balance security and convenience, users should understand the security features of their credit cards. Enabling real-time alerts helps in monitoring transactions without much hassle. Choosing cards from trusted providers ensures better protection and reliability.

Recommendations For Ideal Users Or Scenarios

Credit card security is crucial for protecting your finances. Understanding who should prioritize enhanced security features and the best practices to maximize security can save you from potential fraud. Let’s explore these recommendations in detail.

Who Should Prioritize Enhanced Security Features?

- Frequent Travelers: They often use their cards in different locations, increasing the risk of fraud.

- Online Shoppers: Regular online transactions can expose your card information to cyber threats.

- High Net-Worth Individuals: They have more to lose in case of a security breach.

Best Practices For Maximizing Security

- Enable Two-Factor Authentication: Adds an extra layer of security to your transactions.

- Use Virtual Credit Cards: Generates temporary card numbers for online purchases.

- Monitor Statements Regularly: Quickly identify and report unauthorized transactions.

- Secure Your Devices: Ensure your devices are protected with antivirus software.

Scenarios Where Extra Security Is Crucial

| Scenario | Reason |

|---|---|

| Traveling Abroad | Increased risk of card skimming and loss. |

| Making Large Purchases | Higher amounts attract more attention from fraudsters. |

| Using Public Wi-Fi | Unsecured networks make your card data vulnerable. |

By adopting these practices and understanding when extra security is essential, you can better protect your financial information. Nemo Money, with its high-level security features, ensures your data and funds remain safe while you invest and manage your finances.

Frequently Asked Questions

What Are Chip-enabled Credit Cards?

Chip-enabled credit cards have embedded microchips. These chips encrypt transaction data. This makes it harder for fraudsters to access your information.

How Does Cvv Protect My Credit Card?

The CVV is a three or four-digit code. It adds an extra layer of security. Merchants use it to verify transactions, preventing unauthorized use.

Why Are Contactless Payments Safer?

Contactless payments use secure encryption technology. This reduces the risk of data interception. They also limit physical contact, reducing chances of skimming.

What Is Credit Card Tokenization?

Tokenization replaces sensitive card details with unique tokens. These tokens are useless if intercepted. It enhances security during digital transactions.

Conclusion

Credit card security features play a vital role in protecting users. They help prevent fraud and keep your finances safe. Always check for the latest security measures before choosing a card. Stay informed and protect your financial information. For those interested in secure investments, consider using Nemo Money. Nemo offers global investment opportunities with high-level security. Learn more by visiting the Nemo Money website. Keep your investments and credit cards secure for a worry-free financial experience.