Credit Card Rewards For Businesses: Maximize Your Benefits Today

Credit card rewards can be a game-changer for businesses. They help manage expenses and boost savings.

Understanding the benefits of credit card rewards is essential for any business. These rewards can provide significant advantages, from cashback to travel perks. For businesses, using the right credit card can improve cash flow, reduce costs, and simplify expense management. Flex Super App is one such platform designed to streamline business finances. Flex offers integrated banking, payments, and expense management, making it easier for businesses to grow. With features like simplified banking, expense tools, and net-60 on all purchases, Flex stands out. Additionally, Flex provides secure transactions and scalable credit solutions. Ready to learn more? Check out Flex here.

Introduction To Credit Card Rewards For Businesses

Credit card rewards for businesses offer a great way to manage expenses. They provide numerous advantages, including cashback, points, and travel benefits. These rewards help businesses save money and earn while spending.

Flex is one such financial platform that integrates various services. It simplifies banking, payments, and expense management through one easy-to-use application.

Understanding Business Credit Card Rewards

Business credit card rewards function similarly to personal card rewards. However, they are tailored to meet business needs. Rewards include:

- Cashback on purchases

- Travel rewards such as airline miles

- Points redeemable for merchandise or services

Flex offers a unique credit card service with a Net-60 on all purchases and 0% interest for 60 days. This means businesses have two months to pay off their expenses without incurring interest. Additionally, Flex provides credit limits that grow with the business and individual employee cards at no extra cost.

Purpose Of Maximizing Credit Card Benefits

Maximizing credit card benefits is crucial for managing business finances effectively. Here are some key purposes:

- Improving cash flow: Flex offers enhanced cash flow with Net-60 terms and 0% interest for 60 days.

- Expense control: Flex provides expense management tools to track and manage spending.

- Earning rewards: Businesses can earn up to 2.99% APY on cash on hand with Flex banking services.

Flex ensures secure and compliant transactions with multi-factor authentication, robust encryption, and automated fraud monitoring. FDIC & SIPC insurance coverage ensures the safety of funds.

For more details, visit the Flex Super App website or contact their support team.

Key Features Of Business Credit Card Rewards

Flex Super App offers a range of credit card rewards that can significantly benefit your business. Understanding these rewards can help you make the most out of your financial strategies. Let’s explore the key features of business credit card rewards provided by Flex.

Cash Back Programs

Flex Super App offers cash back programs designed to help businesses save more. These programs provide a percentage of your purchases back in cash. This can be especially useful for frequent business expenses.

With Flex, you can earn up to 2.99% APY on cash on hand. This is a great way to get rewarded for the money you spend. The cash back can be reinvested into your business, helping it grow even faster.

Travel Rewards And Miles

Flex Super App also provides travel rewards and miles. These rewards are perfect for businesses that involve frequent travel. You can earn miles on every purchase, which can be redeemed for flights, hotels, and other travel-related expenses.

Travel rewards can help reduce travel costs for your business. They also offer the potential for upgrades and exclusive travel benefits, making business trips more comfortable and cost-effective.

Points-based Systems

Flex features a points-based system for its credit card rewards. With every purchase, you earn points that can be redeemed for various rewards. These can include merchandise, gift cards, or even statement credits.

The points-based system is flexible, allowing you to choose rewards that best fit your business needs. Accumulating points over time can lead to significant savings and valuable perks for your business.

Exclusive Business Perks

Flex Super App offers exclusive business perks that go beyond standard rewards. These perks can include discounts on business services, access to exclusive events, and special offers tailored to your business needs.

For example, Flex provides the option to issue new team cards at no extra cost. This feature can streamline expense management and improve financial oversight within your business. Additionally, Flex offers enhanced cash flow management with 0% interest for 60 days on all purchases, a net-60 payment term, and scalable credit limits that grow with your business.

These exclusive perks can provide significant advantages, helping your business operate more efficiently and save money in various areas.

How To Maximize Your Business Credit Card Rewards

Business credit cards offer significant rewards that can benefit your company. To fully exploit these rewards, it’s important to follow strategic steps. Below are some tips to help you maximize your business credit card rewards.

Choosing The Right Credit Card

Selecting the correct credit card is crucial. Look for cards that align with your business needs. For instance, the Flex Super App provides various benefits:

- Net-60 on all purchases

- 0% interest for 60 days

- Credit limits that grow with your business

- Individual employee cards at no extra cost

Such features can greatly enhance your business’s financial flexibility and reward potential.

Aligning Rewards With Business Expenses

Match your spending with the card’s reward categories. If your business spends heavily on travel, choose a card that offers higher rewards for travel expenses. The Flex Super App offers simplified banking and expense management tools, making it easier to track and align your spending with rewards.

Leveraging Sign-up Bonuses

Sign-up bonuses can provide a significant boost. Many cards offer large bonuses for meeting a minimum spend within the first few months. Ensure you can meet this requirement without overspending. For example, the Flex Super App provides:

| Feature | Details |

|---|---|

| Sign-Up Bonus | Varies based on spend |

| Interest-Free Period | 60 days |

Effective Management Of Reward Points

Manage your reward points wisely to maximize their value. Use the expense management tools offered by the Flex Super App to keep track of your rewards. Redeem points for business-related expenses to get the most value.

- Track your points regularly

- Redeem points strategically

- Avoid letting points expire

Effective management ensures you get the most out of your rewards program.

Pricing And Affordability Breakdown

Choosing the right credit card for your business involves analyzing pricing and affordability. Flex Super App offers competitive features, but understanding the costs involved is crucial. This section breaks down annual fees, interest rates, cost-benefit analysis, and hidden fees to watch out for.

Annual Fees And Interest Rates

Flex credit cards have a 0% interest rate for the first 60 days on all purchases. This is a great benefit for managing short-term expenses without incurring interest. After the grace period, interest starts accruing if the balance is not paid in full.

There are no annual fees for Flex credit cards. This makes it an affordable option for businesses looking to manage expenses without additional costs.

Cost-benefit Analysis

Using Flex credit cards can be financially beneficial for businesses. Here are some key points:

- 0% interest for 60 days: Saves on interest payments for short-term credit use.

- Net-60 payment terms: Provides extended time to pay off purchases, aiding cash flow management.

- High APY on idle cash: Earn up to 2.99% APY on cash on hand, enhancing returns on unused funds.

- No extra cost for employee cards: Issue individual cards to employees without additional fees.

Balancing these benefits against potential interest costs after the 60-day period is essential for maximizing savings.

Hidden Fees To Watch Out For

While Flex offers many advantages, being aware of possible hidden fees is important:

- Interest accrual: Begins after the 60-day interest-free period if the balance is unpaid.

- ACH/wire payments: Free, but ensure to check for any conditions that might trigger fees.

- Refund policies: Understand the interest-free period conditions to avoid unexpected charges.

Review all terms and conditions carefully to avoid any unexpected charges.

Understanding these pricing and affordability aspects helps businesses make informed decisions about using Flex credit cards.

Pros And Cons Of Using Business Credit Card Rewards

Business credit card rewards can be a double-edged sword. They offer numerous advantages that can benefit your business, but they also come with potential risks. Understanding the pros and cons will help you make an informed decision.

Advantages Of Credit Card Rewards

- Enhanced Cash Flow: Flex credit cards offer a net-60 payment term with 0% interest for 60 days. This can help manage cash flow more effectively.

- Expense Management: Individual employee cards at no extra cost make tracking and managing expenses easier.

- High APY Earnings: Flex Banking allows you to earn up to 2.99% APY on cash on hand.

- Security: Multi-Factor Authentication, robust encryption, and automated fraud monitoring ensure your transactions are secure.

- Scalability: Credit limits grow with your business, providing greater financial flexibility.

Potential Drawbacks And Risks

- Interest Accrual: If the balance is not paid within 60 days, interest will start to accrue.

- Complex Terms: Understanding the detailed terms and conditions is essential to avoid unexpected fees.

- Security Risks: Despite robust security measures, there is always a risk of fraud or phishing attacks.

- Dependency: Relying heavily on credit can lead to financial instability if not managed properly.

Real-world Usage Insights

Businesses using the Flex Super App often highlight its ease of use and the significant advantages it brings to cash flow management. The net-60 payment terms and 0% interest for 60 days are particularly beneficial for startups and growing businesses. Additionally, the high APY earnings on idle cash can be a game-changer for managing operational funds.

On the flip side, some users have pointed out the importance of adhering to the repayment terms to avoid interest accrual. Others emphasize the need to understand the security features thoroughly to prevent potential risks. Overall, the Flex Super App provides a powerful tool for businesses, but it requires careful management and a good understanding of its terms.

For more information about Flex and its features, visit the Flex Super App website.

Specific Recommendations For Ideal Users Or Scenarios

Credit card rewards for businesses can vary based on the type of user or scenario. Identifying the right card for your specific needs ensures you maximize benefits and streamline your financial processes. Here are some tailored recommendations for different user scenarios.

Best For Small Businesses

Small businesses often face tight budgets and cash flow challenges. The Flex Super App offers several features beneficial to small enterprises:

- Net-60 on all purchases: This allows businesses to manage cash flow effectively.

- 0% interest for 60 days: Pay no interest if the balance is cleared within the grace period.

- Credit limits that grow with your business: Ensures that as your business expands, your credit capacity increases too.

- Individual employee cards at no extra cost: Manage team expenses without additional fees.

These features make Flex an ideal choice for small businesses looking to balance growth with financial discipline.

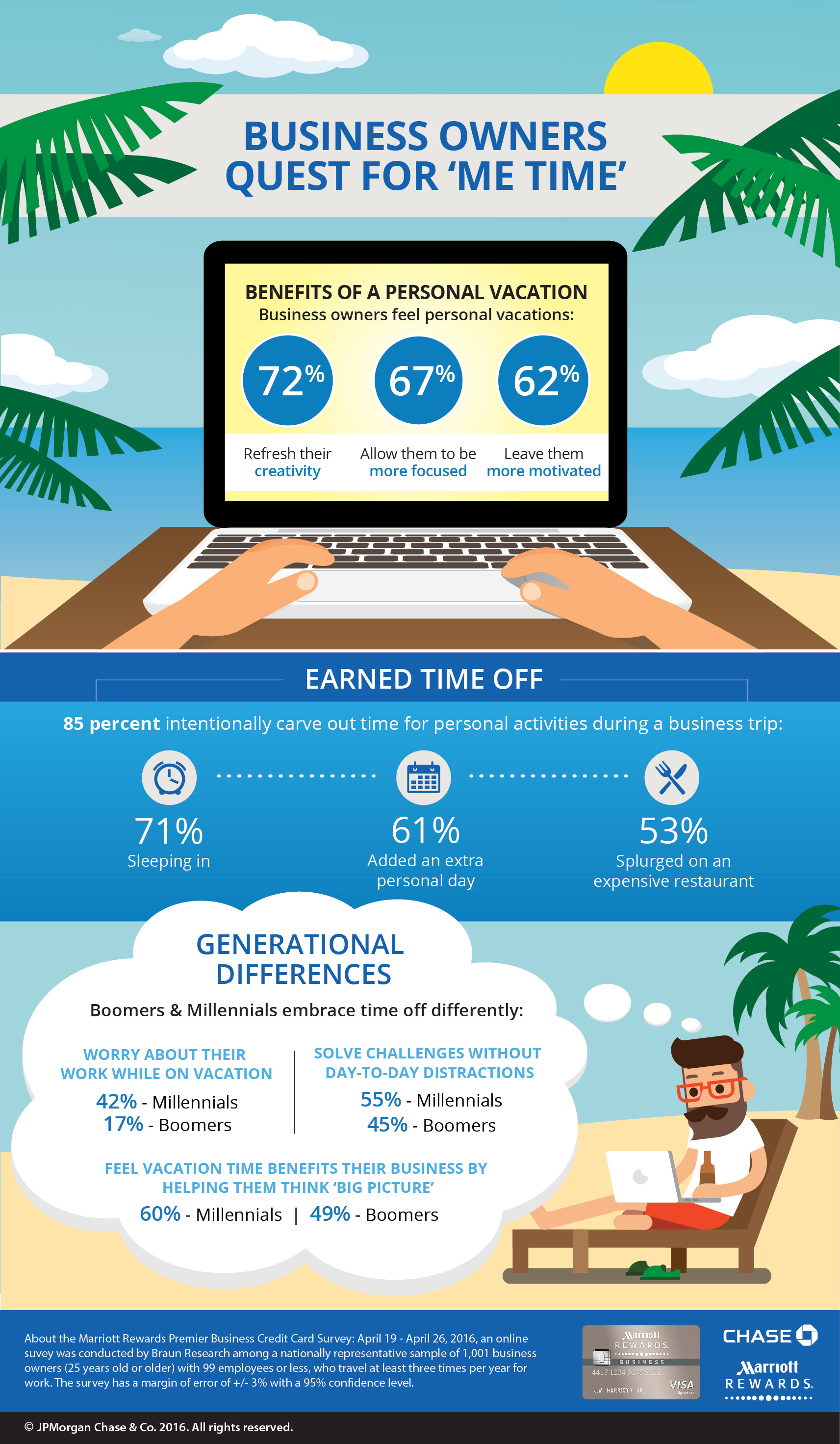

Ideal For Frequent Travelers

Frequent travelers need a credit card that offers convenience and rewards. The Flex Super App provides:

- Free ACH/wire payments: Seamless financial transactions without extra fees.

- Expense management tools: Keep track of travel expenses efficiently.

- High APY earnings on idle cash: Earn up to 2.99% APY, maximizing returns on funds not immediately used.

With these features, business travelers can manage expenses and benefit from financial rewards during their trips.

Suitability For High-spending Enterprises

Large enterprises with high spending need robust financial tools. Flex offers significant advantages:

- Scalable credit solutions: Tailored to support business growth and high expenditure.

- Automated fraud monitoring: Ensures secure transactions, protecting large financial movements.

- Multi-Factor Authentication and robust encryption: Safeguards sensitive financial data.

- FDIC & SIPC insurance up to $3M and up to $75M: Ensures the safety of substantial funds.

These features make Flex ideal for enterprises with substantial financial activities, providing security and scalability.

For more information, visit Flex Super App to see how it can benefit your business.

Frequently Asked Questions

What Are Credit Card Rewards For Businesses?

Credit card rewards for businesses are incentives given by banks. They include cashback, points, and travel rewards. Businesses earn these rewards by making purchases with their credit card.

How Can Businesses Earn Credit Card Rewards?

Businesses earn rewards by using their credit card for everyday expenses. These expenses can include office supplies, travel, and utilities. The more they spend, the more rewards they accumulate.

Are Credit Card Rewards Taxable For Businesses?

Yes, credit card rewards can be taxable for businesses. It depends on how the rewards are used. Consult a tax professional for specific guidance.

What Types Of Rewards Do Business Credit Cards Offer?

Business credit cards offer various rewards like cashback, points, and travel miles. These rewards can be redeemed for purchases, travel, or statement credits.

Conclusion

Credit card rewards can greatly benefit your business. They offer savings, flexibility, and control. Choosing the right card, like the Flex Super App, can provide even more advantages. Simplified banking, expense management, and secure transactions make business operations smoother. Consider exploring the Flex Super App for your business needs. It combines various financial services, helping you manage finances more effectively. The right rewards program can lead to significant growth and efficiency. Make informed decisions to maximize your business potential.