Credit Card Rewards: Unlock Amazing Benefits and Perks

Credit card rewards can offer valuable perks, like cashback, travel points, or discounts. Using the right card can maximize these benefits.

In today’s world, credit card rewards are more than just a nice bonus. They can provide significant financial benefits and enhance your overall spending experience. Whether you’re looking to save money on everyday purchases or planning a dream vacation, understanding how to effectively use credit card rewards is key. This guide will help you navigate the world of credit card rewards and make the most of the options available. From earning points on groceries to flying for free, the possibilities are vast. Let’s dive into how you can optimize your credit card rewards and make your spending work for you. For more financial solutions, consider exploring personal loans through Personal Loans. They offer flexible loan options for various needs, ensuring you have the financial backing when you need it most.

Introduction To Credit Card Rewards

Credit card rewards can help you earn cash, travel points, or other perks. These rewards make spending more rewarding. Understanding how these programs work is key to maximizing their benefits.

Understanding Credit Card Rewards Programs

Credit card rewards programs offer various incentives. These incentives come in different forms:

- Cash Back: Earn a percentage of your spending back as cash.

- Points: Accumulate points for every dollar spent.

- Miles: Earn miles for travel-related spending.

Each card has its own system for earning and redeeming rewards. Some cards offer higher rewards on specific categories such as groceries, travel, or dining. Review the terms carefully to understand how to earn and use rewards efficiently.

Purpose And Benefits Of Credit Card Rewards

Credit card rewards serve several purposes. They provide:

- Incentives for Spending: Rewards encourage cardholders to use their credit cards more frequently.

- Customer Loyalty: Attractive rewards programs foster brand loyalty.

Benefits of credit card rewards include:

- Financial Savings: Cash back can reduce your overall spending.

- Travel Perks: Miles and points can be redeemed for flights, hotels, and more.

- Exclusive Offers: Access special events, discounts, and early sales.

Choosing the right credit card rewards program depends on your spending habits and lifestyle. Evaluate your needs and preferences to select a card that offers the most value.

Types Of Credit Card Rewards

Credit card rewards come in various forms, offering valuable benefits based on your spending habits. Understanding the different types can help you choose the best card for your needs. Below, we explore the main types of credit card rewards.

Cash Back Rewards

Cash back rewards are straightforward and appealing. You earn a percentage of your purchases back as cash. These rewards are often categorized:

- Flat-rate: Earn a consistent percentage on every purchase.

- Tiered: Different rates for different spending categories (e.g., 3% on groceries, 1% on others).

- Rotating categories: Higher rates in specific categories that change quarterly.

Cash back rewards can be redeemed as statement credits, direct deposits, or checks.

Travel Rewards

Travel rewards are ideal for frequent travelers. These cards offer points or miles for every dollar spent, which can be redeemed for:

- Flights

- Hotel stays

- Car rentals

- Other travel-related expenses

Travel reward cards often come with additional perks like free checked bags, priority boarding, and access to airport lounges.

Points And Miles Rewards

Points and miles rewards programs allow you to earn points or miles for purchases. These points can be redeemed for:

- Merchandise

- Gift cards

- Travel

- Cash back

Each program has its own value and redemption options, so it’s important to choose one that aligns with your spending habits.

Store And Brand-specific Rewards

Store and brand-specific rewards cards are designed for loyal customers of a particular retailer or brand. These cards offer:

- Exclusive discounts

- Special financing options

- Bonus points for purchases made at the specific store or brand

These rewards are typically best for those who frequently shop at the same retailer.

Key Features Of Credit Card Rewards Programs

Credit card rewards programs offer numerous benefits to cardholders. These programs can make everyday purchases more rewarding. Let’s dive into the key features that make these rewards programs attractive.

Sign-up Bonuses

Many credit cards offer sign-up bonuses to new cardholders. These bonuses can be a great way to boost your rewards quickly. Typically, you need to spend a certain amount within the first few months to qualify. For example, a card might offer 50,000 points if you spend $3,000 in the first three months.

- Large bonuses for initial spending

- Easy way to earn rewards fast

- Often includes additional perks

Reward Redemption Options

Reward redemption options can vary greatly among credit cards. Common options include:

- Cashback: Use your rewards for statement credits or direct deposits.

- Travel: Redeem points for flights, hotels, and car rentals.

- Gift Cards: Exchange points for gift cards to popular retailers.

- Merchandise: Use points to buy products from the card issuer’s catalog.

Each option has its value, and the best choice depends on your preferences.

Annual Fee Vs. No Annual Fee

Credit cards may come with or without an annual fee. Cards with an annual fee often offer more lucrative rewards.

| Annual Fee Cards | No Annual Fee Cards |

|---|---|

| Higher reward rates | No cost to hold |

| Exclusive benefits | Basic rewards |

| Sign-up bonuses | Limited perks |

Choose based on how often you use your card and the value of rewards and perks.

Reward Earning Rates

The reward earning rates determine how quickly you accumulate points or cashback. Some cards offer:

- Flat-rate rewards: Earn a fixed rate on all purchases, e.g., 1.5% cashback on everything.

- Tiered rewards: Different rates for various categories, e.g., 3% on dining, 2% on groceries, 1% on other purchases.

- Rotating categories: Higher rates on specific categories that change quarterly, e.g., 5% on groceries for one quarter, then 5% on gas the next.

Understanding these rates helps you maximize your rewards based on your spending habits.

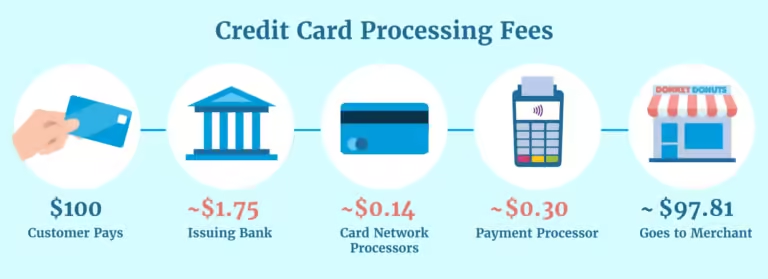

Pricing And Affordability

Understanding the pricing and affordability of credit card rewards is crucial. Managing costs while maximizing rewards can enhance your financial benefits. This section will cover annual fees, interest rates, and strategies to optimize your rewards.

Annual Fees And Other Costs

Many credit cards charge annual fees. These fees can range from $0 to several hundred dollars. Some cards offer benefits that outweigh these fees, such as travel credits or cashback bonuses.

Other costs can include balance transfer fees, foreign transaction fees, and late payment fees. Evaluating these costs can help you choose a card that aligns with your spending habits.

Interest Rates And How They Affect Rewards

Credit card interest rates, or APRs, can significantly impact the value of your rewards. Higher APRs mean more interest charges if you carry a balance. This can offset any rewards you earn.

For example, if your card has a 20% APR and you carry a $1,000 balance, the interest charges could quickly reduce your rewards value. Paying off your balance in full each month can help you avoid interest charges and maximize your rewards.

Maximizing Rewards While Minimizing Costs

To maximize rewards while minimizing costs, consider the following strategies:

- Choose a card with no annual fee or a fee that provides greater value in rewards.

- Pay your balance in full each month to avoid interest charges.

- Take advantage of introductory APR offers for balance transfers or purchases.

- Use your card for categories with higher reward rates, such as groceries or travel.

By carefully selecting and managing your credit card, you can enjoy significant rewards without incurring high costs.

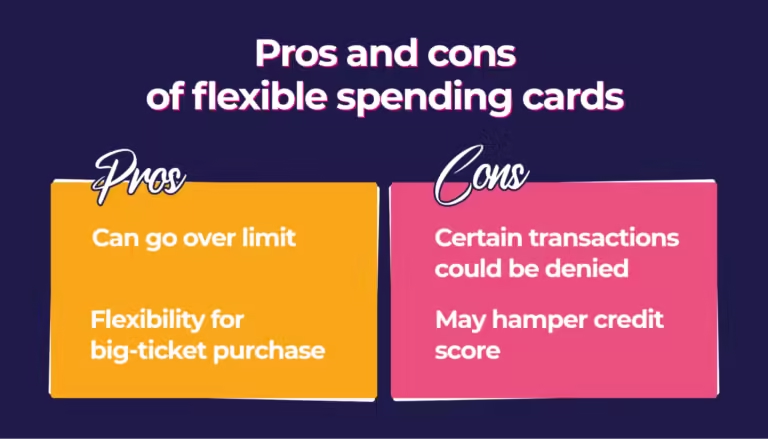

Pros And Cons Of Credit Card Rewards

Credit card rewards can be enticing with their promise of cash back, travel points, and other perks. Understanding the pros and cons helps you decide if they are worth it. Let’s delve into the advantages and potential drawbacks of using credit card rewards.

Advantages Of Using Credit Card Rewards

Credit card rewards offer several benefits that can enhance your financial well-being:

- Cash Back: Many cards offer a percentage back on purchases, which adds up over time.

- Travel Points: Earn points towards flights, hotels, and more, making travel more affordable.

- Exclusive Discounts: Access special deals and discounts not available to non-cardholders.

- Sign-Up Bonuses: Some cards offer significant bonuses when you meet initial spending requirements.

| Reward Type | Benefits |

|---|---|

| Cash Back | Get a percentage of your purchases back as cash. |

| Travel Points | Points can be redeemed for flights, hotels, and travel-related expenses. |

| Exclusive Discounts | Access to special offers and discounts on products and services. |

| Sign-Up Bonuses | Receive a lump sum of points or cash after meeting spending criteria. |

Potential Drawbacks And Risks

While credit card rewards can be beneficial, they also come with risks:

- High Interest Rates: Carrying a balance can negate any rewards earned due to interest charges.

- Annual Fees: Some cards come with high fees that can outweigh the rewards.

- Encourages Overspending: The temptation to earn more rewards can lead to unnecessary purchases.

- Complicated Redemption: Some rewards programs have complex rules and restrictions.

Balancing Rewards With Responsible Spending

Maximize the benefits of credit card rewards while minimizing risks:

- Pay Off Balances Monthly: Avoid interest charges by paying your balance in full each month.

- Choose the Right Card: Select a card with rewards that match your spending habits.

- Monitor Spending: Keep track of your expenses to avoid overspending.

- Understand Terms: Read and understand the terms and conditions of your rewards program.

By balancing rewards with responsible spending, you can enjoy the perks without falling into debt.

Specific Recommendations For Ideal Users

Credit card rewards can offer significant benefits tailored to different types of users. Whether you travel often, spend mostly on daily essentials, run a business, or are new to credit cards, there are options designed to maximize your rewards. Below, we break down the best credit cards for each category.

Best Credit Cards For Frequent Travelers

For those who travel frequently, the right credit card can provide valuable perks and rewards. Here are some top choices:

| Credit Card | Key Benefits | Annual Fee |

|---|---|---|

| Chase Sapphire Preferred | 2X points on travel and dining, 1X on all other purchases | $95 |

| American Express Platinum | 5X points on flights booked directly with airlines, access to premium travel services | $695 |

| Capital One Venture | 2X miles on every purchase, no foreign transaction fees | $95 |

Top Choices For Everyday Spending

If you spend mainly on daily essentials, look for cards with high rewards rates on these categories. Here are some recommendations:

- Blue Cash Preferred® Card from American Express: 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases), 3% at U.S. gas stations, 1% on other purchases. Annual fee: $95.

- Citi® Double Cash Card: 2% cash back on all purchases (1% when you buy, 1% when you pay). No annual fee.

- Chase Freedom Unlimited®: 1.5% cash back on all purchases, no annual fee.

Ideal Cards For Business Owners

Business owners can benefit from cards that offer rewards on business-related expenses. Some top choices include:

- Ink Business Preferred® Credit Card: 3X points on travel and select business categories, 1X on other purchases. Annual fee: $95.

- American Express® Business Gold Card: 4X points on the 2 categories where your business spends the most each month (up to $150,000 per year, then 1X). Annual fee: $295.

- Capital One® Spark® Cash for Business: 2% cash back on all purchases. Annual fee: $0 for the first year, then $95.

Options For Students And First-time Credit Card Users

Students and first-time users should consider cards that offer rewards and help build credit. Here are some good options:

- Discover it® Student Cash Back: 5% cash back on rotating categories, 1% on other purchases. No annual fee.

- Journey® Student Rewards from Capital One: 1% cash back on all purchases, 1.25% when you pay on time. No annual fee.

- Bank of America® Cash Rewards for Students: 3% cash back on a category of your choice, 2% at grocery stores, 1% on other purchases. No annual fee.

How To Maximize Your Credit Card Rewards

Maximizing credit card rewards can lead to significant savings and benefits. By implementing strategic spending habits, combining multiple cards, and avoiding common pitfalls, you can make the most out of your credit card rewards. Here’s how.

Strategic Spending Tips

To make the most of your credit card rewards, prioritize strategic spending. Focus on using your card for everyday purchases like groceries, gas, and dining out. These categories often offer higher reward rates.

Consider the following tips:

- Track your spending categories: Identify where you spend most and use a card that offers high rewards in those areas.

- Utilize bonus categories: Many cards offer rotating categories with higher rewards. Keep track of these and adjust your spending accordingly.

- Pay off your balance monthly: Avoid interest charges by paying your balance in full each month.

Combining Multiple Credit Cards For Maximum Rewards

Using multiple credit cards can amplify your rewards. Each card may offer unique benefits, and combining them can cover all your spending categories.

Here’s how to do it effectively:

- Choose complementary cards: Select cards that offer different rewards categories to maximize your benefits.

- Track rewards and due dates: Use a spreadsheet or app to manage your cards and ensure you don’t miss payments.

- Leverage sign-up bonuses: Many cards offer lucrative sign-up bonuses. Plan your applications to take advantage of these offers.

Avoiding Common Pitfalls

Maximizing rewards involves avoiding common pitfalls that can negate the benefits.

Be mindful of the following:

- Over-spending: Don’t spend more than you can afford just to earn rewards.

- Ignoring fees: Annual fees can offset rewards. Make sure the benefits outweigh the costs.

- Missing payments: Late payments can incur fees and interest, reducing the value of your rewards.

By following these tips, you can maximize your credit card rewards effectively. Remember to stay disciplined and informed about your cards’ terms and conditions.

Frequently Asked Questions

What Are Credit Card Rewards?

Credit card rewards are points, miles, or cashback earned from using a credit card for purchases. They can be redeemed for travel, merchandise, or statement credits.

How Do Credit Card Rewards Work?

Credit card rewards work by earning points or cashback on purchases. The rewards can be redeemed for various benefits like travel, gift cards, or statement credits.

Can I Earn Rewards On All Purchases?

Yes, you can earn rewards on most purchases. However, some cards have specific categories that offer higher rewards rates, like groceries or travel.

Are Credit Card Rewards Taxable?

Generally, credit card rewards are not taxable. They are considered rebates or discounts on purchases, not income. However, consult a tax professional for specific advice.

Conclusion

Exploring credit card rewards can be truly beneficial. Choose cards that align with your spending habits. Make sure to redeem rewards before they expire. Manage your credit responsibly to maximize benefits. Consider additional financial options for unexpected expenses. Personal Loans® offers flexible funding solutions for various needs. They connect you with lenders quickly and securely. Learn more about Personal Loans® for your financial needs. Proper planning and understanding can lead to significant rewards. Happy rewarding!