Credit Card Reporting: Boost Your Financial Health Today

Credit card reporting is crucial for managing your financial health. It impacts your credit score and loan eligibility.

Understanding credit card reporting can seem complex, but it’s essential for anyone looking to maintain a good credit score. Each time you use your credit card, the information is sent to credit bureaus, which then influences your credit report. This report plays a significant role in your financial life, affecting everything from loan approvals to interest rates. In this blog post, we’ll delve into the basics of credit card reporting, explain its importance, and provide tips on how to ensure your credit report accurately reflects your financial behavior. If you’re interested in leveraging credit for real estate investing, consider exploring educational resources like Subto. They offer insights and tools that can help you navigate the complexities of creative financing.

Introduction To Credit Card Reporting

Credit card reporting is crucial for maintaining financial health. It involves the collection and sharing of data regarding your credit card usage. This information impacts your credit score and financial opportunities. Understanding the basics can help you manage your finances better.

Understanding Credit Card Reporting

Credit card reporting is the process where credit card companies send information about your credit card usage to credit bureaus. These bureaus then compile the data into your credit report. The information includes:

- Payment history

- Credit limit

- Account balance

- Account status

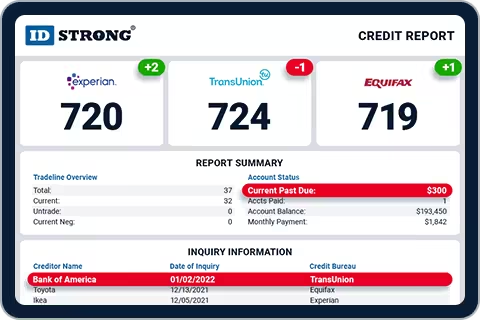

This data is used to calculate your credit score. A good credit score can lead to better loan rates and financial opportunities. Regularly checking your credit report can help you identify errors and manage your credit responsibly.

Importance Of Credit Card Reporting In Financial Health

Credit card reporting plays a significant role in your financial health. Here are some key reasons:

- Credit Score Impact: Your credit report data affects your credit score. A higher score can lead to lower interest rates and better loan terms.

- Loan Approvals: Lenders use credit reports to assess your creditworthiness. A positive report increases your chances of loan approval.

- Identity Theft Detection: Regularly reviewing your credit report helps you spot unauthorized activities. Early detection can prevent further damage.

- Financial Management: Understanding your credit report helps you manage your debts and payments effectively. It encourages responsible credit usage.

In summary, regular credit card reporting and monitoring are essential for maintaining a healthy financial profile. It empowers you to make informed financial decisions and secure better financial opportunities.

Key Features Of Effective Credit Card Reporting

Understanding credit card reporting can help you manage your finances better. Here are some key features that make credit card reporting effective:

Real-time Credit Monitoring

Real-time credit monitoring provides instant updates on your credit activity. This feature allows you to keep track of changes in your credit report as they happen. It helps in maintaining a good credit score and preventing identity theft.

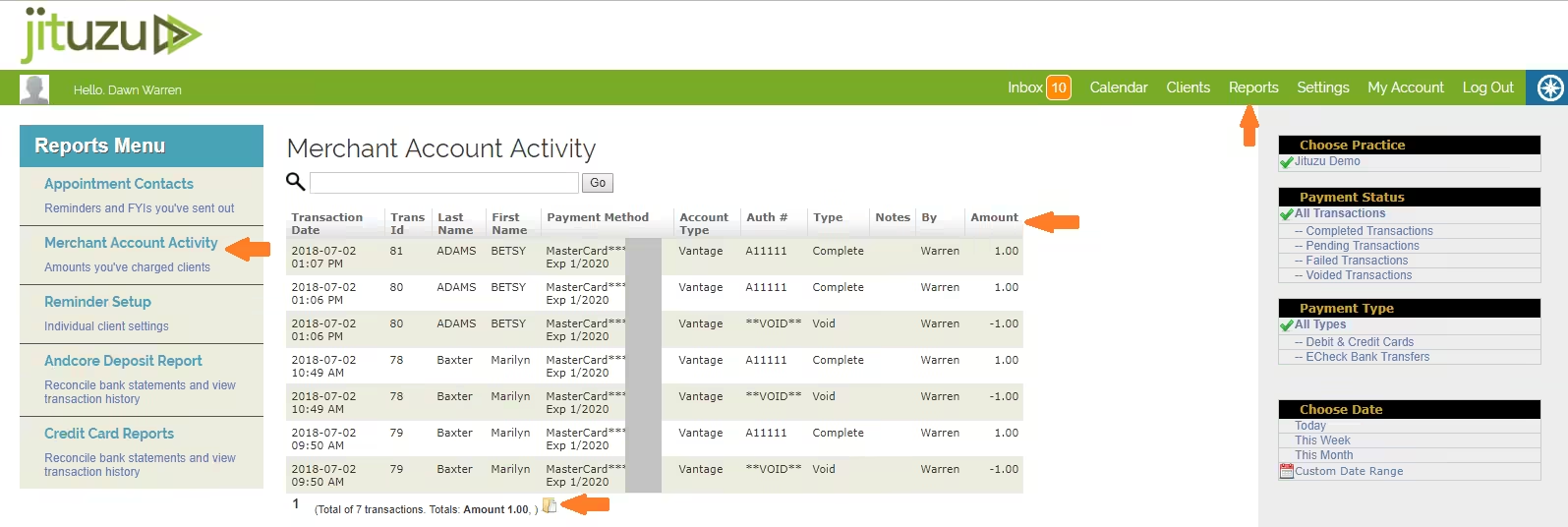

Detailed Transaction History

A detailed transaction history is vital for effective credit card reporting. It includes a comprehensive list of all your credit card transactions. This feature helps you track spending habits, identify errors, and understand your financial behavior better.

Credit Score Tracking

Credit score tracking is a crucial feature that shows your credit score over time. Regular updates help you understand the factors affecting your score. By monitoring your credit score, you can take steps to improve it and qualify for better interest rates.

Fraud Detection And Alerts

Fraud detection and alerts are essential for protecting your finances. This feature notifies you of suspicious activity on your credit card. Immediate alerts allow you to take action quickly to prevent fraud and secure your account.

Effective credit card reporting integrates these features to offer comprehensive financial management. By leveraging real-time monitoring, detailed history, score tracking, and fraud alerts, you can stay on top of your credit health.

Pricing And Affordability Of Credit Card Reporting Services

Understanding the pricing and affordability of credit card reporting services is crucial for both individuals and businesses. Selecting the right service can impact your financial health and credit score. This section will explore various aspects of pricing and affordability, helping you make an informed decision.

Free Vs. Paid Credit Reporting Services

There are numerous credit reporting services available, ranging from free options to paid subscriptions. Free services often provide basic information, such as credit scores and basic reports. They are suitable for those who need occasional updates and do not require in-depth analysis.

Paid services, on the other hand, offer comprehensive reports. These include detailed credit history, alerts for any changes, and personalized advice. They are ideal for users who need regular monitoring and detailed insights. Paying for these services ensures you get timely and accurate information, which can be crucial for making financial decisions.

Cost-benefit Analysis

Performing a cost-benefit analysis helps in understanding the value of paid credit reporting services. While free services might save money initially, they may not provide the depth of information required for serious financial planning. Paid services often include additional features like fraud alerts, identity theft protection, and more frequent updates.

Consider the following points:

- Accuracy: Paid services typically offer more accurate and detailed reports.

- Frequency: Regular updates can help you stay on top of your credit health.

- Support: Access to customer support for resolving issues or understanding reports.

- Security: Enhanced protection against identity theft and fraud.

These benefits can outweigh the costs, especially for those who actively manage their credit.

Subscription Plans And Flexibility

Credit card reporting services often provide various subscription plans to cater to different needs. These plans can range from monthly to annual subscriptions, offering flexibility based on user requirements.

Here is a table summarizing typical subscription plans:

| Plan Type | Features | Cost |

|---|---|---|

| Basic | Monthly credit score updates, basic report | $10/month |

| Standard | Weekly updates, detailed credit report, fraud alerts | $20/month |

| Premium | Daily updates, full credit history, identity theft protection | $30/month |

Selecting the right plan depends on your specific needs. A basic plan may suffice for occasional monitoring, while a premium plan is beneficial for those needing continuous and detailed insights.

In summary, understanding the pricing and affordability of credit card reporting services helps in selecting the most suitable option. By comparing free and paid services, performing a cost-benefit analysis, and considering flexible subscription plans, you can make an informed decision that best fits your financial goals.

Pros And Cons Of Credit Card Reporting Tools

Understanding the pros and cons of credit card reporting tools is crucial. These tools offer various benefits and drawbacks. Knowing both helps users make informed decisions.

Benefits Of Using Credit Card Reporting Tools

Credit card reporting tools provide significant advantages to users. Here are some of the key benefits:

- Improved Financial Awareness: These tools offer detailed insights into spending habits. Users can track expenses and identify areas to cut costs.

- Budget Management: They help in creating and managing budgets. This ensures better control over personal finances.

- Fraud Detection: Reporting tools help detect unusual activities on credit cards. This can prevent potential fraud.

- Credit Score Monitoring: Some tools also monitor credit scores. Users get alerts about changes, helping them maintain good credit health.

- Bill Reminders: Timely reminders for due payments. This helps avoid late fees and maintains a good credit score.

Potential Drawbacks And Limitations

While credit card reporting tools offer numerous benefits, they also have some limitations. Here are a few potential drawbacks:

- Privacy Concerns: Sharing financial data with third-party tools may raise privacy issues. Users need to ensure that their data is secure.

- Subscription Costs: Some advanced tools may charge a subscription fee. This can add to the overall cost of managing finances.

- Complexity: Certain tools might be complex to use. Users may need time to learn how to navigate and utilize all features effectively.

- Limited Integration: Not all tools integrate seamlessly with every bank or financial institution. This can limit their usefulness.

- Data Accuracy: Errors in data reporting can occur. Users should regularly verify the accuracy of their financial information.

By weighing these pros and cons, users can decide if credit card reporting tools are suitable for their financial needs.

Specific Recommendations For Ideal Users

Credit card reporting is essential for maintaining good financial health. Different users have different needs. Here are some specific recommendations for ideal users, including best practices for individuals, small business owners, and frequent travelers.

Best Practices For Individuals

Individuals should follow these best practices to ensure their credit reports reflect positive financial habits:

- Pay on time: Ensure all bills are paid by the due date.

- Keep balances low: Aim to use less than 30% of your credit limit.

- Monitor your report: Regularly check your credit report for errors.

- Avoid opening too many accounts: Only open new credit accounts when necessary.

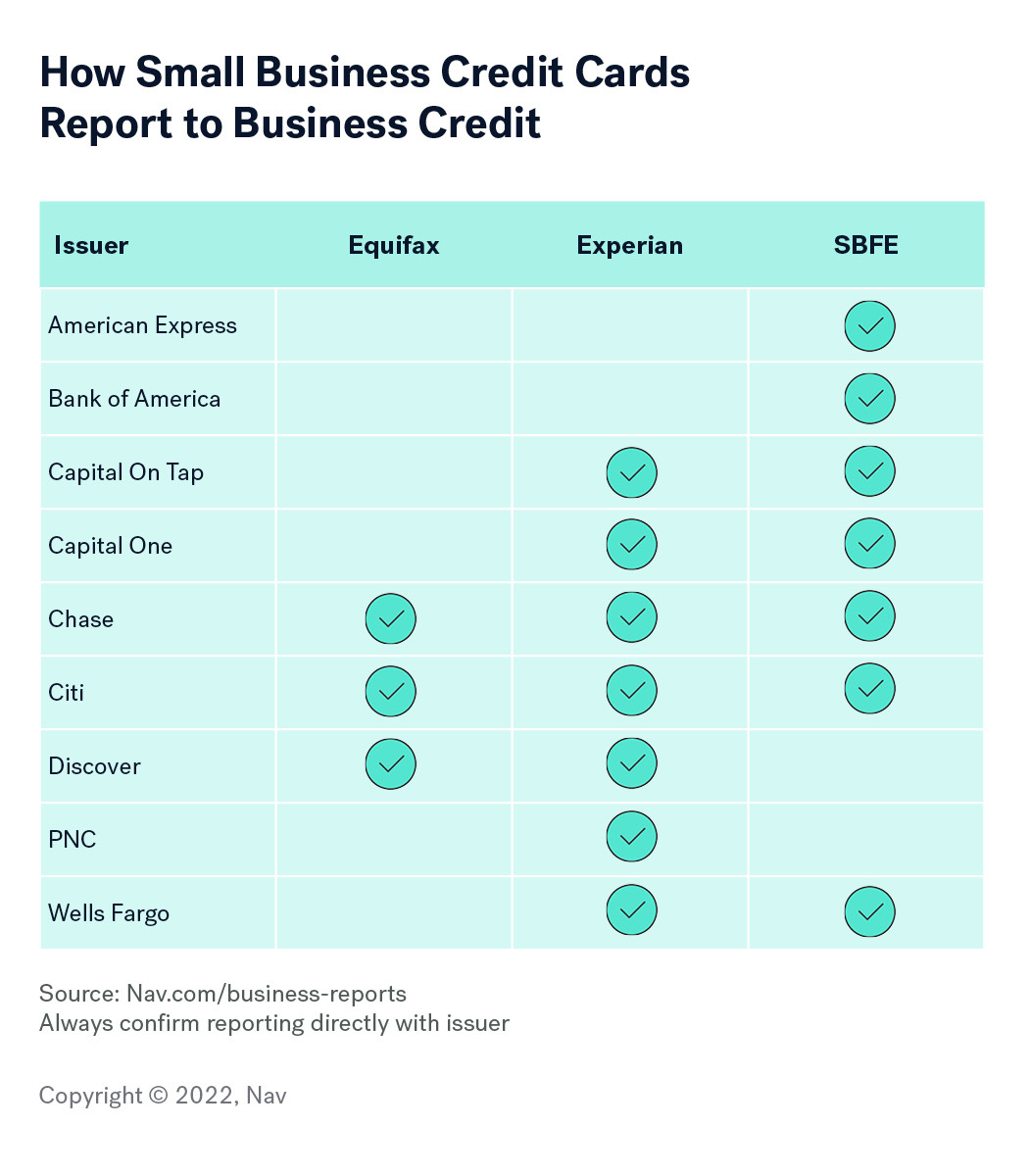

Recommendations For Small Business Owners

Small business owners can benefit from these recommendations to maintain good credit health:

| Recommendation | Details |

|---|---|

| Separate business and personal expenses | Use a business credit card for business expenses to keep finances organized. |

| Keep track of cash flow | Regularly monitor cash flow to ensure bills are paid on time. |

| Build a good credit history | Pay all business-related bills promptly to build a strong credit history. |

Tips For Frequent Travelers

Frequent travelers should consider these tips to make the most out of their credit cards:

- Choose travel rewards cards: Opt for cards that offer travel rewards and benefits.

- Avoid foreign transaction fees: Select credit cards that do not charge foreign transaction fees.

- Use travel insurance: Some cards offer travel insurance, which can be useful in emergencies.

Frequently Asked Questions

What Is Credit Card Reporting?

Credit card reporting involves credit card companies sending your account activity to credit bureaus. This data helps build your credit score.

How Often Do Credit Cards Report?

Credit card companies typically report to credit bureaus every 30 days. This schedule can vary slightly by issuer.

Does Paying Off Credit Cards Improve Credit?

Yes, paying off credit cards can improve your credit score. Lower balances reduce your credit utilization ratio.

Can I Check My Credit Report For Free?

Yes, you can check your credit report for free annually at AnnualCreditReport. com. This helps monitor your credit health.

Conclusion

Credit card reporting is crucial for financial health. Keep track of your spending. Regularly check your credit report for accuracy. Utilize educational resources like SubTo to enhance your financial knowledge. SubTo offers valuable insights into real estate investing and creative financing. Their supportive community and expert guidance can help you succeed. By staying informed, you can manage your credit effectively. Take action today to secure your financial future.