Credit Card Management Tips: Master Your Finances Today!

Managing credit cards effectively can save you from financial stress. Proper management ensures you maintain a healthy credit score.

In today’s world, credit cards are a vital part of our financial toolkit. They offer convenience and purchasing power. Yet, without good management, they can lead to debt. Understanding how to manage your credit cards is crucial. It helps you avoid high interest rates and late fees. This blog will share practical tips to help you manage your credit cards better. From tracking spending to paying bills on time, these tips will guide you. Take control of your financial health and make credit cards work for you. For more help with debt management, check out SoloSuit. This service can assist you with debt disputes and settlements. Stay tuned for valuable credit card management tips!

Introduction To Credit Card Management

Managing credit cards can feel overwhelming, but it is essential for maintaining financial health. Proper management involves keeping track of balances, making timely payments, and understanding the terms of your credit agreements. By doing so, you can avoid unnecessary debt and improve your credit score.

Understanding The Importance Of Credit Card Management

Credit card management is crucial for several reasons. First, it helps in avoiding high-interest debt. Credit cards often come with high interest rates, which can quickly add up if balances are not paid off monthly. Second, proper management helps maintain a good credit score. A good credit score is essential for securing loans, mortgages, and even some jobs.

In addition to these benefits, managing your credit cards wisely can also help you take advantage of rewards and benefits. Many credit cards offer cashback, travel points, and other perks. By managing your spending and paying off balances, you can maximize these rewards without falling into debt.

How Proper Management Can Improve Your Financial Health

Effective credit card management can significantly improve your financial health. Here are a few ways to achieve this:

- Reduce Debt: By paying off your balances each month, you can avoid accumulating debt and the associated interest charges.

- Boost Credit Score: Consistent, on-time payments and low credit utilization can improve your credit score over time.

- Financial Planning: Keeping track of your spending helps you budget more effectively and avoid unnecessary expenses.

Consider using tools like SoloSuit to manage debt disputes and settle debts outside of court. SoloSuit offers automated assistance and ensures legal accuracy, helping you maintain control over your finances.

Remember, the key to successful credit card management is consistency and awareness. By staying on top of your finances, you can enjoy the benefits of credit cards without the stress of debt.

Key Strategies For Managing Credit Card Spending

Managing credit card spending can seem challenging. However, with the right strategies, it becomes easier. Here are some key strategies to help you manage your credit card spending effectively.

Creating And Sticking To A Budget

Start by creating a budget. Track your income and expenses. Allocate specific amounts for different categories, such as groceries, utilities, and entertainment. Use tools like spreadsheets or budgeting apps to monitor your spending.

Once you have a budget, stick to it. Avoid unnecessary purchases and impulse buying. Review your budget regularly to ensure you’re on track. Adjust your spending as needed to stay within your limits.

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Groceries | $300 | $280 |

| Utilities | $150 | $145 |

| Entertainment | $100 | $90 |

Using Credit Cards For Essential Purchases Only

Limit your credit card usage to essential purchases only. Essential purchases include groceries, medical expenses, and utilities. Avoid using credit cards for luxury items or non-essential goods.

By focusing on essential purchases, you can keep your spending in check. This helps prevent accumulating debt. It also ensures you have funds available for emergencies.

- Groceries

- Medical expenses

- Utilities

Setting Up Alerts And Notifications

Set up alerts and notifications on your credit card account. These alerts can notify you of due dates, spending limits, and suspicious activities. Use SMS or email notifications to stay informed.

Alerts help you avoid late payments and over-limit fees. They also help you monitor your spending in real-time. This can prevent overspending and potential fraud.

- Set up payment due date alerts.

- Enable spending limit notifications.

- Activate suspicious activity alerts.

These strategies can make a significant difference. They help you manage credit card spending effectively. Stay disciplined and monitor your spending. This ensures financial stability.

Understanding Credit Card Fees And Interest Rates

Managing credit cards involves understanding the various fees and interest rates. Knowing these details can help you avoid unnecessary charges and keep your debt under control. This section breaks down the different types of fees, explains how interest rates impact your debt, and provides tips to minimize these costs.

Different Types Of Fees To Watch Out For

Credit cards come with various fees that can add up quickly. Here are some of the most common ones:

- Annual Fees: Charged yearly for the privilege of using the card.

- Late Payment Fees: Applied if you miss your payment due date.

- Balance Transfer Fees: Charged when you move debt from one card to another.

- Cash Advance Fees: Imposed for withdrawing cash from your credit card.

- Foreign Transaction Fees: Applied for purchases made outside your home country.

Understanding these fees helps you avoid unexpected charges.

How Interest Rates Affect Your Debt

Interest rates on credit cards can significantly impact your debt. Here’s how:

Credit card companies charge interest on any unpaid balance. This interest is usually expressed as an Annual Percentage Rate (APR). The higher the APR, the more you pay in interest over time. For example, a card with a 20% APR will cost more than one with a 15% APR if both have the same balance.

Interest compounds, meaning you pay interest on both the principal amount and the accumulated interest. This can quickly increase your debt if you only make minimum payments.

Tips For Minimizing Fees And Interest Charges

Here are some tips to help you reduce fees and interest charges:

- Pay Your Balance in Full: Avoid interest by paying off your entire balance each month.

- Make Payments on Time: Prevent late fees and potential APR increases by paying on time.

- Choose a Card with No or Low Fees: Look for cards with no annual fees or low foreign transaction fees.

- Transfer Balances Wisely: Use balance transfers to lower interest rates, but be mindful of transfer fees.

- Avoid Cash Advances: Cash advances come with high fees and interest rates, so use them sparingly.

By following these tips, you can manage your credit card debt more effectively and save money in the long run.

Benefits Of Regularly Monitoring Your Credit Card Statements

Regularly monitoring your credit card statements is crucial for maintaining financial health. It helps you stay on top of your spending, detect unauthorized charges, and avoid penalties. Let’s explore the key benefits in detail.

Identifying And Disputing Unauthorized Charges

Reviewing your credit card statements allows you to identify unauthorized charges quickly. Fraudulent transactions can happen, and catching them early is essential.

- Spotting unfamiliar charges immediately

- Reporting suspicious activities to your card issuer

- Ensuring prompt dispute resolution

By checking your statements regularly, you can address these issues before they escalate.

Tracking Your Spending Habits

Monitoring your statements helps you track your spending habits. Knowing where your money goes each month can lead to better budgeting.

| Category | Monthly Spending |

|---|---|

| Groceries | $200 |

| Utilities | $150 |

| Entertainment | $100 |

Use this information to adjust your budget and save more effectively.

Ensuring Timely Payments To Avoid Penalties

Regularly monitoring your credit card statements ensures you make timely payments. This helps you avoid late fees and penalties.

- Set up payment reminders

- Pay at least the minimum amount due

- Consider automatic payments

Staying on top of your payments can improve your credit score and financial stability.

Effective Ways To Pay Off Credit Card Debt

Struggling with credit card debt can be overwhelming. Finding an effective repayment method is crucial. Here are some strategies to help you manage and pay off your debt efficiently.

Snowball Vs. Avalanche Method

The snowball method involves paying off your smallest debts first. This can give you a quick win and boost your motivation. List your debts from smallest to largest, and focus on paying off the smallest one while making minimum payments on the rest.

The avalanche method targets the debt with the highest interest rate first. This approach can save you more money in the long run. List your debts by interest rate, and pay off the highest rate debt first while making minimum payments on the others.

Both methods have their benefits. Choose the one that fits your financial situation and personality best.

Consolidation Loans And Balance Transfer Cards

Consider a consolidation loan if you have multiple debts. This loan combines all your debts into one. You make a single monthly payment at a lower interest rate. It simplifies your payments and can save you money.

Another option is a balance transfer card. Transfer your high-interest debt to a card with a lower interest rate or a 0% introductory rate. This can reduce the amount of interest you pay and help you pay off your debt faster. Be mindful of balance transfer fees and the expiration of the introductory rate.

Seeking Professional Financial Advice

If managing your debt feels overwhelming, seek professional help. A credit counselor can help you create a budget and develop a debt repayment plan. They offer valuable advice and support.

Services like Solo Debt Resolution Service provide automated assistance. They help you respond to debt lawsuits and settle debts outside of court. An attorney reviews your response to ensure accuracy. This service aims to close your case by paying less than the face value of your debt.

Professional advice can make a significant difference. Don’t hesitate to reach out for help.

Pros And Cons Of Using Credit Cards

Credit cards can be beneficial tools when managed properly. They offer convenience and rewards but also come with potential risks. Understanding the pros and cons helps in making informed decisions.

Advantages Of Credit Cards

Credit cards offer several benefits that can enhance your financial flexibility:

- Convenience: Credit cards are accepted almost everywhere, making transactions easy.

- Rewards and Perks: Many cards offer cash back, travel points, and other rewards.

- Building Credit: Regular use and timely payments can improve your credit score.

- Emergency Funds: They provide a backup for unexpected expenses.

- Purchase Protection: Credit cards often include fraud protection and extended warranties.

Potential Drawbacks And Risks

While credit cards offer many advantages, they also come with significant risks:

- High-Interest Rates: Carrying a balance can lead to high interest charges.

- Debt Accumulation: It’s easy to overspend and fall into debt.

- Impact on Credit Score: Late payments can harm your credit rating.

- Fees: Annual fees, late payment fees, and foreign transaction fees can add up.

- Complex Terms: Understanding the terms and conditions can be challenging.

Balancing Benefits And Risks For Optimal Use

To maximize the benefits of credit cards while minimizing risks, consider these tips:

- Pay Full Balance: Always pay your balance in full to avoid interest charges.

- Monitor Spending: Keep track of your spending to avoid overspending.

- Set Up Alerts: Use alerts for due dates and spending limits.

- Choose the Right Card: Select a card that matches your spending habits and offers relevant rewards.

- Understand Terms: Read and understand the card’s terms and conditions.

Tips For Maintaining A Good Credit Score

Maintaining a good credit score is crucial for financial health. A high score can help you secure loans, credit cards, and better interest rates. Here are some practical tips to help you maintain a solid credit score.

Making Payments On Time

One of the most crucial aspects of maintaining a good credit score is making payments on time. Late payments can negatively impact your credit score.

- Set up automatic payments to ensure you never miss a due date.

- Keep track of your payment due dates with reminders.

- Pay at least the minimum amount due each month to avoid penalties.

Timely payments reflect positively on your credit report. They show lenders that you are a responsible borrower.

Keeping Credit Utilization Low

Credit utilization refers to the percentage of your credit limit that you are using. Lowering your credit utilization can improve your credit score.

- Try to keep your credit utilization below 30%.

- Pay off credit card balances in full each month if possible.

- Consider requesting a credit limit increase to reduce your utilization ratio.

Maintaining a low credit utilization rate shows that you manage your credit well and are less risky to lenders.

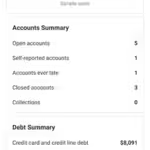

Regularly Checking Your Credit Report

Regularly checking your credit report helps you stay informed about your credit status and detect any errors or fraudulent activities.

- Obtain a free credit report from each of the three major credit bureaus annually.

- Review the report for inaccuracies and dispute any errors.

- Look out for unfamiliar accounts or inquiries that may indicate identity theft.

Staying vigilant about your credit report ensures that your credit score accurately reflects your financial behavior.

Special Recommendations For Different Types Of Users

Credit card management varies for different users. Tailored tips help manage finances effectively. Below are recommendations for students, frequent travelers, and individuals with high debt.

Students And Young Adults

Students and young adults are new to credit. Building good credit habits early is crucial. Here are some tips:

- Start with a secured credit card: It requires a deposit and helps build credit.

- Pay on time: Late payments hurt credit scores. Set reminders to pay on time.

- Keep balances low: Avoid maxing out your card. Aim to use less than 30% of your credit limit.

- Monitor your credit report: Check for errors and track your credit score.

Frequent Travelers

Frequent travelers benefit from cards with travel rewards. Here are some tips:

- Choose a travel rewards card: Earn points or miles for every purchase.

- Look for cards with no foreign transaction fees: Save money on international purchases.

- Use travel benefits: Take advantage of perks like travel insurance, lounge access, and priority boarding.

- Pay your balance in full: Avoid interest charges and maintain a good credit score.

Individuals With High Debt

Managing high debt requires careful planning. These tips can help:

- Create a budget: Track income and expenses. Prioritize debt payments.

- Consider a balance transfer card: Transfer high-interest debt to a card with a lower rate.

- Pay more than the minimum: Reduce debt faster by paying extra each month.

- Seek professional help: Solo Debt Resolution Service can assist with debt disputes and settlements.

For those struggling with high debt, SoloSuit offers automated software to navigate debt disputes and settle debts. Their service helps respond to debt lawsuits and negotiate settlements. It’s available in all 50 states and has helped many individuals protect their finances.

Frequently Asked Questions

How Can I Manage My Credit Card Wisely?

To manage your credit card wisely, always pay your balance in full each month. Monitor your spending regularly. Set up alerts for due dates. Avoid unnecessary purchases and keep your credit utilization low.

What Are The Benefits Of Paying The Full Balance?

Paying the full balance helps you avoid interest charges. It also improves your credit score. Full payments demonstrate financial responsibility. It keeps your debt-to-credit ratio low, benefiting your credit health.

How Can I Avoid Credit Card Debt?

Avoid credit card debt by budgeting your expenses. Spend only what you can afford to repay. Use your card for essential purchases. Pay off balances monthly. Avoid cash advances and high-interest purchases.

Why Is Monitoring Credit Card Statements Important?

Monitoring credit card statements helps you track spending. It ensures there are no unauthorized transactions. Regular review helps you identify billing errors. It keeps you aware of your financial activities and helps in budgeting.

Conclusion

Effective credit card management can safeguard your financial health. Practice good habits and stay vigilant. This ensures you avoid unnecessary debt and stress. For more help with managing debt, consider using SoloSuit’s services. They offer automated assistance to navigate debt disputes and settle debts. Visit SoloSuit for more information. Take control of your credit today and enjoy a brighter financial future.