Credit Card Management: Master Your Finances Effortlessly

Managing credit cards effectively is crucial for financial stability. It helps in avoiding debt and maximizing benefits.

Credit card management involves more than just paying bills on time. It requires a strategic approach to keep your finances in check. From understanding interest rates to monitoring spending, every step is vital. Effective management can help you build a strong credit history, avoid debt, and even save money. This blog post will guide you through essential tips and strategies for better credit card management. By following these steps, you can ensure your financial health remains strong and secure. For those looking to streamline their business finances, consider tools like Firstbase to simplify complex tasks and maintain control over your financial operations.

Introduction To Credit Card Management

Credit card management is an essential skill for anyone using credit cards. Proper management helps maintain a good credit score and avoid debt. This section will cover the basics and importance of managing your credit cards effectively.

Understanding The Basics Of Credit Card Management

Credit cards can be valuable financial tools when used correctly. They offer convenience, rewards, and help build credit history. However, mismanagement can lead to high-interest debt and a poor credit score.

Here are some key points to understand:

- Credit Limit: The maximum amount you can borrow on your credit card.

- Interest Rate: The percentage charged on the borrowed amount.

- Minimum Payment: The smallest amount you can pay each month to avoid penalties.

- Credit Score: A numerical representation of your creditworthiness.

- Billing Cycle: The period between statement dates, usually one month.

The Importance Of Managing Your Credit Cards Effectively

Effective credit card management is crucial for financial stability. Poor management can lead to high-interest debt, penalties, and a damaged credit score. Here’s why it’s important:

- Maintaining a Good Credit Score: Timely payments and low credit utilization help keep your credit score healthy.

- Avoiding High-Interest Debt: Paying off your balance in full each month prevents interest accumulation.

- Access to Better Financial Products: A good credit score offers better loan and mortgage rates.

- Financial Discipline: Managing credit cards teaches budgeting and responsible spending.

By managing your credit cards effectively, you ensure financial security and peace of mind.

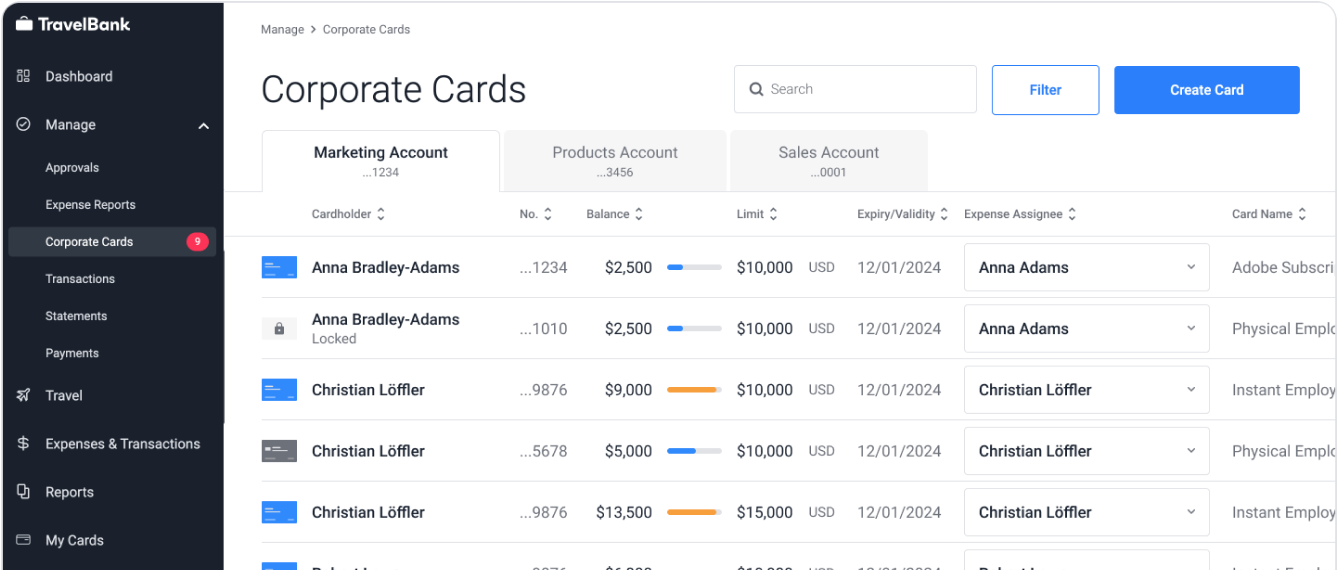

Key Features Of Effective Credit Card Management Tools

Managing credit cards can be overwhelming, especially for busy entrepreneurs. Effective credit card management tools offer several features that simplify and streamline the process. These tools help you stay on top of your finances, avoid late fees, and protect your credit health. Below are the key features you should look for in a credit card management tool.

Automated Bill Payments: Never Miss A Due Date

Automated bill payments ensure you never miss a due date. This feature allows you to set up automatic payments for your credit card bills. It helps you avoid late fees and interest charges, keeping your credit score intact. With automated bill payments, you can focus on your business without worrying about payment deadlines.

Spending Tracking: Monitor Your Expenditures In Real-time

Spending tracking features let you monitor your expenditures in real-time. These tools provide detailed reports and insights into your spending patterns. You can categorize expenses, set spending limits, and identify areas where you can save money. Real-time tracking helps you make informed financial decisions and stay within your budget.

Budgeting Tools: Plan And Stick To Your Financial Goals

Budgeting tools are essential for planning and sticking to your financial goals. They help you create a budget, track your income and expenses, and set financial targets. Budgeting tools also offer alerts and reminders to keep you on track. By using these tools, you can manage your finances more effectively and achieve your financial objectives.

Credit Score Monitoring: Stay Informed Of Your Credit Health

Credit score monitoring keeps you informed of your credit health. This feature provides regular updates on your credit score and alerts you to any changes. Monitoring your credit score helps you identify potential issues early and take corrective action. It also ensures you maintain a good credit rating, which is crucial for securing loans and other financial products.

Fraud Detection And Alerts: Protect Your Finances

Fraud detection and alerts protect your finances from unauthorized transactions. These tools monitor your credit card activity and notify you of any suspicious transactions. They help you quickly detect and address fraud, minimizing financial losses. With fraud detection and alerts, you can have peace of mind knowing your finances are secure.

Pricing And Affordability Of Credit Card Management Tools

Managing credit cards can be a daunting task, especially for startups and small businesses. The right credit card management tool can simplify the process, but understanding the pricing and affordability is crucial. Here’s a breakdown of what you can expect when it comes to the costs associated with these tools.

Free Vs. Paid Tools: What To Expect

Many credit card management tools offer both free and paid versions. Free tools typically provide basic features like transaction tracking and spending alerts. These tools are great for small businesses or startups just starting out.

Paid tools, on the other hand, offer more advanced features. These include detailed analytics, integration with other financial software, and enhanced customer support. The additional features can save time and provide deeper insights into spending patterns. For example, Firstbase One offers a comprehensive suite of services, streamlining many business operations.

Subscription Models And Pricing Tiers

Most credit card management tools operate on a subscription basis. There are usually different pricing tiers, catering to various business needs and sizes. For instance, a basic plan might cover essential features like spending tracking and budgeting tools.

More advanced tiers could include features like compliance management, tax filing, and payroll services. Firstbase One, for example, provides an all-in-one package that can save businesses significant amounts of money by consolidating multiple services into one platform.

| Plan | Features | Cost |

|---|---|---|

| Basic | Transaction tracking, spending alerts | Free |

| Standard | Detailed analytics, financial software integration | $20/month |

| Premium | Compliance management, tax filing, payroll services | $50/month |

Value For Money: Comparing Features And Costs

When evaluating credit card management tools, it’s important to compare the features and costs. Free tools can be useful for basic needs, but paid tools often provide better value. Consider the features that are most important to your business.

For instance, Firstbase One offers an all-in-one platform that combines incorporation, compliance, bookkeeping, and tax services. This integration can save businesses both time and money. Additionally, the platform’s automation features reduce manual effort and increase accuracy.

Here are some key features to look for:

- Spending tracking and alerts

- Detailed analytics and reporting

- Integration with other financial tools

- Compliance and tax management

- Customer support and assistance

By comparing these features and their associated costs, you can determine which tool offers the best value for your business needs.

Pros And Cons Of Credit Card Management Tools

Credit card management tools can be a game-changer for businesses. These tools offer various advantages and some drawbacks. Here’s a closer look at the pros and cons.

Pros: Streamlined Financial Management And Peace Of Mind

Using credit card management tools like Firstbase One simplifies financial operations. They can automate many tasks, such as tracking expenses and managing payments.

- Automated Tracking: These tools automatically track your spending. This reduces manual effort and errors.

- Detailed Reporting: Get detailed reports on your spending patterns. This helps in making informed financial decisions.

- Centralized Management: Manage all your credit cards in one place. This saves time and reduces complexity.

These tools also provide peace of mind. They ensure your financial activities are compliant and secure.

| Benefit | Description |

|---|---|

| Automation | Reduces manual effort and increases accuracy |

| Centralized Management | All credit cards managed in one platform |

| Detailed Reports | Provides insights into spending patterns |

Cons: Potential Costs And Learning Curves

Credit card management tools may come with costs. These can be subscription fees or transaction fees.

- Subscription Fees: Some tools require monthly or yearly subscriptions. These costs can add up over time.

- Transaction Fees: Certain tools charge fees per transaction. This can be a concern for high-volume businesses.

Another drawback is the learning curve. New users might find it challenging to navigate the tool initially.

- User Training: Time and resources needed to train staff.

- Initial Setup: Setting up the tool can be time-consuming.

Despite these drawbacks, the benefits often outweigh the cons. Tools like Firstbase One offer powerful features that simplify financial management.

Recommendations For Ideal Users And Scenarios

Managing credit cards can be complex. Using specialized tools can simplify this process. Different users have unique needs. Understanding these needs helps in choosing the right tools. Below are some recommendations for ideal users and scenarios.

Best Tools For Beginners

Beginners need tools that are easy to use. Firstbase One is a great choice. It automates many tasks, making it simpler for new users. Some features include:

- Start: Automates the formation of LLCs or C-Corps.

- Mailroom: Provides a US address for business mail.

- Agent: Ensures compliance with registered agent services.

These features reduce manual effort and save time. Beginners can focus on growing their business instead of paperwork.

Advanced Features For Experienced Users

Experienced users often need advanced features. Firstbase One offers powerful accounting and tax services. Key features include:

- Accounting: Full-service accrual bookkeeping and financial closures.

- Tax Filing: Simplifies corporate and personal tax returns.

- Payroll Tax Registration: Manages payroll registrations across all 50 states.

These features provide experienced users with detailed insights and control over their finances. It helps in making informed decisions.

Scenarios Where Credit Card Management Tools Are Most Beneficial

Credit card management tools are beneficial in many scenarios. Here are some examples:

| Scenario | Benefits |

|---|---|

| Starting a new business | Automates incorporation and compliance tasks. |

| Managing multiple credit cards | Centralizes information for easy tracking and management. |

| Handling international transactions | Provides global support and simplifies tax filing. |

In these scenarios, tools like Firstbase One streamline processes and reduce manual effort. This allows users to focus on their core business activities.

Frequently Asked Questions

What Is Credit Card Management?

Credit card management involves tracking your spending, paying bills on time, and maintaining a healthy credit score. It helps avoid debt and improve financial health.

How To Manage Credit Card Debt?

To manage credit card debt, create a budget, prioritize high-interest debts, and make more than minimum payments. Regularly review your spending and adjust as needed.

Why Is Credit Card Management Important?

Credit card management is important to avoid excessive debt, maintain a good credit score, and ensure financial stability. Proper management leads to better financial opportunities.

What Tools Help With Credit Card Management?

Budgeting apps, financial planners, and online banking tools assist with credit card management. These tools help track spending, set reminders, and monitor balances.

Conclusion

Managing your credit card wisely can lead to financial stability. Avoid overspending and pay your balance on time. Monitor your statements regularly for any errors or unauthorized charges. Use credit cards that offer rewards and benefits fitting your lifestyle. For more comprehensive business management, consider Firstbase One. It simplifies incorporation, compliance, bookkeeping, and taxes. This all-in-one platform saves time and reduces manual work. With the right tools and habits, managing your finances can become easier and more efficient.