Credit Card Interest Rates: How to Save Money and Avoid Debt

Credit card interest rates can be confusing. They impact how much you pay on balances.

Understanding these rates is crucial for managing your finances effectively. Interest rates on credit cards can vary widely. Factors like credit score, payment history, and the type of card you have all play a role. Knowing how these rates work can help you make better financial decisions. Whether you’re looking to get a new credit card or manage your current one, having the right knowledge is key. Let’s explore what you need to know about credit card interest rates and how they can affect you. For those seeking financial assistance, consider exploring Personal Loans®. They offer a free service connecting borrowers with a wide network of lenders for various credit-related products. This can be an excellent resource if you need additional financial support.

Introduction To Credit Card Interest Rates

Credit card interest rates can be confusing. Understanding them is important. They impact how much you pay when you carry a balance. Let’s explore the basics and purpose of credit card interest rates.

Understanding Credit Card Interest Rates

Credit card interest rates are the cost you pay for borrowing money. This rate is often expressed as an annual percentage rate (APR). It varies based on your credit score and the type of card you have.

Here are some key terms to know:

- Annual Percentage Rate (APR): The yearly interest rate charged on your balance.

- Variable APR: This rate can change based on market conditions.

- Fixed APR: This rate stays the same over time.

- Introductory APR: A lower rate offered for a limited time.

- Penalty APR: A higher rate charged if you miss payments.

The Purpose Of Credit Card Interest Rates

Credit card interest rates serve several purposes. They help lenders manage risk and earn revenue. Here’s a breakdown of why they matter:

- Risk Management: Lenders charge higher rates to riskier borrowers. This compensates for potential losses.

- Revenue Generation: Interest charges are a primary source of income for credit card companies.

- Encouraging Repayment: High interest rates encourage users to pay off balances quickly.

Understanding credit card interest rates can help you manage your finances better. Make informed decisions to avoid unnecessary charges. For more information on personal loans, visit PersonalLoans.com.

Key Features Of Credit Card Interest Rates

Understanding credit card interest rates can help you manage your finances better. Here, we will discuss the key features of credit card interest rates in detail. This section will cover the Annual Percentage Rate (APR), the types of interest rates, and how interest is calculated on credit cards.

Annual Percentage Rate (apr)

The Annual Percentage Rate (APR) is the yearly interest rate charged on borrowed money. It includes any fees or additional costs associated with the loan. For credit cards, the APR can vary based on your credit score, the type of card, and the issuing bank. It’s important to compare APRs when choosing a credit card to find the best deal.

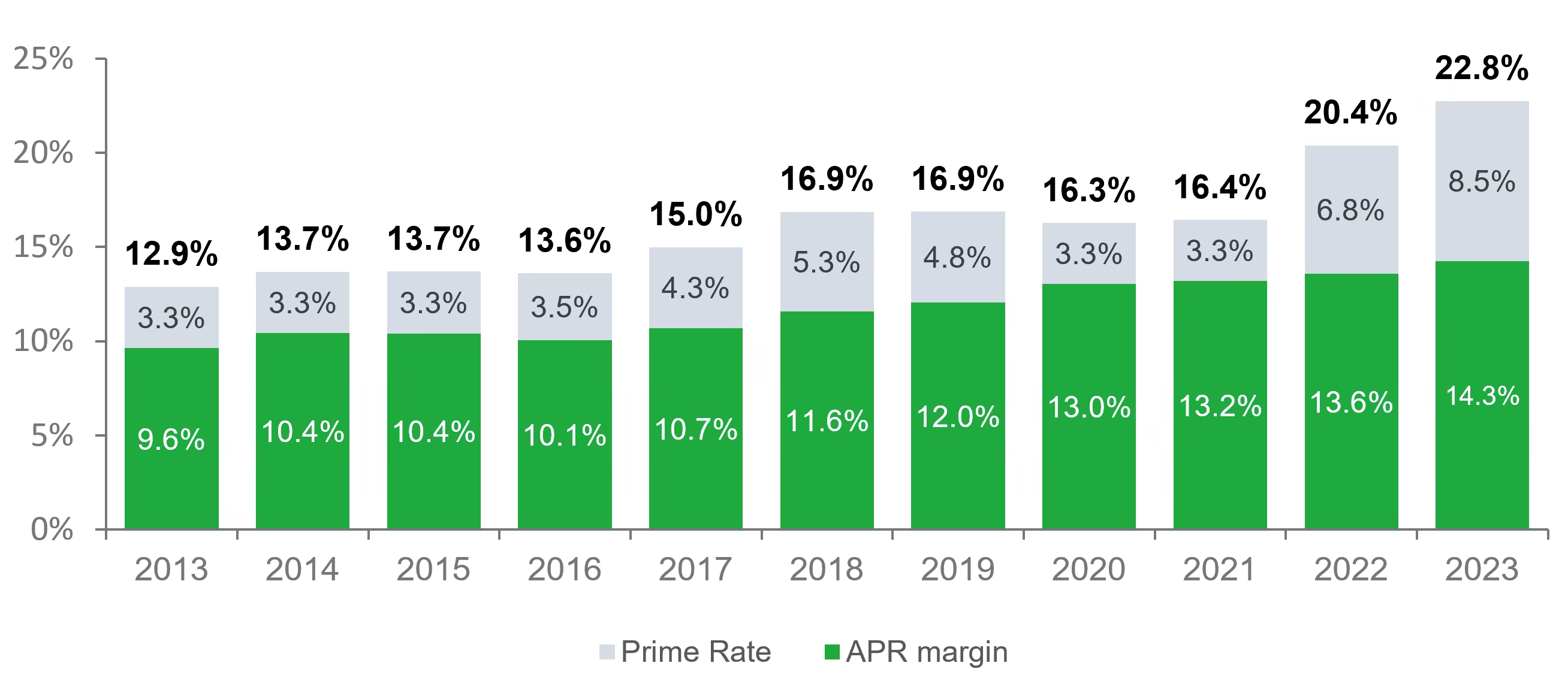

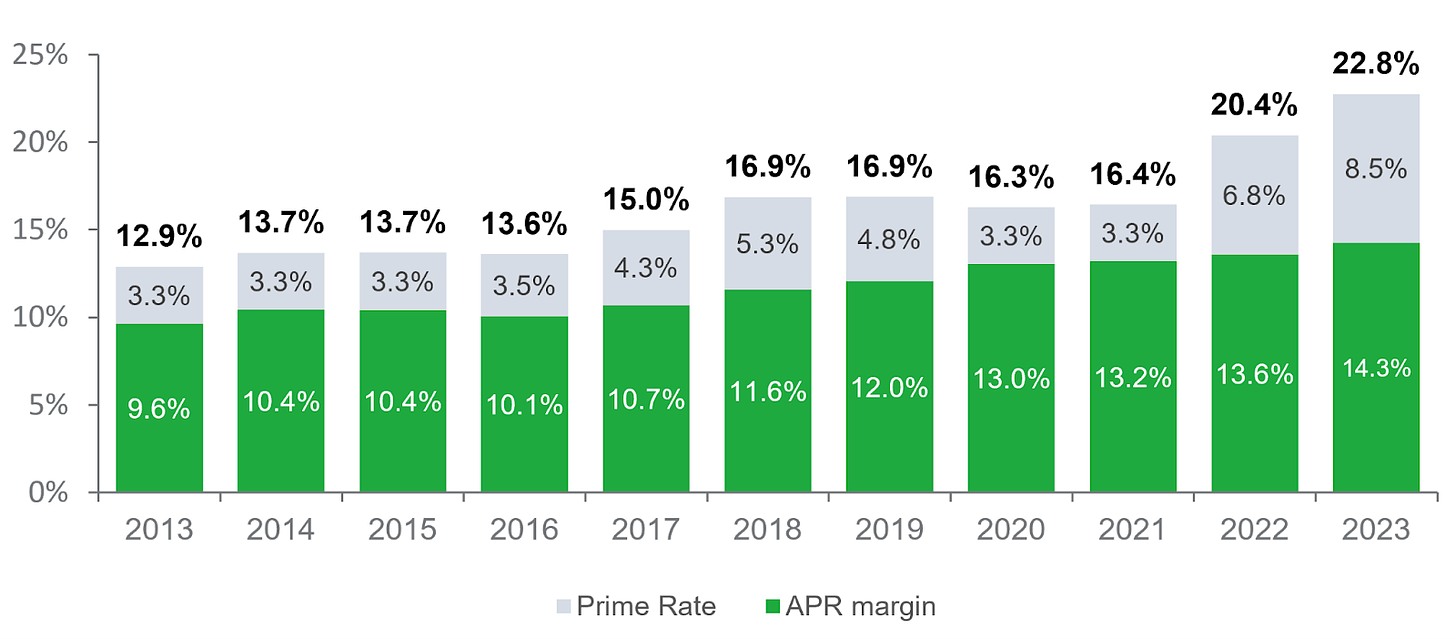

Types Of Interest Rates: Fixed Vs. Variable

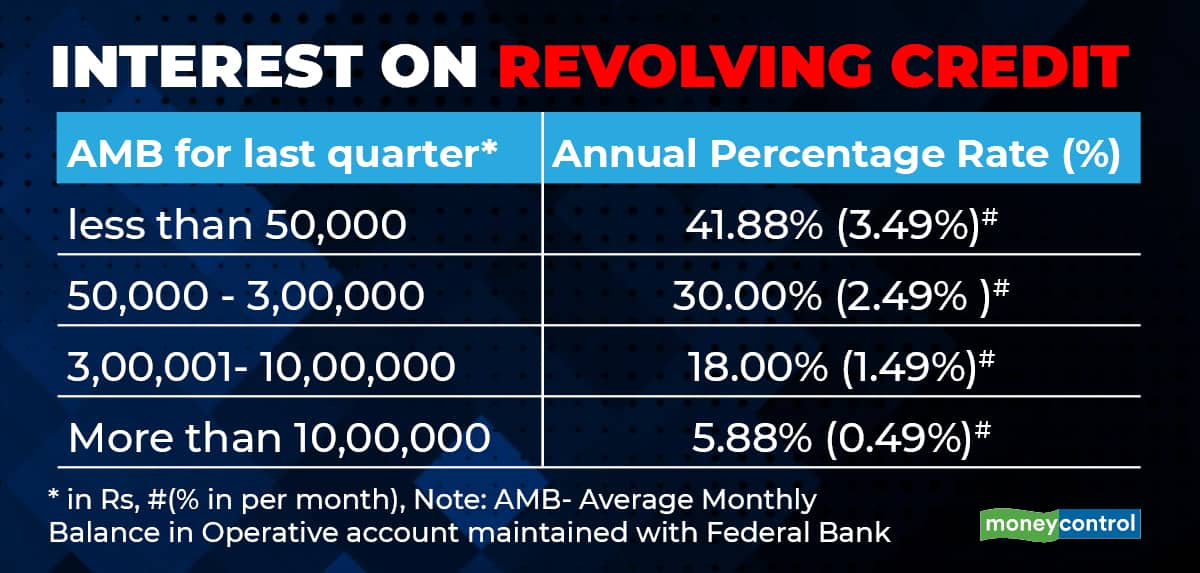

Credit cards can have either fixed or variable interest rates. A fixed interest rate remains the same over time, providing stability and predictability in your monthly payments. On the other hand, a variable interest rate can change, usually based on an index like the prime rate. This can lead to fluctuations in your monthly interest charges.

| Type | Features |

|---|---|

| Fixed Interest Rate | Consistent rate, predictable payments |

| Variable Interest Rate | Rate can change, payments may fluctuate |

How Interest Is Calculated On Credit Cards

Interest on credit cards is typically calculated using the average daily balance method. Here’s how it works:

- Determine your daily balance: Subtract any payments from your balance each day.

- Sum up these daily balances for the billing cycle.

- Divide the total by the number of days in the billing cycle to get the average daily balance.

- Multiply the average daily balance by the daily periodic rate (APR divided by 365).

- Multiply this result by the number of days in the billing cycle.

Understanding these steps can help you know how much interest you will pay on your credit card balances.

Strategies To Save Money On Credit Card Interest

Credit card interest can quickly add up, making it harder to pay off your balance. Implementing effective strategies can help you save money and reduce debt faster. Here are some actionable tips to manage your credit card interest efficiently.

Paying More Than The Minimum Payment

Always try to pay more than the minimum required amount on your credit card bill. By doing so, you reduce the principal balance faster, which in turn decreases the interest accrued.

- Reduces total interest paid over time

- Helps clear debt faster

- Improves credit score

For example, if you have a $5,000 balance with a 20% APR and only pay the minimum each month, it could take years to pay off. Paying an extra $50 or $100 each month can significantly cut down this time and save you money.

Taking Advantage Of Introductory 0% Apr Offers

Many credit cards offer introductory 0% APR on purchases or balance transfers. Using these offers wisely can help you save on interest.

Look for cards with long 0% APR periods. This gives you more time to pay off your balance without accruing interest.

Be aware of the terms. Ensure you understand when the 0% APR period ends and what the rate will be after.

| Offer | Duration | Post-Offer APR |

|---|---|---|

| Card A | 18 months | 15.99%-25.99% |

| Card B | 12 months | 14.99%-24.99% |

Using Balance Transfer Options Effectively

Balance transfers can be a powerful tool to manage high-interest debt. By transferring your existing balance to a card with a lower interest rate, you can save significantly.

- Choose a card with a low or 0% introductory rate

- Check for balance transfer fees

- Create a repayment plan to pay off the balance within the introductory period

For instance, if you transfer a $10,000 balance with a 20% APR to a card offering 0% APR for 12 months with a 3% transfer fee, you save on interest for that year. Ensure you pay off the balance within the promotional period to maximize savings.

By implementing these strategies, you can effectively manage and reduce the interest on your credit card balances, saving you money in the long run.

Avoiding Credit Card Debt

Credit card debt can quickly spiral out of control if not managed properly. It is important to understand how to avoid falling into this financial trap. By creating and sticking to a budget, monitoring and managing your credit card usage, and understanding the consequences of credit card debt, you can maintain financial stability and peace of mind.

Creating And Sticking To A Budget

Creating a budget is a crucial step in avoiding credit card debt. Start by listing all your sources of income and all your expenses. This includes fixed expenses like rent and utilities, and variable expenses like groceries and entertainment.

- Track your spending to identify areas where you can cut back.

- Set realistic financial goals and allocate funds accordingly.

- Ensure you have an emergency fund to cover unexpected expenses.

Sticking to a budget helps you live within your means and avoid unnecessary debt. Regularly review and adjust your budget to reflect changes in your financial situation.

Monitoring And Managing Your Credit Card Usage

Monitoring your credit card usage is essential to prevent debt accumulation. Keep track of your spending and make sure you stay within your budget.

- Check your credit card statements regularly for any unauthorized charges.

- Pay your balance in full each month to avoid interest charges.

- Set up alerts to remind you of payment due dates.

Consider using credit cards only for planned purchases that you can pay off immediately. This way, you can take advantage of rewards without falling into debt.

Understanding The Consequences Of Credit Card Debt

Understanding the consequences of credit card debt can motivate you to manage your finances better. High interest rates and fees can quickly increase the amount you owe.

| Consequence | Impact |

|---|---|

| High Interest Rates | Increase the total amount you owe over time |

| Fees | Late fees and over-limit fees add to your debt |

| Credit Score | Late payments can negatively affect your credit score |

| Stress | Financial stress can impact your overall well-being |

By understanding these consequences, you can make informed decisions about your credit card usage. This will help you avoid falling into a cycle of debt and maintain financial health.

Pricing And Affordability Of Credit Cards

Understanding the pricing and affordability of credit cards is essential for managing personal finances. Credit cards come with various features, interest rates, and fees that can affect overall costs. By comparing different options and being aware of hidden charges, consumers can make informed decisions that align with their financial goals.

Comparing Different Credit Card Interest Rates

Interest rates are a crucial factor in the cost of using credit cards. They can vary significantly based on the card type, issuer, and the user’s creditworthiness.

| Credit Card Type | Interest Rate Range (APR) |

|---|---|

| Standard Credit Cards | 15% – 25% |

| Rewards Credit Cards | 18% – 26% |

| Balance Transfer Cards | 0% introductory rate, then 13% – 23% |

| Secured Credit Cards | 20% – 30% |

It’s essential to consider these rates when choosing a credit card. A lower interest rate can save money on interest payments over time.

Hidden Fees And Charges To Watch Out For

Besides interest rates, credit cards may have hidden fees and charges that can increase costs. Being aware of these can help avoid unnecessary expenses.

- Annual Fees: Some cards charge an annual fee, ranging from $25 to $500.

- Late Payment Fees: Typically $35 to $40, charged if payments are late.

- Balance Transfer Fees: Usually 3% to 5% of the transferred amount.

- Foreign Transaction Fees: Often 3% of the transaction amount for purchases made abroad.

- Cash Advance Fees: High rates and fees for withdrawing cash using the credit card, often 5% of the amount.

Reading the fine print and understanding these charges can help manage and reduce extra costs. Always review the terms and conditions before accepting a credit card offer.

Pros And Cons Of Using Credit Cards

Credit cards are a popular financial tool. They offer convenience, but also come with risks. Understanding the pros and cons can help you make informed decisions.

Advantages Of Credit Cards

- Convenience: Credit cards are easy to use for everyday purchases. You don’t need to carry cash.

- Rewards: Many credit cards offer rewards like cash back, points, or miles. These can be redeemed for travel, shopping, or other perks.

- Building Credit: Responsible use of credit cards can help build your credit score. This is important for future loans, such as mortgages or car loans.

- Fraud Protection: Credit cards offer better protection against fraud compared to debit cards. If your card is stolen, you are not liable for unauthorized charges.

- Emergency Funds: Credit cards can be a helpful tool in emergencies. They provide access to funds when you need them most.

Disadvantages Of Credit Cards

- Interest Rates: Credit cards often have high interest rates. If you carry a balance, you can quickly accumulate debt.

- Fees: Some credit cards come with annual fees, late payment fees, and other charges. These can add up if you are not careful.

- Temptation to Overspend: It can be easy to overspend with a credit card. This can lead to financial trouble if you are not disciplined.

- Impact on Credit Score: Missing payments or maxing out your card can negatively impact your credit score. This can affect your ability to get loans in the future.

- Complex Terms: Credit cards often come with complex terms and conditions. It is important to read and understand these before using your card.

Recommendations For Ideal Credit Card Users

Using credit cards wisely can significantly benefit your financial health. If used responsibly, credit cards offer convenience, rewards, and the opportunity to build credit. Let’s explore some best practices and identify who should consider using credit cards.

Best Practices For Responsible Credit Card Use

Following best practices ensures you make the most out of your credit card while avoiding debt. Here are some tips:

- Pay your balance in full: Avoid paying interest by clearing your balance each month.

- Track your spending: Monitor expenses to stay within your budget.

- Use rewards wisely: Take advantage of cashback, points, or miles. But only on necessary purchases.

- Check statements regularly: Review your monthly statements for unauthorized transactions.

- Understand your terms: Know your interest rates, fees, and rewards structure.

Who Should Consider Using Credit Cards?

Credit cards can be beneficial for many. Here’s who might find them most useful:

- Individuals looking to build credit: Using a credit card responsibly helps establish a positive credit history.

- Those with controlled spending habits: If you can manage your spending and pay off balances, credit cards are suitable.

- Frequent travelers: Travel rewards cards offer points and miles for flights and hotels.

- People seeking convenience: Credit cards provide a simple way to pay for purchases without carrying cash.

- Consumers wanting purchase protection: Credit cards often come with fraud protection and extended warranties.

By adhering to these practices and knowing if a credit card suits your lifestyle, you can make informed financial decisions. For additional credit-related products, visit PersonalLoans.com for more information.

Conclusion: Making Smart Credit Card Decisions

Understanding credit card interest rates is crucial for managing your finances effectively. Making informed decisions about your credit cards can save you a lot of money in the long run. In this section, we’ll summarize key points and offer final tips to help you manage your credit card interest rates wisely.

Recap Of Key Points

Here’s a quick recap of the essential points discussed:

- Credit card interest rates can vary significantly based on your credit score.

- APR (Annual Percentage Rate) includes both the interest rate and any fees associated with the card.

- Understand the difference between fixed and variable interest rates.

- Paying your balance in full each month can help you avoid interest charges.

- Introductory rates are temporary and will revert to the regular APR after a certain period.

Final Tips For Managing Credit Card Interest Rates

Here are some practical tips to help you manage your credit card interest rates:

- Always pay more than the minimum payment. This reduces the principal amount faster and limits interest accumulation.

- Set up automatic payments to avoid late fees and penalty APRs.

- Monitor your credit score regularly. A higher score can help you qualify for lower interest rates.

- Consider balance transfer cards to consolidate debt and reduce interest rates. Be aware of transfer fees and the duration of the introductory period.

- Negotiate with your credit card issuer. Sometimes, a simple request can lead to a reduced APR.

By following these tips, you can manage your credit card interest rates more effectively and maintain financial health. Remember, making smart credit card decisions requires ongoing effort and attention to detail.

Frequently Asked Questions

What Is A Credit Card Interest Rate?

A credit card interest rate is the cost you pay for borrowing money. It’s expressed as an annual percentage rate (APR).

How Is Credit Card Interest Calculated?

Credit card interest is calculated daily based on your average daily balance. The APR is divided by 365 to get the daily rate.

Can I Avoid Paying Credit Card Interest?

Yes, you can avoid paying interest by paying your full balance each month. This prevents any interest charges from accruing.

Why Do Credit Card Interest Rates Vary?

Credit card interest rates vary based on your credit score, card type, and issuer policies. Higher scores often mean lower rates.

Conclusion

Understanding credit card interest rates is crucial for managing finances wisely. High interest rates can lead to significant debt. Compare and choose wisely. For personal loans, consider Personal Loans®. They offer various loan options with competitive rates. Stay informed and make smart financial decisions.