Credit Card Industry Standards: Navigating Compliance Challenges

The credit card industry is ever-evolving, with standards that impact consumers and businesses alike. These standards ensure secure transactions, fair practices, and reliable access to credit.

Understanding credit card industry standards is crucial for anyone using or issuing credit cards. These standards help maintain security, protect against fraud, and ensure fair treatment for consumers. In this blog post, we will dive into the details of these standards, their significance, and how they shape the credit card landscape. Whether you’re a consumer looking to understand your rights or a business wanting to stay compliant, this information is vital. Let’s explore the key aspects of credit card industry standards and their impact on everyday financial activities. For those seeking financial solutions, consider Possible Finance, offering innovative products to help build credit and access funds instantly.

Introduction To Credit Card Industry Standards

The credit card industry operates under specific standards to ensure security, fairness, and efficiency. These standards are vital for protecting both the consumers and the financial institutions involved.

Overview Of The Credit Card Industry

The credit card industry is a complex network of issuers, processors, and merchants. Each player has a role in ensuring the smooth operation of transactions. Issuers provide cards to consumers. Processors handle the transaction data. Merchants accept the cards as payment. This system allows for secure and reliable transactions worldwide.

Possible Finance offers unique financial products in this industry. The Possible Card and Possible Loan are designed to provide instant access to funds. They help build credit history without significant fees or debt traps.

Importance Of Industry Standards

Industry standards are crucial for maintaining trust and security in the credit card ecosystem. They include guidelines for data protection, transaction security, and fair pricing. Adhering to these standards ensures that consumers can use their cards with confidence.

For products like the Possible Card, these standards ensure that users benefit from no credit checks or deposits required for application. The card offers 0% interest, no late fees, and a simple monthly fee. This makes it easier for users to manage their finances and build credit.

Here is a brief comparison of the main features of Possible Finance products:

| Product | Features | Pricing |

|---|---|---|

| Possible Loan | Borrow up to $500, No late fees, Repay in 4 installments, Helps build credit | Repayment in 4 installments |

| Possible Card | Unlock $400 or $800 credit limit, No credit check, 0% interest, No late fees | Monthly fee of $8 or $16 |

These features align with industry standards, making Possible Finance a reliable option for managing personal finances.

For more details, visit Possible Finance.

Key Credit Card Industry Standards

The credit card industry adheres to several crucial standards. These standards ensure security, efficiency, and interoperability. Understanding these standards is essential for both consumers and businesses.

Pci Dss (payment Card Industry Data Security Standard)

PCI DSS is a set of security standards. It aims to protect card information during and after a transaction. Businesses must comply with PCI DSS to handle card payments securely.

- Build and maintain a secure network

- Protect cardholder data

- Maintain a vulnerability management program

- Implement strong access control measures

- Regularly monitor and test networks

- Maintain an information security policy

Emv (europay, Mastercard, And Visa)

EMV is a global standard for credit cards. It uses chip technology to improve payment security. EMV cards reduce the risk of fraud compared to magnetic stripe cards.

- Enhanced card authentication

- Reduced counterfeit fraud

- Increased transaction security

Most modern credit and debit cards now use EMV technology. This standard is critical for secure transactions globally.

Iso/iec Standards

ISO/IEC standards provide guidelines for credit card technology and processes. These standards ensure consistency and interoperability. Some key ISO/IEC standards include:

| Standard | Description |

|---|---|

| ISO/IEC 7810 | Defines physical characteristics of identification cards |

| ISO/IEC 7812 | Specifies the structure of the card number |

| ISO/IEC 7816 | Specifies smart card standards |

Adhering to these standards ensures that credit cards function properly across different systems and regions.

Benefits Of Complying With Credit Card Industry Standards

Complying with credit card industry standards offers numerous benefits for both businesses and cardholders. These standards ensure secure and reliable transactions, which is critical in today’s digital world. Below are some key benefits:

Enhanced Security For Cardholders

Adhering to credit card industry standards enhances security for cardholders. These standards mandate the use of encryption, secure networks, and other measures to protect sensitive information.

- Encryption: Ensures that data is safely transmitted and stored.

- Secure Networks: Protect against unauthorized access and data breaches.

- Regular Updates: Keep systems up-to-date with the latest security patches.

Reduced Risk Of Fraud

Following industry standards reduces the risk of fraud. By implementing robust security protocols, businesses can detect and prevent fraudulent activities.

- Fraud Detection Systems: Monitor transactions for suspicious activity.

- Authentication Methods: Verify the identity of cardholders to prevent unauthorized access.

- Compliance Audits: Regularly review and improve security measures.

Improved Customer Trust And Confidence

Complying with credit card industry standards improves customer trust and confidence. Customers feel secure knowing their personal and financial information is protected.

Customer Assurance: Businesses that comply with standards show commitment to security.

Positive Reputation: Secure transactions enhance a company’s reputation.

Loyalty and Retention: Customers are more likely to return to businesses they trust.

| Benefit | Description |

|---|---|

| Enhanced Security | Protects cardholder data through encryption and secure networks. |

| Reduced Fraud Risk | Detects and prevents fraudulent transactions with advanced systems. |

| Customer Trust | Increases confidence in the business through secure practices. |

By adhering to credit card industry standards, businesses not only protect their customers but also foster a secure and trustworthy environment, essential for long-term success.

Challenges In Navigating Compliance

Navigating compliance in the credit card industry poses significant challenges. Compliance involves adhering to a complex set of standards, managing costs, and keeping up with evolving regulations. Each of these aspects presents unique obstacles that financial institutions must address to stay compliant and secure.

Complexity Of Standards

The credit card industry operates under numerous regulations and standards. These include PCI DSS, AML, and KYC requirements. Each standard requires detailed documentation and rigorous procedures. The complexity increases with the need to integrate these standards seamlessly into existing systems.

Compliance also involves understanding and implementing data protection laws. For instance, GDPR in Europe and CCPA in California. These regulations demand meticulous handling of customer data and impose strict penalties for non-compliance.

Financial institutions must invest in continuous training for staff. They must stay updated on changes and ensure proper implementation of security measures. This complexity often necessitates hiring specialized compliance officers or consultants.

Cost Of Implementation

Implementing compliance standards incurs significant costs. Financial institutions must invest in technology solutions that meet compliance requirements. This includes advanced encryption, secure payment gateways, and fraud detection systems.

There are also costs associated with regular audits and assessments. Institutions must periodically review their systems to ensure ongoing compliance. These audits can be expensive and time-consuming.

Moreover, the need for specialized compliance staff adds to the expenses. These professionals require competitive salaries and continuous training. The overall cost of compliance can strain resources, especially for smaller institutions.

Keeping Up With Evolving Regulations

Regulations in the credit card industry are constantly evolving. New laws and standards are introduced to address emerging threats and technological advancements. Staying updated with these changes is a significant challenge.

Institutions must monitor regulatory updates and adjust their systems accordingly. This often involves revising policies, updating software, and retraining staff. Failure to keep up with these changes can result in hefty fines and reputational damage.

Collaboration with regulatory bodies and industry peers is crucial. By staying engaged in industry forums and working groups, institutions can stay ahead of regulatory changes. This proactive approach helps in anticipating and preparing for new compliance requirements.

Best Practices For Achieving Compliance

Adhering to industry standards in the credit card sector is crucial. Compliance ensures security, reliability, and trust. Here are the best practices to achieve compliance.

Regular Security Audits

Conducting regular security audits is essential. These audits identify vulnerabilities and ensure your systems are up-to-date. Security audits must be scheduled periodically. Consider hiring external experts to perform these audits. They bring an unbiased perspective and expertise. Regular audits help in maintaining the integrity of your systems.

Employee Training And Awareness

Proper employee training and awareness programs are vital. Employees must understand compliance requirements. Regular training sessions should be conducted. Use simple and clear language during these sessions. Incorporate real-life scenarios to make the training engaging. Employees should be aware of the latest security threats. A well-informed team is your first line of defense against breaches.

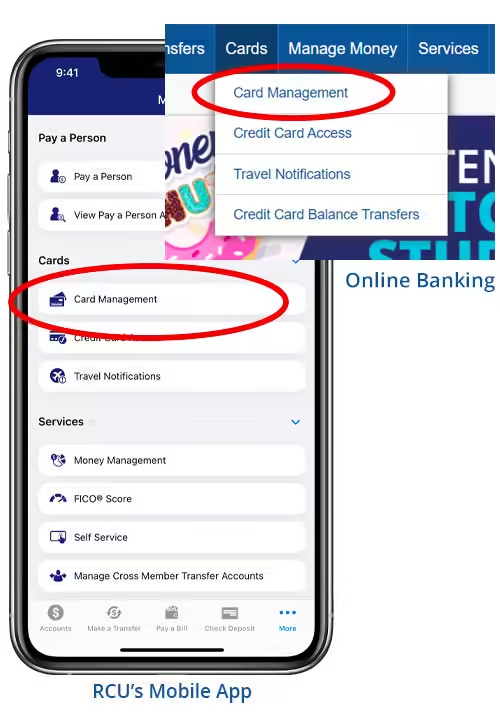

Utilizing Compliance Management Tools

Invest in compliance management tools. These tools streamline the compliance process. They help in tracking compliance requirements. Automate routine tasks using these tools. This ensures accuracy and efficiency. Below is a table of popular compliance management tools and their features.

| Tool | Features |

|---|---|

| Tool A | Automatic compliance tracking, real-time alerts, reporting |

| Tool B | Risk management, audit management, compliance dashboards |

| Tool C | Policy management, incident management, compliance workflow |

Choose tools that fit your organization’s needs. Ensure they are user-friendly and scalable. Utilizing these tools can significantly reduce compliance risks.

In summary, regular audits, training, and compliance tools are key. These practices help you achieve and maintain compliance in the credit card industry.

Pros And Cons Of Compliance

Compliance with credit card industry standards is essential. It ensures security and trust. But it also involves costs and resources. Understanding the pros and cons helps in making informed decisions.

Pros: Enhanced Security And Trust

Compliance with industry standards enhances security. It protects sensitive information. This is crucial for cardholders’ trust.

- Data Protection: Compliance ensures cardholder data is secure.

- Fraud Prevention: Standards help in reducing fraudulent activities.

- Customer Trust: Secure transactions build trust with customers.

Following standards like PCI DSS is vital. It provides a secure environment. Customers feel safe using their cards.

Cons: High Costs And Resource Allocation

Compliance can be costly. It requires significant investment in security measures. Smaller businesses may find it challenging.

| Cost Factor | Description |

|---|---|

| Implementation Costs: | Setting up compliance measures can be expensive. |

| Maintenance Costs: | Ongoing costs for regular audits and updates. |

| Resource Allocation: | Requires dedicated staff and resources. |

Allocating resources for compliance is necessary. But it can strain the budget. Especially for smaller enterprises.

In conclusion, compliance with credit card industry standards brings many benefits. But it also involves challenges. Weighing the pros and cons carefully is crucial for every business.

Recommendations For Businesses

Navigating the credit card industry standards can be challenging for businesses. Adhering to these standards ensures security, builds customer trust, and prevents potential financial losses. Below are some key recommendations for businesses looking to comply with credit card industry standards.

Ideal Businesses For Strict Compliance

Certain businesses benefit greatly from strict compliance with credit card industry standards. These include:

- Online Retailers – Ensure secure transactions and protect customer data.

- Financial Institutions – Maintain trust by adhering to rigorous security protocols.

- Service Providers – Protect clients’ payment information during processing.

These businesses handle sensitive financial information daily. Strict compliance helps prevent data breaches and enhances customer confidence.

Scenarios Where Compliance Is Critical

Compliance with credit card industry standards is crucial in several scenarios, such as:

- High Transaction Volumes – Businesses processing numerous transactions need robust security measures.

- International Transactions – Additional layers of compliance ensure secure cross-border payments.

- Customer Data Storage – Protect stored credit card information from unauthorized access.

In these scenarios, non-compliance can lead to severe penalties and loss of customer trust. Prioritizing compliance minimizes risks and ensures smooth operations.

Possible Finance As A Solution

Possible Finance offers products designed to provide instant access to funds while helping build credit history. Their offerings include:

| Product | Features | Benefits |

|---|---|---|

| Possible Loan |

|

|

| Possible Card |

|

|

These products are ideal for businesses aiming to provide secure and accessible financial solutions to their customers.

Frequently Asked Questions

What Are Credit Card Industry Standards?

Credit card industry standards are guidelines for security, data handling, and transaction processing. They ensure safety and efficiency in credit card transactions.

Why Are Credit Card Industry Standards Important?

They protect consumers and businesses from fraud and data breaches. They also maintain trust and reliability in credit card transactions.

Who Sets Credit Card Industry Standards?

Organizations like PCI Security Standards Council set these standards. They collaborate with major credit card companies to ensure compliance.

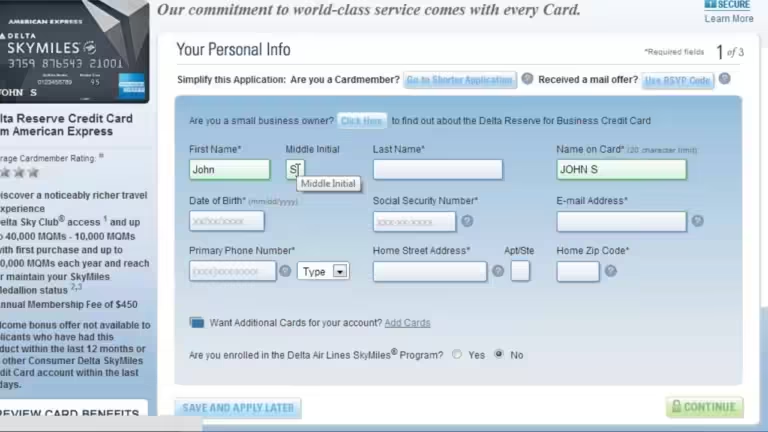

How Do Businesses Comply With Credit Card Standards?

Businesses follow PCI DSS guidelines. They conduct regular assessments, implement security measures, and maintain compliance to protect cardholder data.

Conclusion

Understanding credit card industry standards is crucial for financial health. Stay informed, and choose wisely. For those seeking instant funds and credit building, consider Possible Finance. Their products offer fair terms and no hidden fees. Manage your finances better with their Possible Loan or Possible Card. These options help build credit without significant costs. Start your journey towards improved financial stability today.