Credit Card Fraud Protection: Ultimate Guide to Stay Safe

Credit card fraud protection is essential in today’s digital age. With online transactions increasing, safeguarding your financial information is crucial.

Fraudsters are getting more sophisticated, and credit card fraud is on the rise. Protecting your credit card details isn’t just about preventing unauthorized charges; it’s about keeping your personal data safe. In this blog post, we’ll explore effective strategies to protect yourself from credit card fraud. From using secure passwords to monitoring your accounts, these tips will help you stay a step ahead of potential threats. Plus, we’ll introduce you to Firstbase, an all-in-one startup operating system that can help manage your business finances securely. Stay tuned to learn how you can safeguard your financial information and maintain peace of mind.

Introduction To Credit Card Fraud Protection

Credit card fraud protection is crucial in today’s digital age. With an increase in online transactions, protecting your financial information is more important than ever. This section will guide you through the basics of credit card fraud protection and its significance.

Understanding The Importance Of Fraud Protection

Fraud protection helps safeguard your financial assets. It ensures that your personal and financial information remains secure. Without proper protection, you risk losing money and facing legal troubles.

Key reasons for fraud protection include:

- Preventing unauthorized transactions

- Securing your identity

- Maintaining credit score

- Avoiding financial loss

Effective fraud protection measures help you stay ahead of potential threats.

Overview Of Common Credit Card Fraud Techniques

Understanding common fraud techniques can help you better protect yourself. Here are some typical methods used by fraudsters:

| Fraud Technique | Description |

|---|---|

| Phishing | Fraudsters send fake emails or messages to steal your information. |

| Skimming | Devices capture card details when you swipe at a terminal. |

| Card Not Present (CNP) Fraud | Fraud occurs during online or phone transactions without physical cards. |

| Account Takeover | Fraudsters gain access to your account and make unauthorized transactions. |

Staying informed about these techniques can help you recognize and avoid them.

For more information on secure financial solutions, consider exploring Firstbase. Firstbase One offers a comprehensive platform for businesses, ensuring compliance, bookkeeping, and tax services are managed efficiently.

Key Features Of Credit Card Fraud Protection Tools

Credit card fraud protection tools are vital for safeguarding your financial transactions. These tools offer multiple features to detect and prevent fraudulent activities. Let’s explore the key features that make these tools effective.

Real-time Transaction Monitoring

Real-time transaction monitoring is essential for credit card fraud protection. It allows continuous oversight of transactions. This feature identifies suspicious activities instantly and helps in quick intervention. Real-time monitoring ensures your credit card is safe and secure.

Two-factor Authentication

Two-factor authentication adds an extra layer of security. It requires users to verify their identity through two different methods. This could be a combination of a password and a fingerprint or a code sent to your phone. Two-factor authentication makes unauthorized access difficult.

Ai And Machine Learning Algorithms

AI and machine learning algorithms enhance fraud detection capabilities. These technologies analyze transaction patterns and detect anomalies. They adapt to new fraud techniques and improve over time. AI and machine learning provide a robust defense against credit card fraud.

Fraud Alerts And Notifications

Fraud alerts and notifications keep you informed about suspicious activities. Immediate alerts are sent via SMS or email. These notifications allow you to act quickly and prevent further unauthorized transactions. Staying informed is crucial for protecting your credit card.

Secure Online Transactions

Secure online transactions are vital for preventing credit card fraud. Encryption and tokenization protect your data during online purchases. These methods ensure that your credit card information remains confidential. Secure online transactions offer peace of mind while shopping online.

Pricing And Affordability Of Fraud Protection Tools

Protecting your credit card information is crucial in today’s digital age. Fraud protection tools vary widely in pricing and features. Understanding these differences helps you make an informed decision. Let’s explore the pricing and affordability of fraud protection tools.

Comparison Of Free Vs. Paid Tools

Free fraud protection tools offer basic features. These include monitoring transactions and alerts for suspicious activities. They are suitable for users with minimal needs. However, they often lack advanced features.

Paid tools, on the other hand, provide comprehensive protection. They offer features like real-time alerts, insurance against fraud, and identity theft protection. Paid tools are ideal for users who need robust security and peace of mind.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Basic Monitoring | Yes | Yes |

| Real-time Alerts | No | Yes |

| Insurance Coverage | No | Yes |

| Identity Theft Protection | No | Yes |

Subscription Plans And Pricing Tiers

Paid fraud protection tools often come with various subscription plans. These plans cater to different needs and budgets. Generally, they are divided into pricing tiers. Let’s look at a typical pricing structure:

- Basic Plan: $9.99/month – includes real-time alerts and basic identity theft protection.

- Standard Plan: $19.99/month – offers all basic features plus insurance coverage up to $25,000.

- Premium Plan: $29.99/month – includes all standard features, higher insurance coverage, and advanced identity theft protection.

Each plan offers a different level of protection. Choose one based on your specific needs and financial capacity.

Value For Money: Are Paid Tools Worth It?

Paid fraud protection tools offer great value for money. They provide comprehensive features that free tools lack. The added insurance coverage and real-time alerts alone justify the cost for many users.

Moreover, investing in paid tools can save you from potential financial losses due to fraud. This makes them a worthwhile investment for those who prioritize their financial security.

In conclusion, whether you opt for free or paid fraud protection tools depends on your specific needs and budget. Paid tools offer enhanced security and peace of mind, making them a valuable choice for many.

Pros And Cons Of Credit Card Fraud Protection Tools

Credit card fraud protection tools are essential in the modern world. They offer various features to safeguard your financial information. It is important to understand both the advantages and disadvantages of these tools. This knowledge helps you make informed decisions.

Pros: Enhanced Security And Peace Of Mind

One of the main benefits of credit card fraud protection tools is enhanced security. These tools continuously monitor transactions. They detect any suspicious activity quickly. This reduces the risk of unauthorized transactions.

Another advantage is peace of mind. Knowing that your financial information is protected helps you feel safe. You can shop online and use your credit card without constant worry.

- Real-time transaction monitoring

- Automatic alerts for suspicious activities

- Secure encryption of personal information

Cons: Potential Costs And False Positives

Despite the benefits, there are some drawbacks. One major con is the potential cost. Some credit card fraud protection tools require a subscription fee. This can add to your monthly expenses.

Another issue is false positives. These tools sometimes flag legitimate transactions as fraudulent. This can be frustrating and inconvenient.

| Pros | Cons |

|---|---|

| Enhanced security | Subscription fees |

| Peace of mind | False positives |

| Real-time monitoring | Inconvenience |

Balancing Security With Convenience

Balancing security and convenience is crucial. It’s important to choose tools that provide strong protection without being overly intrusive. Look for features like customizable alerts. These allow you to set preferences for notifications.

Consider the cost as well. Some tools offer free basic services with optional premium features. Evaluate your needs and choose accordingly.

- Choose tools with customizable alerts

- Evaluate the cost and benefits

- Consider both free and premium options

By carefully selecting your credit card fraud protection tools, you can enjoy enhanced security and peace of mind without unnecessary hassle or expense.

Specific Recommendations For Ideal Users

Protecting your credit card from fraud is crucial. Different users have unique needs. Here are specific recommendations for various users.

Best Tools For Frequent Travelers

Frequent travelers face unique credit card fraud risks. Here are some tools that can help:

- Travel Alerts: Notify your bank of travel plans to prevent card blocks.

- Mobile Banking Apps: Monitor transactions in real-time.

- RFID Blocking Wallets: Protect against electronic pickpocketing.

Top Picks For Online Shoppers

Online shoppers need robust fraud protection. Consider these options:

- Virtual Credit Cards: Generate temporary card numbers for online purchases.

- Two-Factor Authentication: Adds an extra layer of security for online transactions.

- Secure Payment Platforms: Use trusted platforms like PayPal or Apple Pay.

Ideal Solutions For Small Business Owners

Small business owners require comprehensive fraud protection. Here are top solutions:

- Expense Management Software: Tools like Firstbase One offer integrated accounting and compliance.

- Employee Spending Limits: Set limits on company cards to control expenses.

- Regular Account Monitoring: Conduct frequent audits to detect unusual activities.

Implement these recommendations to safeguard your credit card information and reduce fraud risks.

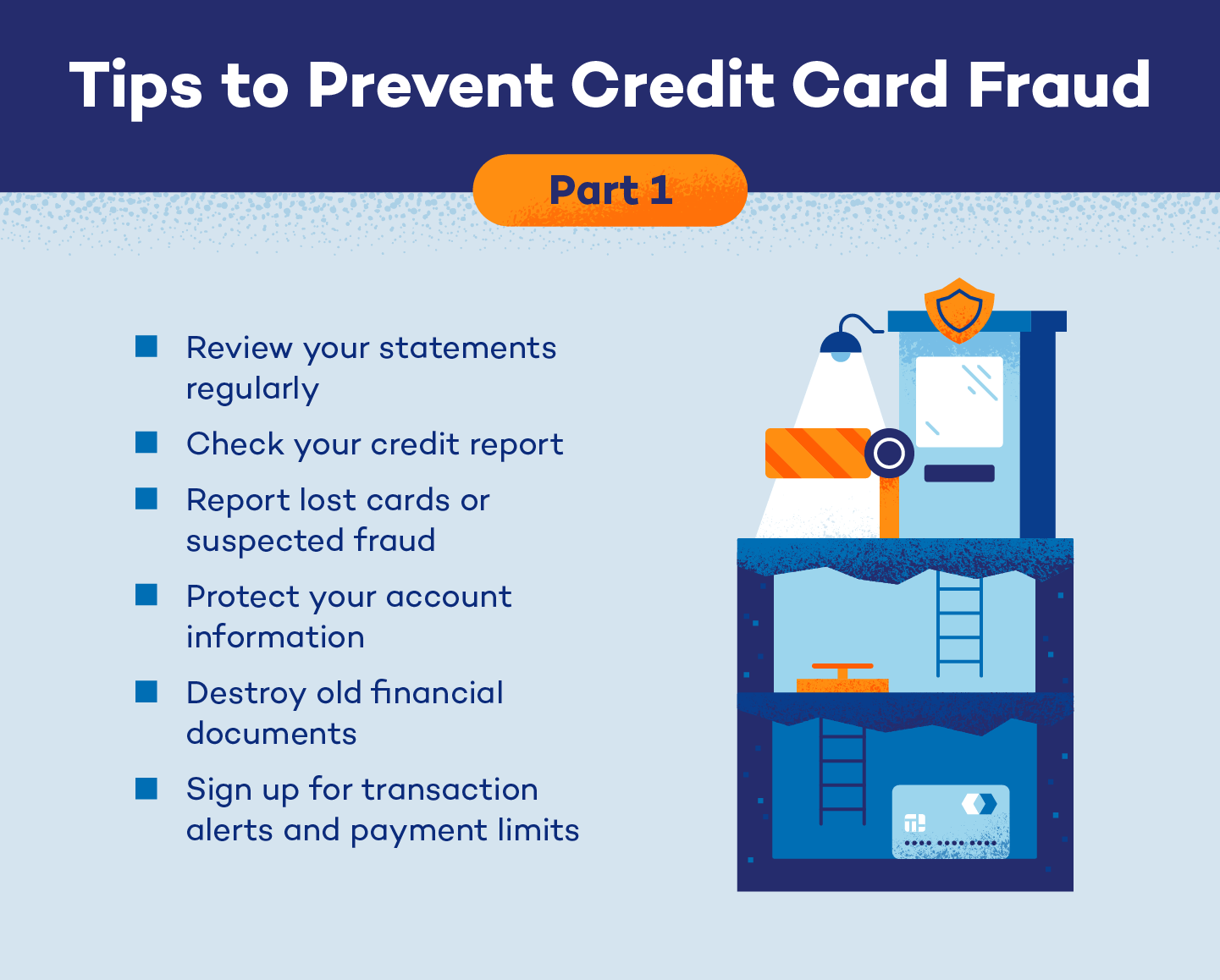

Actionable Tips To Enhance Your Credit Card Security

Credit card fraud can cause significant financial harm. Protecting your credit card information is crucial. Implement these actionable tips to enhance your credit card security and safeguard your finances.

Regularly Monitor Your Statements

Check your credit card statements frequently. Look for any suspicious transactions. If you find any, report them to your bank immediately. Regular monitoring helps you catch fraud early.

Set Up Strong Passwords And Pins

Use strong, unique passwords and PINs for your accounts. Avoid using easily guessed information like birthdays. A strong password includes letters, numbers, and special characters. Change your passwords regularly to enhance security.

Be Aware Of Phishing Scams

Phishing scams trick you into giving away your credit card details. Be cautious of emails or messages asking for personal information. Always verify the source before clicking on any links. Legitimate organizations will never ask for sensitive information via email.

Use Virtual Credit Card Numbers

Many banks offer virtual credit card numbers. These are temporary numbers linked to your main account. Use them for online purchases to reduce the risk of fraud. If a virtual number gets compromised, your main credit card remains safe.

Conclusion: Staying Vigilant And Proactive

Credit card fraud is a serious issue that affects millions of people. Protecting yourself requires constant vigilance and proactive measures. By staying informed and alert, you can significantly reduce the risk of becoming a victim.

Summary Of Key Takeaways

- Monitor your credit card statements regularly for unauthorized transactions.

- Use strong, unique passwords for online accounts linked to your credit cards.

- Enable two-factor authentication where possible.

- Be cautious about sharing your credit card information online.

- Report any suspicious activity to your bank immediately.

Encouragement To Stay Informed And Alert

Staying informed about the latest fraud tactics can help you stay one step ahead. Subscribe to newsletters from trusted financial institutions and read about common fraud schemes. Attend webinars or workshops on financial security.

Always be alert. If something seems off, trust your instincts and verify. Educate yourself and others about the importance of credit card security. Encourage friends and family to take similar precautions.

Frequently Asked Questions

What Is Credit Card Fraud Protection?

Credit card fraud protection involves measures to prevent unauthorized use of your credit card. This includes monitoring transactions, alerting you of suspicious activity, and offering zero-liability policies.

How Can I Protect My Credit Card Online?

To protect your credit card online, use strong passwords, enable two-factor authentication, and avoid sharing card details on untrusted websites.

What Should I Do If My Card Is Stolen?

If your card is stolen, immediately report it to your card issuer. They will block the card and issue a replacement.

Are Credit Card Fraud Alerts Effective?

Yes, fraud alerts are effective. They notify you of suspicious activities, allowing you to quickly take action to prevent further fraud.

Conclusion

Protecting yourself from credit card fraud is crucial. Stay vigilant and proactive. Regularly monitor your accounts for unusual activity. Use strong, unique passwords for online banking. Report any suspicious transactions immediately. Consider using services like Firstbase for added security. They offer comprehensive solutions for businesses. Following these steps helps safeguard your financial information. Stay informed and stay protected.