Credit Card Fraud Prevention: Essential Tips to Stay Safe

Credit card fraud is a growing concern in today’s digital age. Protecting your financial information has never been more crucial.

Credit card fraud prevention is essential to safeguard your hard-earned money and maintain financial security. Whether you are making online purchases or using your card at local stores, understanding how to protect yourself from fraudsters can save you from potential financial loss and stress. With the right tools and knowledge, you can significantly reduce the risk of becoming a victim of credit card fraud. One such tool is EverSafe®, designed to offer comprehensive protection and peace of mind. It monitors your financial activities and alerts you of any suspicious behavior, ensuring your savings remain secure. Learn more about EverSafe® here.

Introduction To Credit Card Fraud Prevention

Credit card fraud affects millions each year. Protecting your financial information is crucial. Learn the basics of credit card fraud prevention and why it matters.

Understanding Credit Card Fraud

Credit card fraud involves unauthorized use of a credit card to obtain goods, services, or money. Common types include:

- Card-not-present fraud: Occurs during online or phone transactions.

- Skimming: Scammers steal card information using a device.

- Phishing: Fraudulent emails or messages trick you into sharing your card details.

- Account takeover: Criminals gain access to your account and make unauthorized transactions.

The Importance Of Fraud Prevention

Preventing fraud saves money and protects your credit score. It also reduces stress and provides peace of mind. EverSafe® offers a comprehensive solution to safeguard your finances.

With features like Smart Alerts, Comprehensive Monitoring, and 24/7 Support, EverSafe® helps detect and prevent suspicious activities. Their personalized alerts and trusted advocate feature ensure your family’s financial well-being.

EverSafe®’s specialized protection for seniors and the consolidated family dashboard make it easier to monitor and secure financial activities across multiple accounts.

For more information, visit EverSafe.

Key Features Of Effective Fraud Prevention Strategies

Effective fraud prevention strategies are essential to safeguard your credit and finances. These strategies incorporate multiple layers of protection to detect and prevent fraudulent activities. Below are some key features that make fraud prevention strategies robust and reliable.

Advanced Security Measures

Advanced security measures are crucial in combating credit card fraud. These measures may include:

- Multi-Factor Authentication (MFA): Requiring multiple forms of verification before granting access.

- Biometric Verification: Using fingerprints, facial recognition, or voice recognition to confirm identity.

- Behavioral Analytics: Monitoring user behaviors to detect anomalies and potential fraud.

EverSafe® employs enhanced algorithms and proprietary technology to offer specialized protection, especially for seniors, making it a reliable solution for preventing fraud.

Real-time Monitoring And Alerts

Real-time monitoring and alerts are fundamental to effective fraud prevention. This feature ensures:

- Immediate Detection: Identifies suspicious activities as they occur.

- Instant Alerts: Notifies users of potential fraud via email, text, phone, or app.

- Historical Analysis: Compares current activity against historical behavior to spot irregularities.

With EverSafe®, users benefit from smart alerts that notify them of changes in spending, dormant credit card use, and more, providing peace of mind and comprehensive protection.

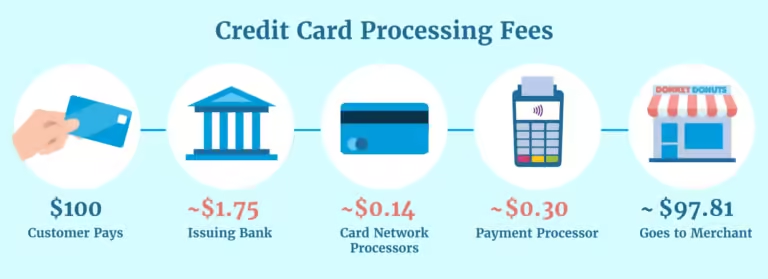

Encryption And Tokenization

Encryption and tokenization are critical components in securing sensitive information:

- Encryption: Converts data into a secure format that is unreadable without a decryption key.

- Tokenization: Replaces sensitive data with unique identification symbols (tokens) that retain essential information without compromising security.

These technologies protect data during transmission and storage, ensuring that even if data is intercepted, it remains secure. EverSafe® ensures user data is encrypted and safeguarded, enhancing overall security.

Adopting these key features in fraud prevention strategies can significantly reduce the risk of credit card fraud and provide robust protection for your finances.

Essential Tips To Stay Safe From Credit Card Fraud

Credit card fraud can be a major concern. Taking preventive measures can help protect your finances. Below are some essential tips to safeguard yourself against credit card fraud.

Regularly Monitor Your Account Statements

Check your credit card statements frequently. This helps you spot unauthorized charges early. If you notice anything unusual, report it immediately.

Using tools like EverSafe® can assist in this process. EverSafe® provides smart alerts for suspicious activities, ensuring you stay informed.

Use Secure Payment Methods

Always use secure payment methods. Online payments should be made through websites with HTTPS encryption. Avoid using public Wi-Fi for transactions. It’s less secure and can expose your information.

EverSafe® offers comprehensive monitoring across multiple accounts. This includes tracking banking, credit card, and investment activities. This adds an extra layer of security to your payments.

Beware Of Phishing Scams

Phishing scams are common tactics used by fraudsters. They often use emails, texts, or calls to trick you into giving personal information.

Never click on suspicious links or provide your credit card details. Verify the source before sharing any information. EverSafe® can help by providing alerts for suspicious vendors and activities.

Keep Your Credit Card Information Private

Always keep your credit card information private. Do not share your card details over the phone or email. Use secure methods to store your information.

Utilize EverSafe®’s trusted advocate feature. This allows you to designate trusted individuals to help monitor your accounts. It adds an additional layer of oversight and security.

| Feature | Benefit |

|---|---|

| Smart Alerts | Notifies of suspicious activities |

| Comprehensive Monitoring | Tracks activities across all accounts |

| 24/7 Support | Access to fraud remediation experts |

| Detection and Alert System | Identifies anomalies and delivers alerts |

| Trusted Advocate Feature | Allows trusted individuals to assist in monitoring |

Pricing And Affordability Of Fraud Prevention Tools

Choosing the right fraud prevention tool involves understanding its costs. Pricing varies depending on the features and services offered. Here, we will explore the affordability and value of different fraud prevention tools.

Subscription-based Services

Many fraud prevention tools, like EverSafe®, offer subscription-based services. These services provide ongoing protection and support. Users can benefit from continuous monitoring, smart alerts, and expert assistance.

| Service | Monthly Cost | Main Features |

|---|---|---|

| EverSafe® | $ | Comprehensive monitoring, smart alerts, 24/7 support |

Subscription-based models ensure that users receive regular updates and support. This is crucial for staying ahead of new fraud tactics.

Free Vs. Paid Solutions

There are both free and paid fraud prevention tools available. Free solutions can offer basic protection. But they may lack advanced features.

- Free Solutions: Limited monitoring, basic alerts.

- Paid Solutions: Comprehensive monitoring, personalized alerts, expert support.

EverSafe® offers a 30-day free trial. This allows users to experience the service at no cost. After the trial, users can decide if the paid service meets their needs.

Cost-benefit Analysis

Investing in a paid fraud prevention tool can be cost-effective. Consider the potential losses from fraud. The benefits of comprehensive monitoring and support can outweigh the monthly fees.

| Feature | Free Solutions | Paid Solutions |

|---|---|---|

| Monitoring | Basic | Comprehensive |

| Alerts | Standard | Personalized |

| Support | Limited | 24/7 Expert Support |

EverSafe® provides a range of features. These include smart alerts, comprehensive monitoring, and expert support. These features help prevent fraud and protect your finances.

Pros And Cons Of Popular Fraud Prevention Tools

Fraud prevention tools are essential for safeguarding finances and identity. They offer various benefits, but they also come with limitations. Understanding these aspects helps in selecting the best tool for your needs.

Benefits Of Using Fraud Prevention Tools

Using fraud prevention tools like EverSafe® offers several advantages:

- Prevents Fraud and Identity Theft: Tools like EverSafe® identify and stop exploiters, keeping your savings secure.

- Peace of Mind: Reliable systems monitor finances and detect suspicious activities, reducing stress.

- Comprehensive Family Protection: EverSafe® ensures all family members’ finances are monitored in one place, making it easier to manage.

- Expert Support: Access to specialized support for fraud remediation and financial recovery is available 24/7.

- Smart Alerts: Notifications for changes in spending, cash usage, and other anomalies help in quick detection of fraud.

- Consolidated Family Dashboard: Centralizes family finances across all accounts and institutions.

Potential Drawbacks And Limitations

While fraud prevention tools are beneficial, they have some limitations:

- Initial Cost: Even with a free trial, the cost of ongoing service might be a concern for some users.

- Complexity: Some users may find setting up and managing these tools challenging without proper guidance.

- Dependence on Technology: A strong internet connection and familiarity with digital tools are necessary.

- False Positives: Alerts for non-fraudulent activities can be frequent, causing unnecessary worry.

- Privacy Concerns: Sharing financial data with a third party might be a concern for some users.

Considering both the benefits and drawbacks helps in making an informed decision about using fraud prevention tools like EverSafe®.

Specific Recommendations For Ideal Users And Scenarios

Ideal users of credit card fraud prevention tools include online shoppers and frequent travelers. Scenarios such as online transactions and international purchases benefit from these tools’ protection.

Credit card fraud prevention is crucial for everyone, but the approach may vary based on individual needs. Below are specific recommendations for different user scenarios.Best Practices For Online Shoppers

Online shoppers are prime targets for fraudsters. Follow these best practices to ensure safety:- Use a secure internet connection. Avoid public Wi-Fi when shopping online.

- Shop only on trusted websites. Look for HTTPS and secure payment gateways.

- Enable two-factor authentication on all your accounts.

- Regularly monitor your transactions for any unauthorized activity.

- Consider using a virtual credit card for added protection.

Tips For Frequent Travelers

Frequent travelers are often vulnerable to credit card fraud. Here are some essential tips:- Notify your bank about your travel plans to avoid transaction blocks.

- Use RFID-blocking wallets to protect your card information.

- Keep your cards in a safe place and carry only what you need.

- Check your credit card statements frequently for suspicious activities.

- Utilize EverSafe’s Smart Alerts to stay informed of any unusual spending.

Advice For Business Owners

Business owners must be vigilant to prevent fraud. Here are some key strategies:| Action | Description |

|---|---|

| Implement Strong Security Protocols | Use encryption and secure payment systems. |

| Monitor Business Accounts | Regularly check for unauthorized transactions. |

| Train Employees | Educate staff on recognizing and preventing fraud. |

| Use EverSafe | Leverage EverSafe’s tools to manage and resolve fraud issues. |

Conclusion And Final Thoughts On Credit Card Fraud Prevention

Credit card fraud is a growing concern in today’s digital world. Protecting your finances is crucial. By following essential tips and recommendations, you can safeguard your credit cards and personal information. Utilizing tools like EverSafe® can further enhance your security.

Summary Of Essential Tips

- Monitor Your Accounts Regularly: Check your statements frequently for any unauthorized transactions.

- Use Strong Passwords: Create unique passwords for all your financial accounts.

- Enable Alerts: Set up alerts for any unusual activity on your credit cards.

- Secure Your Devices: Use antivirus software and avoid using public Wi-Fi for financial transactions.

- Report Suspicious Activity: Contact your bank immediately if you notice any irregularities.

Final Recommendations

For comprehensive protection, consider using EverSafe®. This financial wellness tool offers:

| Feature | Benefit |

|---|---|

| Smart Alerts | Receive notifications for any suspicious activity. |

| Comprehensive Monitoring | Track all your financial accounts in one place. |

| 24/7 Support | Access to fraud remediation experts anytime. |

| Trusted Advocate Feature | Designate trusted individuals to help monitor your accounts. |

EverSafe® provides peace of mind by continuously monitoring your finances and detecting suspicious activities. It is especially beneficial for seniors and caregivers, offering specialized protection and support. Take advantage of their 30-day free trial to experience the service risk-free.

Protecting your credit cards and personal information is essential. Follow these tips and consider using EverSafe® to ensure your financial security.

Frequently Asked Questions

What Is Credit Card Fraud?

Credit card fraud is the unauthorized use of a credit card. It involves stealing card information to make purchases or withdraw funds.

How Can I Prevent Credit Card Fraud?

You can prevent credit card fraud by monitoring your accounts regularly. Use secure passwords and avoid sharing card details online.

What Are Common Signs Of Credit Card Fraud?

Common signs include unfamiliar transactions on your statement. Receiving alerts for purchases you didn’t make is another sign.

How Do Fraudsters Steal Credit Card Information?

Fraudsters use methods like phishing, skimming devices, and hacking. They may also use social engineering tactics.

Conclusion

Protecting your credit card from fraud is crucial. Stay vigilant and proactive. Use tools like EverSafe® to enhance your financial security. EverSafe® offers smart alerts, comprehensive monitoring, and 24/7 support. This ensures peace of mind for you and your loved ones. Try EverSafe® with a 30-day free trial. Safeguard your finances today and prevent identity theft effortlessly.