Credit Card For Beginners: Your Ultimate Guide to Getting Started

Getting your first credit card can be both exciting and daunting. It’s a big step in managing your finances and building your credit score.

For beginners, understanding credit cards is crucial. They offer a convenient way to make purchases and can help build your credit history. But, without proper knowledge, they can lead to debt and financial trouble. This blog post aims to guide you through the basics of credit cards, ensuring you make informed decisions. If you’re looking for an easy way to build credit without a traditional credit card, consider the Cheese Credit Builder Account. It helps improve your credit score by making regular payments, and reports to all three major credit bureaus. Learn more about it here. Ready to dive in? Let’s explore credit cards for beginners.

Credit: www.tiktok.com

Introduction To Credit Cards For Beginners

Starting your journey with credit cards can be both exciting and overwhelming. This guide will help you understand the basics, benefits, and essential tips to manage credit cards effectively.

Understanding Credit Cards

A credit card is a financial tool that allows you to borrow money up to a certain limit. You use it to make purchases and pay back the borrowed amount later. The borrowed amount is subject to interest if not paid in full by the due date.

Here are some key terms to understand:

- Credit Limit: The maximum amount you can borrow.

- Interest Rate (APR): The cost of borrowing money, expressed as a yearly percentage.

- Minimum Payment: The smallest amount you must pay each month.

- Credit Score: A number that represents your creditworthiness.

Why Beginners Should Consider Getting A Credit Card

For beginners, credit cards offer several benefits:

- Build Credit History: Using a credit card responsibly helps build your credit score.

- Convenience: Credit cards are widely accepted and can be used for online and in-store purchases.

- Rewards: Many credit cards offer rewards such as cashback, points, or miles.

- Emergency Fund: A credit card can act as a backup for unexpected expenses.

| Feature | Benefit |

|---|---|

| Build Credit History | Improves your credit score for future financial needs. |

| Convenience | Easy to use for various types of purchases. |

| Rewards | Earn cashback, points, or travel miles. |

| Emergency Fund | Provides financial support in emergencies. |

If you are not ready for a credit card, consider using tools like the Cheese Credit Builder Account. This account helps you build your credit score without requiring a credit card.

Cheese Credit Builder features include:

- Reports to all three major credit bureaus.

- No admin or membership fees.

- No credit check required.

- Deposits are secured and refunded at the end of the term.

For more information, visit Cheese Credit Builder.

Key Features Of Credit Cards

Credit cards come with various features that can benefit beginners. Understanding these key features is essential to using credit cards wisely and effectively.

Credit Limit And How It’s Determined

The credit limit is the maximum amount you can charge on your credit card. It’s determined by several factors:

- Your credit score

- Your income

- Your credit history

Credit card issuers review these details to decide your creditworthiness. They want to ensure you can repay what you borrow.

Interest Rates And How They Work

The interest rate on a credit card is the cost of borrowing money. It’s expressed as an annual percentage rate (APR). If you carry a balance from month to month, you’ll be charged interest:

- Interest is calculated daily.

- Higher balances lead to higher interest charges.

- Paying the full balance each month avoids interest.

Understanding interest rates helps in managing costs and avoiding debt.

Rewards Programs And Benefits

Many credit cards offer rewards programs to benefit users. These can include:

| Type of Reward | Description |

|---|---|

| Cashback | Earn a percentage of your spending back as cash. |

| Points | Accumulate points to redeem for travel, merchandise, or gift cards. |

| Miles | Earn miles that can be used for flights and travel expenses. |

Rewards programs incentivize spending but should be used wisely to avoid debt.

Security Features Of Credit Cards

Credit cards include numerous security features to protect users:

- EMV Chips: Reduce fraud by adding a layer of security.

- Fraud Alerts: Notify you of suspicious activity.

- Zero Liability: Protects you from unauthorized charges.

These features ensure safe and secure transactions, giving peace of mind when making purchases.

For those looking to build credit without a traditional credit card, consider the Cheese Credit Builder Account. It offers an easy way to improve your credit score by making regular payments and doesn’t require a credit card.

Choosing The Right Credit Card

Choosing the right credit card can be a daunting task for beginners. With so many options available, it’s important to understand the different types of credit cards and what factors to consider before making a decision. This guide will help you navigate the process and find the best credit card that suits your needs.

Types Of Credit Cards Available

There are several types of credit cards available in the market. Each type serves different purposes and offers unique benefits. Here are the main types:

- Rewards Credit Cards: These cards offer points, miles, or cash back for every dollar spent.

- Low-Interest Credit Cards: These cards come with lower APRs, making them ideal for carrying balances.

- Balance Transfer Credit Cards: These cards allow you to transfer existing debt to a card with a lower interest rate.

- Secured Credit Cards: These cards require a security deposit and are ideal for those building or rebuilding credit.

- Student Credit Cards: Designed for students with limited or no credit history, often with lower credit limits.

Factors To Consider When Choosing A Credit Card

When selecting a credit card, several factors need to be considered to ensure you choose the right one for your needs:

- Interest Rates (APR): Look for cards with low APRs to save on interest payments.

- Annual Fees: Some cards charge annual fees. Determine if the benefits outweigh the cost.

- Rewards and Benefits: Consider what rewards and benefits you will use the most.

- Credit Limit: Ensure the card offers a suitable credit limit for your spending habits.

- Introductory Offers: Look for cards with introductory 0% APR on purchases or balance transfers.

How To Compare Different Credit Card Offers

Comparing credit card offers can help you find the best deal. Here’s a step-by-step guide:

- Identify Your Needs: Determine what you need most from a credit card, such as low interest rates, rewards, or balance transfer options.

- Research Available Options: Use comparison websites or visit bank websites to explore different offers.

- Compare Key Features: Create a table to compare interest rates, annual fees, rewards, and other important features.

- Read the Fine Print: Carefully read the terms and conditions to understand fees and penalties.

- Check Customer Reviews: Look for reviews from other users to gauge the card’s reliability and customer service.

| Credit Card | APR | Annual Fee | Rewards | Introductory Offer |

|---|---|---|---|---|

| Card A | 15% | $0 | 1.5% cash back | 0% APR for 12 months |

| Card B | 18% | $95 | 2x points on travel | 50,000 bonus points |

By carefully considering these factors and comparing different offers, you can find the best credit card to match your financial goals and needs.

Credit: www.brightmoney.co

Applying For Your First Credit Card

Applying for your first credit card is an exciting milestone. It opens the door to building your credit history. This guide will help you understand the process and get you started on the right foot.

Eligibility Requirements

Before you apply, check if you meet the basic eligibility requirements:

- Age: You must be at least 18 years old.

- Income: You need a steady income source.

- Credit Score: Some cards require a minimum score, but Cheese Credit Builder does not.

Documents Needed For Application

Gather these documents for a smooth application process:

- Proof of Identity: Passport, driver’s license, or state ID.

- Proof of Address: Utility bill, lease agreement, or bank statement.

- Proof of Income: Pay stubs, tax returns, or bank statements.

Step-by-step Application Process

Follow these steps to apply for your first credit card:

- Research: Find a card that suits your needs. The Cheese Credit Builder is a great option for beginners.

- Check Eligibility: Ensure you meet the card’s requirements.

- Gather Documents: Collect the necessary documents listed above.

- Fill Out Application: Complete the application form with accurate information.

- Submit Application: Submit your application online or in-person.

- Wait for Approval: The approval process can take a few days.

By following these steps, you can successfully apply for your first credit card. The Cheese Credit Builder offers a simple and effective way to start building your credit.

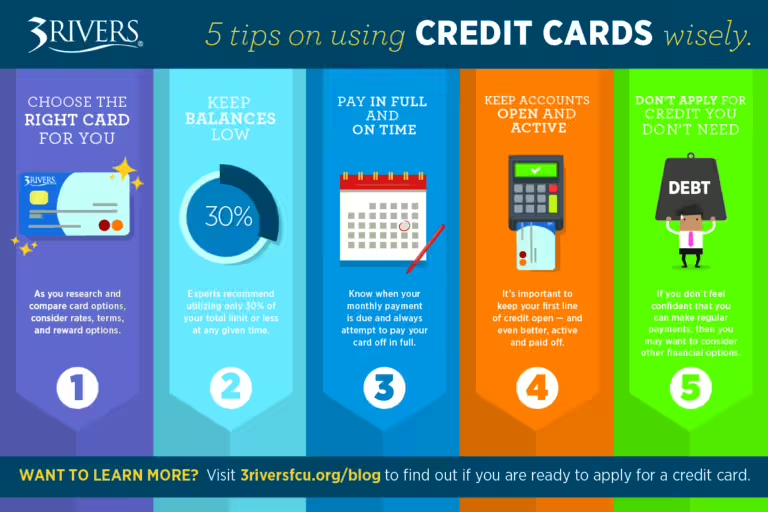

Using Your Credit Card Wisely

Getting a credit card for the first time can be both exciting and overwhelming. It opens up new financial opportunities, but it’s important to use it wisely to avoid falling into debt. Below are some tips to help you manage your credit card responsibly and build a good credit history.

Tips For Responsible Credit Card Usage

Using a credit card responsibly is crucial for maintaining financial health. Here are some practical tips:

- Pay your balance in full: Always aim to pay off your credit card balance each month to avoid interest charges.

- Set up autopay: Enabling autopay ensures you never miss a payment, which can harm your credit score.

- Monitor your spending: Keep track of your expenses and stick to a budget to avoid overspending.

- Check statements regularly: Review your credit card statements to spot any errors or fraudulent charges.

How To Build A Good Credit History

Building a good credit history is essential for future financial opportunities such as loans and mortgages. Follow these steps to establish a solid credit history:

- Start with a secured credit card: If you’re new to credit, consider using a secured card to build your credit history.

- Make regular payments: Consistently pay your bills on time to demonstrate reliability to lenders.

- Keep credit utilization low: Aim to use no more than 30% of your credit limit to maintain a healthy credit score.

- Maintain a long credit history: Keep older accounts open to show a lengthy credit history.

Common Mistakes To Avoid

To ensure you use your credit card wisely, avoid these common pitfalls:

- Maxing out your credit card: High credit utilization can negatively impact your credit score.

- Making only minimum payments: This can lead to accruing high-interest debt over time.

- Applying for multiple cards: Too many credit applications in a short period can lower your credit score.

- Ignoring due dates: Late payments can result in fees and a decrease in your credit score.

For those looking to build their credit without a traditional credit card, consider the Cheese Credit Builder Account. It helps users improve their credit score by making regular payments, with no credit check required. This account is free from hidden fees and reports to all three major credit bureaus. It’s an excellent option for beginners who want to build credit responsibly and securely.

Managing Credit Card Debt

Managing credit card debt is crucial for beginners. It ensures financial stability and improves credit scores. Let’s explore essential strategies and tips for handling credit card debt effectively.

Understanding Minimum Payments

Minimum payments are the smallest amounts you can pay each month to keep your account in good standing. While paying the minimum helps you avoid late fees, it does not reduce your debt significantly. The remaining balance accrues interest, increasing your overall debt. Always aim to pay more than the minimum to reduce your debt faster.

| Payment Type | Impact |

|---|---|

| Minimum Payment | Prevents late fees, high interest accrual |

| More Than Minimum | Reduces debt faster, lowers interest |

Strategies For Paying Off Credit Card Debt

Several strategies can help you pay off credit card debt efficiently. Here are some effective methods:

- Snowball Method: Pay off the smallest debt first. Then, move to larger ones. This builds momentum and motivation.

- Avalanche Method: Focus on the debt with the highest interest rate first. It reduces the total interest paid over time.

- Balance Transfer: Transfer balances to a card with a lower interest rate. This can save money on interest.

- Consolidation Loan: Combine multiple debts into one loan with a lower interest rate.

How To Avoid Accumulating Debt

Preventing debt accumulation is as important as paying off existing debt. Here are some tips to help you avoid accumulating debt:

- Create a Budget: Track your income and expenses. Allocate funds for necessities and avoid overspending.

- Use Autopay: Set up automatic payments for your credit card bills. This ensures timely payments and avoids late fees.

- Limit Credit Card Usage: Use credit cards for essential purchases only. Avoid impulse buying.

- Build an Emergency Fund: Save money for unexpected expenses. This reduces reliance on credit cards during emergencies.

- Monitor Your Credit: Regularly check your credit reports. Identify and address any discrepancies immediately.

Consider using the Cheese Credit Builder to improve your credit score. It’s a simple way to build credit without a credit card. Make regular payments and track your progress with ease.

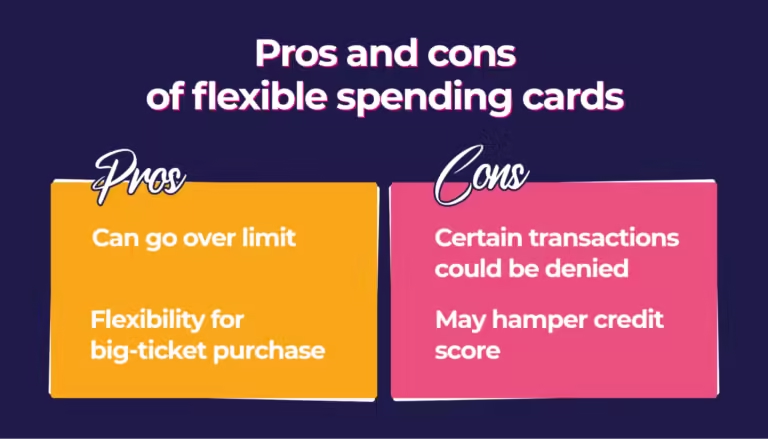

Pros And Cons Of Having A Credit Card

Credit cards can be a powerful tool for financial management. They offer numerous benefits but also come with potential risks. Understanding these pros and cons is essential, especially for beginners in personal finance.

Advantages Of Using A Credit Card

Credit cards provide several advantages that can make managing your finances easier and more rewarding:

- Convenience: Credit cards are widely accepted, allowing you to make purchases easily.

- Build Credit: Responsible use of a credit card helps build your credit score over time.

- Rewards and Cash Back: Many credit cards offer rewards, points, or cash back on purchases.

- Fraud Protection: Credit cards offer better protection against fraud compared to debit cards.

- Emergency Funds: Access to credit can be helpful during emergencies when you don’t have cash.

Potential Drawbacks And Risks

While credit cards offer many benefits, they also come with some potential drawbacks and risks:

- High Interest Rates: Carrying a balance can result in high interest charges.

- Debt Accumulation: It’s easy to overspend and accumulate debt if not careful.

- Fees: Some credit cards have annual fees, late payment fees, and other charges.

- Impact on Credit Score: Missed payments or high balances can negatively impact your credit score.

- Temptation to Overspend: The ease of use can lead to unnecessary purchases and financial strain.

For beginners, it’s crucial to weigh these pros and cons carefully. Consider products like the Cheese Credit Builder Account which offers a way to build credit without the risks associated with traditional credit cards. Learn more at Cheese Credit Builder.

Credit: www.youtube.com

Specific Recommendations For Ideal Users

Choosing the right credit card can be daunting, especially for beginners. Here are some specific recommendations tailored to different groups of ideal users.

Best Credit Cards For Students

Students often need a credit card for daily expenses and to build credit. Here are some options:

| Card Name | Annual Fee | Rewards |

|---|---|---|

| Discover it® Student Cash Back | $0 | 5% cash back on rotating categories |

| Journey® Student Rewards from Capital One® | $0 | 1% cash back on all purchases |

Credit Cards Suitable For Young Professionals

Young professionals may seek cards that offer rewards and benefits. Some recommendations include:

- Chase Sapphire Preferred® Card – $95 annual fee, 2x points on travel and dining.

- American Express® Gold Card – $250 annual fee, 4x points at restaurants.

Options For Those With No Credit History

For individuals with no credit history, starting with a secured card or a credit builder account is wise. Consider these options:

- Cheese Credit Builder Account – No credit check, reports to all three major credit bureaus. Learn more.

- Discover it® Secured Credit Card – $0 annual fee, 2% cash back at gas stations and restaurants.

Frequently Asked Questions

What Is A Credit Card For Beginners?

A credit card for beginners is designed for those new to credit. It typically has lower limits and fewer perks.

How To Choose A Beginner Credit Card?

Choose a beginner credit card with no annual fee, low interest rates, and rewards. Consider your spending habits.

Can Beginners Get Approved For Credit Cards?

Yes, beginners can get approved. Look for cards with easier approval processes, like student or secured cards.

What Are The Benefits Of A Beginner Credit Card?

Benefits include building credit history, learning financial responsibility, and earning rewards. They also offer fraud protection.

Conclusion

Starting with a credit card can be a smart financial move. Be mindful of your spending and pay your bills on time. If you’re looking for an alternative to traditional credit cards, consider the Cheese Credit Builder Account. It helps improve your credit score without a credit card. Plus, there are no hidden fees or credit checks. For more information, visit Cheese Credit Builder. Building credit has never been easier. Take control of your financial future today.