Credit Card Features: Unlock the Best Benefits and Perks

Credit cards have become an essential part of our financial lives. They offer convenience, security, and rewards that can make managing money easier.

Understanding the various features of credit cards can help you make informed decisions and maximize their benefits. From cash back and travel rewards to fraud protection and spending tracking, credit cards come with a range of features designed to cater to different needs and preferences. Whether you are a frequent traveler, a savvy shopper, or a business owner, knowing what features to look for can help you choose the right card. In this blog post, we will explore some of the most important credit card features that can enhance your financial management and provide added value. Interested in a comprehensive financial solution? Check out Wallester’s business expense cards and white-label card issuing services. They offer efficient corporate spending management and customizable branded card programs.

Introduction To Credit Card Features And Benefits

Credit cards offer a convenient way to manage your finances. Understanding their features and benefits can help you make the most of your card. Let’s explore the essentials.

Understanding Credit Cards

Credit cards are financial tools that allow you to borrow money for purchases. They come with various features designed to make your financial life easier. You can use them for daily expenses or larger purchases.

Each credit card has unique features. These features depend on the card issuer and the type of card you choose. Knowing these features helps you select the right card for your needs.

Purpose Of Credit Card Features

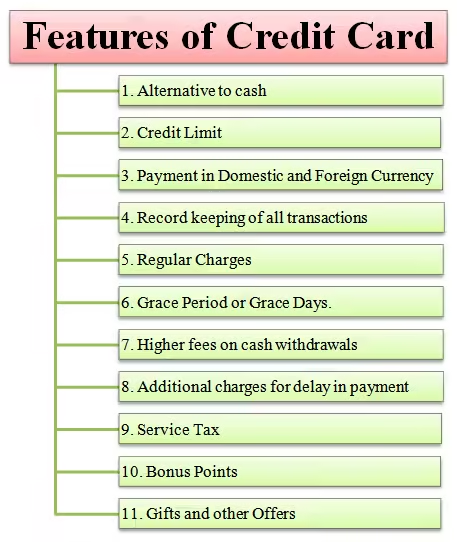

Credit card features serve several purposes. They provide convenience, security, and rewards. Let’s break down the main features:

- Convenience: Use your card for purchases anywhere, anytime.

- Security: Credit cards offer protection against fraud and theft.

- Rewards: Earn points, cash back, or miles with each purchase.

Credit card features also include tools for managing your spending. These tools help you track expenses and set budgets. Some cards offer real-time tracking and instant issuance for added convenience.

| Feature | Description |

|---|---|

| Virtual Cards | 300 free virtual cards with no hidden fees. |

| Instant Issuance | Get your card instantly with real-time tracking. |

| Fraud Monitoring | Continuous monitoring to protect against fraud. |

Using a credit card with these features can make managing your finances easier and more secure. Select a card that matches your lifestyle and financial goals.

:max_bytes(150000):strip_icc()/creditcard.asp-b8ba018266f64ff49216d2b919d8e280.jpg)

Key Features Of Credit Cards

Credit cards offer various features that enhance the financial experience. These features can vary significantly based on the card issuer and the specific card type. Understanding these key features can help you choose the right card that aligns with your financial goals and lifestyle.

Many credit cards come with rewards programs that allow you to earn points or miles on your purchases. These points can be redeemed for various rewards such as gift cards, merchandise, travel, or even cashback. Some cards offer higher points on specific categories like dining, groceries, or fuel, making them suitable for different spending habits.

Credit cards with cashback offers provide a percentage of your purchase amount back to you. This feature is particularly beneficial for those who prefer direct savings over accumulating points. Cashback rates can vary, with some cards offering higher rates for specific categories or during promotional periods.

Frequent travelers can benefit significantly from credit cards that offer travel perks. These perks may include airline miles, free checked bags, priority boarding, access to airport lounges, and travel insurance. Some cards also provide exclusive discounts on hotel bookings and car rentals, enhancing your travel experience.

Many credit cards offer introductory APR offers with 0% interest for a limited period on purchases or balance transfers. This feature can help you save on interest if you plan to make a large purchase or transfer high-interest debt to the new card. Be sure to understand the terms and duration of the introductory period.

Balance transfer options allow you to transfer existing credit card debt to a new card, often with a lower or 0% introductory APR. This feature can help you manage your debt more effectively and reduce the interest you pay over time. Keep an eye on any fees associated with balance transfers and ensure you have a plan to pay off the debt within the promotional period.

Rewards Programs

Credit cards often offer rewards programs that provide benefits to cardholders. Rewards programs can vary greatly, offering points, cashback, travel miles, and more. Understanding these programs can help you choose the best credit card for your needs.

Types Of Rewards

Credit card rewards come in various forms. Here are the most common types:

- Points: Earn points for every purchase, which can be redeemed for merchandise, gift cards, or travel.

- Cashback: Receive a percentage of your spending back as cash, either as a statement credit or direct deposit.

- Travel Miles: Accumulate miles that can be used for flights, hotel stays, and other travel-related expenses.

How Rewards Benefit Cardholders

Rewards programs provide numerous benefits:

- Cost Savings: Cashback and points can reduce your overall spending.

- Travel Perks: Travel miles can make vacations more affordable.

- Special Offers: Some programs offer exclusive discounts and promotions.

For example, Wallester credit cards offer various benefits such as no hidden fees and 3D Secure protection. These features enhance the value of their rewards programs.

Maximizing Your Rewards

To get the most out of your rewards programs, follow these tips:

- Choose the Right Card: Select a card that matches your spending habits and preferences.

- Understand the Terms: Read the terms and conditions to know how to earn and redeem rewards.

- Use Your Card Regularly: Consistent use helps accumulate rewards faster.

- Take Advantage of Bonuses: Look for sign-up bonuses and special promotions to boost your rewards.

Wallester’s business expense cards and white-label card issuing services provide additional features, such as real-time tracking and instant issuance, making it easier to manage and maximize your rewards.

Cashback Offers

Credit cards with cashback offers provide a great way to earn money back on your purchases. These cards reward you with a percentage of your spending, returned as cash, making everyday spending more rewarding. Let’s explore how cashback works, best practices for earning cashback, and the top cashback cards available.

How Cashback Works

When you use a credit card with cashback, you earn a small percentage of each purchase back as cash. For example, if your card offers 2% cashback, you’ll get $2 back for every $100 you spend. This cashback can usually be redeemed as a statement credit, direct deposit, or gift card.

Different cards offer varying cashback rates. Some cards provide flat-rate cashback on all purchases, while others offer higher rates in specific categories like groceries, dining, or gas. Understanding the terms of your card is crucial for maximizing your rewards.

Best Practices For Earning Cashback

- Know Your Categories: Use cards that offer higher cashback rates in categories where you spend the most.

- Pay Off Your Balance: Avoid interest charges by paying your balance in full each month.

- Take Advantage of Bonuses: Look for sign-up bonuses and special promotions to boost your cashback earnings.

- Monitor Your Spending: Use your card regularly but responsibly to maximize rewards without overspending.

Top Cashback Cards

Here are some top cashback cards that offer excellent rewards:

| Card Name | Cashback Rate | Key Features |

|---|---|---|

| Wallester Business Expense Card | Varies |

|

| Card B | 1.5% flat rate |

|

| Card C | 5% on categories |

|

Choosing the right cashback card can significantly benefit your finances. The Wallester Business Expense Card, for example, offers multiple features like no hidden fees and easy spending management, making it a great option for businesses. Evaluate different cards to find one that matches your spending habits and financial goals.

Travel Perks

Credit cards offer an array of travel perks that can enhance your travel experience. From travel insurance to airport lounge access, these features provide convenience and security. Explore the benefits and make your trips more enjoyable and worry-free.

Travel Insurance

Many credit cards include travel insurance as a complimentary benefit. This can cover trip cancellations, lost luggage, and medical emergencies. With travel insurance, you can travel with peace of mind, knowing you are protected against unforeseen events.

Airport Lounge Access

Some credit cards grant airport lounge access. This feature allows you to relax in exclusive lounges, away from the crowded terminals. Enjoy complimentary snacks, drinks, and Wi-Fi while waiting for your flight. Airport lounges can make your travel experience more comfortable and luxurious.

No Foreign Transaction Fees

Credit cards with no foreign transaction fees save you money when traveling abroad. You can make purchases without worrying about extra charges. This benefit is perfect for frequent travelers who want to avoid unnecessary expenses on international trips.

Introductory Apr Offers

Introductory APR offers are a great way to save money on interest charges. They allow you to pay off purchases or transfer balances at a low or zero percent interest rate for a limited time. Let’s dive into the details of these offers and how they can benefit you.

Understanding Introductory Apr

Introductory APR stands for Annual Percentage Rate. It’s a temporary interest rate that credit card companies offer to attract new customers. These rates are typically much lower than the standard APR and can be as low as 0%.

During the introductory period, which can last from six to 18 months, you can make purchases or balance transfers without accruing interest. This can be a significant financial benefit if you plan to make large purchases or consolidate existing debt.

Benefits Of Introductory Apr

- Cost Savings: You save money on interest payments.

- Debt Consolidation: Combine multiple debts into one payment with lower interest.

- Budget Flexibility: Spread out payments on large purchases without extra cost.

These benefits make introductory APR offers an attractive option for many consumers. They provide a window of opportunity to manage finances more effectively.

Best Cards For Introductory Apr Offers

| Card Name | Introductory APR Offer | Additional Features |

|---|---|---|

| Wallester Business Expense Card | 0% APR for 12 months | 300 free virtual cards, no hidden fees, easy corporate spending management |

| Wallester White-Label Card | 0% APR for 15 months | Branded card program, instant issuance, real-time tracking |

The Wallester Business Expense Card and White-Label Card are excellent options. They offer generous introductory APR periods and additional features that can help manage corporate spending and launch branded card programs efficiently.

Balance Transfer Options

Balance transfer options can be a lifeline for managing credit card debt. They allow you to move high-interest balances to a new card with lower rates. This saves you money on interest and helps you pay off debt faster. Let’s dive into what balance transfers are, their benefits, and the top cards you can consider.

What Is A Balance Transfer?

A balance transfer means moving debt from one credit card to another. This new card usually has a lower interest rate. This process helps reduce the amount of interest you pay on your debt. It’s a strategic way to manage multiple credit card debts.

Benefits Of Balance Transfers

Balance transfers offer several advantages:

- Lower Interest Rates: Save money by transferring to a card with a lower APR.

- Consolidation: Combine multiple debts into one payment.

- Improved Credit Score: Reducing debt can enhance your credit score.

- Debt Repayment: Easier to manage and pay off debt.

Top Cards For Balance Transfers

| Card Name | Intro APR | Regular APR | Fees |

|---|---|---|---|

| Card A | 0% for 18 months | 15.99% – 25.99% | 3% balance transfer fee |

| Card B | 0% for 12 months | 16.99% – 26.99% | No balance transfer fee |

| Card C | 0% for 21 months | 14.99% – 24.99% | 3% balance transfer fee |

Consider these options carefully. Each offers unique benefits. Choose a card that fits your financial needs and helps you achieve your debt repayment goals.

Pricing And Affordability

Understanding the pricing and affordability of credit cards is crucial. It helps in managing your finances effectively. Wallester’s financial solutions are designed to be cost-effective and transparent. Below, we explore key aspects of their pricing structure.

Annual Fees

Many credit cards charge annual fees, but Wallester Business solutions stand out. Their business expense cards come with no annual fees. This makes it easier for businesses to manage expenses without additional costs. Wallester also offers 300 free virtual cards, providing significant savings.

Interest Rates

Interest rates can significantly impact the affordability of a credit card. While Wallester’s product information does not specify interest rates, their focus on no hidden fees suggests competitive rates. Businesses can benefit from this by reducing the cost of borrowing.

Hidden Fees

Hidden fees can be a financial burden. Wallester ensures transparency with no hidden fees. This includes their business expense cards and white-label card issuing services. Clear pricing helps in accurate budgeting and financial planning.

Here’s a summary of Wallester’s pricing features:

| Feature | Details |

|---|---|

| Annual Fees | No annual fees |

| Interest Rates | Not specified, likely competitive |

| Hidden Fees | No hidden fees |

By choosing Wallester, businesses can enjoy cost-effective financial solutions. Transparent pricing and affordability are key features of their offerings.

Pros And Cons Of Credit Card Features

Credit cards offer a range of features that can be both advantageous and disadvantageous. Understanding the pros and cons helps in making informed decisions about their usage. Below, we explore these aspects in detail.

Advantages Of Using Credit Cards

- Convenience: Credit cards are widely accepted for payments, both online and offline.

- Rewards Programs: Many cards offer cashback, points, or travel rewards.

- Financial Flexibility: Allows for purchases when funds are low, with the option to pay later.

- Security: Credit cards provide fraud protection and secure transactions.

- Building Credit History: Responsible use can improve your credit score.

- Emergency Funds: Useful in unexpected situations where cash is not available.

Potential Drawbacks

- High-Interest Rates: Carrying a balance can result in significant interest charges.

- Debt Accumulation: Easy access to credit can lead to overspending and debt.

- Fees: Some cards come with annual fees, late payment fees, and foreign transaction fees.

- Credit Score Impact: Late payments and high credit usage can lower your credit score.

- Complex Terms: Understanding the fine print can be challenging and may lead to unexpected costs.

Balancing Benefits And Risks

To maximize the benefits and minimize the risks of credit card features, consider the following:

| Tip | Details |

|---|---|

| Pay on Time | Always pay your bill by the due date to avoid fees and interest. |

| Monitor Spending | Keep track of your expenses to stay within your budget. |

| Read Terms | Understand the terms and conditions of your card to avoid surprises. |

| Use Rewards Wisely | Redeem rewards in a way that benefits you the most. |

| Limit Cards | Only have as many cards as you can manage responsibly. |

By following these tips, you can enjoy the advantages of credit cards while mitigating potential drawbacks.

Recommendations For Ideal Users

Choosing the right credit card can be a daunting task. With so many options available, it’s essential to select one that aligns with your lifestyle and financial goals. Here are some recommendations based on specific needs and spending habits.

Best Cards For Frequent Travelers

For frequent travelers, having a credit card that offers travel rewards and benefits is crucial. These cards often provide:

- Travel miles and points: Earn miles on every purchase, which can be redeemed for flights, hotel stays, and more.

- No foreign transaction fees: Save money when making purchases abroad.

- Travel insurance: Coverage for trip cancellations, lost luggage, and other travel-related issues.

- Airport lounge access: Relax in exclusive lounges while waiting for your flight.

Consider cards like the Wallester Business Expense Card, which offers virtual and physical Visa-branded cards, real-time tracking, and 3D Secure protection.

Best Cards For Everyday Spending

For those who want to maximize their everyday spending, look for cards that offer:

- Cashback rewards: Earn cashback on groceries, gas, dining, and other daily expenses.

- No annual fees: Save money on maintenance costs.

- Flexible redemption options: Use rewards for statement credits, gift cards, or direct deposits.

The Wallester card stands out with no hidden fees and easy corporate spending management, making it a great option for everyday use.

Best Cards For Building Credit

Building credit is essential for financial stability. Ideal cards for this purpose offer:

- Low or no annual fees: Minimize costs while building your credit history.

- Secured cards: Use a deposit as collateral, making it easier to qualify.

- Credit-building tools: Access to credit score monitoring and educational resources.

Wallester’s solutions ensure financial security and compliance, making them a reliable choice for those looking to establish or rebuild their credit.

Whether you are a frequent traveler, daily spender, or someone building credit, selecting the right card can simplify your financial life. Evaluate your needs and choose a card that offers the most relevant features and benefits.

Frequently Asked Questions

What Are Common Credit Card Features?

Credit cards offer rewards, cashback, and travel points. They provide fraud protection and purchase insurance. Many cards have zero liability for unauthorized charges.

How Do Credit Card Rewards Work?

Credit card rewards accumulate through purchases. Points or cashback can be redeemed for travel, merchandise, or statement credits. Terms vary by card.

Are There Fees For Credit Card Features?

Yes, credit cards may have annual fees, late payment fees, and foreign transaction fees. Always review your card’s fee structure.

How Does Credit Card Fraud Protection Work?

Credit card fraud protection monitors for suspicious activity. Many cards offer zero liability for unauthorized transactions. Report fraud immediately.

Conclusion

Discovering the right credit card features is crucial for effective financial management. Wallester offers excellent solutions for managing business expenses and launching branded card programs. Their platform provides 300 free virtual cards, no hidden fees, and real-time tracking. Simplify corporate spending and ensure financial security with Wallester. Start today and explore their comprehensive services at Wallester. Enhance your financial operations with a trusted partner.