Credit Card Eligibility: Unlock Your Financial Freedom Today

Understanding credit card eligibility can help you choose the right card. Many factors impact your approval chances.

Credit cards offer convenience and financial flexibility. But before applying, you need to know if you qualify. Various factors, like your credit score, income, and employment status, determine your eligibility. Knowing these can improve your chances of approval. Not all credit cards have the same requirements. Researching and understanding these criteria can save you time and disappointment. For more detailed information on credit card eligibility, visit FairFigure. This guide will help you navigate the process and choose the best card for your needs. Let’s explore the key factors that determine credit card eligibility.

Introduction To Credit Card Eligibility

Understanding credit card eligibility is essential for anyone seeking a new credit card. Knowing the requirements can help you choose the right card and improve your chances of approval. In this section, we will discuss the basics of credit card eligibility and why it is important.

Understanding Credit Card Eligibility

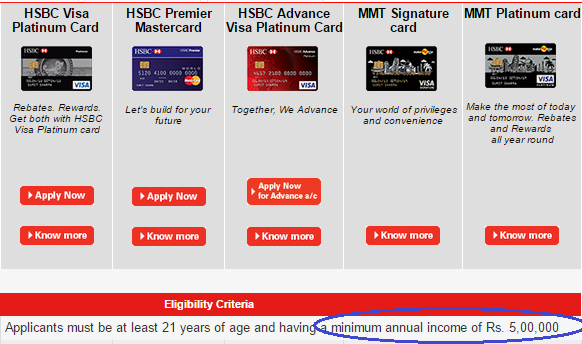

Credit card eligibility refers to the criteria that applicants must meet to qualify for a credit card. These criteria vary by issuer and card type, but generally include:

- Credit Score: Your credit score is a key factor. Higher scores often lead to better card options.

- Income: Most issuers require proof of income to ensure you can repay the credit.

- Age: Applicants must be at least 18 years old.

- Citizenship or Residency: Some cards are only available to residents or citizens of certain countries.

By understanding these criteria, you can better prepare your application and increase your chances of approval.

Importance Of Credit Card Eligibility

Knowing the importance of credit card eligibility can help you make informed decisions. Here are some reasons why it matters:

- Approval Chances: Meeting eligibility criteria improves your chances of getting approved.

- Card Benefits: Eligible applicants can access better rewards, lower interest rates, and higher credit limits.

- Financial Health: Choosing the right card can positively impact your financial health and credit score.

Ensuring you meet the eligibility requirements can save you time and effort, leading to a smoother application process.

To learn more about credit card options and eligibility, visit FairFigure.

Key Features Of Credit Card Eligibility Criteria

Understanding the credit card eligibility criteria can help you get approved for a credit card. The criteria ensure you can handle the financial responsibility. Below are the key features you should know about.

Credit Score Requirements

Your credit score is a major factor in credit card approval. Credit card companies check your score to assess your creditworthiness. A higher score means a better chance of approval. Typically, a score above 700 is considered good.

Income And Employment Verification

Credit card issuers verify your income and employment. They need to know you have a steady income to pay off your debts. You may need to provide proof of income such as pay stubs or tax returns.

Age And Residency Requirements

To be eligible for a credit card, you must meet the age and residency criteria. You must be at least 18 years old. You also need to be a resident of the country where you are applying for the card.

Benefits Of Meeting Credit Card Eligibility

Meeting credit card eligibility is crucial for financial growth. It opens doors to numerous advantages that can help you manage your finances better. Let’s explore the benefits that come with meeting credit card eligibility criteria.

Improved Financial Flexibility

Having a credit card provides improved financial flexibility. You can make purchases even when cash is low. This can be especially helpful during emergencies. You also get the option to pay in installments. This makes managing large expenses easier.

Credit cards also offer a revolving line of credit. This means you can borrow up to a certain limit. Once you pay back, you can borrow again. This cycle can help you manage short-term financial needs effectively.

Access To Rewards And Benefits

Credit cards often come with a range of rewards and benefits. These can include:

- Cashback on purchases

- Travel rewards and miles

- Discounts on dining and shopping

- Exclusive access to events and sales

Meeting the eligibility criteria for credit cards can give you access to these perks. Using these rewards smartly can save you a lot of money. Moreover, some credit cards offer protection benefits. These include travel insurance, purchase protection, and extended warranties.

Building Credit History

Using a credit card responsibly helps in building a good credit history. A strong credit history is essential for future financial endeavors. It can help you secure loans at lower interest rates. It also increases your chances of getting approved for mortgages and car loans.

To build a good credit history, ensure timely payments. Keep your credit utilization low. This means using only a small portion of your available credit. Regular, responsible use of your credit card can significantly boost your credit score over time.

In summary, meeting credit card eligibility criteria can offer many benefits. From financial flexibility to access to rewards and building a strong credit history, the advantages are manifold. Explore your options and choose the right credit card to meet your financial needs.

Pricing And Affordability Of Credit Cards

Credit cards offer various benefits, but understanding their pricing and affordability is crucial. Different credit cards have distinct costs, including annual fees and interest rates. Comparing these factors ensures you find the best card for your needs.

Annual Fees And Interest Rates

Credit card costs often start with annual fees. Some cards have no annual fee, while others charge up to $500 or more. It’s important to know this before applying.

Interest rates, or APR, significantly impact your card’s cost. These rates vary between 10% and 25% based on creditworthiness. Lower rates are better, especially if you carry a balance.

Here’s a table summarizing typical annual fees and interest rates:

| Credit Card Type | Annual Fee | Interest Rate (APR) |

|---|---|---|

| No Annual Fee Cards | $0 | 12% – 20% |

| Low APR Cards | $0 – $100 | 10% – 15% |

| Rewards Cards | $50 – $500 | 15% – 25% |

Comparing Different Credit Card Offers

Comparing credit card offers helps identify the best option for your budget. Consider the following factors:

- Annual Fees: Choose a card with fees you can afford.

- Interest Rates: Lower rates save money on carried balances.

- Rewards: Look for cards offering cash back or travel points.

- Introductory Offers: Some cards offer 0% APR for a limited time.

Here’s an example comparison:

| Card | Annual Fee | Interest Rate (APR) | Rewards | Introductory Offer |

|---|---|---|---|---|

| Card A | $0 | 14% | 1% cash back | 0% APR for 12 months |

| Card B | $99 | 18% | 2% travel points | 0% APR for 18 months |

Using this comparison method, you can find a credit card that fits your financial situation.

Pros And Cons Of Credit Card Eligibility

Understanding the pros and cons of credit card eligibility helps you make informed decisions. While easy eligibility can be tempting, it’s important to be aware of the potential drawbacks.

Advantages Of Easy Eligibility

Having easy credit card eligibility opens doors to many opportunities. Here are some advantages:

- Improved Access to Credit: With easy eligibility, more people can get credit cards. This is helpful for those with no credit history.

- Quick Financial Assistance: Credit cards can offer quick financial help in emergencies. This is much faster than applying for a loan.

- Rewards and Benefits: Many credit cards come with rewards programs. You can earn points, cashback, or discounts on purchases.

- Building Credit Score: Using a credit card responsibly can help build your credit score. A good score is important for future loans or mortgages.

- Convenience: Credit cards are convenient for daily transactions. No need to carry large amounts of cash.

Potential Drawbacks To Watch Out For

While easy eligibility has its perks, there are potential drawbacks:

- High Interest Rates: Many credit cards come with high interest rates. If you don’t pay the full balance, interest can add up quickly.

- Overspending Risk: Having a credit card can lead to overspending. It’s easy to lose track of how much you’ve spent.

- Fees and Charges: Credit cards often have fees. These can include annual fees, late payment fees, and foreign transaction fees.

- Impact on Credit Score: Missing payments or maxing out your credit card can hurt your credit score. This can affect your ability to get loans in the future.

- Debt Accumulation: It’s easy to fall into debt with a credit card. If you can’t pay off your balance, the debt can grow.

While the FairFigure credit card offers many benefits, it’s important to be aware of these potential drawbacks.

Specific Recommendations For Ideal Users

Choosing the right credit card can be daunting. Different cards suit different needs. Here are some tailored recommendations for specific user groups.

Best Credit Cards For Students

Students often need credit cards with low fees and great rewards. Here are some top picks:

- FairFigure Student Card: Low annual fee, cashback on textbooks, and no foreign transaction fees.

- Campus Rewards Card: Earn points on dining and entertainment, and access to credit-building tools.

- Learn & Earn Card: Introductory APR for 6 months and rewards for good grades.

Top Picks For Working Professionals

Working professionals need credit cards that offer rewards for daily spending and travel benefits. Consider these options:

- FairFigure Professional Card: High cashback rates on groceries and gas, and travel insurance.

- Executive Rewards Card: Points on business expenses, airport lounge access, and no annual fee for the first year.

- Everyday Rewards Card: Discounts on utility bills and free supplementary cards for family members.

Options For Individuals With Low Credit Scores

Building or rebuilding credit? These cards can help improve your credit score:

- FairFigure Rebuild Card: Reports to all major credit bureaus, low security deposit, and credit limit increases with responsible use.

- Credit Builder Card: No annual fee, educational resources, and tools for monitoring credit score progress.

- Secured Credit Card: Low-interest rates, refundable deposit, and a pathway to an unsecured card.

Steps To Improve Your Credit Card Eligibility

Improving your credit card eligibility can open up many financial opportunities. By taking specific steps, you can improve your chances of getting approved for a credit card. Below are some essential steps you can follow to enhance your eligibility.

Enhancing Your Credit Score

Your credit score is a major factor in credit card eligibility. Here’s how to improve it:

- Pay your bills on time. This includes credit card bills, loans, and utilities.

- Keep your credit utilization ratio low. Aim for less than 30% of your total credit limit.

- Avoid opening too many new credit accounts in a short period.

- Regularly check your credit report for errors and dispute any inaccuracies.

Increasing Your Income

Higher income can improve your credit card eligibility. Consider these strategies:

- Ask for a raise at your current job.

- Take on a second job or freelance work.

- Include all sources of income on your credit card application.

Correcting Inaccuracies In Your Credit Report

Errors in your credit report can hurt your credit score. Follow these steps to fix them:

- Request a free copy of your credit report from each of the three major credit bureaus.

- Carefully review each report for any mistakes.

- File a dispute with the credit bureau for any errors you find.

- Follow up to ensure the errors are corrected.

By focusing on these steps, you can improve your eligibility for credit cards. For more tips and guidance, visit FairFigure.

Frequently Asked Questions

What Are The Basic Credit Card Eligibility Criteria?

Basic eligibility criteria include age, income, employment, and credit score. Requirements vary by the card issuer.

How Does My Credit Score Affect Eligibility?

A higher credit score increases your chances of approval. It indicates financial responsibility.

Can I Apply For A Credit Card With No Credit History?

Yes, some cards are designed for beginners. Consider student or secured credit cards.

What Income Is Required For A Credit Card?

Income requirements vary by card. Generally, a stable income is needed to qualify.

Conclusion

Understanding credit card eligibility helps you make informed financial decisions. Research different options and find the best fit. Consider your income, credit score, and spending habits. Always compare offers and read terms carefully. For a detailed guide on choosing the right credit card, check out FairFigure. This resource can help you navigate the complex world of credit cards with ease. Stay informed, choose wisely, and enjoy the benefits of the right credit card.