Credit Card Customer Service: Tips for Hassle-Free Support

Credit card customer service can make or break your experience. Good service ensures smooth financial management.

Navigating the world of credit cards can be daunting. From understanding interest rates to managing your credit score, many factors come into play. That’s where excellent customer service becomes crucial. With the right support, you can get the answers and assistance you need, easing the stress of managing your finances. One such credit solution is the Possible Card from Possible Finance. This card offers a simple, fair approach with no interest or late fees, designed to help you build your credit history. With a quick application process and instant credit limit, it’s an option worth considering for anyone looking to improve their credit score with ease. For more information, visit Possible Finance.

Introduction To Credit Card Customer Service

Credit card customer service plays a crucial role in the financial world. It ensures that users have a smooth experience with their credit cards. Quality customer service can make a significant difference in user satisfaction and loyalty.

Understanding The Importance Of Quality Customer Service

Quality customer service is vital for credit card users. It helps resolve issues quickly and efficiently. Users need a reliable support system to address their concerns.

With the Possible Card, customer service becomes even more critical. As a unique credit solution, it offers instant access to credit with no interest or late fees. Ensuring users can easily access support is essential for maintaining trust and satisfaction.

Common Challenges Faced By Credit Card Users

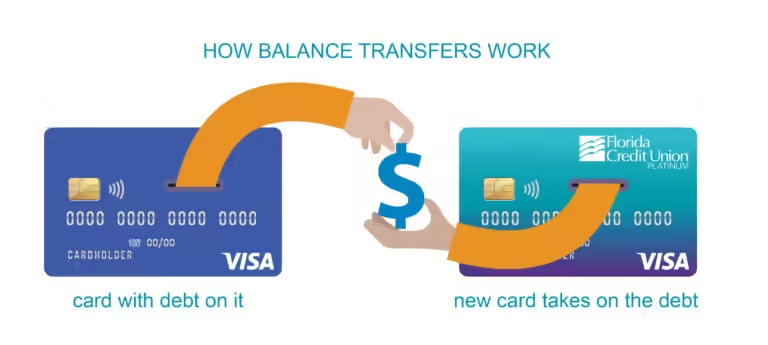

- High Interest Rates: Many credit cards have high interest rates, leading to debt.

- Late Fees: Missing a payment can result in hefty late fees.

- Complex Application Processes: Applying for a credit card can be time-consuming and complicated.

- Credit Score Impact: Poor management of credit cards can negatively impact credit scores.

The Possible Card addresses these challenges effectively. It offers a simple application process with no credit check. Users can enjoy a 0% interest rate and no late fees, making it easier to manage finances.

For more information about the Possible Card, visit Possible Finance.

Key Features Of Effective Credit Card Customer Service

Understanding the key features of effective credit card customer service is crucial. Customers need quick and helpful support. This helps them manage their credit cards better. Here are some essential features to look for:

24/7 Availability For Immediate Assistance

24/7 availability ensures customers get help whenever they need it. Problems can arise at any time. Having support available day and night is vital. This builds trust and ensures customers feel supported.

Multi-channel Support: Phone, Email, And Chat

Effective customer service offers multi-channel support. This means customers can contact support through phone, email, and chat. Offering multiple channels caters to different preferences. Some prefer speaking on the phone. Others like the convenience of email or chat. This flexibility improves customer satisfaction.

Knowledgeable And Well-trained Representatives

Knowledgeable and well-trained representatives are the backbone of good customer service. They should understand the product thoroughly. They need to answer questions accurately and efficiently. This expertise ensures customers get the help they need without frustration.

Personalized Service For Different Customer Needs

Customers have different needs. Personalized service caters to these individual requirements. Some may need help understanding their credit limit. Others might need assistance with the application process. Tailoring support improves the customer experience. It makes customers feel valued and understood.

Effective credit card customer service is essential for customer satisfaction. 24/7 availability, multi-channel support, knowledgeable representatives, and personalized service are key features. These elements ensure customers have a positive experience and get the help they need when they need it.

| Feature | Details |

|---|---|

| 24/7 Availability | Support available anytime |

| Multi-Channel Support | Phone, email, and chat options |

| Knowledgeable Representatives | Well-trained and informed staff |

| Personalized Service | Catering to individual customer needs |

Tips For Getting The Most Out Of Credit Card Customer Service

Credit card customer service can be a lifesaver when you run into issues. Knowing how to communicate effectively with support can save you time and frustration. Here are some tips for making the most of your credit card customer service experience.

Preparing Your Information Before Contacting Support

Before reaching out to customer service, gather all necessary information. This includes your account number, recent transactions, and any relevant correspondence. Having these details ready can speed up the process.

- Account Number: Keep your credit card account number handy.

- Recent Transactions: Note down any recent transactions related to your issue.

- Correspondence: Have copies of any emails or letters you’ve received.

Using The Right Communication Channel

Different issues may require different communication channels. For urgent matters, a phone call may be best. For less urgent issues, consider email or live chat. Choose the right method to ensure a quick response.

| Communication Channel | Best Use |

|---|---|

| Phone | Urgent issues or complex problems |

| Documentation and less urgent matters | |

| Live Chat | Quick questions or troubleshooting |

Being Clear And Concise In Your Requests

When explaining your issue, be clear and concise. Provide all necessary details but avoid unnecessary information. This helps the support team understand your problem quickly and find a solution faster.

- State the Problem: Clearly describe the issue you are facing.

- Provide Details: Include relevant dates, amounts, and other specifics.

- Avoid Extra Information: Stick to the facts to keep the communication efficient.

Following Up On Unresolved Issues

If your issue is not resolved, follow up with customer service. Keep track of your communications and provide any additional information requested. Persistence often leads to resolution.

- Document Communications: Keep a record of all interactions with support.

- Follow Up Regularly: Check in if you haven’t received a response within a reasonable timeframe.

- Provide Additional Information: Offer any new details that may help resolve the issue.

By preparing your information, choosing the right communication channel, being clear in your requests, and following up on unresolved issues, you can get the most out of credit card customer service. These tips can help you resolve problems efficiently and maintain a good credit experience.

Pricing And Affordability Of Premium Customer Service

Understanding the pricing and affordability of premium customer service is crucial. It helps users decide the best support option for their needs. This section provides insights into both free and paid support options. It also evaluates the cost-benefit of opting for premium services.

Free Vs. Paid Support Options

Many credit card companies offer basic customer service for free. This usually includes:

- General inquiries

- Account balance checks

- Basic troubleshooting

On the other hand, premium support often comes with a fee. For instance, Possible Finance’s Possible Card offers a premium service with a monthly fee of $8 or $16 depending on the credit limit. This fee ensures users receive priority support and personalized assistance.

Comparing the two:

| Free Support | Premium Support |

|---|---|

| Basic services | Priority handling |

| General inquiries | Personalized assistance |

| No fee | $8 or $16 monthly fee |

Evaluating The Cost-benefit Of Premium Services

Choosing between free and paid support involves weighing the benefits against the costs. With Possible Finance’s premium service, users get:

- Priority support for faster resolutions.

- Personalized assistance tailored to individual needs.

- Access to a higher credit limit of up to $800.

The cost of $8 or $16 per month might seem high. But the benefits, such as no interest and no late fees, can outweigh this cost. Additionally, the opportunity to build a better credit history adds significant value.

Thus, for users seeking enhanced support and credit improvement, investing in premium services can be worthwhile. The key is to assess individual needs and determine the value of premium support in enhancing their financial journey.

Pros And Cons Of Different Credit Card Customer Service Approaches

Credit card customer service plays a crucial role in user satisfaction. Understanding the pros and cons of different approaches can help you choose the best option for your needs. Let’s dive into the advantages and disadvantages of various customer service methods.

Automated Support Systems Vs. Human Representatives

Automated Support Systems are becoming increasingly popular. They offer 24/7 availability and can handle basic queries quickly. This reduces wait times and provides instant answers. However, they may lack the ability to handle complex issues or provide personalized support.

Human Representatives, on the other hand, offer personalized assistance. They can understand nuanced problems and provide tailored solutions. This approach fosters a stronger connection with customers. Yet, it may involve longer wait times and higher operational costs.

| Approach | Pros | Cons |

|---|---|---|

| Automated Support Systems |

|

|

| Human Representatives |

|

|

In-house Customer Service Vs. Outsourced Support

In-House Customer Service provides direct control over the quality and training of representatives. This approach ensures that the team is deeply familiar with the company’s products and policies. It can lead to higher customer satisfaction. However, it requires significant investment in resources and infrastructure.

Outsourced Support allows companies to save on costs and scale operations quickly. It offers flexibility and access to a larger pool of talent. Yet, it may lead to inconsistencies in service quality and lack of familiarity with specific company policies.

| Approach | Pros | Cons |

|---|---|---|

| In-House Customer Service |

|

|

| Outsourced Support |

|

|

Specific Recommendations For Ideal Users Or Scenarios

Credit card customer service can vary greatly depending on the user and the situation. To maximize your experience with The Possible Card, consider these specific recommendations for when to opt for premium customer service, ideal scenarios for using multi-channel support, and best practices for resolving disputes quickly.

When To Opt For Premium Customer Service

Premium customer service is essential for users who require immediate assistance or personalized solutions. Here are some scenarios where opting for premium customer service can be beneficial:

- Complex Issues: Users facing complicated billing or account problems.

- High-Value Transactions: If you are dealing with large purchases or payments.

- Frequent Travelers: Those who need reliable and quick support while traveling.

Premium support ensures you get prompt and efficient service tailored to your needs, preventing potential disruptions to your financial activities.

Ideal Scenarios For Using Multi-channel Support

Multi-channel support offers flexibility and convenience. Here are ideal scenarios for utilizing different support channels:

| Channel | Best For |

|---|---|

| Detailed inquiries, documentation, or non-urgent requests. | |

| Phone | Urgent issues needing immediate resolution or complex queries. |

| Live Chat | Quick questions or troubleshooting during business hours. |

Using the right channel for your needs ensures efficient and effective communication with customer service representatives.

Best Practices For Resolving Disputes Quickly

Resolving disputes quickly is crucial for maintaining a good credit history. Follow these best practices:

- Document Everything: Keep records of all communications and transactions.

- Contact Support Immediately: Reach out as soon as you notice an issue.

- Be Clear and Concise: Provide clear details about the dispute.

- Follow Up: Regularly check the status of your dispute.

- Use Multiple Channels: If necessary, escalate your issue using different support channels.

Following these practices will help you resolve disputes effectively and maintain a positive relationship with your credit card provider.

Frequently Asked Questions

What Is The Best Way To Contact Credit Card Customer Service?

The best way to contact credit card customer service is by calling the number on your card. Alternatively, you can reach out via the bank’s website or mobile app.

How Can I Dispute A Credit Card Charge?

To dispute a credit card charge, contact your card issuer. Provide details of the transaction in question. Follow their specific dispute process for resolution.

What Should I Do If My Credit Card Is Lost?

If your credit card is lost, immediately contact customer service. They will block your card and issue a replacement. Make sure to monitor your account for any unauthorized transactions.

How Can I Request A Credit Limit Increase?

You can request a credit limit increase by contacting your card issuer. This can be done through their customer service number, website, or mobile app. Provide any necessary financial information.

Conclusion

Effective credit card customer service is essential for a positive experience. It ensures timely help and clear communication. Good service can solve issues quickly and build trust. Choose a card provider that values customer support. Consider the Possible Card from Possible Finance. It offers no interest or late fees and helps build credit. Apply in minutes with no credit check. Learn more at Possible Finance. Improving your credit card experience starts with choosing the right card. Reliable customer service makes a big difference.