Credit Card Cashback Offers: Maximize Your Savings Today

Credit card cashback offers provide a great way to save money. They reward you for spending on everyday purchases.

In today’s world, smart financial decisions can make a big difference. Credit card cashback offers are designed to help you save while you spend. These offers give back a percentage of your purchases, which can accumulate into significant savings over time. Whether you are a business owner or an individual, understanding how these offers work can greatly benefit your financial health. At FairFigure, we provide tools and resources to help businesses monitor and improve their credit scores, secure funding, and manage their financial health. Learn more about our FairFigure Capital Card and how it can enhance your business operations by visiting FairFigure today.

Introduction To Credit Card Cashback Offers

Credit card cashback offers have become a popular feature among cardholders. They provide a simple way to earn rewards on everyday purchases. In this section, we will explore what cashback offers are and why they are beneficial.

What Are Cashback Offers?

Cashback offers are rewards programs provided by credit card companies. These programs give you a percentage of your purchases back as cash. For example, if you spend $100 on a card with a 2% cashback offer, you will receive $2 back.

These rewards can be redeemed in various ways. Some cards allow you to apply cashback as a statement credit. Others let you deposit it into a bank account. Some programs even offer gift cards or merchandise as redemption options.

Why Cashback Offers Are Beneficial

Cashback offers provide several benefits to cardholders:

- Extra Savings: Earn money back on purchases you would make anyway.

- Flexibility: Use cashback rewards for various purposes, such as paying off your balance or making new purchases.

- No Restrictions: Unlike points programs, cashback rewards are straightforward and easy to understand.

- Boost Business Finances: For business owners, cashback rewards can improve cash flow and reduce expenses.

Overall, credit card cashback offers are an attractive feature for many cardholders. They provide tangible benefits and can make managing finances easier.

Key Features Of Credit Card Cashback Programs

Credit card cashback programs provide valuable rewards to cardholders. Understanding their key features helps maximize benefits. Here’s a breakdown of essential elements.

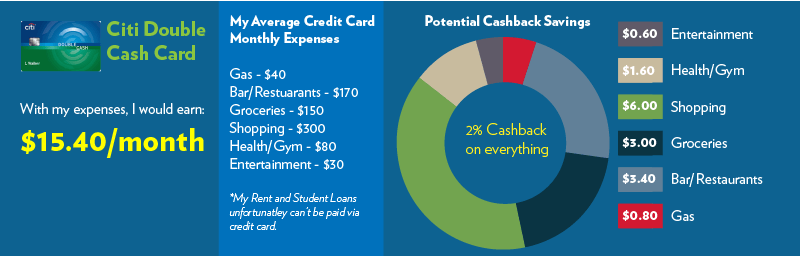

Percentage-based Cashback

Many cashback programs offer a fixed percentage of cashback on purchases. For example, you might earn 1% back on every dollar spent. This type of reward is straightforward and easy to track.

| Spending Category | Cashback Percentage |

|---|---|

| General Purchases | 1% |

| Groceries | 2% |

| Dining | 3% |

Category-specific Cashback

Some cards provide higher cashback rates for specific categories. These categories often include groceries, dining, and travel. For example, you might earn 3% cashback on dining expenses and 2% on groceries.

- Groceries: 2%

- Dining: 3%

- Travel: 4%

Introductory Offers And Bonuses

Many cashback cards offer introductory bonuses. These bonuses often apply after meeting a spending threshold. For example, spend $500 in the first three months and earn $100 cashback.

- Spend $500 in the first three months.

- Earn $100 cashback.

- Boost your rewards with initial spending.

Cashback Redemption Options

Cashback redemption options vary. Common methods include statement credits, direct deposits, and gift cards. Some programs also allow for points conversion. This flexibility helps tailor rewards to individual preferences.

| Redemption Option | Description |

|---|---|

| Statement Credit | Apply cashback to your credit card balance. |

| Direct Deposit | Transfer cashback to your bank account. |

| Gift Cards | Redeem cashback for various gift cards. |

Top Credit Cards For Cashback Offers In 2023

Finding the right credit card can boost your savings through cashback offers. Whether you spend on groceries, dining, or online shopping, a good cashback card can make a big difference. Here are some top picks for cashback credit cards in 2023.

Best Overall Cashback Card

The FairFigure Capital Card is a standout option. It offers a range of benefits tailored for businesses. Key features include:

- Credit Monitoring: Real-time tri-bureau business credit score monitoring with detailed information.

- Credit Building: Reports payment history to commercial bureaus, potentially boosting scores by up to 60%.

- Funding Access: Same-day funding with no personal credit checks or personal guarantees.

- Business Credit Correct Tool: Identifies and corrects wrong information on business credit reports.

- EIN-Based Applications: Utilizes EIN for funding applications and reporting.

With its comprehensive credit monitoring and building capabilities, FairFigure Capital Card is a solid choice for businesses looking to improve their financial health.

Best Cashback Card For Groceries

For those who spend a lot on groceries, the Blue Cash Preferred® Card from American Express is highly recommended. It offers:

- 6% cashback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%).

- 3% cashback at U.S. gas stations and on transit.

- 1% cashback on other purchases.

This card helps you save significantly on your grocery bills, making it a great option for families and individuals alike.

Best Cashback Card For Dining And Entertainment

The Savor Rewards Card from Capital One excels in dining and entertainment. It provides:

- 4% cashback on dining and entertainment.

- 2% cashback at grocery stores.

- 1% cashback on all other purchases.

If you frequently dine out or enjoy entertainment, this card can help you earn substantial rewards on your spending.

Best Cashback Card For Online Shopping

Online shoppers should consider the Amazon Prime Rewards Visa Signature Card. This card offers:

- 5% cashback on Amazon.com and Whole Foods Market purchases with an eligible Prime membership.

- 2% cashback at restaurants, gas stations, and drugstores.

- 1% cashback on all other purchases.

This card is ideal for frequent Amazon shoppers, providing significant savings on a variety of purchases.

Choosing the right cashback card can enhance your purchasing power and provide valuable rewards. These top picks for 2023 cater to different spending habits and offer generous cashback rates to help you save more.

How To Choose The Right Cashback Credit Card

Selecting the best cashback credit card can be challenging. With numerous options available, it’s essential to find a card that aligns with your spending habits, offers favorable cashback rates, and provides additional perks. Here’s a guide to help you make an informed decision.

Assessing Your Spending Habits

Understanding your spending patterns is the first step. Evaluate where you spend the most money. Do you frequently shop at grocery stores, dine out, or travel? Identifying your primary expenses helps you choose a card that maximizes your cashback rewards in these categories.

Comparing Cashback Rates And Categories

Not all cashback rates are equal. Some cards offer a flat rate on all purchases, while others provide higher rates for specific categories. Compare the rates and ensure they align with your spending habits. Here’s a quick comparison:

| Card Type | Flat Rate | Category Rate |

|---|---|---|

| Card A | 1.5% | 3% on groceries |

| Card B | 2% | 5% on travel |

Evaluating Annual Fees And Other Charges

Annual fees can significantly impact your overall savings. Some cards offer great cashback rates but charge high fees. Calculate if the rewards outweigh the fees. Also, consider other charges like foreign transaction fees or late payment penalties.

- No Annual Fee: Ideal for moderate spenders.

- High Annual Fee: Suitable if rewards significantly exceed the fee.

- Foreign Transaction Fees: Important for frequent travelers.

Considering Additional Perks And Benefits

Beyond cashback, consider other benefits. Some cards provide travel insurance, purchase protection, or extended warranties. These perks can add substantial value, especially if they align with your lifestyle.

- Travel Insurance: Covers trip cancellations or delays.

- Purchase Protection: Protects against theft or damage.

- Extended Warranties: Extends the warranty on purchased items.

Choosing the right cashback credit card involves assessing your spending habits, comparing cashback rates, evaluating fees, and considering additional perks. By focusing on these factors, you can select a card that maximizes your rewards and complements your financial habits.

Tips For Maximizing Your Cashback Savings

Maximizing your cashback savings can be a great way to enhance your financial health. With the right strategies, you can make the most out of your credit card rewards. Below are some practical tips to help you maximize your cashback savings effectively.

Combining Multiple Cashback Cards

Using multiple cashback cards can significantly increase your savings. Each card often has different reward categories and rates. For instance, one card might offer 5% cashback on groceries, while another offers 3% on fuel. By using the right card for the right purchase, you can maximize your rewards.

| Credit Card | Category | Cashback Rate |

|---|---|---|

| Card A | Groceries | 5% |

| Card B | Fuel | 3% |

| Card C | Dining | 2% |

Staying Informed About Promotions

Promotions and special offers can lead to significant cashback savings. Stay informed by regularly checking your card issuer’s website or app. Subscribe to newsletters and set up alerts. This way, you won’t miss out on limited-time offers.

Using Cashback Portals And Apps

Cashback portals and apps are excellent tools to stack your rewards. Websites like Rakuten and TopCashback offer extra cashback for shopping through their links. Combine these with your credit card rewards for maximum savings.

- Sign up for cashback portals

- Use the portals before making any online purchase

- Check for additional app-based offers

Avoiding Common Pitfalls

To maximize your savings, avoid common pitfalls. Overspending to earn cashback can lead to debt. Late payments can result in interest charges, negating your cashback benefits. Always pay your balance in full each month to truly benefit from your rewards.

- Stick to your budget

- Pay your balance in full

- Avoid unnecessary purchases

By following these tips, you can make the most out of your credit card cashback offers and enhance your financial health.

Pros And Cons Of Cashback Credit Cards

Cashback credit cards offer many benefits but also come with some drawbacks. Understanding the pros and cons can help you decide if a cashback credit card is right for you.

Advantages Of Cashback Credit Cards

Cashback credit cards can provide several benefits. The most prominent advantages are:

- Earn Rewards: You get a percentage of your spending back as cash.

- Simple Redemption: Redeem your cashback as a statement credit or direct deposit.

- Flexible Spending: Use your cashback on anything you want.

- Special Offers: Some cards offer higher cashback rates on specific categories, like groceries or gas.

Disadvantages Of Cashback Credit Cards

While cashback credit cards offer rewards, they also have some downsides. Consider these potential drawbacks:

- High Interest Rates: If you carry a balance, interest charges can outweigh your cashback rewards.

- Fees: Some cashback cards come with annual fees that might reduce your net rewards.

- Spending Limits: Certain cards cap the amount of cashback you can earn in a specific period.

- Complex Reward Structures: Some cards have complicated tiered reward systems that can be hard to track.

Table Of Comparison

| Pros | Cons |

|---|---|

| Earn Rewards | High Interest Rates |

| Simple Redemption | Fees |

| Flexible Spending | Spending Limits |

| Special Offers | Complex Reward Structures |

Who Should Get A Cashback Credit Card?

Cashback credit cards are a popular choice among consumers. They offer rewards for everyday spending. But, who should get a cashback credit card? Let’s explore.

Ideal Users For Cashback Credit Cards

Cashback credit cards are perfect for those who pay their balance in full each month. This ensures they avoid interest charges. Frequent shoppers can also benefit from cashback rewards. If you spend a lot on groceries, gas, or dining out, this card is for you.

Businesses may find cashback cards useful too. The FairFigure Capital Card offers real-time credit monitoring and same-day funding. This is ideal for businesses needing quick access to funds.

| Ideal User | Reason |

|---|---|

| Individuals | Earn rewards on everyday purchases. |

| Businesses | Monitor credit and secure funding easily. |

Scenarios Where Cashback Credit Cards Shine

Cashback credit cards excel in various scenarios. Here are a few:

- Grocery Shopping: Earn cashback on every grocery purchase.

- Gas Stations: Get rewards for every gallon of gas bought.

- Dining Out: Enjoy cashback rewards on restaurant bills.

- Online Shopping: Benefit from cashback on online purchases.

For businesses, scenarios include:

- Quick Funding: The FairFigure Capital Card offers same-day funding with no personal credit checks.

- Credit Building: Reports payment history to commercial bureaus, boosting credit scores by up to 60%.

Choosing the right cashback credit card can save money and earn rewards. Whether for personal use or business, cashback credit cards like the FairFigure Capital Card offer numerous benefits.

Frequently Asked Questions

What Are Credit Card Cashback Offers?

Credit card cashback offers provide a percentage of your spending back as a reward. These rewards can be in the form of cashback, statement credits, or discounts.

How Do Cashback Offers Work?

Cashback offers work by returning a percentage of your purchases. The percentage varies by card and purchase category. Rewards are usually credited to your account.

Are Cashback Offers Worth It?

Yes, cashback offers are worth it if you use your credit card frequently. They can provide significant savings and rewards over time.

Which Purchases Earn The Most Cashback?

Purchases in categories like groceries, dining, and travel often earn the most cashback. Check your card’s terms to know specific categories and rates.

Conclusion

Exploring credit card cashback offers can save you money on purchases. Consider options that align with your spending habits. The FairFigure Capital Card is an excellent choice for business credit-building. It offers credit monitoring, same-day funding, and accurate reporting. Improve your credit score and gain access to more funding. Easy application with no personal guarantees needed. Visit FairFigure for more details and start boosting your business credit today.