Credit Card Benefits: Maximize Your Financial Freedom

Credit cards offer more than just a way to pay for purchases. They come with a variety of benefits that can enhance your financial life.

Understanding the perks of credit cards can help you make smarter financial decisions. From earning rewards on daily spending to protecting your purchases and improving your credit score, credit cards offer numerous advantages. But with so many options available, how do you choose the right one? This guide will break down the key benefits of credit cards, helping you understand how they can work for you. Let’s dive into the world of credit card benefits and see how you can make the most out of them. For detailed insights and free credit score monitoring, visit Credit Sesame.

Introduction To Credit Card Benefits

Credit cards offer numerous advantages, making them a valuable tool for managing finances. Understanding these benefits can help you maximize their potential. Let’s delve into the world of credit card benefits and see how they can enhance your financial health.

Understanding Financial Freedom

Financial freedom means having control over your finances, and credit cards play a significant role in this journey. They provide the flexibility to manage expenses, build credit, and access rewards.

Here are some key aspects of financial freedom:

- Control over Spending: Track and manage your spending effortlessly.

- Build Credit: Use credit cards responsibly to improve your credit score.

- Access to Rewards: Earn rewards like cashback, points, and travel benefits.

The Role Of Credit Cards In Achieving Financial Freedom

Credit cards are a powerful tool in achieving financial freedom. They offer several features that support your financial goals. Let’s explore how Credit Sesame can aid in this process:

| Feature | Benefit |

|---|---|

| Daily Credit Score Monitoring | Check your credit score daily and understand the factors impacting it. |

| Sesame Grade | Get a letter grade evaluating the five major factors affecting your credit score. |

| Personalized Actions | Receive recommendations to improve your credit score. |

| Offers | Access credit products with high approval chances based on your credit profile. |

| Credit Builder | Build credit using everyday purchases made with a debit card. |

By leveraging these features, you can work towards improving your credit score and achieving financial stability. Credit Sesame provides a comprehensive approach to credit management, making it easier to understand and improve your financial standing.

Key Benefits Of Using Credit Cards

Credit cards offer numerous advantages that can enhance your financial management. They provide a range of benefits that go beyond simple purchasing power. Here, we explore the key benefits of using credit cards.

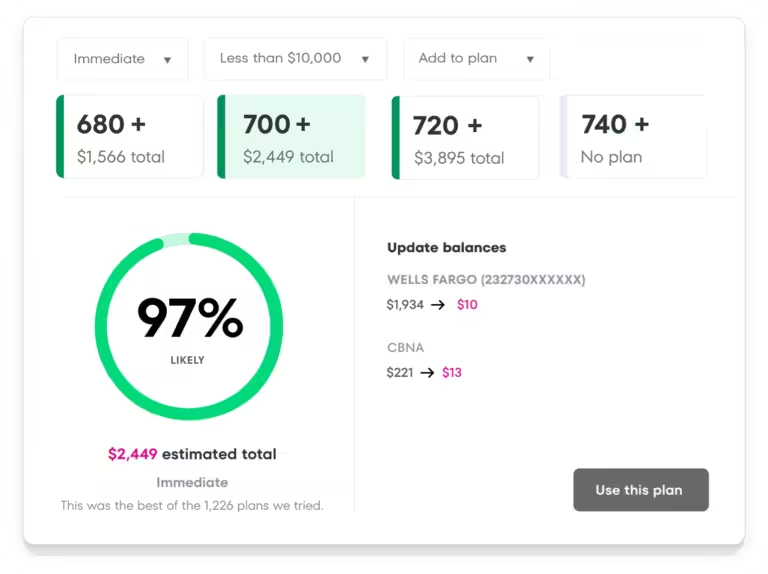

Building And Improving Credit Score

Using credit cards responsibly helps in building and improving your credit score. Regular payments show lenders your reliability. This can lead to better loan approval chances and lower interest rates in the future.

Credit Sesame provides daily credit score monitoring, helping users track and improve their scores. Personalized recommendations guide you on actions to take for a better credit score.

Convenience And Security Of Transactions

Credit cards offer convenience and security for everyday transactions. You don’t need to carry cash around. Most cards have fraud protection features. This ensures your money stays safe.

Credit Sesame ensures your data is protected with 256-bit encryption. You can manage all your credit needs securely in one place.

Rewards Programs And Cash Back Offers

Many credit cards come with rewards programs. You can earn points on purchases. These points can be redeemed for travel, gift cards, or merchandise. Some cards offer cash back on everyday spending.

Credit Sesame helps you find credit products with high chances of approval. This includes cards with attractive rewards and cash back offers.

Introductory Offers And Interest-free Periods

Credit cards often offer introductory deals. These can include low or zero interest rates for an initial period. This can be beneficial for large purchases or balance transfers.

Using these offers wisely can save you money. Credit Sesame provides personalized actions to help you make the most of these offers.

Purchase Protection And Extended Warranties

Many credit cards offer purchase protection. This covers your new purchases against theft or damage for a certain period. Extended warranties can also be provided, giving you extra peace of mind.

Credit Sesame gives you access to credit products that offer these benefits. You can choose the card that best suits your needs.

For more details, visit the Credit Sesame website and review their terms of use and privacy policy.

How To Maximize Credit Card Rewards

Maximizing credit card rewards can help you earn more points, cash back, and other benefits. Here are some effective strategies to get the most out of your credit cards.

Choosing The Right Credit Card For Your Lifestyle

Selecting a card that aligns with your spending habits is crucial. Consider these factors:

- Spending Categories: Look for cards offering higher rewards in categories where you spend the most, such as groceries, travel, or dining.

- Annual Fees: Weigh the annual fee against the benefits. Sometimes, paying a fee is worth it for better rewards.

- Sign-Up Bonuses: Many cards offer substantial sign-up bonuses if you meet a spending threshold within the first few months.

Strategies For Earning Maximum Points

To earn the most points, follow these strategies:

- Use Cards Strategically: Use the card that offers the best rewards for each purchase category.

- Combine Rewards Programs: Some cards allow you to transfer points to travel partners, maximizing their value.

- Monitor Promotions: Take advantage of limited-time promotions and special offers to boost your rewards.

Utilizing Cash Back Offers

Cash back offers can provide immediate value. Here’s how to utilize them effectively:

- Automatic Cash Back: Some cards offer automatic cash back on every purchase, making it easy to earn rewards.

- Category Bonuses: Look for cards that offer higher cash back percentages in specific categories that match your spending.

- Redeem Regularly: Cash back can often be redeemed as a statement credit, direct deposit, or gift cards. Make sure to redeem it regularly to maximize your benefits.

Redeeming Rewards Efficiently

Efficient redemption of rewards ensures you get the most value. Follow these tips:

- Understand Redemption Options: Learn about different redemption options available, such as travel, gift cards, or cash back.

- Avoid Expiration: Some points or rewards may expire. Keep track of expiration dates to avoid losing your rewards.

- Maximize Point Value: Redeem points for options that give you the highest value per point, such as travel or high-value gift cards.

By following these strategies, you can maximize the rewards you earn and make the most out of your credit card benefits.

For more information on managing and improving your credit score, visit Credit Sesame.

Understanding Credit Card Fees And Costs

Credit cards offer many benefits, but they also come with fees and costs. Understanding these expenses helps you make informed decisions and avoid unnecessary charges.

Annual Fees And How To Avoid Them

Many credit cards charge an annual fee, which can range from $0 to several hundred dollars. To avoid these fees, consider the following:

- Look for cards with no annual fee.

- Check if the card offers enough benefits to justify the fee.

- Negotiate with the card issuer for a fee waiver.

Some cards waive the fee for the first year, so it’s essential to track when the fee will start applying.

Interest Rates And How To Minimize Them

Credit card interest rates, also known as APR, can be quite high. To minimize these costs, follow these tips:

- Pay your balance in full each month to avoid interest.

- Look for cards with lower APR rates.

- Transfer balances to a card with a 0% introductory APR.

Always read the terms and conditions to understand how interest is calculated.

Hidden Fees And Charges To Watch Out For

Credit cards often come with hidden fees and charges that can add up quickly. Be aware of the following:

| Fee Type | Description |

|---|---|

| Late Payment Fee | Charged if you miss a payment due date. |

| Foreign Transaction Fee | Applied to purchases made outside your home country. |

| Cash Advance Fee | Fee for withdrawing cash using your credit card. |

Read your credit card agreement carefully to understand all potential fees and charges. This way, you can avoid unexpected costs and manage your finances better.

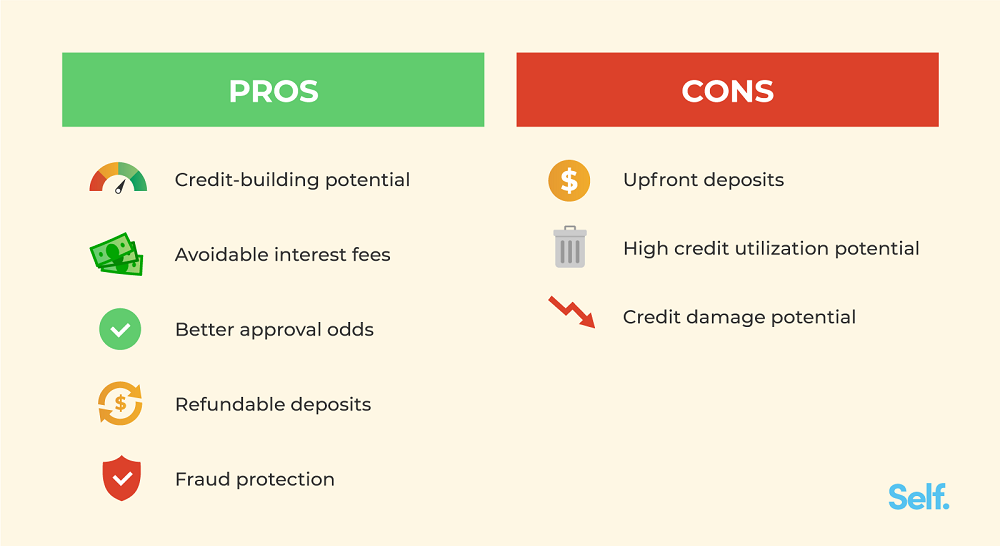

Pros And Cons Of Credit Cards

Credit cards offer convenience, but they also come with risks. Understanding the pros and cons helps you make informed decisions about using credit cards responsibly.

Advantages Of Using Credit Cards

Credit cards have several benefits that can enhance your financial management and provide additional perks.

- Convenience and Flexibility: Credit cards are accepted worldwide, making it easier to make purchases without carrying cash.

- Rewards and Cash Back: Many credit cards offer rewards, points, or cash back for purchases. This can save you money on everyday expenses.

- Building Credit: Using a credit card responsibly helps build your credit score. A good credit score is essential for loans and mortgages.

- Fraud Protection: Credit cards offer protection against unauthorized charges. You can dispute fraudulent transactions and get your money back.

- Emergency Funds: A credit card can be a valuable resource in emergencies when cash is not available.

Potential Drawbacks And How To Mitigate Them

While credit cards offer many benefits, they also come with potential drawbacks. Being aware of these can help you avoid common pitfalls.

- High-Interest Rates: Credit cards often have high-interest rates. To avoid interest charges, pay your balance in full each month.

- Debt Accumulation: It’s easy to overspend with a credit card. Set a budget and stick to it to avoid falling into debt.

- Fees: Credit cards can have various fees, such as annual fees, late payment fees, and foreign transaction fees. Read the terms and conditions to understand all fees associated with your card.

- Impact on Credit Score: Late payments or high credit utilization can negatively impact your credit score. Monitor your credit regularly and make timely payments.

Using tools like Credit Sesame can help you manage your credit effectively. They offer free credit score monitoring and personalized advice to improve your credit score.

| Feature | Description |

|---|---|

| Daily Credit Score Monitoring | Check your credit scores daily and see the factors impacting your credit. |

| Sesame Grade | A letter grade system that evaluates major factors affecting credit scores. |

| Personalized Actions | Recommendations to help improve your credit scores. |

| Offers | Access to credit products with high chances of approval based on your credit profile. |

| Credit Builder | Build credit using everyday purchases with a debit card, no credit check required. |

Remember, responsible use of credit cards can lead to financial benefits and improved credit health. Always stay informed and use available resources to manage your credit effectively.

Recommendations For Ideal Credit Card Users

Credit cards can be a powerful financial tool when used wisely. Not everyone benefits from using credit cards, and understanding the ideal scenarios and best practices is crucial. Below are some recommendations for those who can make the most out of their credit cards.

Best Practices For Responsible Credit Card Use

To use credit cards responsibly, follow these best practices:

- Pay your balance in full each month to avoid interest charges.

- Keep your credit utilization ratio below 30%.

- Monitor your account regularly for fraudulent activity.

- Take advantage of rewards and cashback offers.

- Use tools like Credit Sesame for daily credit score monitoring.

Ideal Scenarios For Using Credit Cards

| Scenario | Benefit |

|---|---|

| Travel | Earn travel rewards and get travel insurance. |

| Large Purchases | Take advantage of interest-free periods. |

| Online Shopping | Extra layer of fraud protection. |

| Building Credit | Improve credit score with responsible use. |

Who Should Avoid Using Credit Cards

Credit cards are not for everyone. Avoid using credit cards if:

- You struggle with impulse spending.

- You cannot pay off the balance in full each month.

- You have a low credit score and need time to rebuild it.

- You’re not disciplined in managing your finances.

Using tools like Credit Sesame can offer personalized recommendations and insights to improve your credit profile and ensure responsible credit card use.

Conclusion: Achieving Financial Freedom With Credit Cards

Credit cards can be powerful tools for achieving financial freedom. They offer numerous benefits that can help you manage your finances better. Using credit cards wisely can lead to improved credit scores, greater financial flexibility, and access to rewarding benefits.

Summarizing The Benefits

Credit cards offer a variety of benefits that can aid in achieving financial goals:

- Convenience: Easily make purchases without carrying cash.

- Credit Score Improvement: Regular and responsible use can boost your credit score.

- Rewards: Earn points, cashback, or miles on everyday purchases.

- Security: Enhanced protection against fraud and unauthorized transactions.

- Purchase Protection: Many cards offer insurance on purchases and extended warranties.

Final Tips For Maximizing Credit Card Use

To get the most out of your credit cards, consider these tips:

- Pay on Time: Always pay your bill on time to avoid late fees and interest charges.

- Keep Balances Low: Try to keep your credit card balance below 30% of your credit limit.

- Use Rewards Wisely: Redeem rewards for valuable items like travel, gift cards, or cashback.

- Monitor Your Credit: Regularly check your credit score and report for any errors or fraudulent activities.

- Take Advantage of Offers: Look for credit card offers that match your spending habits and financial goals.

Using services like Credit Sesame can help you manage your credit effectively. It provides free credit score monitoring, personalized recommendations, and access to credit products tailored to your profile. With Credit Sesame, you can keep track of your credit score daily and take actionable steps to improve it.

By understanding and leveraging the benefits of credit cards, you can move closer to financial freedom and enjoy the rewards and security they offer.

Frequently Asked Questions

What Are The Main Benefits Of Credit Cards?

Credit cards offer rewards, cashback, and travel points. They also provide purchase protection and fraud liability. Credit cards can help build your credit score.

How Do Credit Cards Improve Credit Score?

Using credit cards responsibly boosts your credit score. Timely payments and low credit utilization are crucial. It shows lenders your reliability.

Are There Rewards For Credit Card Usage?

Yes, many credit cards offer rewards. These include cashback, travel points, and discounts. Rewards vary by card type.

Can Credit Cards Offer Travel Benefits?

Credit cards often provide travel perks. These include airline miles, hotel discounts, and travel insurance. Benefits depend on the card issuer.

Conclusion

Understanding credit card benefits can greatly enhance your financial health. Credit cards offer numerous advantages, from rewards and cash back to travel perks. Managing credit well can improve your credit score. For those seeking to monitor and improve their credit, Credit Sesame is an excellent resource. It provides free credit score monitoring and personalized advice. Take control of your credit today. Credit Sesame can help guide you on this journey. Visit their website to learn more and start improving your credit score. Your financial future starts now.