Credit Card Approval: Tips to Boost Your Chances

Credit card approval can feel like a daunting process. The good news is, it doesn’t have to be.

Understanding how to increase your chances of getting approved for a credit card can open up new financial opportunities. With the right approach, you can navigate through the complexities of the application process smoothly. Whether you’re aiming to build credit, earn rewards, or manage expenses, getting that approval can be a game changer. In this guide, we’ll explore key factors that influence credit card approval and provide practical tips to help you succeed. Let’s dive in and demystify the credit card approval process together. Looking for a personal loan instead? Check out Personal Loans® for a quick and easy way to connect with lenders.

Introduction To Credit Card Approval

Credit card approval can seem like a mysterious process. Knowing what goes into it can ease your worries. Understanding the steps can boost your chances of getting approved.

Understanding The Credit Card Application Process

The credit card application process involves several key steps:

- Application Submission: You fill out an application with your personal information.

- Credit Check: The issuer checks your credit report and score.

- Income Verification: Your income is verified to ensure you can repay the debt.

- Approval Decision: The issuer makes a decision based on your creditworthiness.

A smooth application process requires accurate information. Any mistakes can delay or harm your chances of approval.

Importance Of Boosting Your Approval Chances

Boosting your approval chances involves simple but crucial steps:

- Maintain a Good Credit Score: Pay your bills on time and keep your credit utilization low.

- Check Your Credit Report: Review it for errors and get them corrected.

- Have a Stable Income: Ensure your income can support the credit limit you seek.

- Limit New Credit Applications: Too many applications can negatively impact your score.

These steps increase your chances of getting approved. They also help you get better terms and lower interest rates.

In summary, understanding the credit card approval process and taking steps to improve your creditworthiness can significantly enhance your chances of approval.

| Key Factors | Importance |

|---|---|

| Credit Score | Determines your creditworthiness |

| Income | Ensures you can repay the debt |

| Credit Utilization | Shows how much credit you use |

| Application Accuracy | Avoids delays and rejections |

By focusing on these factors, you can navigate the credit card approval process more effectively.

Key Factors That Influence Credit Card Approval

Understanding the key factors that influence credit card approval can make the process smoother. Different banks and financial institutions consider various aspects before approving a credit card application. Knowing these factors can help you prepare better and improve your chances of getting approved.

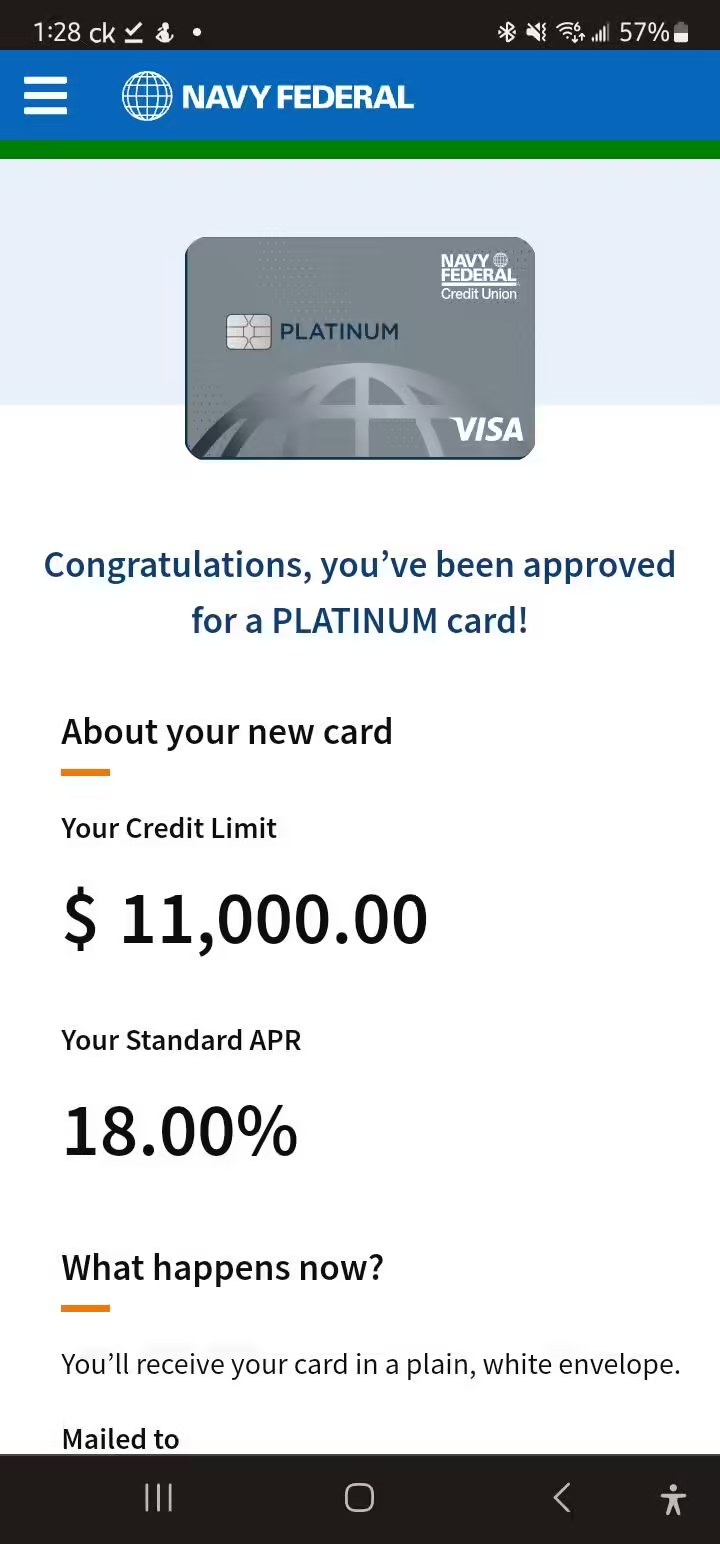

Credit Score And Its Impact

Your credit score plays a significant role in credit card approval. Lenders use it to assess your creditworthiness. A higher credit score indicates responsible credit behavior and reduces the risk for the lender. Credit scores typically range from 300 to 850. Aim for a score above 700 for better approval chances. Maintaining a good credit score involves timely payments, low credit card balances, and avoiding too many new credit inquiries.

Income And Employment Status

Lenders also consider your income and employment status. A steady income shows that you can repay your debts. While applying for a credit card, you will need to provide proof of income. This can include salary slips, bank statements, or tax returns. Stable employment history is also a plus, as it indicates job security and a consistent income stream.

Existing Debt Levels

Existing debt levels can impact your credit card approval. Lenders evaluate your debt-to-income ratio (DTI). This ratio compares your monthly debt payments to your monthly income. A lower DTI ratio is favorable as it shows you have sufficient income to manage new debt. Keep your DTI ratio below 36% for better chances of approval.

Credit History And Length

Your credit history and its length also influence credit card approval. Lenders prefer applicants with a longer credit history as it provides more information on their credit behavior. Positive credit history with timely payments can increase your approval chances. It’s essential to start building your credit early and maintain good credit habits over time.

In summary, focusing on these key factors can enhance your credit card approval chances. Regularly monitor your credit score, maintain a stable income, manage existing debts, and build a positive credit history for better outcomes.

Tips To Improve Your Credit Score

Improving your credit score is essential for better credit card approval rates and loan terms. Follow these tips to enhance your creditworthiness and financial health.

Paying Bills On Time

Paying your bills on time is crucial for maintaining a good credit score. Late payments can significantly impact your credit report. Set up reminders or automatic payments to avoid missing due dates. Consistent, on-time payments show lenders you are responsible.

Reducing Outstanding Debt

High levels of outstanding debt can harm your credit score. Focus on paying down your balances. Create a repayment plan and prioritize high-interest debts first. Reducing your debt improves your credit utilization ratio, which is a key factor in credit scoring.

Avoiding New Credit Inquiries

Applying for multiple credit cards or loans in a short period can lower your credit score. Each credit inquiry can cause a small, temporary dip. Space out your credit applications and only apply for new credit when necessary.

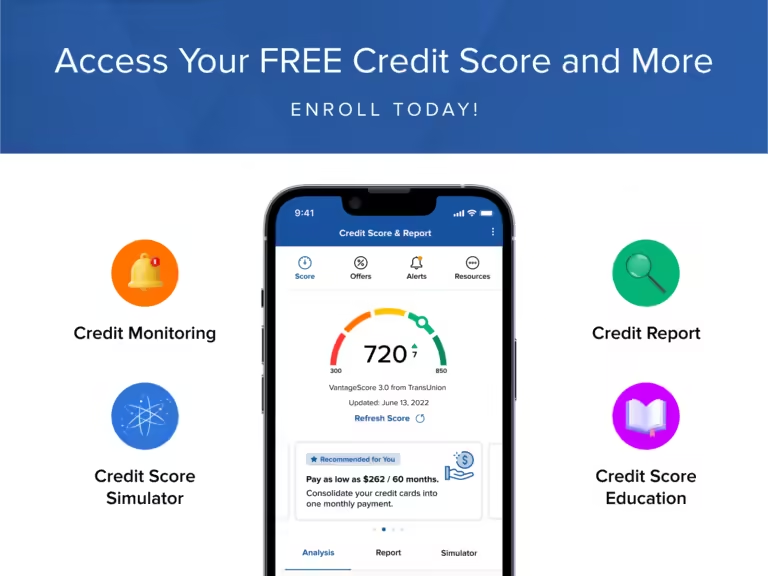

Correcting Errors On Credit Reports

Errors on your credit report can negatively impact your score. Regularly check your credit reports for inaccuracies. If you find any mistakes, dispute them with the credit bureau. Correcting errors can improve your credit score.

For further guidance on managing your finances, explore Personal Loans®. They offer a wide range of loan options and financial services to meet your needs.

How To Present A Strong Credit Card Application

Submitting a strong credit card application is crucial for approval. The process involves several steps that can influence the decision positively. Follow these essential tips to improve your chances of getting approved.

Providing Accurate And Complete Information

Ensure all the information you provide is accurate and complete. Lenders verify the details you submit, so any discrepancies may lead to rejection. Double-check your personal information, employment details, and financial records before submission.

| Information | Details to Include |

|---|---|

| Personal Information | Full name, date of birth, social security number, current address |

| Employment Details | Employer’s name, job title, employment duration |

| Financial Records | Annual income, existing debts, assets |

Highlighting Stable Income Sources

Show that you have a stable income source. Lenders need to see that you can manage monthly payments. Provide proof of employment, such as pay stubs or tax returns. If you have multiple income sources, list them all to strengthen your application.

- Pay stubs

- Tax returns

- Bank statements

Choosing The Right Type Of Credit Card

Select the credit card that suits your financial situation and needs. There are various types of credit cards available, including rewards cards, balance transfer cards, and secured cards. Research and choose the one that aligns with your spending habits and credit score.

- Rewards Cards: Best for earning points or cashback.

- Balance Transfer Cards: Ideal for consolidating existing debt.

- Secured Cards: Perfect for building or rebuilding credit.

Including A Co-signer, If Necessary

If your credit score is low, consider including a co-signer. A co-signer with a good credit history can enhance your application. They agree to pay the debt if you default, reducing the lender’s risk.

Ensure that your co-signer understands their responsibilities and the potential impact on their credit score.

For more information on managing personal finances and obtaining loans, visit Personal Loans®.

Understanding Different Types Of Credit Cards

Credit cards come in various types, each serving different needs. Understanding these types can help you choose the right card for your financial goals.

Secured Vs. Unsecured Credit Cards

Secured Credit Cards require a cash deposit as collateral. This deposit acts as your credit limit. These cards are ideal for building or rebuilding credit.

Unsecured Credit Cards do not require a deposit. They are the most common type of credit card and often come with rewards or other perks.

| Type | Deposit Required | Ideal For |

|---|---|---|

| Secured Credit Cards | Yes | Building/Rebuilding Credit |

| Unsecured Credit Cards | No | Everyday Use |

Student Credit Cards

Student Credit Cards are designed for college students with limited credit history. These cards often have lower credit limits and may offer rewards for responsible use.

- Lower credit limits

- Rewards for good grades

- Build credit history while studying

Business Credit Cards

Business Credit Cards help manage business expenses and often come with higher credit limits. They may offer rewards tailored to business spending categories like travel or office supplies.

- Separate business and personal expenses

- Higher credit limits

- Rewards for business-related purchases

Rewards And Cashback Credit Cards

Rewards Credit Cards offer points or miles for purchases. You can redeem these rewards for travel, merchandise, or other perks.

Cashback Credit Cards return a percentage of your spending as cash. This cash can be used as statement credits or deposited into your bank account.

| Type | Benefits |

|---|---|

| Rewards Credit Cards | Points or miles for purchases, redeemable for travel or merchandise |

| Cashback Credit Cards | Percentage of spending returned as cash |

Choosing the right credit card depends on your needs and spending habits. Evaluate the features and benefits of each type to make an informed decision.

For more details on personal loans, visit Personal Loans®.

Common Mistakes To Avoid When Applying For A Credit Card

Applying for a credit card can be a significant step in managing your finances. However, there are common mistakes that many people make during the application process. Avoiding these errors can improve your chances of approval and help you get the best possible terms.

Applying For Too Many Cards At Once

Submitting multiple credit card applications at the same time can negatively impact your credit score. Each application triggers a hard inquiry on your credit report. Multiple inquiries in a short period suggest financial instability to lenders.

Instead, space out your applications and research which card suits your needs best before applying. This approach minimizes the risk of rejection and keeps your credit score in check.

Ignoring Terms And Conditions

Many applicants skip reading the terms and conditions, which is a crucial mistake. The terms outline important details like interest rates, fees, and rewards. Ignoring this information can lead to unexpected charges and less favorable terms.

| Term | Importance |

|---|---|

| Interest Rate | Determines the cost of borrowing |

| Annual Fee | Yearly cost for using the card |

| Rewards | Benefits like cash back or travel points |

Always read the fine print to understand what you are agreeing to. This knowledge helps you avoid unpleasant surprises and manage your card effectively.

Overlooking Fees And Interest Rates

Fees and interest rates significantly impact the cost of using a credit card. Many cards come with fees such as annual charges, late payment fees, and balance transfer fees. High interest rates can also lead to substantial debt if balances are not paid off in full each month.

- Annual Fees: Some cards charge a yearly fee for membership.

- Late Payment Fees: Charges incurred for missing payment deadlines.

- Balance Transfer Fees: Costs associated with transferring debt from one card to another.

Compare the fees and interest rates of different cards to find the most cost-effective option. Paying attention to these details can save you money and prevent financial stress.

Pros And Cons Of Credit Card Use

Credit cards can be a valuable financial tool when used responsibly. They offer convenience and rewards but also come with potential risks. Understanding the benefits and pitfalls of credit card use can help you make informed decisions.

Benefits Of Responsible Credit Card Use

Using a credit card responsibly can bring several advantages:

- Convenience: Credit cards are easy to carry and use for purchases, both online and offline.

- Rewards: Many credit cards offer rewards such as cashback, points, or travel miles.

- Build Credit: Timely payments help improve your credit score, making it easier to obtain loans and better interest rates.

- Protection: Credit cards often provide fraud protection and purchase insurance, safeguarding you against unauthorized transactions.

- Emergency Fund: Credit cards can serve as a backup for unexpected expenses.

Potential Pitfalls And How To Avoid Them

While credit cards offer many benefits, they also have potential downsides:

- High-Interest Rates: Carrying a balance can lead to significant interest charges. To avoid this, try to pay off your balance in full each month.

- Debt Accumulation: It’s easy to overspend with a credit card. Set a budget and stick to it to prevent debt build-up.

- Fees: Some credit cards come with annual fees, late payment fees, or foreign transaction fees. Read the terms carefully and choose a card that fits your needs.

- Credit Score Impact: Late payments or high credit utilization can negatively affect your credit score. Monitor your spending and make timely payments.

By understanding the pros and cons, you can use credit cards to your advantage while avoiding common pitfalls. For more financial tips and resources, visit Personal Loans®.

Recommendations For Ideal Credit Card Users

Using a credit card wisely can greatly enhance your financial health. Here are some key recommendations for becoming an ideal credit card user. These tips help you build credit, maximize rewards, and avoid debt.

Best Practices For New Credit Card Users

For new credit card users, understanding the basics is crucial. Follow these best practices to start on the right foot:

- Pay your balance in full: Avoid interest charges by paying your balance every month.

- Keep track of spending: Monitor your expenses to stay within your budget.

- Understand your card’s terms: Know the interest rates, fees, and rewards associated with your card.

- Set up automatic payments: Ensure you never miss a payment by automating your credit card bill.

Strategies For Maximizing Rewards And Benefits

Credit cards offer various rewards and benefits that can be maximized with the right strategies. Here are some ways to get the most out of your credit card:

- Choose the right card: Select a card that offers rewards matching your spending habits.

- Utilize sign-up bonuses: Take advantage of introductory offers by meeting the spending requirements.

- Use your card for everyday purchases: Earn rewards on regular expenses like groceries and utilities.

- Redeem rewards smartly: Opt for the best redemption options, such as travel or cash back, to maximize value.

- Stay updated on promotions: Keep an eye on special offers and promotions to earn extra rewards.

By following these recommendations, you can become an ideal credit card user and enjoy the numerous benefits that come with responsible credit management.

Frequently Asked Questions

What Affects Credit Card Approval?

Credit card approval is influenced by your credit score, income, and debt-to-income ratio. Lenders also consider your employment status and credit history.

How Can I Improve My Credit Score?

To improve your credit score, pay bills on time, reduce debt, and avoid applying for multiple cards. Regularly check your credit report for errors.

Why Was My Credit Card Application Denied?

Your credit card application may be denied due to a low credit score, high debt, or insufficient income. Check the denial letter for specific reasons.

How Long Does Credit Card Approval Take?

Credit card approval can take minutes to weeks. Instant decisions are possible online, while paper applications may take longer.

Conclusion

Securing a credit card approval can be smooth with the right steps. Understand your credit, compare options, and apply confidently. Need extra funds? Consider exploring personal loans for quick access to cash. Personal Loans® offers a simple, free service connecting you to a network of lenders. Loans range from $250 to $35,000 with flexible terms. Fast funding options are available. Find more information and start your journey at Personal Loans®. Make informed financial decisions and manage your credit wisely.