Credit Card Applications: Tips for Instant Approval

Applying for a credit card can seem like a complex task. With so many options, where do you begin?

Credit cards offer convenience and financial flexibility, making them a popular choice for managing expenses. But the application process involves several steps and understanding what to look for in a card. This guide aims to simplify credit card applications, providing you with essential tips and insights to help you choose the right card for your needs. Whether you are seeking rewards, lower interest rates, or building your credit, knowing how to navigate credit card applications can save you time and effort. Let’s delve into the key aspects you need to consider before applying. Explore loan options at PersonalLoans.com for more financial flexibility.

Introduction To Credit Card Applications

Credit card applications can be a daunting process. Understanding the basics can help you make informed decisions. This guide will walk you through the essentials of applying for a credit card.

Understanding The Importance Of Credit Cards

Credit cards are more than just a convenient way to make purchases. They play a crucial role in building your credit score. A good credit score can help you secure loans with favorable terms. It can also impact your ability to rent an apartment or even get a job.

- Credit Building: Responsible use of credit cards helps build your credit history.

- Convenience: Credit cards offer a convenient way to pay for goods and services.

- Rewards: Many credit cards offer rewards like cash back, points, or travel miles.

Overview Of Instant Approval Credit Cards

Instant approval credit cards are a fast and convenient option. They provide a quick decision on your application. This can be especially useful in emergencies.

| Card Type | Benefits | Considerations |

|---|---|---|

| Cash Back Cards | Earn cash back on purchases. | May have annual fees. |

| Travel Cards | Accumulate travel miles for flights and hotels. | Often require good credit scores. |

| Balance Transfer Cards | Transfer balances from high-interest cards. | Introductory rates may expire quickly. |

Instant approval credit cards typically require a good credit score. Ensure you have all necessary documents ready before applying. This includes proof of income and personal identification.

Key Features Of Instant Approval Credit Cards

Instant approval credit cards offer a convenient way to access credit swiftly. These cards provide several key features that make the application process simple and efficient. Below, we explore the essential features of instant approval credit cards.

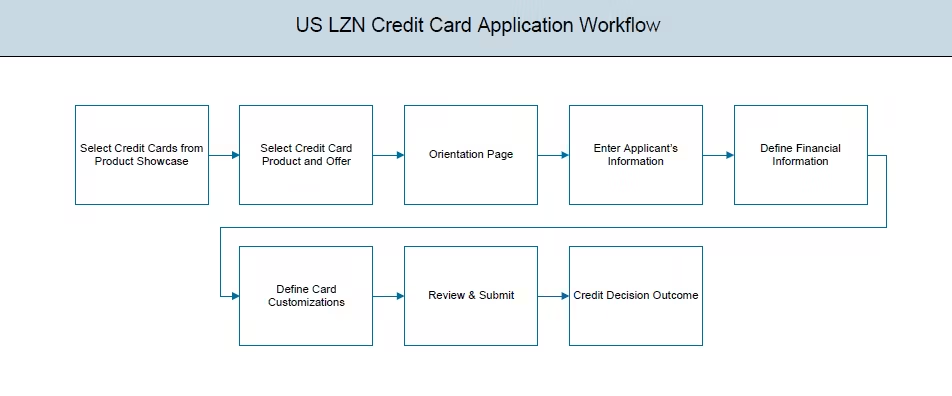

Quick And Easy Application Process

The application process for instant approval credit cards is designed to be quick and straightforward. Applicants can complete the form in just a few minutes. This streamlined process ensures that there are minimal delays.

Here are some steps involved:

- Provide basic personal information

- Enter financial details

- Submit the application

With a simple and hassle-free application, more people can access the credit they need promptly.

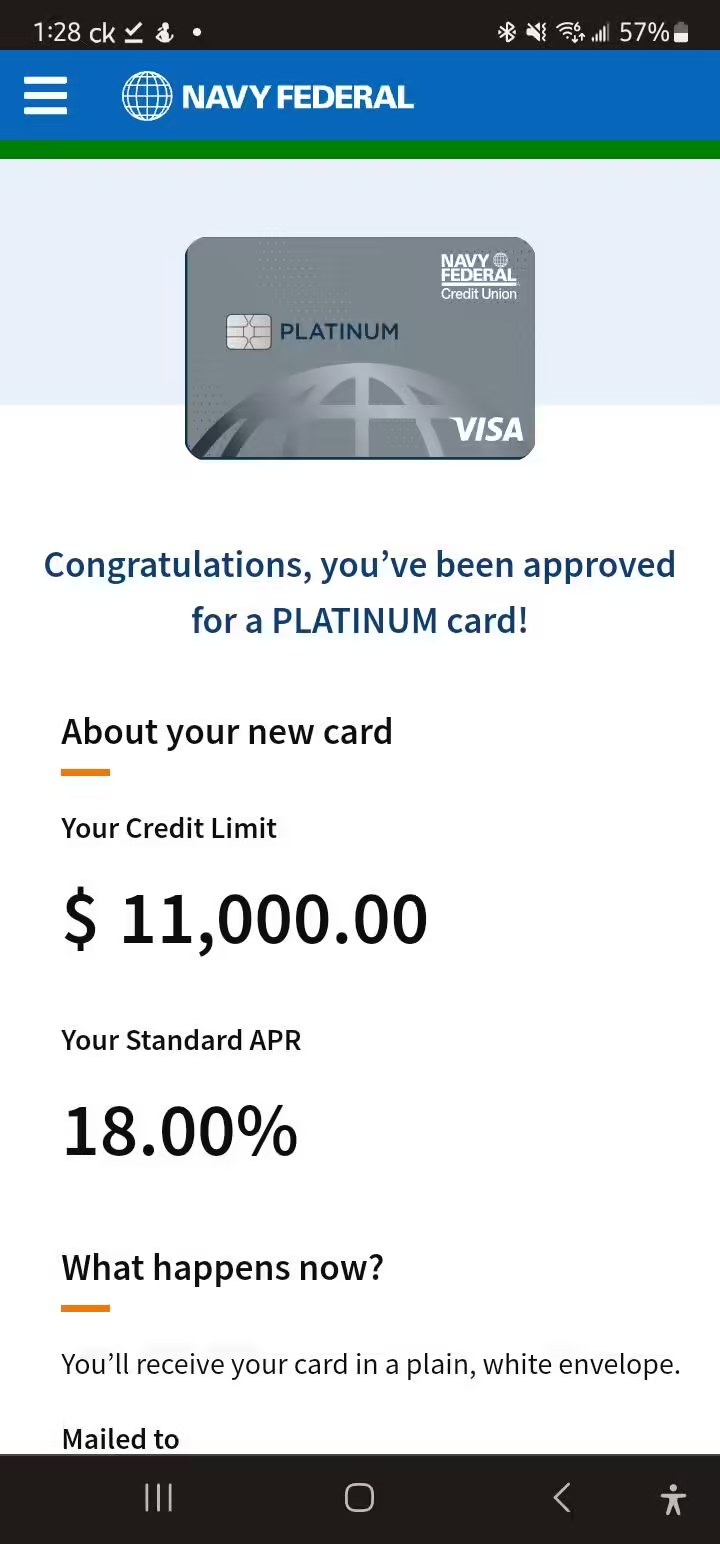

Immediate Decision On Approval

One of the standout features of instant approval credit cards is the immediate decision on approval. After submitting the application, applicants receive an instant response. No more waiting for days or weeks to know the outcome.

This immediate feedback helps applicants plan their finances better and reduces the anxiety of waiting.

Online And Mobile Application Options

Instant approval credit cards offer flexibility through online and mobile application options. Applicants can apply from the comfort of their home or on the go. This convenience caters to the needs of a tech-savvy generation.

Here are some benefits:

- Apply anytime, anywhere

- Access through desktops, tablets, or smartphones

- Secure application process with advanced data encryption

With these options, obtaining a credit card has never been more accessible or secure.

Tips For Boosting Your Chances Of Instant Approval

Applying for a credit card can be a daunting process. To improve your chances of instant approval, follow these practical tips. They will help you present the best possible application to lenders.

Maintain A Good Credit Score

Your credit score is a key factor in credit card approval. Lenders use it to assess your creditworthiness. To maintain a good score:

- Pay your bills on time

- Keep your credit utilization low

- Avoid opening too many new accounts

- Check your credit report for errors

Regularly monitoring your credit score ensures you catch and correct any issues promptly. This vigilance can significantly boost your chances of approval.

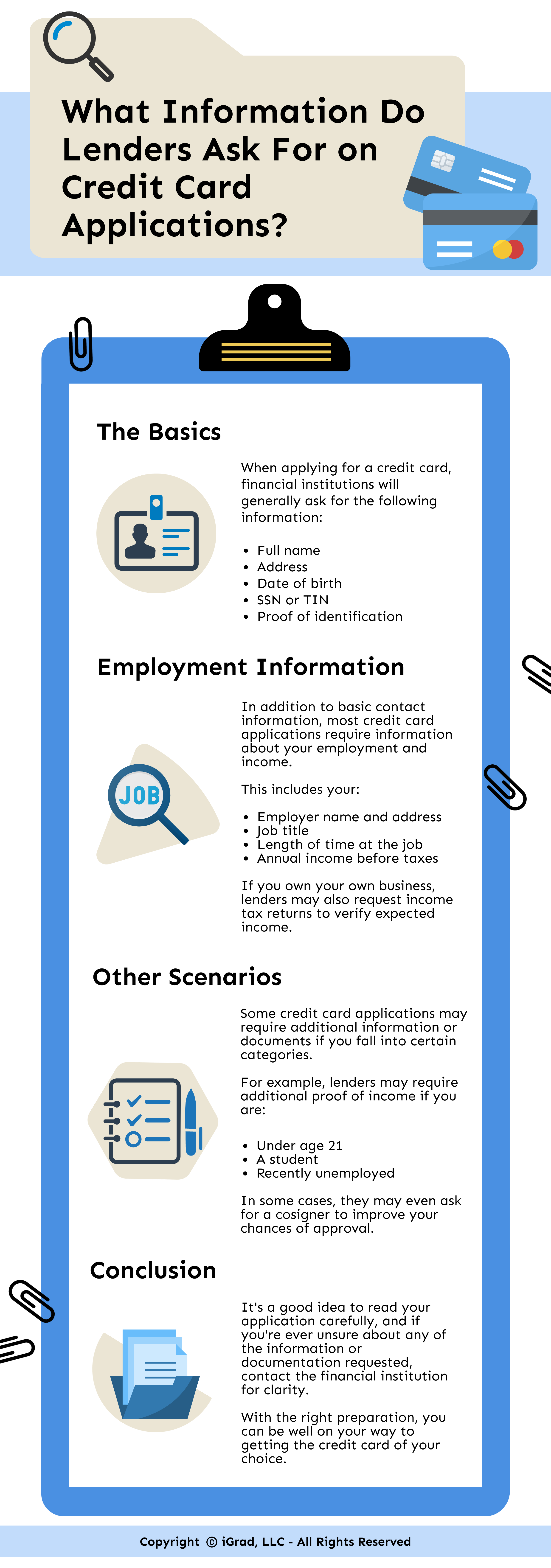

Ensure Accurate And Complete Application Information

Accuracy in your application is crucial. Lenders will verify the details you provide, so ensure they are correct and complete. Here’s a checklist for accuracy:

- Double-check your personal information

- Provide accurate income details

- Ensure your employment history is up to date

- Review your application for any missing information

Complete and accurate applications demonstrate reliability and reduce the chances of delays or rejections.

Limit The Number Of Applications Submitted

Submitting multiple applications can harm your credit score. Each application triggers a hard inquiry, which can lower your score. To avoid this:

- Research and choose the best card for your needs

- Check the eligibility criteria before applying

- Consider pre-qualification offers

By limiting your applications, you protect your credit score and increase the likelihood of approval.

Common Pitfalls To Avoid During Credit Card Applications

Applying for a credit card can be a smart financial move. But several common pitfalls can derail your application process. Let’s explore these pitfalls to ensure your application is smooth and successful.

Applying For Multiple Cards Simultaneously

Avoid applying for multiple credit cards at the same time. Each application triggers a hard inquiry on your credit report. Too many hard inquiries can lower your credit score. Lenders may view you as a high-risk applicant if they see numerous applications within a short period. Focus on one application at a time to maintain a healthy credit score.

Ignoring Terms And Conditions

Always read the terms and conditions before applying. Ignoring them can lead to unexpected fees and charges. Look for details about interest rates, annual fees, and reward programs. Make sure you understand the repayment terms and any penalties for late payments. Knowing these details helps you choose the best card for your needs.

Providing Inconsistent Information

Ensure all information on your application is consistent and accurate. Inconsistent information can lead to application rejection. Double-check your personal details, employment information, and income. Inaccurate data can delay the approval process or result in a declined application.

Here are some tips to avoid these common pitfalls:

- Check your credit score before applying.

- Research different credit cards to find the best fit.

- Read the fine print to understand all fees and charges.

- Keep your information consistent across all applications.

By following these tips, you can improve your chances of a successful credit card application.

Understanding Credit Card Fees And Charges

Applying for a credit card can be exciting, but it’s important to understand the fees and charges that come with it. These costs can impact your financial health if not managed properly. Let’s break down some common fees and charges associated with credit cards.

Annual Fees And Interest Rates

Many credit cards come with an annual fee. This is a charge you pay every year for the privilege of using the card. Some cards, especially those with rewards programs, have higher annual fees.

Interest rates are another critical aspect. The Annual Percentage Rate (APR) determines how much interest you will pay on carried balances. Higher APRs can lead to significant charges if you do not pay off your balance each month.

| Card Type | Annual Fee | APR Range |

|---|---|---|

| Basic | $0 – $50 | 12% – 20% |

| Rewards | $50 – $200 | 15% – 25% |

| Premium | $200+ | 18% – 30% |

Late Payment Penalties

Missing a payment or not paying at least the minimum amount due can result in late payment penalties. These fees can be substantial and negatively affect your credit score. Always try to make at least the minimum payment on time to avoid these penalties.

Foreign Transaction Fees

If you travel or make purchases from foreign merchants, you might incur foreign transaction fees. These are typically a percentage of the transaction amount, usually around 1% to 3%. Consider cards with no foreign transaction fees if you plan to travel frequently.

Understanding these fees and charges helps you manage your credit card wisely and avoid unnecessary costs. For more information on personal loans, visit PersonalLoans.com.

Pros And Cons Of Instant Approval Credit Cards

Instant approval credit cards offer a convenient way to get quick access to credit. They can be a great option if you need to make a purchase or cover an emergency expense. However, there are both benefits and potential downsides to consider.

Benefits Of Instant Approval

- Quick Access: Get approved and use your card almost immediately.

- Convenience: The application process is usually simple and can be completed online.

- Emergency Use: Ideal for unexpected expenses or emergencies.

- Credit Building: Helps build credit if used responsibly.

Potential Downsides To Consider

- Higher APR: Instant approval cards often come with higher interest rates.

- Limited Rewards: May offer fewer rewards or benefits compared to traditional credit cards.

- Credit Check: Approval may still require a credit check, affecting your credit score.

- Lower Limits: Initial credit limits might be lower than other cards.

Instant approval credit cards can be very beneficial, but it’s important to weigh the pros and cons. Consider your financial situation and needs before applying.

Ideal Users For Instant Approval Credit Cards

Instant approval credit cards offer quick access to credit, ideal for specific user groups. These cards can benefit frequent travelers, online shoppers, individuals with strong credit histories, and young adults or first-time credit card applicants. Let’s explore the benefits for each group.

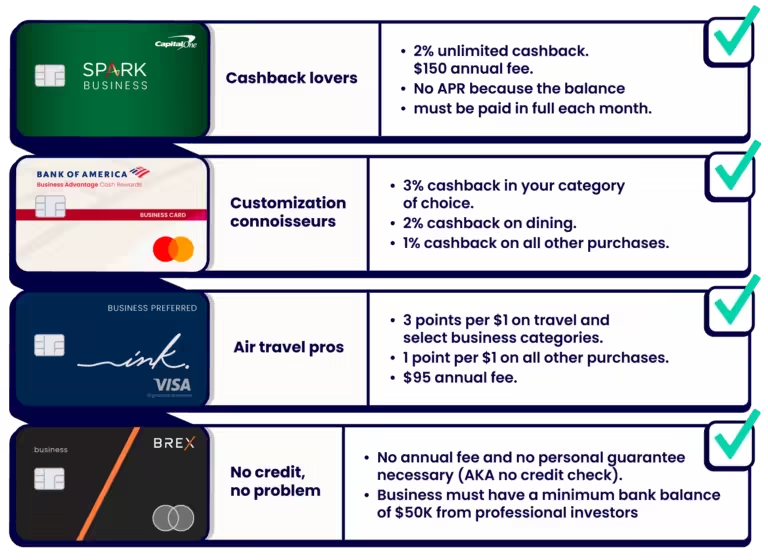

Frequent Travelers And Online Shoppers

Frequent travelers and online shoppers find instant approval credit cards very useful. For travelers, these cards often come with perks like:

- Travel rewards

- Airline miles

- Hotel discounts

Online shoppers can benefit from:

- Cashback offers

- Discounts on popular shopping sites

- Purchase protection

These features make shopping and traveling more rewarding and secure.

Individuals With Strong Credit Histories

Individuals with strong credit histories are ideal candidates for instant approval credit cards. These users typically enjoy:

- Higher credit limits

- Lower interest rates

- Exclusive offers

Strong credit histories make it easier to qualify for premium cards with better rewards and terms.

Young Adults And First-time Credit Card Applicants

Young adults and first-time credit card applicants can also benefit from instant approval credit cards. These cards help them:

- Build credit history

- Learn financial responsibility

- Access emergency funds

Starting with an instant approval card can simplify the process of establishing a solid credit foundation.

For more information on personal loans and other credit-related products, visit PersonalLoans.com.

Conclusion: Making The Right Choice For Your Financial Needs

Choosing the right credit card can have a significant impact on your financial health. Understanding your needs and comparing various options are crucial steps in making an informed decision. Let’s recap some key tips for instant approval and reflect on the importance of responsible credit card use.

Summarizing Key Tips For Instant Approval

- Check Your Credit Score: A higher credit score increases your chances of approval.

- Complete the Application Accurately: Ensure all details are correct to avoid delays.

- Meet Minimum Income Requirements: Verify that your income meets the card issuer’s criteria.

- Reduce Existing Debt: Lower your debt-to-income ratio to appear less risky to lenders.

- Limit Applications: Too many applications can negatively affect your credit score.

Final Thoughts On Responsible Credit Card Use

Responsible use of credit cards is essential for maintaining good credit health. Here are some tips to help you stay on track:

- Pay Your Balance in Full: Avoid interest charges by paying off your balance each month.

- Monitor Your Spending: Keep track of your expenses to avoid overspending.

- Set Up Payment Reminders: Ensure timely payments to avoid late fees and penalties.

- Review Statements Regularly: Check for any errors or unauthorized charges on your account.

- Use Rewards Wisely: Take advantage of rewards programs, but do not overspend to earn points.

By following these tips, you can make the most of your credit card while maintaining financial stability. Remember, the right credit card should align with your financial goals and needs.

For more information on personal loans and other credit-related products, visit PersonalLoans.com. They offer a wide range of options with competitive rates and flexible terms to suit your needs.

Frequently Asked Questions

What Is The Best Credit Card For Beginners?

The best credit card for beginners often has no annual fee. It offers rewards and a low-interest rate. Look for one with a simple rewards program.

How Long Does A Credit Card Application Take?

A credit card application usually takes a few minutes online. Approval can happen instantly or take a few days.

What Affects My Credit Card Approval?

Your credit score, income, and existing debt affect approval. Lenders review your credit history and ability to repay.

Can I Apply For Multiple Credit Cards At Once?

Yes, you can apply for multiple cards. However, multiple applications can impact your credit score temporarily.

Conclusion

Applying for a credit card can be a crucial financial step. With numerous options, choose wisely. Consider interest rates, fees, and rewards. Research and compare offerings. For more help with personal loans, visit PersonalLoans.com. Take control of your finances today. Stay informed, and make the best decisions for your needs.