Credit Card Alternatives: Top Options for Smart Spending

In today’s fast-paced world, credit cards aren’t the only way to manage your finances. Many people are now exploring alternatives to traditional credit cards that offer more flexibility and fewer fees.

Whether you’re looking to build your credit, avoid high interest rates, or simply find a better way to shop, there are plenty of options available. One such alternative is Perpay, a financial service that allows you to shop, build credit, and pay over time directly with your paycheck. Perpay offers an online marketplace where you can buy a wide range of products and pay for them in installments, without any interest or fees. Plus, their credit card can be used anywhere Mastercard is accepted, helping you earn rewards and build your credit history. Curious to learn more? Discover how Perpay can be a game-changer for your finances by visiting their website here. In this blog post, we’ll explore various credit card alternatives like Perpay, and how they can benefit you in managing your finances more effectively. Whether you’re new to credit or simply looking for a better way to pay, these alternatives can offer the flexibility and convenience you need. Let’s dive in!

Introduction To Credit Card Alternatives

For many, credit cards offer convenience and rewards, but they also come with risks like high-interest rates and debt. Understanding credit card alternatives can help you make smarter financial choices. In this section, we will explore the need for alternatives and an overview of smart spending strategies.

Understanding The Need For Alternatives

Credit cards can lead to significant debt if not managed well. The average credit card interest rate is around 16%. This high interest can quickly accumulate, making it hard to pay off your balance. Additionally, missed payments affect your credit score negatively. Therefore, many seek alternatives to avoid these pitfalls.

Alternatives like Perpay offer unique solutions. Perpay allows you to shop and pay over time without interest or fees. The payments are deducted directly from your paycheck, helping you manage your finances better. Plus, it helps build your credit score, typically increasing it by 36 points within three months.

Overview Of Smart Spending

Smart spending involves making informed choices to manage your money wisely. Here are some tips to help you spend smarter:

- Budgeting: Track your income and expenses to avoid overspending.

- Prioritize Needs Over Wants: Focus on essential expenses before spending on luxuries.

- Use Alternatives: Consider options like Perpay that allow you to pay over time without interest.

Perpay’s marketplace offers a $1,000 credit line to shop for electronics, home goods, apparel, and more. You can earn 2% rewards on purchases, adding value to every transaction. The automatic payments from your paycheck ensure you never miss a payment, helping you maintain a positive credit history.

| Feature | Description |

|---|---|

| Perpay Marketplace | Shop top brands with a $1,000 credit line. |

| Perpay Credit Card | Use anywhere Mastercard is accepted and earn 2% rewards. |

| Credit Building | Automatic payments help build credit history. |

| No Interest or Fees | Pay over time without interest or fees. |

| Mobile Accessibility | Manage your account and shop with the Perpay app. |

Choosing the right financial tools can make a significant difference in your financial health. With alternatives like Perpay, you can enjoy the benefits of credit without the associated risks. Always consider the terms and conditions and choose the option that best fits your financial situation.

Top Credit Card Alternatives

Credit cards offer convenience, but they are not the only option. Explore these top alternatives to find what suits your financial needs best. Each has unique benefits, from direct access to controlled spending and more.

Debit Cards: Direct Access To Your Money

Debit cards link directly to your bank account. You spend only what you have, avoiding debt. They are widely accepted and offer the same convenience as credit cards.

Prepaid Cards: Controlled Spending

Prepaid cards let you load a specific amount onto the card. You can only spend what is loaded, making it easy to control spending. They are useful for budgeting and for those who want to avoid overspending.

Mobile Payment Solutions: Convenience And Security

Mobile payment solutions like Apple Pay and Google Wallet offer secure, contactless payments. They use encryption and tokenization for added security. Many retailers accept these payments, making them a convenient option.

Buy Now, Pay Later Services: Flexible Payments

Buy Now, Pay Later services like Perpay allow you to make purchases and pay over time. Perpay offers an online marketplace and a credit card with no interest or fees. Payments are made directly from your paycheck, helping to build credit.

| Service | Feature |

|---|---|

| Perpay | Shop top brands with $1,000 credit |

| Perpay Credit Card | Use anywhere Mastercard is accepted |

| Credit Building | Improve credit score with timely payments |

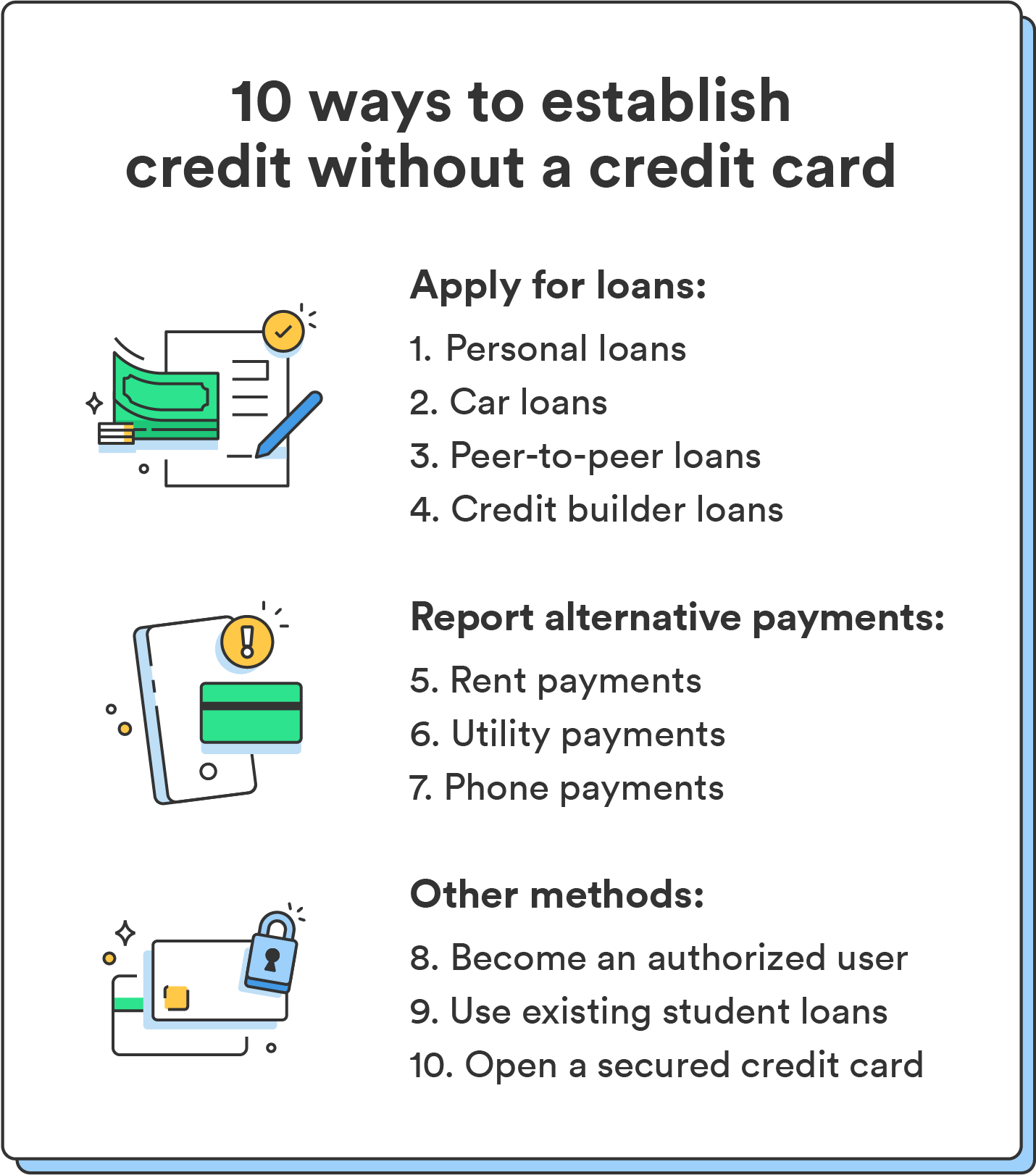

Secured Credit Cards: Building Credit Safely

Secured credit cards require a cash deposit as collateral. They help build or rebuild credit. The deposit reduces risk for the issuer, making approval easier for those with poor credit.

Peer-to-peer Payment Apps: Instant Transfers

Peer-to-peer payment apps like Venmo and PayPal allow instant money transfers. They are ideal for splitting bills or sending money to friends and family. These apps are easy to use and widely accepted.

Key Features And Benefits Of Each Alternative

Finding a suitable alternative to credit cards can help you manage your finances better. Here we explore the key features and benefits of various credit card alternatives.

Debit Cards: No Interest Fees

Debit cards are linked directly to your bank account. Key benefits include:

- No Interest Fees: You only spend what you have, avoiding debt.

- Budget Control: Helps in managing your budget effectively.

- Instant Transactions: Payments are processed immediately.

Prepaid Cards: Budget Management

Prepaid cards allow you to load money onto the card before spending. Key features include:

- Spending Limit: You can only spend the loaded amount, aiding in budget management.

- No Credit Check: Ideal for those with poor credit history.

- Widely Accepted: Can be used anywhere major cards are accepted.

Mobile Payment Solutions: Enhanced Security

Mobile payment solutions like Apple Pay and Google Wallet offer secure transactions. Key benefits include:

- Enhanced Security: Uses encryption to protect your data.

- Convenience: Pay using your smartphone without carrying physical cards.

- Quick Transactions: Faster checkout times with contactless payments.

Buy Now, Pay Later Services: Interest-free Periods

Services like Perpay allow you to shop and pay over time. Key features include:

- Interest-Free Periods: Pay in installments without interest fees.

- Credit Building: Helps improve your credit score with timely payments.

- Rewards Program: Earn rewards on purchases and payments.

Secured Credit Cards: Improving Credit Scores

Secured credit cards require a deposit as collateral. Key benefits include:

- Credit Building: Helps improve your credit score with responsible use.

- Approval Chances: Higher approval rates for those with poor credit.

- Deposit Safety: Your deposit is refundable after closing the account.

Peer-to-peer Payment Apps: User-friendly Interfaces

Apps like Venmo and PayPal offer easy money transfers. Key features include:

- User-Friendly Interfaces: Simple and intuitive app interfaces.

- Instant Transfers: Quick and easy money transfers between users.

- Low Fees: Minimal transaction fees for sending money.

Pricing And Affordability Breakdown

Exploring alternatives to traditional credit cards can be crucial for financial health. Let’s dive into the pricing and affordability of various options.

Debit Cards: Minimal Fees

Debit cards are widely used due to their minimal fees. They link directly to your bank account, allowing you to spend only what you have. Here is a quick look at the common fees associated with debit cards:

- Monthly Maintenance Fees: Usually waived if certain conditions are met.

- ATM Fees: May apply if using out-of-network ATMs.

- Overdraft Fees: Charged if you spend more than your balance.

Prepaid Cards: Reloading Costs

Prepaid cards require you to load money onto the card before use. They are convenient but come with various reloading costs:

- Reload Fees: Typically range from $1 to $5 per transaction.

- Monthly Fees: Some cards charge a monthly fee, usually around $5.

- ATM Withdrawal Fees: Often higher than debit cards, around $2 to $3 per transaction.

Mobile Payment Solutions: Transaction Fees

Mobile payment solutions like Apple Pay, Google Pay, and PayPal offer convenience but may include transaction fees:

- Merchant Fees: Typically borne by the merchant, not the user.

- Transfer Fees: For sending money to friends or family, fees can be around 2.9% plus a fixed fee.

- Currency Conversion Fees: Additional charges for international transactions.

Buy Now, Pay Later Services: Late Payment Fees

Buy Now, Pay Later (BNPL) services such as Afterpay and Klarna allow you to split payments into smaller installments. Watch out for these fees:

- Late Payment Fees: Ranging from $5 to $10 per missed payment.

- Interest Charges: Some BNPL services may charge interest on longer-term plans.

Secured Credit Cards: Security Deposits

Secured credit cards require a security deposit, which acts as your credit limit. Understanding the costs involved is essential:

- Security Deposit: Typically $200 to $500, refundable if the account is in good standing.

- Annual Fees: Some cards charge an annual fee, around $25 to $50.

- Interest Rates: Similar to unsecured cards, ranging from 15% to 25% APR.

Peer-to-peer Payment Apps: Transfer Fees

Peer-to-peer (P2P) payment apps like Venmo and Cash App offer quick transfers but may have associated fees:

- Instant Transfer Fees: Usually 1% to 1.5% of the transfer amount.

- Standard Transfer Fees: Free if you opt for the standard transfer time (1-3 business days).

- Credit Card Fees: Typically around 3% if using a credit card to fund the transfer.

Understanding the various fees and costs associated with these credit card alternatives can help you make informed financial decisions. Whether you prefer the minimal fees of debit cards or the convenience of mobile payment solutions, knowing the costs involved is key to managing your finances effectively.

Pros And Cons Of Credit Card Alternatives

Credit cards offer convenience, rewards, and credit building, but they also come with high-interest rates and fees. Understanding credit card alternatives helps you make informed financial decisions. Let’s delve into the pros and cons of various alternatives.

Debit Cards: Pros And Cons

Debit cards are linked to your bank account and offer a straightforward way to spend money you already have. They are widely accepted, easy to use, and there are no interest charges. However, they do not help build your credit score, and losing your card can give direct access to your funds.

| Pros | Cons |

|---|---|

| No interest charges | No credit building |

| Widely accepted | Direct access to bank funds |

Prepaid Cards: Pros And Cons

Prepaid cards require you to load money onto the card before use. They offer control over spending and are available without a bank account. However, they come with fees for loading money, ATM withdrawals, and inactivity. They also don’t build credit.

- Pros: No overdraft risk, no bank account needed.

- Cons: Fees, no credit building.

Mobile Payment Solutions: Pros And Cons

Mobile payment solutions like Apple Pay and Google Pay offer convenience and security. Payments are quick, and you can track spending easily. Yet, they rely on having a smartphone and may not be accepted everywhere.

- Pros: Convenience, security.

- Cons: Requires a smartphone, limited acceptance.

Buy Now, Pay Later Services: Pros And Cons

Buy Now, Pay Later (BNPL) services, such as Klarna or Afterpay, let you split purchases into installments. They offer no interest if paid on time and can be helpful for budgeting. The downside is potential late fees and the risk of overspending.

| Pros | Cons |

|---|---|

| No interest (if paid on time) | Potential late fees |

| Helps budget large purchases | Risk of overspending |

Secured Credit Cards: Pros And Cons

Secured credit cards require a cash deposit as collateral. They are good for building or rebuilding credit. They usually have lower credit limits and may come with fees. Your deposit is at risk if you don’t pay your balance.

- Pros: Builds credit, accessible for low credit scores.

- Cons: Requires a deposit, potential fees.

Peer-to-peer Payment Apps: Pros And Cons

Peer-to-peer (P2P) payment apps like Venmo and PayPal make sending money to friends easy. They are convenient and fast. Yet, they may charge fees for instant transfers, and funds are not FDIC insured.

- Pros: Fast, convenient.

- Cons: Fees for instant transfers, not FDIC insured.

Specific Recommendations For Ideal Users

Choosing the right credit card alternative depends on your financial habits, credit history, and spending needs. Here, we break down the best options for different types of users, helping you make an informed decision.

Who Should Use Debit Cards?

Debit cards are ideal for those who prefer to spend only what they have. They are directly linked to your bank account, ensuring you don’t overspend.

- Great for individuals with a tight budget

- Reduces the risk of debt accumulation

- Perfect for day-to-day purchases

Who Should Use Prepaid Cards?

Prepaid cards work well for those who want to control their spending. You load funds onto the card and can only use the available balance.

- Ideal for teenagers and young adults learning financial responsibility

- Useful for managing allowances or specific budgets

- No credit check required

Who Should Use Mobile Payment Solutions?

Mobile payment solutions, such as Apple Pay or Google Wallet, suit tech-savvy users. They offer convenience and security for digital transactions.

- Perfect for frequent online shoppers

- Ensures secure payments with encryption

- Easy to track spending via mobile apps

Who Should Use Buy Now, Pay Later Services?

Buy Now, Pay Later (BNPL) services like Afterpay or Klarna are great for those who want flexibility. They allow you to make purchases and pay in installments.

- Ideal for larger purchases without upfront cost

- No interest if paid on time

- Helps manage cash flow

Who Should Use Secured Credit Cards?

Secured credit cards are excellent for individuals rebuilding or establishing credit. They require a security deposit, which acts as your credit limit.

- Great for those with poor or no credit history

- Helps build credit score with responsible use

- Usually reports to major credit bureaus

Who Should Use Peer-to-peer Payment Apps?

Peer-to-Peer (P2P) payment apps like Venmo or Zelle are perfect for quick, easy transfers between individuals. They are convenient for splitting bills and sending money to friends or family.

- Best for social payments and small transactions

- Instant transfers and low fees

- Easy to use with mobile integration

Frequently Asked Questions

What Are Some Credit Card Alternatives?

Credit card alternatives include debit cards, prepaid cards, and digital wallets. These options often come with fewer fees. They also help you avoid debt.

How Do Prepaid Cards Work?

Prepaid cards are loaded with a specific amount of money. They work like debit cards. You can only spend the loaded amount.

Are Digital Wallets Safe?

Yes, digital wallets are generally safe. They use encryption and tokenization to protect your information. Always use strong passwords and enable two-factor authentication.

Can Debit Cards Help Build Credit?

No, debit cards do not help build credit. They are linked directly to your bank account. Only credit cards or certain loans can build credit.

Conclusion

Exploring credit card alternatives can simplify your financial life. Consider Perpay for a flexible solution. Perpay offers a unique marketplace, easy payments, and credit-building features. Manage spending wisely with no interest or fees. Improve your credit score over time and enjoy convenient shopping. Choose what’s right for your financial goals.