Credit Building Tips: Proven Strategies to Boost Your Score

Building a strong credit score is essential for financial health. It helps secure loans, get better interest rates, and more.

In this guide, we’ll explore practical credit building tips to improve your credit score. Good credit isn’t built overnight. It takes careful planning and smart financial habits. Understanding how credit works can make a big difference in reaching your financial goals. By following these tips, you’ll learn how to manage your credit effectively. From paying bills on time to using credit wisely, these strategies can help you boost your credit score. Plus, you’ll discover useful tools like Freecash that can provide extra income through simple tasks. Start your journey to better credit today and enjoy the financial benefits that come with it. For more information, visit Freecash.

Introduction To Credit Building

Building good credit is essential for financial health. Understanding the steps to improve your credit score can lead to better opportunities for loans, credit cards, and even renting an apartment. Let’s explore the basics of credit building.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Higher scores indicate better creditworthiness. Major credit bureaus like Equifax, Experian, and TransUnion calculate these scores based on your credit history.

The key factors influencing your credit score include:

- Payment History

- Credit Utilization

- Length of Credit History

- New Credit Inquiries

- Types of Credit Used

Keeping these factors in mind can help you maintain a healthy credit score.

Why Building Credit Is Important

Having a good credit score can open doors to various financial benefits. Here are some reasons why building credit is crucial:

- Loan Approval: Lenders look at your credit score before approving loans.

- Lower Interest Rates: Better credit scores often result in lower interest rates on loans and credit cards.

- Higher Credit Limits: With good credit, you can qualify for higher credit limits.

- Rental Opportunities: Landlords may check your credit score when you apply to rent an apartment.

- Employment Opportunities: Some employers review credit scores as part of their hiring process.

Improving your credit score can enhance your financial stability and open up more opportunities.

Key Factors Influencing Your Credit Score

Your credit score is a crucial part of your financial health. Several key factors influence it. Understanding these factors can help you build and maintain a strong credit score.

Payment History

Your payment history is the most significant factor. It makes up 35% of your credit score. Lenders want to see that you pay your bills on time. Even one missed payment can lower your score. Regular, on-time payments build trust and improve your score.

Credit Utilization Ratio

The credit utilization ratio is the amount of credit you use compared to your total credit limit. This factor accounts for 30% of your score. Keeping your credit utilization below 30% is ideal. For example, if you have a $10,000 credit limit, try to keep your balance below $3,000. High utilization can signal financial distress.

Length Of Credit History

The length of your credit history contributes 15% to your score. A longer credit history shows lenders that you have experience managing credit. Even if you no longer use an old account, keeping it open can positively impact your score. Closing old accounts can shorten your credit history.

Types Of Credit

Having a mix of different types of credit accounts for 10% of your credit score. Lenders like to see that you can handle various types of credit, such as credit cards, mortgages, and auto loans. A diverse credit portfolio can boost your score.

New Credit Inquiries

New credit inquiries make up 10% of your score. Each time you apply for new credit, a hard inquiry is recorded on your report. Too many hard inquiries in a short period can lower your score. Limit new credit applications to maintain a healthy score.

By focusing on these key factors, you can build a strong credit score. Remember, consistency is essential. Regularly monitor your credit report to stay on top of any changes or errors. This proactive approach will help you achieve your financial goals.

Proven Strategies To Boost Your Credit Score

Improving your credit score takes time and effort. Following proven strategies can help you reach your goal faster. These tips will guide you through the process of building a strong credit score.

Paying Bills On Time

Paying bills on time is crucial for building good credit. Late payments can negatively impact your credit score. Set up reminders or automate payments to ensure timely bill payments.

Reducing Outstanding Debt

High debt levels can hurt your credit score. Focus on paying down outstanding balances. Consider using a budget to manage your finances better. Aim to keep credit card balances low relative to your credit limit.

Avoiding New Hard Inquiries

Each hard inquiry can slightly lower your credit score. Limit the number of new credit applications. Only apply for credit when necessary. Hard inquiries stay on your report for two years.

Using Credit Cards Wisely

Credit cards can be useful tools for building credit. Use them responsibly by keeping balances low. Pay off the full balance each month to avoid interest charges. Avoid maxing out your credit cards.

Becoming An Authorized User

Ask a trusted friend or family member to add you as an authorized user. Their positive credit history can benefit your score. Ensure they have good credit habits before joining their account.

Checking Credit Reports Regularly

Regularly check your credit reports for errors. Dispute any inaccuracies you find. Monitoring your credit helps you stay on track. Free annual reports are available from major credit bureaus.

Tools And Resources To Help Build Credit

Building credit can seem challenging, but various tools and resources can simplify the process. Here are some effective options to help you improve your credit score.

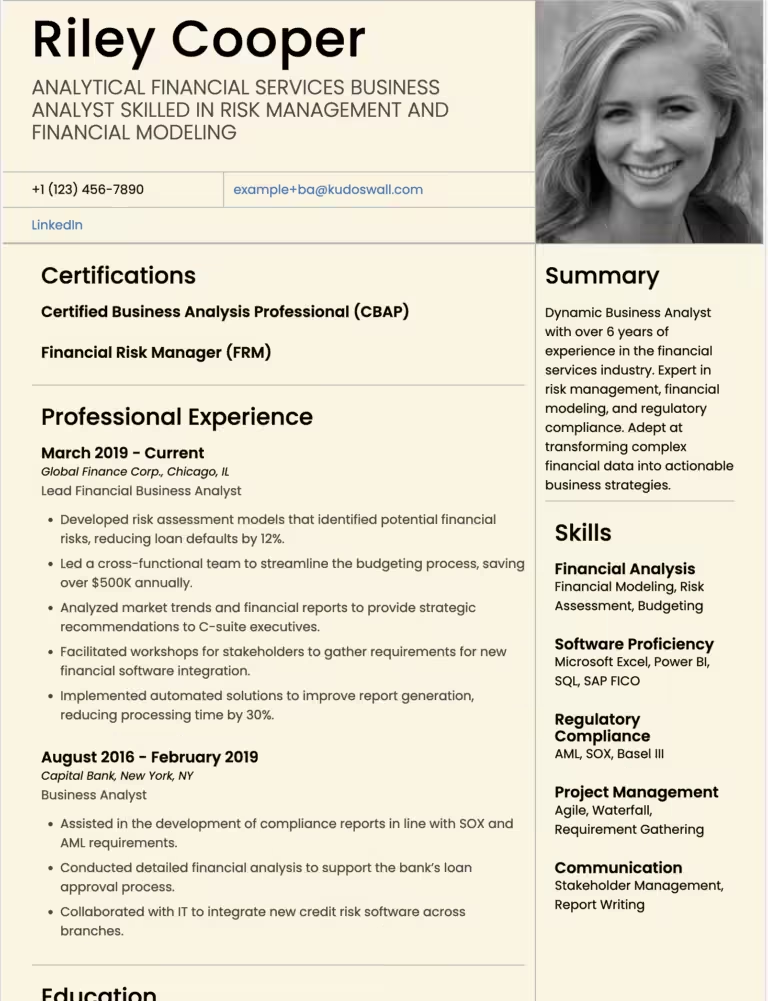

Credit Builder Loans

Credit builder loans are specifically designed to help individuals build or rebuild their credit. These loans work by holding the borrowed amount in a bank account while you make monthly payments. Once the loan is paid off, the funds are released to you. This method helps establish a positive payment history, which is crucial for building credit.

Secured Credit Cards

Secured credit cards require a deposit that serves as collateral. The deposit amount usually determines your credit limit. Using a secured credit card responsibly, such as making timely payments and keeping your balance low, can help improve your credit score over time. Secured cards are a great way to demonstrate your ability to manage credit.

Credit Monitoring Services

Credit monitoring services track changes to your credit report and alert you of any significant updates. These services can help you stay informed about your credit status and identify any potential fraudulent activities. By regularly checking your credit report, you can ensure that your credit-building efforts are on track.

Financial Counseling And Education

Financial counseling and education provide valuable insights into managing your finances and improving your credit. Many non-profit organizations offer free or low-cost counseling services. These sessions can help you understand your credit report, develop a budget, and create a plan to pay off debt. Educating yourself about personal finance can empower you to make better financial decisions.

Common Mistakes To Avoid

Building credit requires careful management. Avoiding common mistakes can help you maintain a healthy credit score. Here are some frequent errors to steer clear of.

Missing Payments

Missing payments can significantly damage your credit score. Always make payments on time. Set up reminders or automatic payments to avoid late fees.

Maxing Out Credit Cards

Maxing out credit cards hurts your credit utilization ratio. Keep your credit card balances below 30% of your limit. This improves your credit score.

Closing Old Accounts

Closing old accounts can shorten your credit history. Longer credit histories are better for your score. Keep old accounts open, even if unused.

Applying For Multiple Credit Lines At Once

Applying for multiple credit lines at once can lower your credit score. Each application results in a hard inquiry. Too many inquiries suggest financial instability.

How To Maintain A Good Credit Score Over Time

Maintaining a good credit score requires consistent effort and smart financial habits. It’s essential to keep an eye on your credit report and make necessary adjustments to ensure a healthy credit profile. Below are some effective tips to help you maintain a good credit score over time.

Consistent Monitoring And Management

Regular monitoring of your credit report is crucial. Check for any errors or unusual activities. You can access your credit report for free once a year from major credit bureaus. Look out for:

- Incorrect personal information

- Unauthorized accounts or inquiries

- Discrepancies in account balances and payment history

Address any discrepancies immediately by contacting the credit bureau and the creditor involved. Keeping your credit report error-free helps in maintaining a good credit score.

Staying Informed About Credit Score Changes

Stay updated with any changes in your credit score. Many financial institutions and credit monitoring services offer alerts for significant changes in your score. These alerts help you:

- Identify potential fraud or identity theft

- Understand the impact of your financial actions on your credit score

- Make informed decisions about future credit applications

Understanding the factors that affect your credit score can help you take proactive measures to maintain or improve it.

Adjusting Financial Habits As Needed

Healthy financial habits are key to maintaining a good credit score. Consider the following tips:

- Pay bills on time: Timely payments are one of the most important factors in your credit score. Set up reminders or automate payments to avoid late fees.

- Keep credit utilization low: Aim to use less than 30% of your available credit. High credit utilization can negatively impact your score.

- Limit new credit applications: Multiple credit inquiries within a short period can lower your score. Only apply for new credit when necessary.

Adjusting your financial habits accordingly helps in building a strong credit history. Consistency in these practices ensures a good credit score over time.

Conclusion And Final Recommendations

Building credit is crucial for financial stability. Following key strategies can help you achieve this goal effectively. Below are some final thoughts and recommendations to guide you on your credit-building journey.

Recap Of Key Strategies

Let’s summarize the essential credit-building strategies discussed:

- Pay Bills on Time: Timely payments positively impact your credit score.

- Keep Balances Low: Maintain low credit card balances to improve your score.

- Diversify Credit Types: Use a mix of credit types like credit cards and loans.

- Regularly Check Credit Reports: Monitor your credit report for errors and discrepancies.

- Limit New Credit Applications: Avoid too many new credit inquiries in a short period.

Encouragement To Take Action

Start today. Each step brings you closer to a better credit score. Use the tips and strategies to build and maintain good credit. Stay committed and consistent in your efforts.

Additional Resources For Ongoing Support

For continuous support and resources, consider the following:

- Freecash.com: Earn extra money by completing tasks like surveys and watching videos. Convert points into cash to manage your finances better.

- Consumer Financial Protection Bureau: Offers resources and tools for managing credit.

- Annual Credit Report: Get free credit reports from major credit bureaus annually.

Implement these strategies and use available resources to build a solid credit foundation. It’s a journey worth taking for your financial future.

Frequently Asked Questions

How Can I Start Building Credit?

To start building credit, open a secured credit card. Pay your bills on time. Keep credit utilization low. Monitor your credit report regularly.

What Is The Fastest Way To Build Credit?

The fastest way to build credit is by paying bills on time. Also, keep your credit utilization below 30%. Consider using a credit-builder loan.

Does Paying Rent Help Build Credit?

Yes, paying rent can help build credit. Use rent reporting services to report payments to credit bureaus. Ensure timely payments for a positive impact.

How Often Should I Check My Credit Report?

Check your credit report at least once a year. Regular monitoring helps identify errors and detect fraud early.

Conclusion

Building credit takes time and effort. Consistent good habits matter. Use your credit card responsibly. Pay bills on time. Keep balances low. Check your credit report regularly. Consider various earning opportunities, like Freecash. It offers ways to earn extra cash. Extra income can help manage bills. Remember, patience and discipline are key. Stick to these tips. Watch your credit score improve. Your financial future will benefit.