Credit Alerts: Protect Your Finances with Real-Time Updates

Credit alerts can be crucial for managing your financial health. They notify you of changes to your credit report, helping you stay informed and proactive.

Understanding how credit alerts work can empower you to take control of your financial future. These alerts provide real-time updates on your credit score and report, ensuring you are always aware of any significant changes. With tools like Credit Sesame, you can receive daily updates, personalized actions to improve your credit score, and tailored credit offers. This can be especially helpful in avoiding identity theft and ensuring that your credit remains in good standing. Keep reading to learn more about the benefits of credit alerts and how they can help you stay financially secure. To explore Credit Sesame, visit Credit Sesame.

Introduction To Credit Alerts

Managing credit is crucial for financial health. Credit alerts help you stay informed about changes to your credit profile. They provide real-time updates, aiding in proactive financial management. Below, we explore what credit alerts are and why they are important.

What Are Credit Alerts?

Credit alerts are notifications sent to you about changes in your credit report. These changes could include:

- New credit inquiries

- Updates to existing accounts

- New accounts being opened

- Changes in your credit score

Credit Sesame, for instance, offers daily credit score updates and comprehensive monitoring. This service ensures you know what impacts your credit and when changes happen. With tools like Sesame Grade, you receive a letter grade based on factors affecting your credit score.

The Importance Of Credit Alerts

Credit alerts are vital for several reasons:

- Identity Theft Prevention: Alerts notify you of suspicious activities, helping you detect and address potential identity theft quickly.

- Financial Management: Regular updates allow you to track your credit health, manage debts, and stay informed of credit score changes.

- Credit Building: Services like Credit Sesame offer personalized actions to improve your credit score, alongside tools like the Credit Builder feature.

- Application Confidence: Understanding your credit profile helps in applying for new credit products with better approval odds.

Additionally, Credit Sesame provides free access to your credit score and report, without requiring a credit card for sign-up. This makes credit monitoring accessible to everyone.

| Feature | Description |

|---|---|

| Daily Credit Score Updates | Check your credit score daily without any charges. |

| Sesame Grade | Receive a letter grade based on the five major factors impacting your credit score. |

| Personalized Actions | Get tailored actions to improve your credit score. |

| Credit Offers | Find the best credit offers with a high chance of approval based on your credit profile. |

| Credit Builder | Build credit using everyday purchases with a prepaid debit card (Sesame Cash). |

By staying informed through credit alerts, you take control of your financial future. Credit Sesame’s features and benefits make it easier to manage and build your credit effectively.

Key Features Of Credit Alerts

Credit alerts are essential tools for managing and protecting your credit health. With Credit Sesame, you receive comprehensive credit monitoring services that offer several key features to stay informed and secure. Below, we explore the main features that make credit alerts indispensable.

Real-time Updates

With Credit Sesame, you get real-time updates on your credit activities. Whenever there is a significant change, you will be notified immediately. These updates help you stay aware of any suspicious activities that could affect your credit score.

Customizable Alert Settings

Credit Sesame allows you to customize your alert settings. You can choose which types of alerts you want to receive. For instance, you might want to be notified about new credit inquiries, changes in your credit score, or any new accounts opened in your name. This flexibility ensures you get only the alerts that matter most to you.

Comprehensive Monitoring

The platform offers comprehensive monitoring of your credit profile. This includes monitoring your credit score, credit report, and any changes that occur. Credit Sesame keeps track of factors impacting your credit, ensuring you have a clear picture of your credit health at all times.

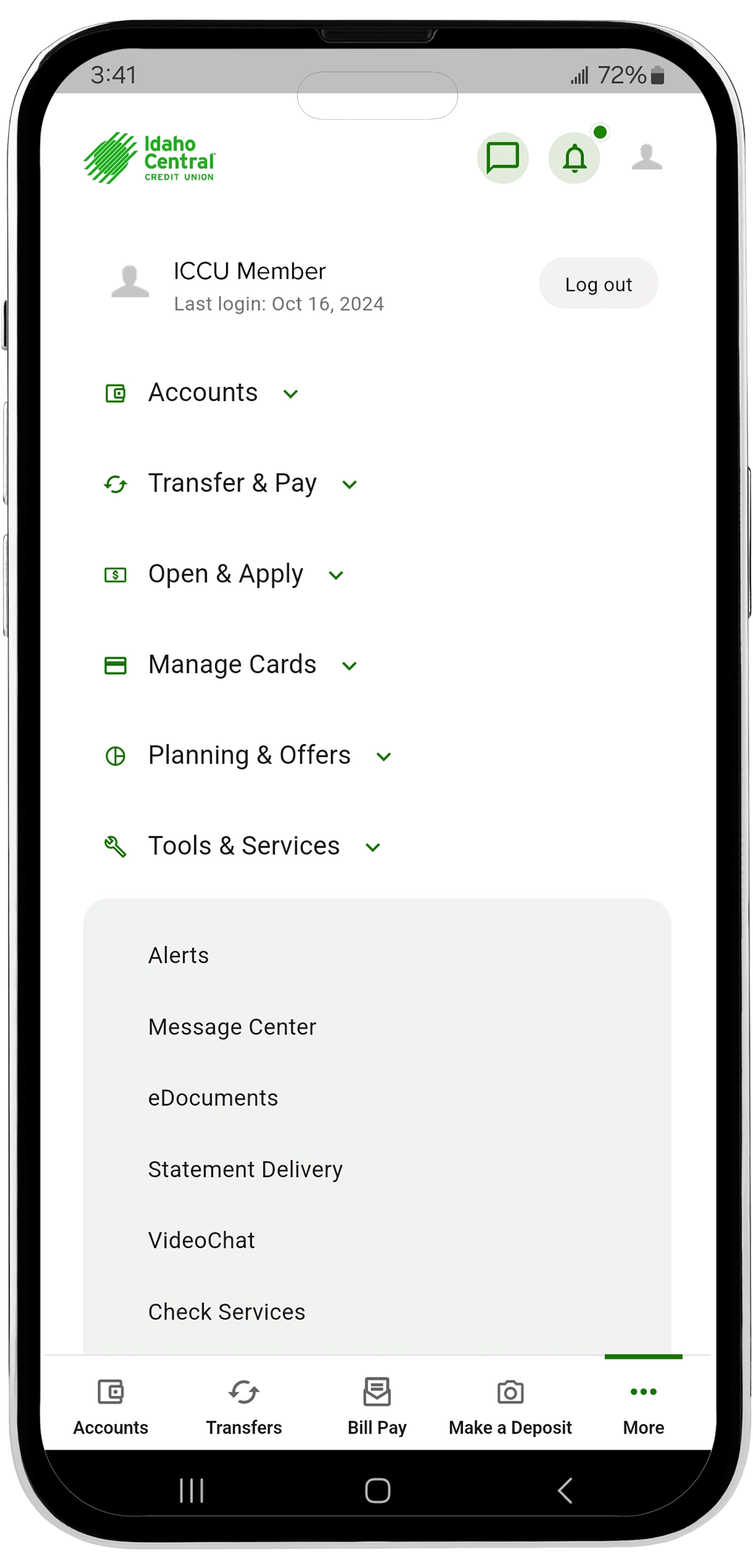

Easy Integration With Financial Accounts

Credit Sesame easily integrates with your financial accounts. This means you can link your bank accounts, credit cards, and other financial products to monitor all your financial activities in one place. This integration makes it easier to manage your finances and stay on top of your credit health.

Conclusion: Credit alerts from Credit Sesame offer real-time updates, customizable settings, comprehensive monitoring, and easy integration with your financial accounts. These features help you protect and manage your credit effectively, ensuring you stay informed and secure.

Benefits Of Using Credit Alerts

Credit alerts can be a valuable tool in managing your financial health. They offer several advantages, including early fraud detection, improved financial management, enhanced credit score monitoring, and peace of mind. Below, we delve into each of these benefits in detail.

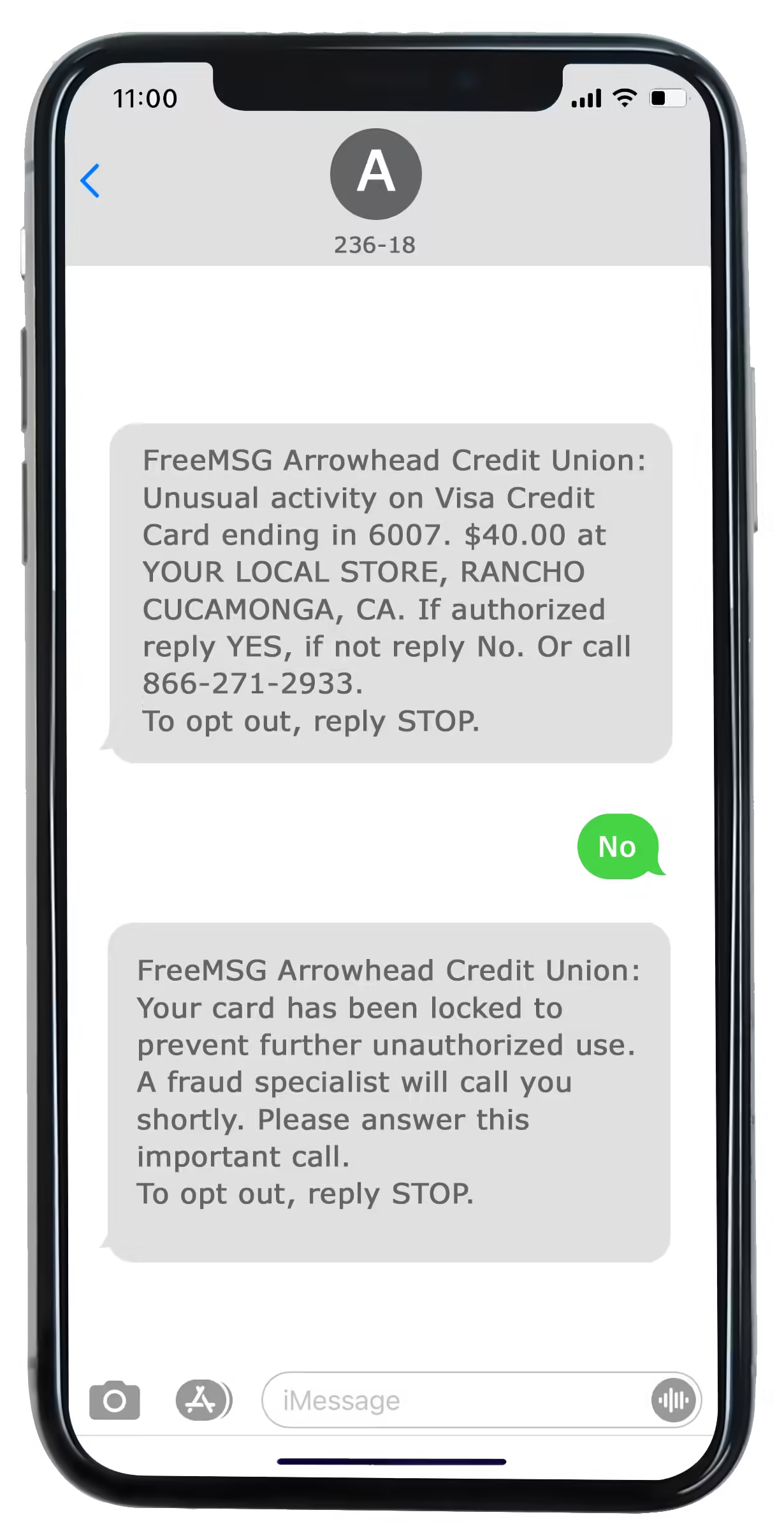

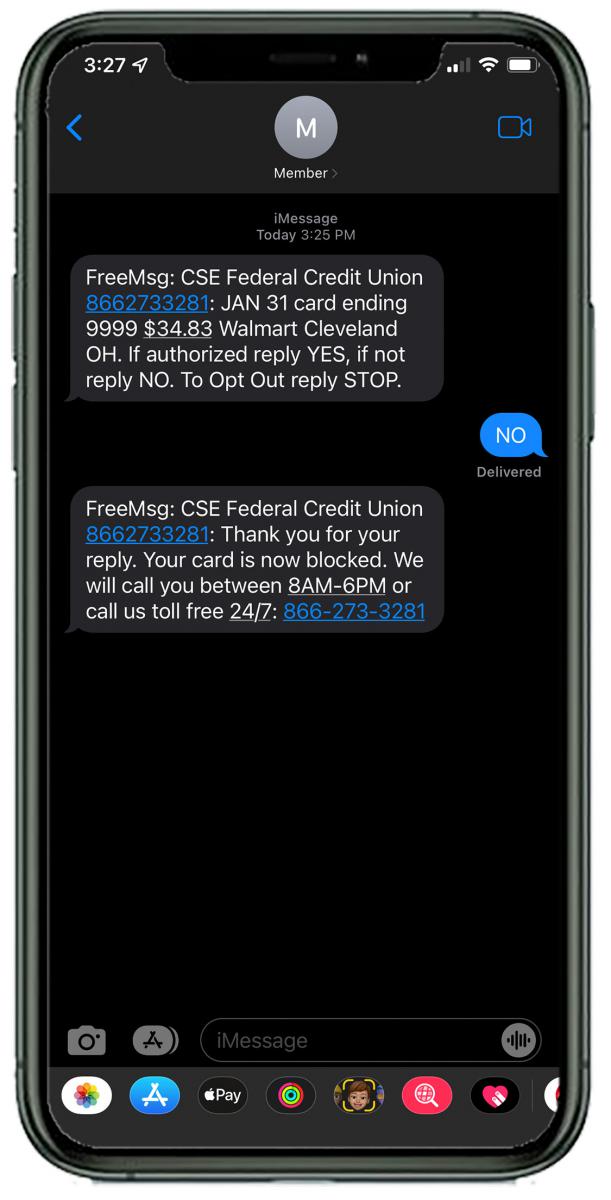

Early Fraud Detection

One of the primary benefits of using credit alerts is early fraud detection. Credit Sesame provides real-time notifications when suspicious activity is detected on your account. This allows you to take immediate action, preventing potential damage to your credit score.

Improved Financial Management

Credit alerts help in improved financial management. With daily credit score updates and personalized actions, Credit Sesame enables you to stay on top of your financial situation. You can monitor changes in your credit report and make informed decisions about your finances.

- Daily Credit Score Updates

- Personalized Actions

- Credit Offers with High Approval Odds

Enhanced Credit Score Monitoring

With Credit Sesame, you get enhanced credit score monitoring. The platform provides a Sesame Grade, which is a letter grade based on the five major factors impacting your credit score. This helps you understand what areas need improvement.

| Feature | Benefit |

|---|---|

| Sesame Grade | Understand credit score factors |

| Comprehensive Monitoring | Know what impacts your credit |

Peace Of Mind

Finally, credit alerts provide peace of mind. Knowing that your credit is being monitored 24/7 allows you to focus on other aspects of your life. Credit Sesame’s secure data handling and privacy policies ensure that your personal information is protected.

Sign up for Credit Sesame today and take advantage of these benefits. Visit Credit Sesame for more information.

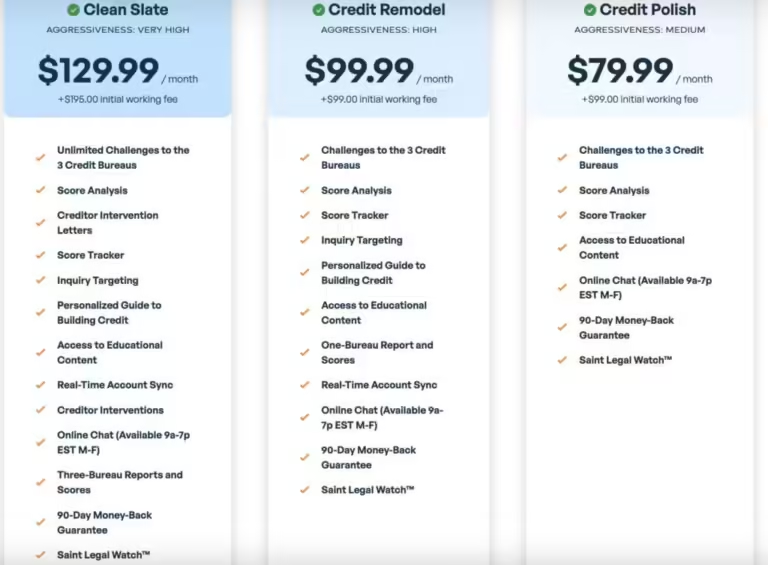

Pricing And Affordability

Credit Sesame offers a variety of credit alert services designed to fit different budgets and needs. Understanding the pricing and affordability of these services is key to making an informed decision. Below, we break down the options available.

Free Vs. Paid Credit Alert Services

Credit Sesame provides both free and paid services. Here is a breakdown of what each includes:

| Service | Features | Cost |

|---|---|---|

| Free Service |

|

$0 |

| Paid Service (Sesame Cash) |

|

$9.99/month (Waived with $500 direct deposit or $1,000 spent monthly) |

Value For Money

Credit Sesame’s free services offer valuable tools for those just starting to monitor their credit. The free access to daily credit score updates and personalized actions helps users stay informed without any cost.

For those who need more comprehensive services, the Sesame Cash plan provides excellent value. For $9.99 a month, users get a credit builder tool and can avoid fees with qualifying activity. This plan is ideal for individuals looking to actively improve their credit score.

Additional benefits like comprehensive monitoring and confidence in credit applications make the paid service a worthwhile investment. It ensures you get the most out of your credit management efforts.

Pros And Cons Of Credit Alerts

Credit alerts can be a vital tool in managing and protecting your credit. They notify you of significant changes in your credit report, helping you stay informed and take action quickly. Below, we explore the advantages and potential drawbacks of using credit alerts.

Advantages Of Credit Alerts

Credit alerts offer many benefits that can help you maintain a healthy credit score and financial security. Here are some key advantages:

- Immediate Notifications: Receive instant alerts for any changes in your credit report, such as new accounts, hard inquiries, or late payments.

- Fraud Prevention: Get notified of suspicious activities, which can help prevent identity theft and unauthorized transactions.

- Credit Improvement: Personalized actions and recommendations from platforms like Credit Sesame can help you improve your credit score over time.

- Confidence in Applications: Knowing your credit status allows you to apply for credit products with a better understanding of approval odds.

- Daily Updates: Services like Credit Sesame provide daily credit score updates, keeping you constantly informed.

Potential Drawbacks

While credit alerts are beneficial, there are some potential drawbacks to consider:

- Overwhelming Alerts: Frequent notifications might become overwhelming, especially if minor changes occur often.

- Costs: Some services may charge fees for advanced features, although Credit Sesame offers free access to basic credit scores and reports.

- Privacy Concerns: Sharing personal information with credit monitoring services might raise privacy concerns, despite their use of encryption and data protection.

- Accuracy: Inaccurate alerts can lead to unnecessary panic and time spent resolving issues that may not affect your credit.

Considering these pros and cons can help you decide if credit alerts are the right choice for you. Services like Credit Sesame offer a range of features and benefits that make credit monitoring more accessible and effective.

Ideal Users For Credit Alerts

Credit alerts are a valuable tool for anyone looking to stay on top of their financial health. Credit Sesame offers a range of features that make it ideal for various user groups. Below are the types of users who can benefit the most from credit alerts.

Individuals With High Credit Activity

People who use credit frequently need to monitor their credit closely. Daily transactions can impact credit scores. Credit Sesame provides daily credit score updates and personalized actions to help manage credit effectively. Frequent credit users can benefit from:

- Real-time alerts on credit score changes

- Personalized recommendations to maintain or improve their score

- High approval odds for the best credit offers

People With Previous Fraud Incidents

Individuals who have faced fraud or identity theft in the past need robust monitoring. Credit Sesame offers comprehensive monitoring and real-time alerts to detect suspicious activities. This group can benefit from:

- Immediate alerts on suspicious transactions

- Detailed credit report summaries to spot irregularities

- Enhanced data protection with 256-bit encryption

Those Looking To Improve Their Credit Score

Anyone aiming to improve their credit score can benefit from Credit Sesame. The platform provides tailored actions and a Sesame Grade that highlights areas for improvement. Users looking to boost their credit score can benefit from:

- Personalized actions to improve credit score

- Daily updates to track progress

- Credit building options like Sesame Cash

General Financial Security Seekers

Anyone who values financial security will find credit alerts useful. Regular monitoring helps in understanding credit impacts and avoiding financial pitfalls. This group can benefit from:

- Free access to credit scores and reports

- Confidence in applying for credit products

- Educational resources on credit management

Frequently Asked Questions

What Are Credit Alerts?

Credit alerts are notifications about changes to your credit report. They help you monitor your credit activity.

How Do Credit Alerts Work?

Credit alerts notify you of changes to your credit report. This can include new accounts or hard inquiries.

Why Are Credit Alerts Important?

Credit alerts help you detect fraud quickly. They allow you to take action to protect your credit score.

Are Credit Alerts Free?

Many credit monitoring services offer free credit alerts. Check with your credit card issuer or bank for options.

Conclusion

Staying on top of your credit is crucial. Credit Sesame makes it easy. With daily updates and personalized tips, you can improve your score confidently. Access your free credit score and report today. Start your credit journey here: Credit Sesame. Make informed financial decisions and build a better financial future. Regular monitoring ensures you’re always in control. Try Credit Sesame now and see the difference.