Consumer Credit Protection: Safeguarding Your Financial Rights

Understanding consumer credit protection is crucial. It safeguards your financial interests.

Consumer credit protection laws are designed to shield you from unfair practices in the credit industry. These laws ensure that you are treated fairly when applying for credit, using credit cards, or managing debt. Knowing your rights can help you make informed decisions and avoid common pitfalls. In this blog post, we will explore the key aspects of consumer credit protection, highlighting its importance and how it affects your financial well-being. Stay tuned to learn more about how these protections work and how you can benefit from them. Plus, discover tools like the Hello Alice Business Health Score™ Assessment to further enhance your financial health.

Introduction To Consumer Credit Protection

Consumer credit protection is essential for safeguarding the financial interests of individuals. It ensures that consumers are treated fairly and have access to accurate information. This protection is vital for maintaining a healthy financial environment.

Understanding Consumer Credit

Consumer credit refers to the loans and credit extended to individuals. These include credit cards, personal loans, and mortgages. Understanding how consumer credit works is crucial for managing personal finances effectively.

Credit allows consumers to borrow money for purchases and repay it over time. It is an important tool for managing cash flow and making large purchases. However, it requires responsible use to avoid debt accumulation.

Purpose Of Consumer Credit Protection

The main purpose of consumer credit protection is to ensure fairness and transparency. It helps consumers make informed decisions and protects them from unfair practices. Here are some key aspects:

- Transparency: Lenders must provide clear information about terms and conditions.

- Fair Treatment: Consumers are protected from discriminatory practices.

- Dispute Resolution: Mechanisms are in place to resolve disputes between consumers and lenders.

- Fraud Prevention: Measures are established to protect consumers from identity theft and fraud.

Consumer credit protection laws enforce these principles, ensuring a balanced relationship between lenders and consumers.

Product Summary

Hello Alice offers a unique service to small businesses, focusing on financial health. The Hello Alice Business Health Score™ Assessment helps businesses measure and improve their financial standing.

This service includes:

- Business Health Assessment: Analyze and measure your business’s financial health.

- Personalized Growth Plan: Create tailored plans to position your business for success.

- Health Score Visibility: Understand how banks, creditors, investors, and partners view your business.

- Step-by-Step Frameworks: Access detailed frameworks to improve your business health score.

- Rewards for Growth: Unlock grants, discounts, and other opportunities as your business grows.

Product Benefits

The benefits of using Hello Alice’s service include:

- Financial Fitness: Enhance your business’s financial standing and open doors to new opportunities.

- Credibility: Improve how financial institutions and partners perceive your business.

- Strategic Growth: Follow a personalized plan to achieve sustainable growth.

- Incentives: Receive rewards and benefits as you improve your business health score.

This service is available for free, allowing small businesses to measure and improve their financial health without any initial cost.

Join 1.4 million businesses as part of Wonderland, a connected community of healthy and growing businesses. Learn more about Hello Alice’s mission to support small business financial health.

| Feature | Description |

|---|---|

| Business Health Assessment | Analyze and measure your business’s financial health. |

| Personalized Growth Plan | Create tailored plans to position your business for success. |

| Health Score Visibility | Understand how banks, creditors, investors, and partners view your business. |

| Step-by-Step Frameworks | Access detailed frameworks to improve your business health score. |

| Rewards for Growth | Unlock grants, discounts, and other opportunities as your business grows. |

For more information, visit the Hello Alice website.

Key Features Of Consumer Credit Protection Laws

Consumer credit protection laws safeguard consumers in financial transactions. These laws ensure fair practices, transparency, and equality. Understanding these laws helps you make informed decisions and protect your financial health.

Fair Credit Reporting Act (fcra)

The Fair Credit Reporting Act (FCRA) promotes accuracy, fairness, and privacy of consumer information in credit reporting. It gives consumers the right to:

- Access their credit reports

- Dispute inaccurate information

- Receive notification of negative information

Credit reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. This ensures your credit report reflects your true credit history.

Truth In Lending Act (tila)

The Truth in Lending Act (TILA) aims to protect consumers from unfair lending practices. It requires lenders to provide clear and detailed information about loan terms and costs. Key provisions include:

- Disclosure of the annual percentage rate (APR)

- Details on total finance charges

- Information on payment schedule and total repayment amount

Consumers can compare loan offers and make informed choices with this information.

Fair Debt Collection Practices Act (fdcpa)

The Fair Debt Collection Practices Act (FDCPA) regulates how debt collectors can interact with consumers. It prohibits abusive, deceptive, and unfair debt collection practices. Important protections include:

- Restrictions on the time and place of contact

- Prohibition of harassment or threats

- Requirement to provide debt validation notice

Consumers can file complaints and seek damages for violations of the FDCPA.

Equal Credit Opportunity Act (ecoa)

The Equal Credit Opportunity Act (ECOA) ensures that all consumers have an equal chance to obtain credit. It prohibits discrimination based on:

- Race, color, religion, national origin

- Sex, marital status, age

- Receipt of public assistance

Creditors must provide reasons for denying credit applications. This promotes fair and equal access to credit for everyone.

Understanding these key features of consumer credit protection laws empowers you. Stay informed, protect your rights, and maintain a healthy financial profile.

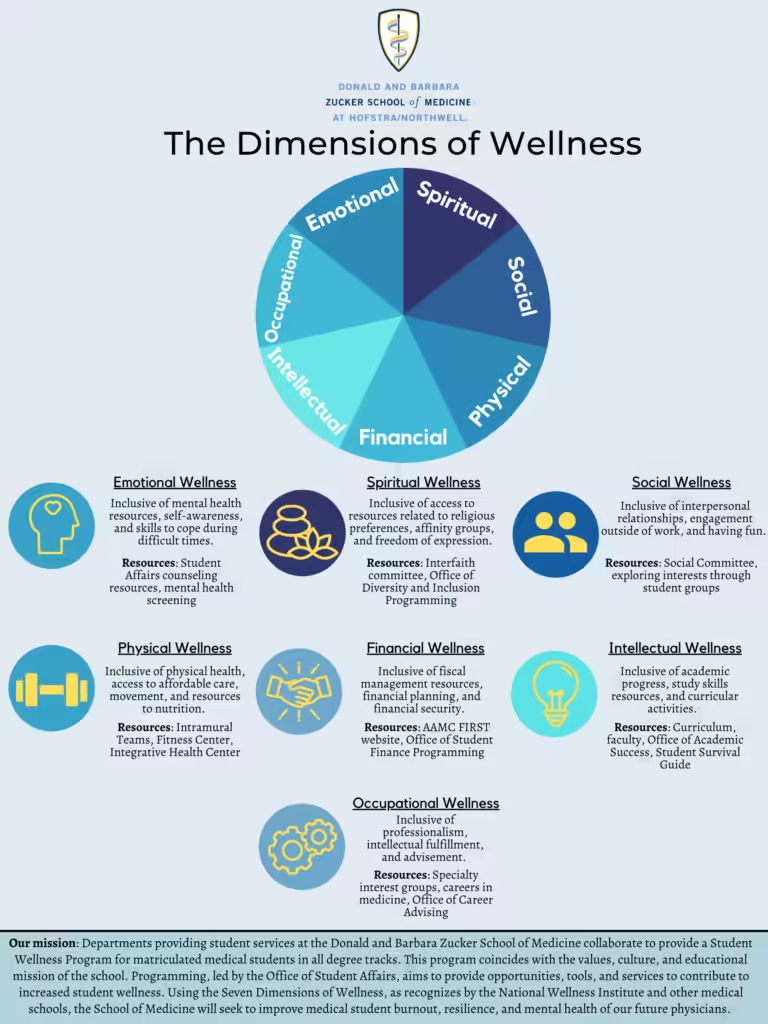

How Consumer Credit Protection Benefits You

Consumer credit protection offers several benefits that can help you manage your finances more effectively. These protections ensure fair practices and provide safeguards against various financial risks. Understanding these benefits can help you make better financial decisions and secure your financial future.

Protection Against Identity Theft

Identity theft is a growing concern. Consumer credit protection laws help protect you from identity theft. These laws require creditors to verify your identity before granting credit. This reduces the risk of someone else using your personal information to open accounts in your name.

Moreover, you have the right to place a fraud alert on your credit report. This alerts creditors to take extra steps to verify your identity before opening new accounts.

Ensuring Fair Lending Practices

Fair lending practices are essential for a healthy financial system. Consumer credit protection laws prohibit discriminatory lending practices. This ensures that all consumers have equal access to credit.

These laws also require lenders to provide clear and understandable information about loan terms. This transparency helps you make informed decisions about borrowing money.

Regulating Debt Collection

Debt collection can be stressful. Consumer credit protection laws regulate how debt collectors can contact you. These laws prevent harassment and abusive practices.

For example, debt collectors cannot call you at unreasonable hours. They also must provide accurate information about your debt. These regulations help ensure that you are treated fairly during the debt collection process.

Transparent Credit Reporting

Accurate credit reporting is crucial for maintaining your financial health. Consumer credit protection laws ensure that your credit report is accurate and up-to-date. You have the right to dispute any incorrect information on your credit report.

Additionally, you are entitled to one free credit report from each of the three major credit bureaus every year. This allows you to monitor your credit and catch any errors or signs of fraud early.

By understanding and utilizing these consumer credit protection benefits, you can safeguard your financial well-being and make more informed financial decisions.

Pricing And Affordability Of Credit Protection Services

Understanding the costs and benefits of credit protection services is crucial for consumers. These services offer various features, from free resources to paid monitoring services. Evaluating their pricing and affordability helps in making informed decisions.

Free Consumer Rights Resources

Many organizations offer free resources to help consumers understand their rights. These resources include:

- Educational guides on credit scores and reports

- Access to credit reports once a year from major credit bureaus

- Tools and calculators to manage debt and budget

These free resources empower consumers to take control of their financial health without incurring costs. Hello Alice offers a free service to measure and improve small business financial health. They provide a Business Health Assessment, Personalized Growth Plans, and Step-by-Step Frameworks at no cost.

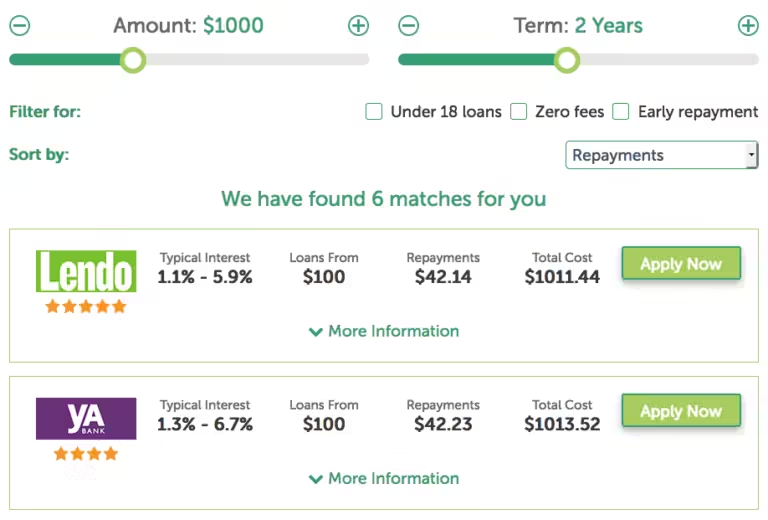

Paid Credit Monitoring Services

Paid credit monitoring services provide enhanced protection and additional features. These services often include:

- Real-time alerts for any changes in credit reports

- Identity theft protection and recovery assistance

- Access to all three credit reports and scores

These services typically charge a monthly or annual fee. The cost varies based on the features offered. Some popular paid services include Credit Karma, Experian, and TransUnion.

Cost-benefit Analysis

Conducting a cost-benefit analysis helps determine the value of credit protection services. Consider the following factors:

| Feature | Free Services | Paid Services |

|---|---|---|

| Credit Report Access | Annual | Unlimited |

| Credit Score Monitoring | Limited | Real-time |

| Identity Theft Protection | Basic | Comprehensive |

| Alerts | Delayed | Real-time |

Free services offer basic protection and are suitable for those with minimal needs. Paid services provide comprehensive protection, ideal for those requiring advanced features. Evaluating these factors helps in choosing the right service based on individual needs.

Pros And Cons Of Consumer Credit Protection

Consumer credit protection laws are designed to safeguard borrowers from unfair practices and ensure transparency in lending. These laws offer several benefits but also come with some challenges. Understanding both sides helps consumers make informed decisions.

Advantages Of Credit Protection Laws

- Enhanced Transparency: Lenders must disclose all loan terms, interest rates, and fees clearly.

- Fair Practices: Protection against predatory lending practices, ensuring consumers are not exploited.

- Improved Credit Scores: Regular monitoring and dispute options help consumers maintain healthy credit scores.

- Legal Recourse: Consumers have the right to take legal action if lenders violate these laws.

Limitations And Challenges

- Complex Regulations: The legal language can be difficult for the average consumer to understand.

- Limited Awareness: Many consumers are not fully aware of their rights under these laws.

- Enforcement Issues: Regulatory bodies may lack resources to enforce all aspects of the laws consistently.

- Potential Costs: Some protections might lead to increased costs for consumers in the form of higher interest rates.

Real-world Usage Insights

Consumer credit protection laws directly impact both businesses and consumers. For small businesses, utilizing tools like the Hello Alice Business Health Score™ Assessment can offer significant advantages:

| Feature | Benefit |

|---|---|

| Business Health Assessment | Analyze and measure financial health, enhancing credibility with lenders. |

| Personalized Growth Plan | Create tailored strategies for sustainable growth and improved credit standing. |

| Health Score Visibility | Understand how banks and investors view your business, facilitating better financial decisions. |

| Rewards for Growth | Unlock grants and discounts as the business health score improves. |

Small businesses can join a community of 1.4 million businesses to gain support and improve their financial health. The service is free, making it accessible for businesses at any stage of growth.

Specific Recommendations For Ideal Users

Consumer Credit Protection is essential for maintaining financial stability. It is important to understand who should consider credit protection and the scenarios where it is essential.

Who Should Consider Credit Protection?

Credit protection is beneficial for various individuals. Here are some groups who should consider it:

- Small Business Owners: Protecting credit is vital for maintaining business health.

- Individuals with High Debt: Those with significant credit card debt should secure their credit.

- Frequent Travelers: Protect against potential fraud during travel.

- Senior Citizens: Safeguard against scams targeting the elderly.

The Hello Alice Business Health Score™ Assessment can be a useful tool for small business owners. It helps analyze and measure financial health, offering a clear picture of how banks, creditors, investors, and partners view their business.

Scenarios Where Credit Protection Is Essential

Consider credit protection in the following scenarios:

- Identity Theft: Protect against unauthorized use of personal information.

- Fraudulent Transactions: Monitor and dispute suspicious activity on your accounts.

- Business Loans: Ensuring a good credit score can secure better loan terms.

- Credit Card Applications: Avoid unexpected declines by maintaining a healthy credit report.

- Financial Planning: Secure your financial future by maintaining a good credit score.

Using Hello Alice’s services can enhance your business’s financial standing. It provides a comprehensive assessment and tailored growth plans, improving your business health score and credibility with financial institutions.

Frequently Asked Questions

What Is Consumer Credit Protection?

Consumer Credit Protection refers to laws and regulations that safeguard consumers. These laws protect against unfair credit practices. They ensure transparency and fairness in lending.

Why Is Consumer Credit Protection Important?

Consumer Credit Protection is crucial as it prevents predatory lending. It ensures consumers receive fair credit terms. It promotes financial stability and informed decision-making.

How Does Consumer Credit Protection Work?

Consumer Credit Protection works through federal laws and regulations. It mandates lenders to disclose terms clearly. It provides consumers with rights and recourse options.

Which Laws Govern Consumer Credit Protection?

Key laws include the Truth in Lending Act (TILA) and Fair Credit Reporting Act (FCRA). These laws ensure transparent and fair credit practices. They protect consumers’ credit rights.

Conclusion

Protecting consumer credit is crucial. It ensures financial security and peace of mind. Stay informed and aware of your rights as a consumer. Utilize tools like the Hello Alice Business Health Score™ Assessment. This can help you measure and improve your business’s financial health. For more information, visit Hello Alice. Investing time in understanding credit protection pays off in the long run. Stay proactive and safeguard your financial future.