Comprehensive Credit Analysis: Unlocking Financial Insights

Understanding your credit score is crucial. It affects loan approvals, interest rates, and more.

Comprehensive credit analysis helps you get a clear picture of your financial health. With a detailed review, you can identify what impacts your credit score and how to improve it. Credit Sesame offers a free service that not only provides your credit score but also personalized recommendations to boost it. Whether you aim to buy a house, secure a loan, or simply improve your credit standing, understanding your credit report is the first step. Dive in to learn how comprehensive credit analysis can guide you toward better financial decisions and help you achieve your financial goals. For more insights, visit Credit Sesame.

Introduction To Comprehensive Credit Analysis

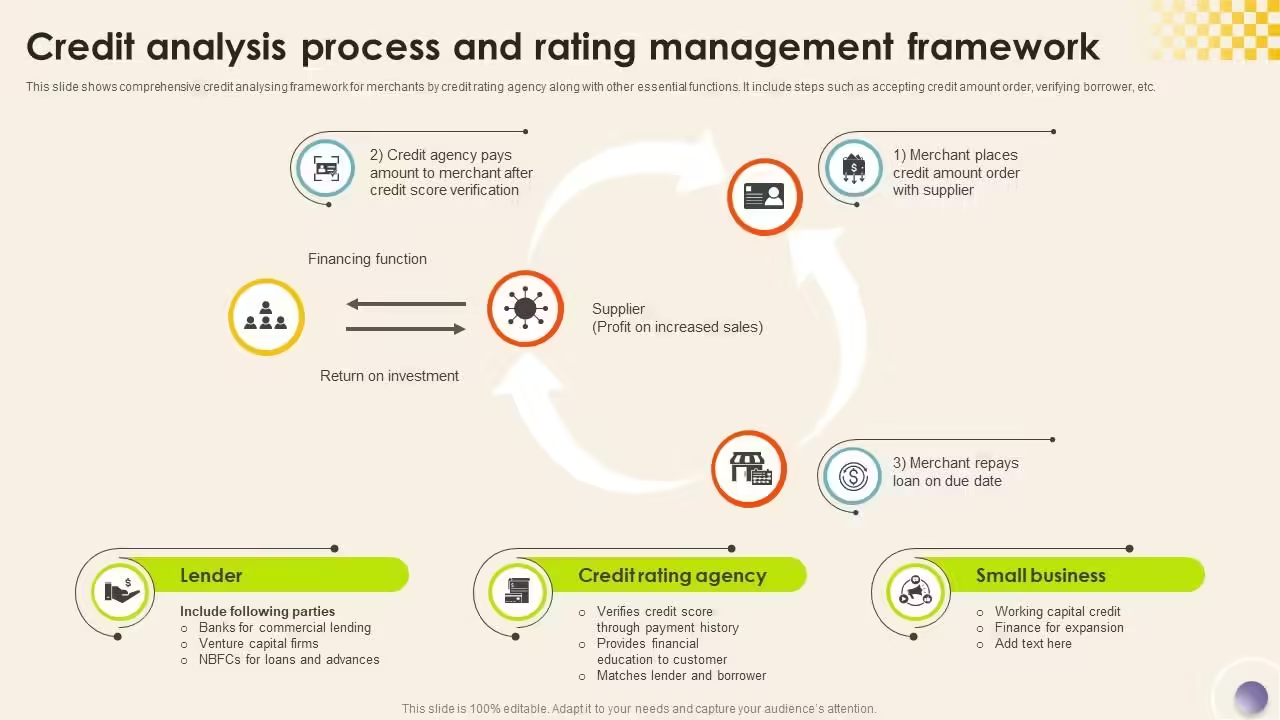

Understanding credit analysis is crucial for making informed financial decisions. Comprehensive credit analysis evaluates the creditworthiness of a borrower. It helps individuals and financial institutions assess the risk involved in lending money.

What Is Credit Analysis?

Credit analysis involves assessing a borrower’s ability to repay a loan. It examines various factors such as credit history, financial health, and current obligations. The goal is to determine the level of risk associated with lending to the borrower.

Credit Sesame offers a free service that helps users access their credit score and report. Users receive personalized recommendations to improve their credit score. This makes it easier to understand and manage credit effectively.

Importance Of Credit Analysis In Financial Decision Making

Credit analysis plays a vital role in financial decisions. It helps lenders decide whether to approve a loan application. It also determines the interest rate and terms of the loan. A thorough credit analysis can prevent financial losses due to defaults.

Using Credit Sesame, users can check their credit score daily. They receive alerts for changes and personalized actions to improve their score. This continuous monitoring helps in making better financial decisions.

Furthermore, Credit Sesame provides a Sesame Grade, a clear letter grade based on the five major factors affecting your credit score. This simple grading system makes it easy to understand your credit health at a glance.

Key Features Of Comprehensive Credit Analysis

Comprehensive credit analysis involves evaluating creditworthiness using various tools and methods. Understanding key features of this analysis helps you make informed financial decisions. Below are essential features of a robust credit analysis system.

Detailed Credit Scoring Models

Credit scoring models provide insights into an individual’s credit behavior. Credit Sesame offers a daily credit score feature. You can check your score daily and receive alerts for any changes. It also includes a Sesame Grade, a clear letter grade based on five major factors affecting your credit score.

| Feature | Description |

|---|---|

| Daily Credit Score | Check your score daily and get alerts for changes. |

| Sesame Grade | A letter grade based on factors impacting your credit score. |

Risk Assessment Tools

Risk assessment tools help identify potential financial risks. Credit Sesame offers personalized actions to improve your credit score. These tailored actions guide you on steps to enhance your creditworthiness. It also provides credit offers with a high chance of approval based on your credit profile.

- Personalized Actions: Tailored steps to improve your score.

- Credit Offers: Offers with high approval chances.

Integration With Financial Data Sources

Integration with financial data sources ensures accurate credit analysis. Credit Sesame integrates with TransUnion to provide detailed credit information. This integration allows users to access their credit report summary for free and understand the factors impacting their score.

- Credit Report Summary: Access to detailed credit data.

- Data Provider: TransUnion for accurate information.

Customizable Reporting

Customizable reporting allows users to generate reports based on their needs. Credit Sesame offers a feature to build credit with everyday purchases. You can use a prepaid debit card and a virtual secured credit card to build your credit profile. The mobile app provides easy access to all features and tools, ensuring you stay updated on your credit status.

- Credit Builder: Build credit with everyday purchases.

- Mobile App: Access features and tools on the go.

By leveraging these key features, you can gain a comprehensive understanding of your credit health and take actionable steps to improve it.

Benefits Of Using Comprehensive Credit Analysis

Comprehensive credit analysis is a powerful tool for individuals and businesses. It provides an in-depth understanding of financial health, empowering better decisions and risk management.

Enhanced Decision-making Accuracy

Using comprehensive credit analysis, decision-making becomes more accurate. It offers detailed insights into credit scores, financial behavior, and creditworthiness. Users can make informed decisions based on reliable data. This reduces the chances of financial mistakes.

Early Detection Of Financial Risks

Early detection of financial risks is crucial. Comprehensive credit analysis helps identify potential risks before they become major issues. It provides alerts on changes in credit scores and financial activities. This allows for proactive measures to mitigate risks.

Improved Creditworthiness Evaluation

Evaluating creditworthiness is easier with comprehensive credit analysis. It factors in various elements such as credit history, debt levels, and payment patterns. This holistic approach gives a clearer picture of an individual’s or business’s financial reliability.

Streamlined Financial Operations

Comprehensive credit analysis streamlines financial operations. It integrates various financial data points into one cohesive report. This simplifies the process of monitoring and managing finances. Users can track their credit score, see impacts, and get personalized recommendations.

How Credit Sesame Enhances Credit Analysis

| Feature | Benefit |

|---|---|

| Daily Credit Score | Monitor and get alerts for changes in real-time |

| Personalized Actions | Receive tailored recommendations to improve credit score |

| Credit Offers | Find the best offers with high chances of approval |

| Credit Builder | Build credit through everyday purchases |

| Security | 256-bit encryption ensures data protection |

| Mobile App | Access all features on the go |

Credit Sesame provides a comprehensive credit analysis tool. It offers free access to credit scores and reports. Users can track their credit score daily and understand the factors impacting it. With personalized actions, users can take steps to improve their score.

For more information, visit Credit Sesame.

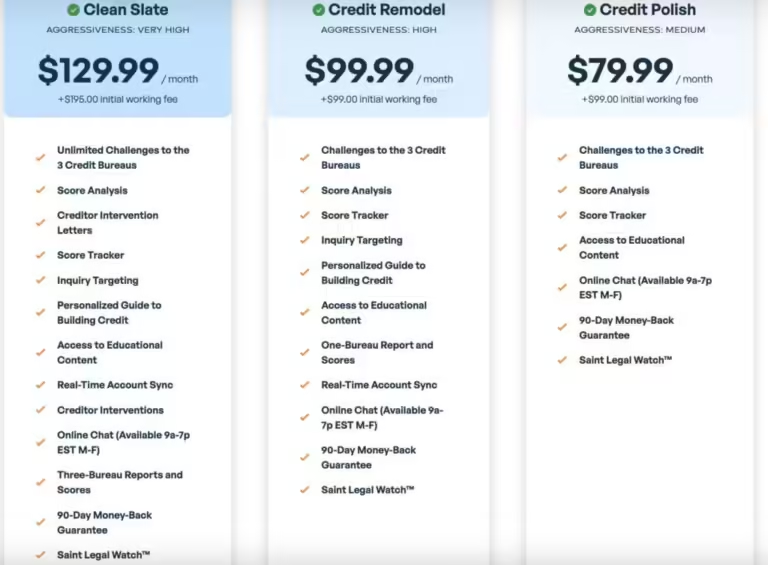

Pricing And Affordability

Understanding the pricing and affordability of credit analysis tools is essential. It helps users decide whether the service is worth the investment. Credit Sesame offers a range of features, but understanding the costs involved can help you make an informed decision.

Cost Structure Of Credit Analysis Tools

Credit Sesame provides a free service to access your credit score and report. Here are the details of their cost structure:

- Sesame Cash Fees:

- $9.99 monthly fee, waived with a $500 direct deposit or $1,000 monthly spending.

- $3 monthly inactivity fee, waived with at least one transaction every 30 days.

- No fees for the first 30 days of account opening.

- Additional fees for international and out-of-network cash withdrawals, third-party, and cash deposits.

Comparing Pricing Plans

Comparing different pricing plans helps you understand the value each offers. Here’s a simple comparison:

| Feature | Free Plan | Sesame Cash Plan |

|---|---|---|

| Daily Credit Score | Yes | Yes |

| Personalized Actions | Yes | Yes |

| Monthly Fee | Free | $9.99 (waivable) |

| Inactivity Fee | None | $3 (waivable) |

Value For Money: Is It Worth The Investment?

The value of investing in Credit Sesame depends on your needs and financial goals. Consider the following benefits:

- Free Access: 100% free access to your credit score and report.

- Credit Building: Build credit through everyday purchases without a credit check or security deposit.

- Security: Protects your data with 256-bit encryption.

Users like Shiva and Charles praise Credit Sesame for its secure and unique credit-building methods. Brian and Amanda trusted the service for long-term credit monitoring. These testimonials highlight the value Credit Sesame can provide.

Pros And Cons Based On Real-world Usage

Understanding the real-world pros and cons of comprehensive credit analysis is crucial. Here’s a look at the advantages and challenges based on user experiences.

Advantages Of Comprehensive Credit Analysis

Comprehensive credit analysis offers several benefits that can help users manage their credit more effectively:

- Daily Credit Score: Users can check their score daily, allowing them to stay informed about their credit status.

- Personalized Recommendations: The service provides tailored actions to help improve credit scores, making it easier to achieve financial goals.

- Credit Offers: Users receive offers with a high chance of approval, helping them apply with confidence.

- Credit Building: The platform allows users to build credit through everyday purchases without a credit check or security deposit.

- Security: Data is protected with 256-bit encryption, ensuring user privacy and security.

- Free Access: The service is completely free, providing significant value without additional costs.

Limitations And Challenges Users Might Face

While the benefits are numerous, there are some limitations and challenges to consider:

- Monthly Fees: The Sesame Cash account has a $9.99 monthly fee, which can be waived but might still be a burden for some users.

- Inactivity Fees: A $3 monthly inactivity fee applies if no transactions are made every 30 days.

- Limited Credit Data: Credit data is sourced from TransUnion, which means users might not get a full picture from all three major credit bureaus.

- Additional Fees: Users might incur additional fees for international transactions, out-of-network cash withdrawals, and third-party deposits.

Overall, while comprehensive credit analysis tools like Credit Sesame offer significant advantages, users should be aware of potential fees and limitations. Balancing the benefits and challenges is key to making the most of these services.

Recommendations For Ideal Users And Scenarios

Comprehensive credit analysis is essential for various users and scenarios. It helps in making informed financial decisions. Let’s explore the best fit for different entities and situations where this analysis is crucial.

Best Fit For Financial Institutions

Financial institutions, such as banks and credit unions, greatly benefit from comprehensive credit analysis. They need to assess the creditworthiness of potential borrowers. This helps in mitigating risks and making informed lending decisions.

Key Benefits for Financial Institutions:

- Accurate assessment of borrowers’ creditworthiness.

- Risk mitigation in lending decisions.

- Enhanced decision-making process.

Applicability For Small And Medium Enterprises (smes)

Small and medium enterprises (SMEs) also find comprehensive credit analysis beneficial. It helps them evaluate the credit health of their business and potential partners. This ensures better financial stability and growth.

Benefits for SMEs:

- Better understanding of business credit health.

- Informed decisions on extending credit to partners.

- Enhanced financial stability and growth prospects.

Scenarios Where Comprehensive Credit Analysis Is Crucial

There are specific scenarios where comprehensive credit analysis becomes crucial:

- Loan Applications: Helps in evaluating the creditworthiness of applicants.

- Partnerships: Ensures potential partners have a healthy credit status.

- Credit Card Approvals: Assists in assessing applicants’ ability to manage credit.

In all these scenarios, using tools like Credit Sesame can be beneficial. It provides daily credit scores, personalized recommendations, and secure data protection.

Features of Credit Sesame:

- Free access to credit score and report.

- Personalized actions to improve credit score.

- Secure data protection with 256-bit encryption.

Frequently Asked Questions

What Is Credit Analysis?

Credit analysis assesses a borrower’s ability to repay a loan. It evaluates financial history, credit score, and repayment capacity.

Why Is Credit Analysis Important?

Credit analysis helps lenders determine risk levels. It ensures loans are given to creditworthy individuals or businesses.

How Does Credit Scoring Work?

Credit scoring uses data from credit reports. It calculates a score that predicts the likelihood of timely repayment.

What Factors Affect Credit Analysis?

Key factors include credit history, income, outstanding debts, and repayment behavior. Each factor influences the final assessment.

Conclusion

Understanding credit is crucial for financial health. Comprehensive credit analysis helps you make informed decisions. Use tools like Credit Sesame to monitor your credit score. This service offers free access to your credit report and personalized advice. Improve your credit score with daily updates and tailored actions. Secure your financial future by staying informed and proactive. Remember, knowledge is power in managing your credit effectively. Take advantage of Credit Sesame’s resources and start your journey toward better credit today.